The Ohio State University Max M. Fisher College of Business

advertisement

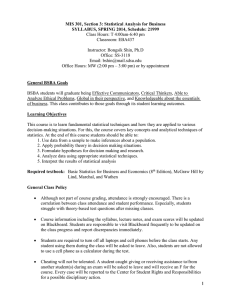

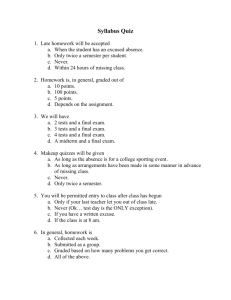

The Ohio State University Max M. Fisher College of Business Accounting and Management Information Systems 522: Intermediate Accounting II Course Syllabus - Summer 2009 – Mon/Weds - 10:30-12:18 –Schoenbaum 215 Instructor: Stephanie L. Brewer, CPA, CVA Office: 434 Fisher Hall Phone: 614-292-3903 (office) / 937-245-0958 (cell) E-mail: brewer.205@osu.edu Office Hours: Mon/Weds 9:15-10:15; Tues/Thurs 4:15-5:15; and by appointment Course Materials: Required - Spiceland, Sepe, Tomassini, 5th ed. Intermediate Accounting, ISBN 0-077-28207-8 & 978-0-07352687-4 Course Description and Objective: This is the second of a three-course sequence in financial accounting and reporting at the intermediate level. This course will examine conceptual fundamentals of accounting and reporting as well as accounting standards and practical applications. You will not only learn how to apply a procedure, but also understand why it is being applied in that particular business context. We will focus primarily on the financing activities of the firm including, but not limited to, measurement and reporting of notes payable, bonds payable, investment securities, leases, capital stock structures, stock-based compensation, dividend distributions, and earnings per share. Course Methods: AMIS 522 is conducted primarily in lecture/discussion format. My job is to help you understand key concepts and issues in financial accounting. I will explain and illustrate important concepts in a lecture-like format, and I will engage you in dialogue through answering questions and working through problems in class. Your job is to be prepared for every class by reading (in advance) the relevant chapter and completing the assigned problems. You are encouraged to ask questions and be actively involved in class discussions. Class sessions will be most productive if you come to class with a basic understanding of the concepts being covered. While I will not take attendance, you are responsible for everything said in class (in addition to the required reading and assignments). If you miss class, be sure to get the notes from a classmate. Homework will be collected at the beginning of the class period indicated on the assignment schedule. No accommodations will be made for late arrivals or absences. Regular class attendance will improve your chances of meeting the course objectives. Homework: Homework will be collected at the beginning of the class period indicated on the class schedule. Your lowest homework grade will be dropped. If you have to miss a class (excused or unexcused), you will receive zero points for that assignment, and you may drop that grade. If you submit an assignment for someone not present in class, you will also receive zero points for that assignment. You will not receive any credit for homework submitted without your name. You are encouraged to attempt problems at the end of the chapters in addition to the problems assigned in class. Questions will be answered about additional problems if class time permits, but you are free to check your answers during office hours or by appointment. Case Paper: Each person will complete one case involving a recent Wall Street Journal article pertaining to a topic covered in class. This assignment must be done individually and is mandatory. Additional information will be provided. Exams: Three exams will be given on the dates indicated on the assignment schedule. The exams will consist of objective questions and problems. Other than the general cumulative nature of accounting material and concepts, Exam 3 will not be comprehensive in nature. Each exam will last one full class period. Exams must be returned following the in-class review to receive credit. If you miss an exam for a valid reason (e.g., sickness, death in immediate family) and provide sufficient documentation to support your situation, you will receive an excused absence. Those students receiving an excused absence will be given a make-up exam. The make-up exam will be scheduled within one week of the original exam date. If you receive an excused absence from the final examination, you will receive an incomplete grade until you complete a make-up exam. Unexcused absences from exams will result in a grade of zero. Course Grade: There is no extra credit work. You must complete all of the requirements of the course to receive a grade for the course. Each student will be evaluated on the following elements: Case Paper Homework 1st exam 2nd exam Final exam Total 10% 15% 25% 25% 25% 100% Your final letter grade will generally be assigned based on the following table: A AB+ B 93% and above 90% - less than 93% 87% - less than 90% 83% - less than 87% BC+ C C- 80% - less than 83% 77% - less than 80% 73% - less than 77% 70% - less than 73% D+ D E 67% - less than 70% 60% - less than 67% Less than 60% Grade Disputes: Any concerns or questions about grading on a quiz or exam must be resolved within one week after the graded quiz or exam is returned in class. This time frame applies whether or not you were present in class to receive your graded quiz or exam. Individual grading issues will be handled outside of normal class time. Notification of Scores and Final Grades: The results of any graded materials, including final grades, will not be given by the instructor to individual students via phone, e-mail, or prior to the initial returning of the assignment in class. Final grades will be available online from the Registrar within one week following the final exam. Academic Misconduct: Academic misconduct will not be tolerated. According to University Rule 3335-31-02, all suspected cases of academic misconduct will be reported to the Committee on Academic Misconduct. Disability Services: The Office of Disability Services verifies students with specific disabilities and develops strategies to meet the needs of those students. Students requiring accommodations based on identified disabilities should contact the instructor at the beginning of the quarter to discuss his or her individual needs. All students with a specific disability are encouraged to contact the Office of Disability Services to explore the potential accommodations available to them. Teaching Plan and Assignment Schedule: The following schedule is subject to change; schedule changes will be announced in class. Homework problems assigned for grading will be announced in class one class period before they are due. Date 6/22 6/24 6/29 7/1 7/6 7/8 7/13 7/15 7/20 7/22 7/27 7/29 8/3 8/5 8/10 8/12 8/17 8/19 8/24 8/27 Chapter/Topic Ch 6, Time Value of Money (Present Value Review) Ch 12, Investments (pg. 587 – 611) Homework Due Chapter 6 - Exercise 6, 11, 15, 16,18 Problems 6, 9, 10 Note: All problems must be solved using formulas ONLY. Chapter 12 Ch 14, Bonds and Long-Term Notes Chapter 14 Exam 1 Ch 15, Leases Chapter 15 Ch 12, Investments (pg. 611-626) Chapter 12 Ch 19, Share-Based Compensation (pg. 1001-1012) Chapter 19 Exam 2 Ch 18, Shareholders’ Equity Chapter 18 Ch 19, Earnings Per Share (pg. 1012-1031) Chapter 19 Case Paper Due Final exam (11:30-1:18)