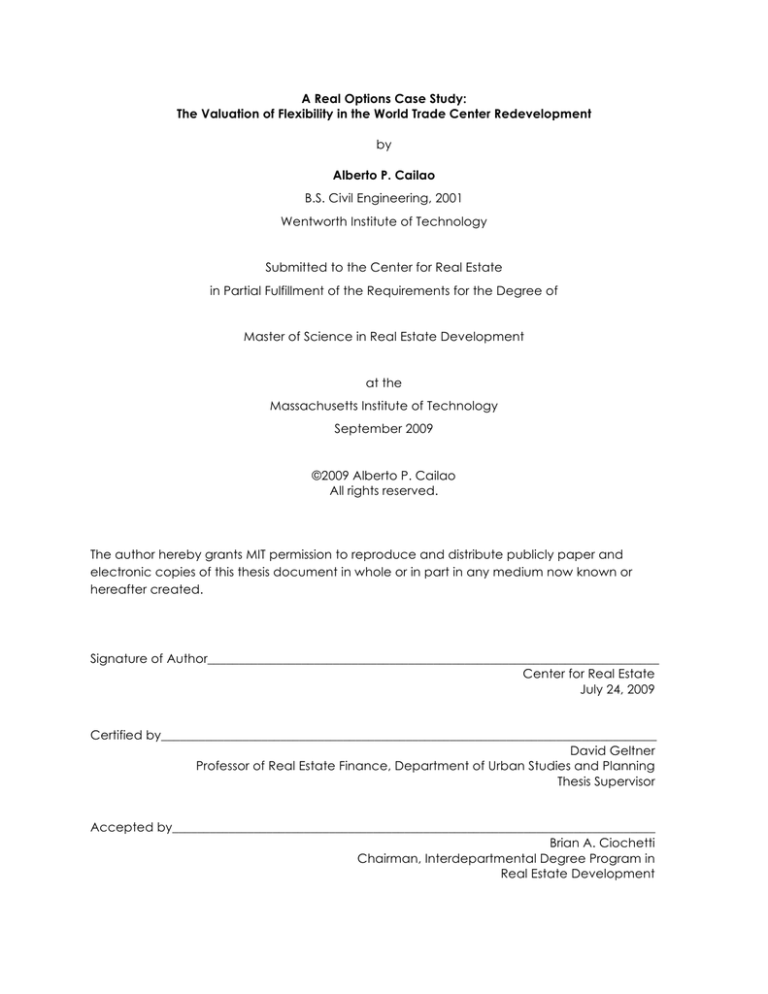

A Real Options Case Study: Alberto P. Cailao

advertisement