LooPs CLOSING

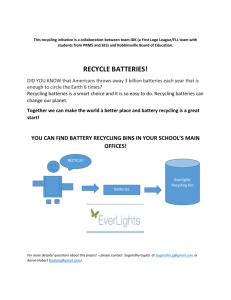

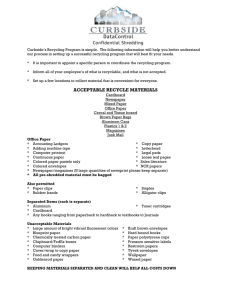

advertisement