Gross Margin Analysis

advertisement

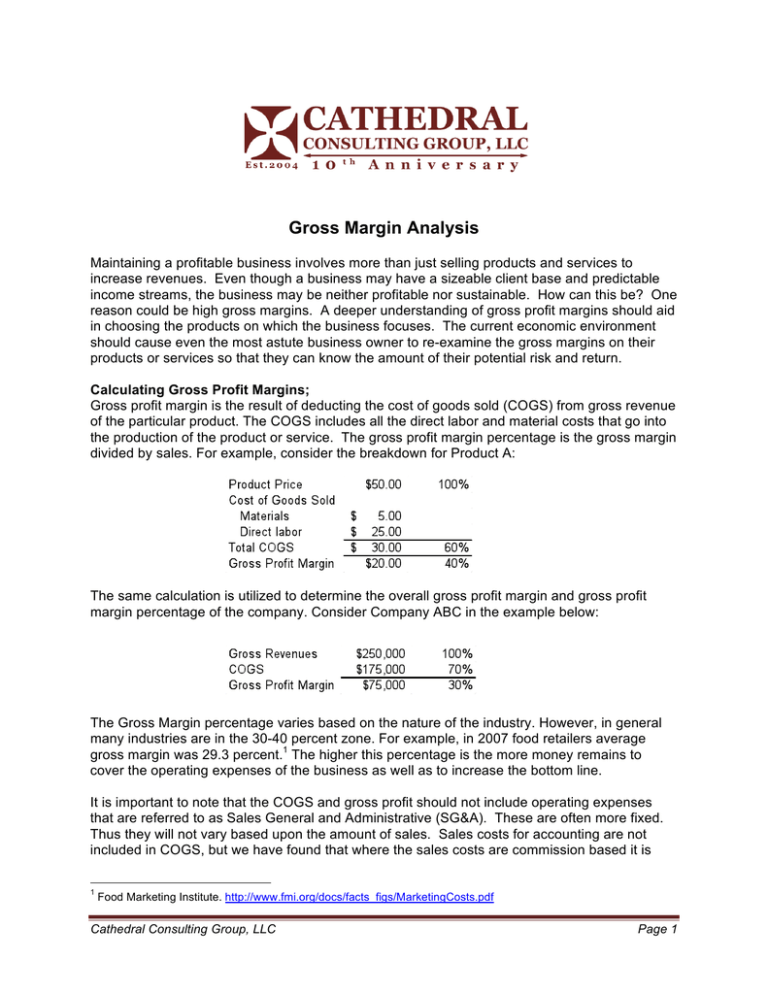

Gross Margin Analysis Maintaining a profitable business involves more than just selling products and services to increase revenues. Even though a business may have a sizeable client base and predictable income streams, the business may be neither profitable nor sustainable. How can this be? One reason could be high gross margins. A deeper understanding of gross profit margins should aid in choosing the products on which the business focuses. The current economic environment should cause even the most astute business owner to re-examine the gross margins on their products or services so that they can know the amount of their potential risk and return. Calculating Gross Profit Margins; Gross profit margin is the result of deducting the cost of goods sold (COGS) from gross revenue of the particular product. The COGS includes all the direct labor and material costs that go into the production of the product or service. The gross profit margin percentage is the gross margin divided by sales. For example, consider the breakdown for Product A: The same calculation is utilized to determine the overall gross profit margin and gross profit margin percentage of the company. Consider Company ABC in the example below: The Gross Margin percentage varies based on the nature of the industry. However, in general many industries are in the 30-40 percent zone. For example, in 2007 food retailers average gross margin was 29.3 percent.1 The higher this percentage is the more money remains to cover the operating expenses of the business as well as to increase the bottom line. It is important to note that the COGS and gross profit should not include operating expenses that are referred to as Sales General and Administrative (SG&A). These are often more fixed. Thus they will not vary based upon the amount of sales. Sales costs for accounting are not included in COGS, but we have found that where the sales costs are commission based it is 1 Food Marketing Institute. http://www.fmi.org/docs/facts_figs/MarketingCosts.pdf Cathedral Consulting Group, LLC Page 1 helpful to include them in COGS for the gross margin analysis purposes, because the sales costs are variable. Overhead can be a challenge in this calculation because overhead is also fixed but will often belong in COGS. Part of the benefit of keeping the fixed amounts out of COGS and gross profit is the ability to use the gross profit margin to determine the level of sales required to make a profit. In today’s economic environment being able to model the sales requirements as costs and prices change is critical. Gross Profit Margin Evaluations: Gross margins should be evaluated at the individual product level as well as to the entirety of the product mix. Each level of calculation offers valuable information with which better informed decisions can be made for the business. A gross margin analysis will provide information on the profitability of each item, the profitability of each line of items, the amount of costs that need to be cut to achieve the target gross margin, or perhaps that a price increase is necessary. As businesses grow and consider adding new product lines or new methods of distribution, it is vital to examine the gross margin implications of these decisions. Occasionally, revenues can be increased with new products that result in an overall decrease of your gross profit margins, even resulting in less net profit. For example, suppose that a manufacturer was considering utilizing a new wholesale distribution channel to broaden exposure in the market with their product. The product is typically sold for $20 at a retail level with a 60% gross margin. Wholesalers get a 30 percent discount from the retailer price, resulting in a $14 wholesale price and a 43% gross