Document 11114862

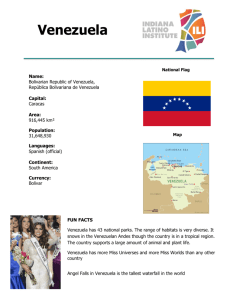

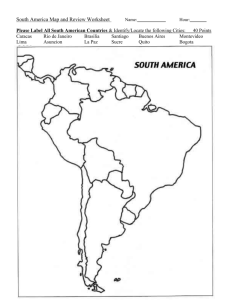

advertisement