Trade and Job Loss in U.S. Manufacturing, 1979-94 Lori G. Kletzer

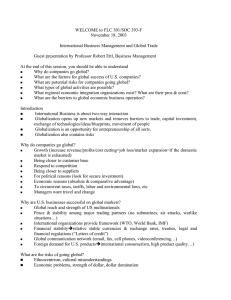

advertisement