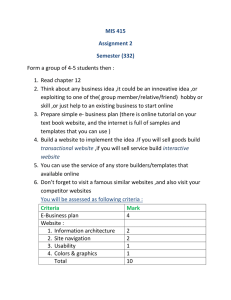

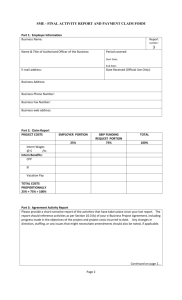

CENTER FOR Massachusetts INFORMATION Institute of

advertisement