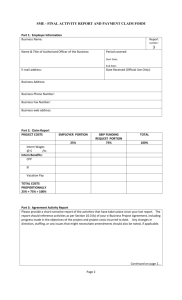

Document 11205181

advertisement