Inequality, Leverage and Crises

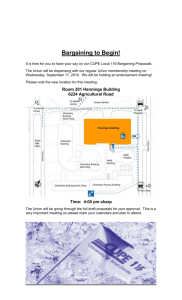

advertisement