HARVARD

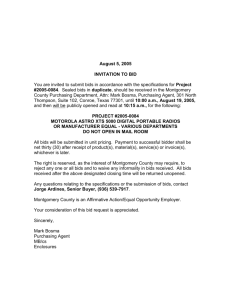

advertisement