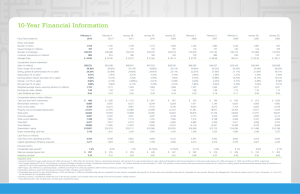

Table 1 EMERSON AND SUBSIDIARIES CONSOLIDATED OPERATING RESULTS

advertisement

Table 1 EMERSON AND SUBSIDIARIES CONSOLIDATED OPERATING RESULTS (AMOUNTS IN MILLIONS EXCEPT PER SHARE, UNAUDITED) Quarter Ended June 30, 2014 2015 Net sales Costs and expenses: Cost of sales SG&A expenses Other deductions, net Interest expense, net Earnings before income taxes Income taxes Net earnings Less: Noncontrolling interests in earnings of subsidiaries Net earnings common stockholders Percent Change $6,312 $5,503 (13)% 3,674 1,424 96 46 1,072 334 738 10 $728 3,269 1,276 122 40 796 222 574 10 $564 (26)% Diluted avg. shares outstanding 703.3 668.9 Diluted earnings per share common stockholders $1.03 $0.84 Quarter Ended June 30, 2014 2015 Other deductions, net Amortization of intangibles Rationalization of operations Other Total $55 11 30 $96 $52 36 34 $122 (22)% (23)% (18)% Table 2 EMERSON AND SUBSIDIARIES CONSOLIDATED OPERATING RESULTS (AMOUNTS IN MILLIONS EXCEPT PER SHARE, UNAUDITED) Nine Months Ended June 30, 2014 2015 Net sales Costs and expenses: Cost of sales SG&A expenses Gain on sale of business Other deductions, net Interest expense, net Earnings before income taxes Income taxes Net earnings Less: Noncontrolling interests in earnings of subsidiaries Net earnings common stockholders $17,730 $16,490 10,461 4,262 — 328 147 2,532 763 1,769 32 $1,737 9,810 3,999 932 322 126 3,165 1,083 2,082 20 $2,062 Diluted avg. shares outstanding 705.6 682.6 Diluted earnings per share common stockholders $2.45 $3.01 Nine Months Ended June 30, 2014 2015 Other deductions, net Amortization of intangibles Rationalization of operations Other Total $170 45 113 $328 $160 89 73 $322 Percent Change (7)% 25% 18% 19% 23% Table 3 EMERSON AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (DOLLARS IN MILLIONS, UNAUDITED) Quarter Ended June 30, 2014 2015 Assets Cash and equivalents Receivables, net Inventories Other current assets Total current assets Property, plant & equipment, net Goodwill Other intangible assets Other Total assets $3,049 4,772 2,253 739 10,813 3,737 7,917 1,768 880 $25,115 $3,393 4,272 2,144 835 10,644 3,610 6,930 1,575 705 $23,464 Liabilities and equity Short-term borrowings and current maturities of long-term debt Accounts payables Accrued expenses Income taxes Total current liabilities Long-term debt Other liabilities Total equity Total liabilities and equity $2,975 2,645 2,736 177 8,533 3,565 2,144 10,873 $25,115 $3,179 2,402 2,678 53 8,312 4,290 2,063 8,799 $23,464 Table 4 EMERSON AND SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOWS (DOLLARS IN MILLIONS, UNAUDITED) Nine Months Ended June 30, 2014 2015 Operating activities Net earnings Depreciation and amortization Changes in operating working capital Pension funding Gain on divestiture of business, after tax Income taxes paid on divestiture gain Other, net Net cash provided by operating activities $1,769 623 (157) (90) — — 139 2,284 $2,082 613 (530) (21) (528) (360) 172 1,428 Investing activities Capital expenditures Purchase of businesses, net of cash and equivalents acquired Divestitures of businesses Other, net Net cash (used by) provided by investing activities (573) (610) 264 (107) (1,026) (516) (250) 1,399 (86) 547 Financing activities Net increase in short-term borrowings Proceeds from long-term debt Principal payments of long-term debt Dividends paid Purchases of common stock Purchases of noncontrolling interests Other, net Net cash used by financing activities 1,133 1 (323) (910) (783) (574) (19) (1,475) 945 1,000 (504) (960) (2,041) — (12) (1,572) (9) (159) Effect of exchange rate changes on cash and equivalents Increase (decrease) in cash and equivalents (226) 244 Beginning cash and equivalents 3,275 3,149 Ending cash and equivalents $3,049 $3,393 Table 5 EMERSON AND SUBSIDIARIES SEGMENT SALES AND EARNINGS (DOLLARS IN MILLIONS, UNAUDITED) Quarter Ended June 30, 2014 2015 Sales Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Eliminations Net sales Earnings Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Differences in accounting methods Corporate and other Interest expense, net Earnings before income taxes Rationalization of operations Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Total $2,317 1,289 1,237 1,191 492 6,526 (214) $6,312 $2,084 990 1,028 1,125 477 5,704 (201) $5,503 $473 214 107 250 108 1,152 63 (97) (46) $1,072 $373 156 37 222 98 886 54 (104) (40) $796 $4 2 3 1 1 $11 $12 4 17 2 1 $36 Table 6 EMERSON AND SUBSIDIARIES SEGMENT SALES AND EARNINGS (DOLLARS IN MILLIONS, UNAUDITED) Nine Months Ended June 30, 2014 2015 Sales Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Eliminations Net sales Earnings Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Differences in accounting methods Corporate and other Interest expense, net Earnings before income taxes Rationalization of operations Process Management Industrial Automation Network Power Climate Technologies Commercial & Residential Solutions Total $6,466 3,670 3,711 3,018 1,418 18,283 (553) $17,730 $6,225 3,176 3,210 3,007 1,422 17,040 (550) $16,490 $1,229 563 286 543 307 2,928 180 (429) (147) $2,532 $1,064 464 150 518 292 2,488 165 638 (126) $3,165 $12 7 13 11 2 $45 $37 8 31 8 5 $89 Reconciliations of Non-GAAP Financial Measures & Other Table 7 The following reconciles non-GAAP measures (denoted by *) with the most directly comparable GAAP measure (dollars in millions, except per share amounts): Q3 sales change Underlying* Acq/Div FX Other Reported 2015E sales change Underlying* Acq/Div FX Reported Process Industrial Mgmt Auto (4 )% (5 )% —% (11 )% (6 )% (7 )% —% —% (10 )% (23 )% Network Power (11 )% (1 )% (5 )% —% (17 )% Climate Comm & Tech Res Solns (3 )% 1% —% —% (3 )% (2 )% —% (2 )% (6 )% (3 )% Q3 2014 $— $— $— Q3 2015 $— $— $— Total (5 )% (3 )% (5 )% —% (13 )% ~(2)% ~(2)% ~(5)% ~(9)% EPS Reported Gain on sale of power transmission solutions Adjusted* % Change —% —% —% Note: Underlying sales and orders exclude the impact of acquisitions, divestitures and currency translation.