a GAO TRANSPORTATION SECURITY

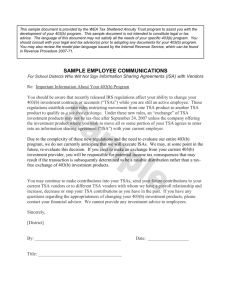

advertisement