Business Office AA Round Up Wednesday March 27, 2008

advertisement

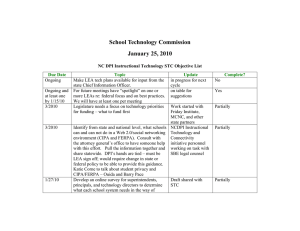

Business Office AA Round Up Wednesday March 27, 2008 Topics of Discussion Accounts Payable Timeline Consequences of late payments Account code definitions and examples Local Vendor Payment Timeline (current) STC employee receives notice that purchase order and/or credit card available at Purchasing department at beginning of month STC employee purchases item from local vendor within a few days of receiving purchase order and/or credit card STC employee receives original invoice from local vendor AP receives statement from Vendor at the beginning of the following month As soon as statement is received, the Accounting Assistant requests copies of the invoices from the vendor. As soon as copies of the invoices are received, the Accounting Assistant faxes the invoice to the Administrative Assistants for FM approval At this point the invoice is approximately 45 days past the invoice date If Administrative Assistant unable to return original invoice within 3 days (due to FM or STC employee not being available), this delays the payment further. Local Vendor Prompt Payment Timeline (Goal) STC employee receives notice that purchase order and/or credit card available at Purchasing department at beginning of month STC employee purchases item from local vendor within a few days of receiving purchase order and/or credit card STC employee receives original invoice from local vendor STC employee turns in original invoice to Administrative Assistant Administrative Assistant has FM approve original invoice Administrative Assistant forwards original invoice to AP Accounting Assistant within 3 working days from invoice date AP Accounting Assistant processes payment within 2 weeks of invoice date (dependent on AP check cycle deadlines) Possible consequences for STC of late payments to Vendors Holds on STC account Reduction of credit limit Placing STC on cash only basis Credit rating effects Hold on STC Account Most vendors require payment within 30 days of invoice date, local vendors included. Examples: HEB Wal Mart Exxon Reminder: Many departments use our local vendors, when an invoice is not turned in, and vendors place a hold on the STC account, NO departments can charge even with a valid purchase order. Authorized purchaser should submit invoices to AA and AA in turn should forward approved original invoice to Accounts Payable. Reduction of credit limit Does not happen often, however, it is a possibility This would be caused by consistent delayed payment to vendor This would increase the possibility of not being able to purchase the items you wish because another department could use up our line of credit more quickly Placing STC on Cash Basis Another situation that does not happen often, however, it is a possibility Many local vendors depend on consistent cash flow to stay in business and expect prompt payment from STC Perhaps you have a favorite vendor that you like to use for purchasing certain items for your office, or student events. STC needs to keep a positive payment relationship with their vendors Placement on cash basis requires planning ahead for event, prepayment, and AP check cycle deadlines, as well as confirmation with Purchasing and AP that all proper paperwork received (contracts, prepayment request forms, etc) STC Credit Rating effects STC, like other businesses, has a credit rating report with Dun and Bradstreet These ratings tell other vendors how quickly STC processes payments to their vendors If vendors do not like STC’s credit rating they will not do business with STC This creates problems with Sole Source vendors, or vendors who provide the best services but will not be available for STC due to our Credit rating At this time, STC’s credit rating is a 2 (the best rating is a 1). This means we have a low to moderate risk of severe payment delinquency within the next 12 months. AP is constantly striving to change our rate to a 1, but we need your help Account Code Definitions and examples Website for the Account codes: http://www.southtexascollege.edu/businessoffice/forms/Account_Classifications.pdf Most commonly questioned account codes: 710002 – Consumables 713005, 713010, 713015, 713020, 713025, 713030, 713035, 713040 – Non Inventory and Inventory Furniture/Equipment/Computer Equipment Software and licenses 714030 Hardware/Materials/Parts/Supplies 714035 Telecommunication parts/supplies 714505 Purchased contracted services 714525 Consultant Services 716505 Penalties/Fines 710002 Consumables To record payment for supplies that cannot be categorized as office supplies, computer supplies and janitorial supplies. This code includes paper cups, napkins, and paper plates. Use this account code if no other account code available and items are disposable 713005 Non-Inventory Furniture & Equip $0-$999.99 To record payment for the purchase of furniture and equipment whose unit value is below $1,000. These items will last more than one year, such as 10 key calculators, chairs, bookshelves, tables, magazine racks, date stamp machines, file cabinets, etc 713010 Non-Inventory Computer Equip $0-$999.99 To record payment for the purchase of microcomputers and computer printers whose unit value is below $1,000. These items will last more than one year such as printer, scanner, computer items purchased separately (monitor, keyboard, speakers) 713015 Inventory Furniture & Equip $1,000-$4,999.99 To record payment for the purchase of furniture and equipment whose unit value is greater than $1,000 and less than $5,000. These items are considered controlled by Planning & Construction and must be secured and tracked due to their nature. Items such as Fireproof file cabinets, safes, CPR items (testing mannequins, nursing equipment) 713020 Inventory Computer Equip $1,000-$4,999.99 To record payment for payment for the purchase of microcomputers and computer printers whose unit value is greater than $1,000 and less than $5,000. These items are considered controlled by I.T. and must be secured and tracked due to their nature. Items such as servers, computers (when everything purchased as one unit – computer, monitor, keyboard speakers), printer/fax/scan machines, etc 713025 Inventory Software $1,000-$4,999.99 To record payment for the purchase of computer software whose unit value is between $1,000 and $5,000. These items are considered controlled by I.T. & must be secured and tracked due to their nature. These are software items that STC owns, we have purchased the software to keep, and item description will say “software”. 713030 Non-Inventory Software $0-$999.99 To record payment for the purchase of computer software whose unit value is below $1000. These are software items that STC owns, we have purchased the software to keep, and item description will say “software”. 713035 Non-Inventory Software License $0-$999.99 To record payment for the license to use specific software whose unit value is below $1000. This is permission to use someone else’s software – does not belong to STC. The description will say “License”. 713040 Inventory Software License $1,000-$4,999.99 To record payment for the license to use specific software whose unit value is greater than $1,000 and less than $5,000. This is permission to use someone else’s software – does not belong to STC. The description will say “License”. 714030 Hardware/Materials/Parts/Supplies To record payment for hardware, materials, parts and supplies. This code includes countertops, caulking compound breaker boxes, electrical outlets, lumber, siding, door jams, door locks, wire, paint, copper tubing, cement, pipe adapters and bolts. (Maintenance department only). These items will be mostly used by the Facilities department. However, there are exceptions allowed (IT, Purchasing), most other departments should ask prior to using this account code 714035 Telecom parts/supplies To record payment for parts and supplies for telecommunications equipment. This code include replacement parts, telephone headsets, telephone cables, telephone jacks, telephone cords, cell phone batteries and telephone receivers. 714505 Purchased contracted services vs 714525 Consultant services 714505 – To record payment for contracted services not listed in account codes below. This code includes moving services, collection agency services, officiating services, extermination services, and entertainment services. 714525 – To record payment for consultant services. This code does not include computer consultant services. 716505 Penalties & Fines To record payment for fines and penalties. No longer “other fees”

![[PowerPoint 2007] presentation file](http://s2.studylib.net/store/data/005406460_1-7834316c409f9802f7aec3d8538324fb-300x300.png)

![Career Center 5 English [005] .indd](http://s3.studylib.net/store/data/008252861_1-a505cad1ddf780a5cb1005da866a969e-300x300.png)