Face of Instability: Collective Bargaining in the A Resource for Workers and

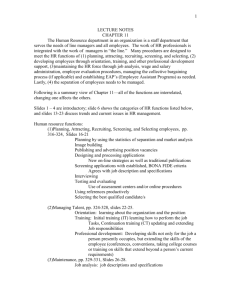

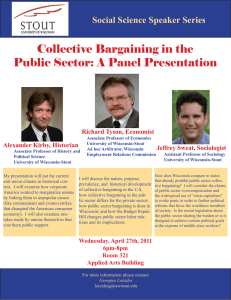

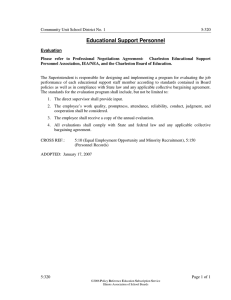

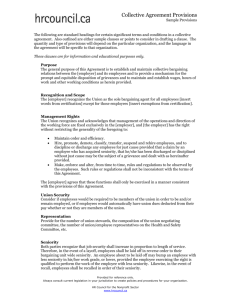

advertisement