Business Department — Queensborough Community College/CUNY

advertisement

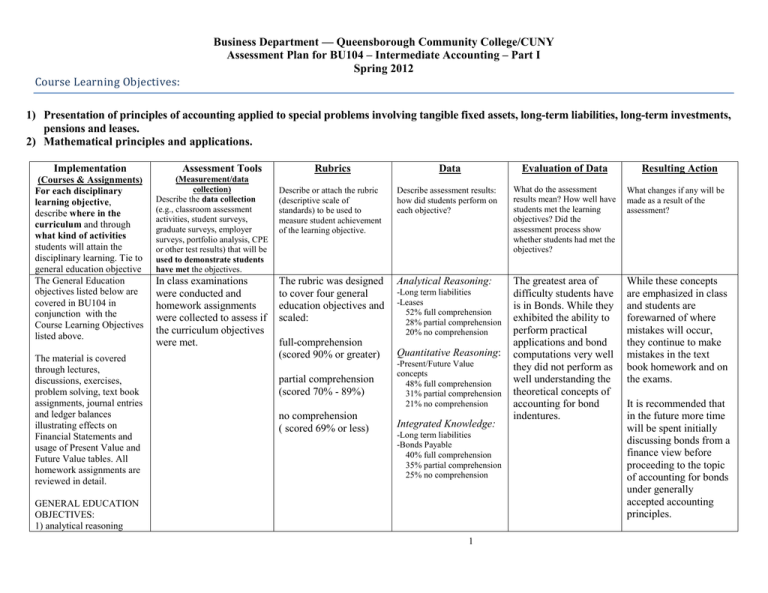

Business Department — Queensborough Community College/CUNY Assessment Plan for BU104 – Intermediate Accounting – Part I Spring 2012 Course Learning Objectives: 1) Presentation of principles of accounting applied to special problems involving tangible fixed assets, long-term liabilities, long-term investments, pensions and leases. 2) Mathematical principles and applications. Implementation (Courses & Assignments) For each disciplinary learning objective, describe where in the curriculum and through what kind of activities students will attain the disciplinary learning. Tie to general education objective The General Education objectives listed below are covered in BU104 in conjunction with the Course Learning Objectives listed above. The material is covered through lectures, discussions, exercises, problem solving, text book assignments, journal entries and ledger balances illustrating effects on Financial Statements and usage of Present Value and Future Value tables. All homework assignments are reviewed in detail. Assessment Tools (Measurement/data collection) Describe the data collection (e.g., classroom assessment activities, student surveys, graduate surveys, employer surveys, portfolio analysis, CPE or other test results) that will be used to demonstrate students have met the objectives. In class examinations were conducted and homework assignments were collected to assess if the curriculum objectives were met. Rubrics Data Evaluation of Data Resulting Action Describe or attach the rubric (descriptive scale of standards) to be used to measure student achievement of the learning objective. Describe assessment results: how did students perform on each objective? What do the assessment results mean? How well have students met the learning objectives? Did the assessment process show whether students had met the objectives? What changes if any will be made as a result of the assessment? The rubric was designed to cover four general education objectives and scaled: Analytical Reasoning: The greatest area of difficulty students have is in Bonds. While they exhibited the ability to perform practical applications and bond computations very well they did not perform as well understanding the theoretical concepts of accounting for bond indentures. While these concepts are emphasized in class and students are forewarned of where mistakes will occur, they continue to make mistakes in the text book homework and on the exams. -Long term liabilities -Leases 52% full comprehension 28% partial comprehension 20% no comprehension full-comprehension (scored 90% or greater) Quantitative Reasoning: partial comprehension (scored 70% - 89%) -Present/Future Value concepts 48% full comprehension 31% partial comprehension 21% no comprehension no comprehension ( scored 69% or less) Integrated Knowledge: -Long term liabilities -Bonds Payable 40% full comprehension 35% partial comprehension 25% no comprehension GENERAL EDUCATION OBJECTIVES: 1) analytical reasoning 1 It is recommended that in the future more time will be spent initially discussing bonds from a finance view before proceeding to the topic of accounting for bonds under generally accepted accounting principles. Business Department — Queensborough Community College/CUNY Assessment Plan for BU104 – Intermediate Accounting – Part I Spring 2012 (Gen Ed Obj 2) 2) quantitative reasoning (Gen Ed Obj 3) 3) integrated knowledge (Gen Ed Obj 5) 2