Document 11077726

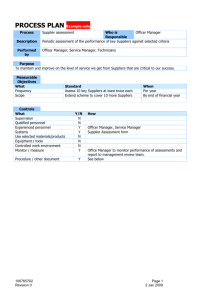

advertisement