E-business models

advertisement

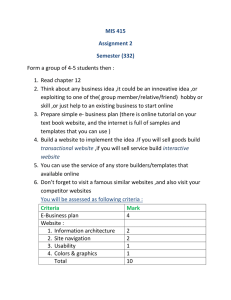

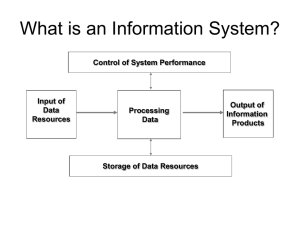

E-business models Making sense of the Internet business landscape Unprohibited want Massive channel disintermediation? Delineation between technology producers and technology users? Conducts of Dot-com Performance of vogue virtual integrations? The “new” economics of information Evan & Wurster Less about any specific new technology than a new behavior for reaching critical mass; The universal pervasion of open standards; The precipitate changes of the structure of entire industry and the ways companies compete M. Porter: Return to the fundamental principles underlying the novelty of phenomena Operations of new business Be shaped and reshaped by customers and the business community Emerging through evolution and adaptation A flexible Value web (network) dominated a single/dedicated value chain What is a model? The properties of models Enable study of the structure of a complex system, relationships among structural elements, assumptions, and a description of the system in action Can be built before the real system to help predict how the system might respond if we change the structure, structure, relationships, and assumptions A model in the world of business A description of a complex business that enables study of its structure, the relationships among structural elements, and how it will respond in the real world What is the so-called business model? A business model depicts the content, structure, and governance of transactions designed so as to create value through the exploitation of business opportunities. Amit & Zott (SMJ, 2001, p.511) The Content of Business Model The good or information that are being exchanged The resources and capabilities that are required to enable the exchange E.g., transparency of transaction, vertical & horizontal expansion of product/service, the degree of customization, technologies of transaction The Structure of Business Model The parties that participate in the exchange The ways in which these parties are linked The order process and the adopted exchange mechanism E.g., the providers of complementary assets, transaction speed, mode, simplicity, safety & reliability, integration of online & offline supply chains The Governance of Business Model The ways in which flows of information, resources, and goods are controlled by the relative parties The incentives for the participants in transactions E.g.,cooperative and shared incentive among allied partners, commitment and investment of co-specialized assets, loyalty maintenance E-business Models A description of roles and relationships among a firm’s consumers, customers, allies, and suppliers that identifies the major flows of product, information, and money, and the major benefits to participants, almost, over Internet . (Weill & Vitale, Place to Space, 2001, p.34) E-business models & examples Distributors models Focused distributor models Portal models Retailer, marketplace, aggregator/infomediary, exchange, E*trade, Amazon Horizontal, vertical, affinity, AOL, Yahoo!, iVillage Producer models Manufacturers, service providers, educators, advisors, information/news service, custom suppliers, Ford, GE, Boeing, Ernst & Yong, WSJ, McGraw-Hill E-business models & examples (cont.) Infrastructure provider models: to construct business that deliver the technology infrastructure Focused distributor Infrastructure retailer/marketplace/exchange, CompUSA, Staples, IngramMicro, Egghead Portal Horizontal/vertical infrastructure portals, AOL, AT&T, Oracle Producer Equipment/component manufacturers, infrastructure software/services firms, IBM, Dell, Compaq, Oracle, Ariba, MS, Doubleclick Custom software/hardware suppliers, Dell, Andersen Consulting Does Adam Smith’s law still work? Three technological prerequisites to facilitate market economy Excludability Rivalry Transparency Could Internet technologies promote above three properties for the information-based economy? If not all, some business mechanisms will be needed Indicators of survival business model Customer value—segmentation, value proposition Scope—core or by-products Pricing—attractive willingness-to-pay prices Revenue sources—exploitation & leverage of complements Connected activities—the complete value chain Construction—IT infrastructure, organization, and key champion Capability—acquisition of necessary competence Sustainability—setup firewall to prevent imitation Business models: a matter of perspective The customer perspective Efficiency, responsiveness, security Anything valuable more than social contact & face-to-face interactions? The business community perspective Assets investment: current/tangible/intangible assets Revenue flow: commerce/content/community/ infrastructure revenue sources Cost allocation: M/I/T categories Crafting an e-business web Attach to the gateway Leverage with the complements Search the common interface Enhancement on functionality Expansion of diversity on existing businesses Extension on new businesses Exit for far-leap Extended readings Evans, P. and T. Wurster (1997), “Strategy and the New Economics of Information,” Harvard Business Review, 75(5), Sept.-Oct., pp.70-83. Porter, M. E. (2001), “Strategy and the Internet,” Harvard Business Review, 79(3), March, pp.62-78. Referred papers Chatterjee, Debabroto, Rajdeep Grewal and V. Sambamurthy (2002), “Shaping Up for E-commerce: Institutional Enablers of the Organizational Assimilation of Web Technologies,” MIS Quarterly, Volume 26, Number 2, pp.65-89. Fichman, R. G. and Kemerer C. F. (1999), “The Illusion Diffusion of Innovation: An Examination of Assimilation Gaps,” Information Systems Research, Sept. pp, 255-275. Kline, R. B. (1998), Principles and Practices of Structural Equation Modeling, The Guilford Press, New Work. Referred papers (cont.) Grover, Varun, and Pradipkumar Ramanlal (1999), “Six Myths of Information and Markets: Information Technology Network, Electronic Commerce, and the Battle for Consumer Surplus,” MIS Quarterly, Volume 23, Number 4, pp.469-495. Stigler, George (1961), "The Economics of Information", Journal of Political Economy. Distorted Market Signals Attracting the base of customers by heavy discounts rather than true costs Click-through is not the same as cash Booming by the curiosity rather than utility Revenue inflow from stocks rather prices Enjoying subsidized inputs Masking true costs but transferring them to shareholders Understatement of the need of capital for asset building The Illusion of Prosperity Dot-Coms multiplied so rapidly because of Every low barriers to entry Raising capital without having to demonstrate performance and viability. Just going through a period of transition Return to the fundamentals eventually A Return to Fundamentals Industry structure Five/six forces analysis Competitors/complementarities Customers Suppliers Substitutes Entrants Sustainable competitive advantage Operational effectiveness Strategic positioning