margin. For illustration purposes we assume that the new wholesaler demands a 50 percent discount from retail price. The Gross Margin percentage for the new wholesaler would be 20 percent, rather than the usual 43 percent for other wholesalers. The result is that a $200,000 increase in revenue results in a $40,000 increase in gross margin. On its face this seems positive, but if there is significant added costs to generate this revenue, then the margin may be inadequate. Furthermore the overall gross margin percentage is now 38%. If this is used for future pricing, then there can be permanent erosion of gross margin. Cathedral Consulting Group, LLC Page 2 Suppose that this new distribution channel would also come at the cost of a 10 percent sales commission to a representative. Including the sales commission in COGS would decrease the gross margins to 10 percent. Again, the business needs to evaluate the merit of pushing sales through this channel versus broadening already existing channels. Now the gross margin from the added $200,000 of sales is $20,000 and the overall gross margin is 35%. Thus the overall gross margin percentage has gone form 47% to 35% adding to the risk that 35% becomes the going forward pricing strategy. In addition the operating costs were probably designed for a 47% gross margin with costs growing with sales at this rate. The result is that with the growth in revenue of $200,000, operating cost of $80,000 (40%) are added, causing a decline in profits of $60,000. These situations occur more often than we like, which is why we note them here. Strategic observations: Increasing market presence: In the example, a strategic reason for the new distributor can be increasing awareness. The goal is to maximize sales volume while maintaining pricing that ensures that the gross margin adequately covers all fixed overhead and variable expenses associated with additional sales and the aggregate gross margin covers all operating costs of the business with an eye on profit level. In today’s economic times, many companies are finding opportunities to increase market share, but using reduced prices and gross margin. The above analysis is critical to these decisions in order not to create a loss situation for the enterprise. Required sales levels from gross margin: It is possible to determine the required sales from gross margin by dividing the operating costs (SG&A) by the overall gross margin percentage. SG&A Gross margin percentage Required sales to cover SG&A $250,000 40% $625,000 This shows that with $625,000 in sales having a 40% gross margin, this company will break even. In setting budgets and sales targets, such information is critical. Developing and retiring products: When it comes to making decisions to develop new products or eliminate current products from the product mix, gross margin analysis as illustrated above will be most helpful. Inventory Management: Too often inventory management is not factored into the COGS and gross margin analysis. Inventory costs start with the abortion of cash. Liquidity in the current economic situation is critical and thus a minimum amount of inventory is essential. The next piece to consider is carrying costs, both financial and operational. Financial today will generally be an equity rate, which has to be at least 12%, with 24% not being unreasonable. Thus $100,000 of inventory costs $1,000 to $2,000 per month just to finance. Operating costs include shelf and storage space. Phil Clements is CEO of Cathedral Consulting Group, LLC and a Managing Director in the New York Office. Sharon Nolt is a former Senior Associate in the New York Office. For more information, please visit Cathedral Consulting Group LLC online at www.cathedralconsulting.com or contact us at info@cathedralconsulting.com. Cathedral Consulting Group, LLC Page 3