FUTURE full Speed ahead! An interview with Bode Miller proof Your future

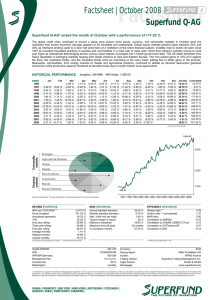

advertisement