OUTH CAR SALE E X C H A N G E ENTERPRISE/CREDIT UNION

advertisement

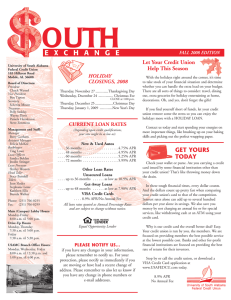

OUTH E X C H A N G E ENTERPRISE/CREDIT UNION University of South Alabama Federal Credit Union 103 Hillcrest Road Mobile, AL 36608 Board of Directors: President Chuck Warnol Vice President Ben Tipton Secretary Scherita Mixon Treasurer Polly Stokley Wayne Davis Pamela Henderson Steve Simmons Management and Staff: Manager Betty Gorham Assistant Manager Felicia McKee Bookkeeper Ting Lowe Loan Officers Sandra Bolden Jenifer Stringer Loan Processor Shirley Wesson Head Teller Stacy Barnhill Tellers Doris Martin Joan Sluder Stephanie Lowe Kathleen Ellis Brenda Walker Phone: (251) 706-0255 Fax: (251) 706-0299 Main (Campus) Lobby Hours: Monday-Friday 8:00 a.m. til 5:00 p.m. Drive-Up Hours: Monday-Thursday 7:30 a.m. til 5:00 p.m. Friday 7:30 a.m. til 5:30 p.m. USAMC Branch Office Hours: Monday, Wednesday, Friday 8:00 a.m. til 12:30 p.m. and 1:00 p.m. til 4:00 p.m. SUMMER 2008 EDITION CAR SALE HOLIDAY CLOSINGS, 2008 Friday, July 4 ................................Independence Day Monday, September 1 ..............................Labor Day Thursday, November 27 ..............Thanksgiving Day Wednesday, December 24 ................ Christmas Eve CLOSE at 1:00 p.m. Thursday, December 25 ....................Christmas Day September 4 & 5, 2008, 8:00 – 5:00 September 25 & 26, 2008, 8:00 – 5:00 • • • • • • No-Haggle Pricing Certified Vehicles Trade-Ins 7-Day Repurchase Agreement 12/12 Limited Powertrain Warranty Enterprise Roadside Assistance See current inventory at www.cuautodeals.com. MARK YOUR CALENDAR for these important dates. CURRENT LOAN RATES (Depending upon credit qualifications, your rate might be as low as): New & Used Autos . . . . 36 months . . . . 48 months . . . . 60 months . . . . 72 months . . . . . . . . . . . . . . . . . . .4.75% APR . . . . . . . . . . . . . . . . . . .4.95% APR . . . . . . . . . . . . . . . . . . .5.25% APR . . . . . . . . . . . . . . . . . . .5.99% APR Other Loan Rates Unsecured Loans . . . . up to 36 months . . . . . . as low as 10.9% APR Get-Away Loans . . . . up to 48 months . . . . . . as low as 7.90% APR VISA Credit Cards . . . . 8.9% APR/No Annual Fee All loan rates quoted as Annual Percentage Rates and are subject to change without notice. EQUAL HOUSING LENDER Equal Opportunity Lender PLEASE NOTIFY US... if you have any changes in your information, please remember to notify us. For your protection, please notify us immediately if you are moving or have had a recent change of address. Please remember to also let us know if you have any change in phone numbers or email addresses. Hybrids are HOT and So Are Our RATES! With gas prices climbing steadily higher, more consumers are checking out hybrids. The Toyota Prius is the number one selling brand according to www.hybridcars.com, but as carmakers jump on the hybrid bandwagon, drivers have more options. Although hybrids offer excellent fuel economy, be prepared for sticker shock. And because demand is high, it may be difficult to negotiate the price. That makes getting preapproved for a loan at the credit union more important than ever. With your financing taken care of, you’ll be able to focus on getting the best deal possible. Our rates are great, so this may well be the perfect time to say farewell to your gas guzzler and hello to the eco-friendly way to get around. Call or stop by the credit union to find out how a pre-approved vehicle loan can help you go green. STATEMENT OF FINANCIAL CONDITION AS OF MAY 31, 2008 ASSETS: Total Net Loans & VISAs Net Investments Fixed Assets Land and Building Other Assets TOTAL ASSETS $14,445,017.30 9,731,216.02 108,680.34 842,939.52 98,633.11 $25,226,486.29 Liabilities & equity: Liabilities (Payables) Member Deposits: Certificates of deposit Share Drafts (Checking) IRAs Christmas & Youth Clubs Regular Shares Equity Regular Reserves Undivided Earnings TOTAL LIABILITIES & EQUITY 624,430.08 5,091,804.00 2,879,654.01 890,576.62 463,588.17 12,275,633.00 336,491.99 2,664,308.42 $25,226,486.29 THE ADVANTAGES OF “SIGNATURE-BASED” DEBIT CARD PURCHASES When you make a purchase with your USAFCU VISA® Debit Card, the merchant usually asks you "debit or credit?" When you say "credit," you will typically be given a receipt to sign. Or you may be using your Debit Card at a pay-at-the-pump gas station where you can select "credit" as the payment option. In both cases, your purchase will be processed as a signature-based transaction. PLEASE NOTE: When you say "credit" to a merchant and the amount of your purchase is less than $50, you may not be required to sign the receipt. There are three good reasons for making signature-based/credit purchases with your VISA Debit Card: SMART REASONS TO TAKE OUT A HOME EQUITY LOAN For those who treated their home as if it were an ATM, the housing slump may be causing some financial difficulty. But a home equity loan is still a shrewd way to borrow. The key, as always, is the wise use of credit. Here are three smart reasons to consider a home equity loan: For renovations, repairs, or upgrades to your home. Making your home more energy efficient by replacing windows or adding insulation, for example, can save you money as well as help save Mother Earth. For debt consolidation. While a home equity loan isn’t a free pass to turn short-term debt you’ve accumulated on credit cards into long-term debt, it is a way to get back on track. Make a plan and stick to it. For tax savings. A home equity loan can be a taxadvantaged way to borrow. So if you need new wheels, financing a vehicle with a home equity loan rather than a traditional car loan may save you tax dollars. The loan process is very simple. Depending on the amount of the loan and the amount of equity in your home, the loan can be available in a few days. Stop by our main branch today to see if you qualify for a home equity loan. ***PLEASE NOTE*** Per Board of Directors Policy Effective July 1, 2006, members with less than the credit union’s required minimum share balance of $25.00 will be charged a fee of $24.99. Please check your statement to make sure you have the minimum $25.00 balance in shares. 1. You help prevent your PIN number (typically used for ATM cash withdrawals) from being stolen by an unauthorized user. 2. Your purchase will be identified by the name of the merchant as well as the city and state on .your transaction records (online banking and mailed statements). 3. You will be protected by VISA’s Zero Liability Policy if your card is used fraudulently. TRAVEL THE SMART WAY The really happy person is one who can enjoy the scenery when on a detour. CREDIT UNION SERVICE CENTERS The Member-Friendly Financial Network Summertime is travel time for many of our credit union members, and the smart way to carry cash is with travelers checks. Travelers checks are secure, accepted most everywhere, and easily replaced if lost or stolen. With travelers checks, you carry the money you want without the worry. They are available in a variety of denominations, and the cost is very reasonable. Stop by the credit union before your trip and let us set you up with travelers checks.