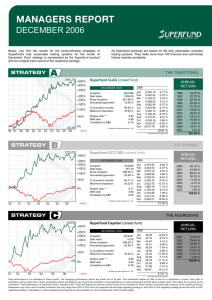

Factsheet Superfund Q-AG

advertisement

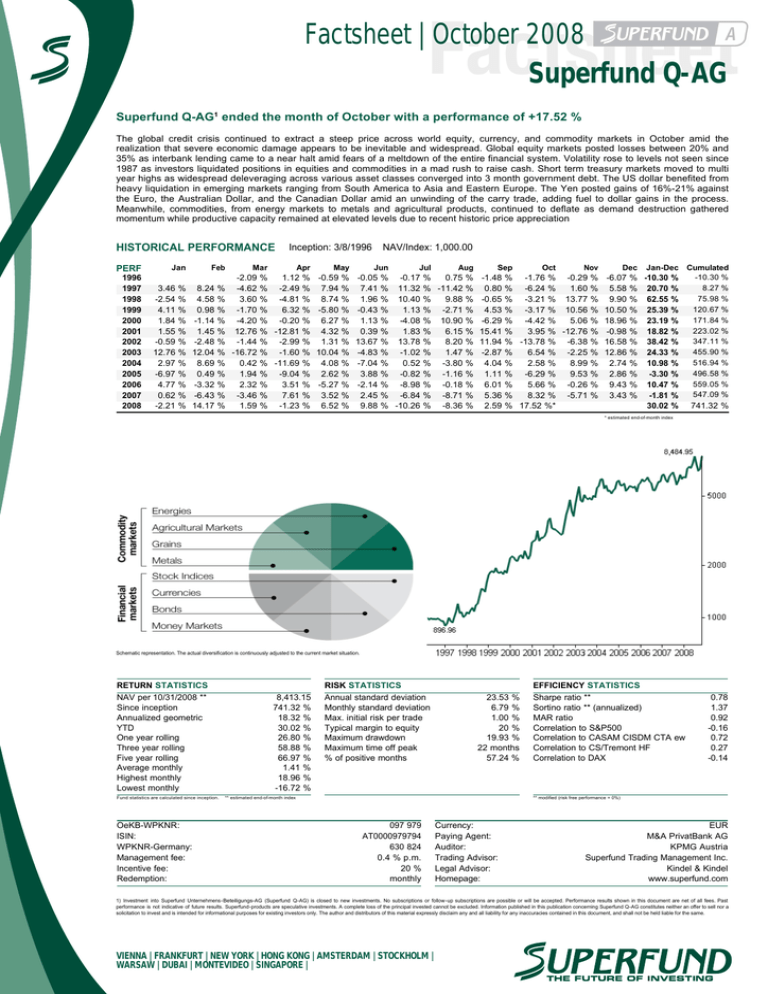

Factsheet Factsheet | October 2008 Superfund Q-AG Superfund Q-AG1 ended the month of October with a performance of +17.52 % The global credit crisis continued to extract a steep price across world equity, currency, and commodity markets in October amid the realization that severe economic damage appears to be inevitable and widespread. Global equity markets posted losses between 20% and 35% as interbank lending came to a near halt amid fears of a meltdown of the entire financial system. Volatility rose to levels not seen since 1987 as investors liquidated positions in equities and commodities in a mad rush to raise cash. Short term treasury markets moved to multi year highs as widespread deleveraging across various asset classes converged into 3 month government debt. The US dollar benefited from heavy liquidation in emerging markets ranging from South America to Asia and Eastern Europe. The Yen posted gains of 16%-21% against the Euro, the Australian Dollar, and the Canadian Dollar amid an unwinding of the carry trade, adding fuel to dollar gains in the process. Meanwhile, commodities, from energy markets to metals and agricultural products, continued to deflate as demand destruction gathered momentum while productive capacity remained at elevated levels due to recent historic price appreciation HISTORICAL PERFORMANCE PERF 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Jan 3.46 -2.54 4.11 1.84 1.55 -0.59 12.76 2.97 -6.97 4.77 0.62 -2.21 % % % % % % % % % % % % Feb 8.24 4.58 0.98 -1.14 1.45 -2.48 12.04 8.69 0.49 -3.32 -6.43 14.17 % % % % % % % % % % % % Inception: 3/8/1996 Mar -2.09 -4.62 3.60 -1.70 -4.20 12.76 -1.44 -16.72 0.42 1.94 2.32 -3.46 1.59 Apr May NAV/Index: 1,000.00 Jun Jul % 1.12 % -0.59 % -0.05 % -0.17 % -2.49 % 7.94 % 7.41 % 11.32 % -4.81 % 8.74 % 1.96 % 10.40 % 6.32 % -5.80 % -0.43 % 1.13 % -0.20 % 6.27 % 1.13 % -4.08 % -12.81 % 4.32 % 0.39 % 1.83 % -2.99 % 1.31 % 13.67 % 13.78 % -1.60 % 10.04 % -4.83 % -1.02 % -11.69 % 4.08 % -7.04 % 0.52 % -9.04 % 2.62 % 3.88 % -0.82 % 3.51 % -5.27 % -2.14 % -8.98 % 7.61 % 3.52 % 2.45 % -6.84 % -1.23 % 6.52 % 9.88 % -10.26 Aug Sep Oct Nov Dec Jan-Dec Cumulated -10.30 % 8.27 % 75.98 % 120.67 % 171.84 % 223.02 % 347.11 % 455.90 % 516.94 % 496.58 % 559.05 % 547.09 % % 0.75 % -1.48 % -1.76 % -0.29 % -6.07 % -10.30 % % -11.42 % 0.80 % -6.24 % 1.60 % 5.58 % 20.70 % % 9.88 % -0.65 % -3.21 % 13.77 % 9.90 % 62.55 % % -2.71 % 4.53 % -3.17 % 10.56 % 10.50 % 25.39 % % 10.90 % -6.29 % -4.42 % 5.06 % 18.96 % 23.19 % % 6.15 % 15.41 % 3.95 % -12.76 % -0.98 % 18.82 % % 8.20 % 11.94 % -13.78 % -6.38 % 16.58 % 38.42 % % 1.47 % -2.87 % 6.54 % -2.25 % 12.86 % 24.33 % % -3.80 % 4.04 % 2.58 % 8.99 % 2.74 % 10.98 % % -1.16 % 1.11 % -6.29 % 9.53 % 2.86 % -3.30 % % -0.18 % 6.01 % 5.66 % -0.26 % 9.43 % 10.47 % % -8.71 % 5.36 % 8.32 % -5.71 % 3.43 % -1.81 % % -8.36 % 2.59 % 17.52 %* 30.02 % 741.32 % * estimated end-of-month index Schematic representation. The actual diversification is continuously adjusted to the current market situation. RETURN STATISTICS NAV per 10/31/2008 ** Since inception Annualized geometric YTD One year rolling Three year rolling Five year rolling Average monthly Highest monthly Lowest monthly Fund statistics are calculated since inception. OeKB-WPKNR: ISIN: WPKNR-Germany: Management fee: Incentive fee: Redemption: 8,413.15 741.32 % 18.32 % 30.02 % 26.80 % 58.88 % 66.97 % 1.41 % 18.96 % -16.72 % RISK STATISTICS Annual standard deviation Monthly standard deviation Max. initial risk per trade Typical margin to equity Maximum drawdown Maximum time off peak % of positive months 23.53 % 6.79 % 1.00 % 20 % 19.93 % 22 months 57.24 % ** estimated end-of-month index EFFICIENCY STATISTICS Sharpe ratio ** Sortino ratio ** (annualized) MAR ratio Correlation to S&P500 Correlation to CASAM CISDM CTA ew Correlation to CS/Tremont HF Correlation to DAX 0.78 1.37 0.92 -0.16 0.72 0.27 -0.14 ** modified (risk free performance = 0%) 097 979 AT0000979794 630 824 0.4 % p.m. 20 % monthly Currency: Paying Agent: Auditor: Trading Advisor: Legal Advisor: Homepage: EUR M&A PrivatBank AG KPMG Austria Superfund Trading Management Inc. Kindel & Kindel www.superfund.com 1) Investment into Superfund Unternehmens-Beteiligungs-AG (Superfund Q-AG) is closed to new investments. No subscriptions or follow-up subscriptions are possible or will be accepted. Performance results shown in this document are net of all fees. Past performance is not indicative of future results. Superfund-products are speculative investments. A complete loss of the principal invested cannot be excluded. Information published in this publication concerning Superfund Q-AG constitutes neither an offer to sell nor a solicitation to invest and is intended for informational purposes for existing investors only. The author and distributors of this material expressly disclaim any and all liability for any inaccuracies contained in this document, and shall not be held liable for the same. VIENNA | FRANKFURT | NEW YORK | HONG KONG | AMSTERDAM | STOCKHOLM | WARSAW | DUBAI | MONTEVIDEO | SINGAPORE |