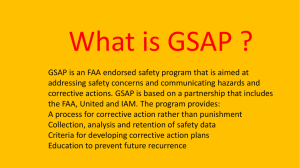

The Graduate Student Anchored Project:

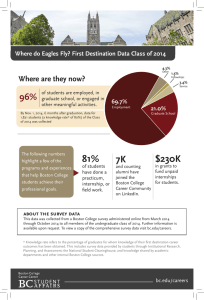

advertisement