Document 11062494

advertisement

'^^^^

28

414

\1l\'S^

I

ALFRED

P.

WORKING PAPER

SLOAN SCHOOL OF MANAGEMENT

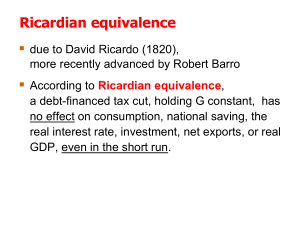

MORAL HAZARD, BORROUING, LENDING AND

RICARDIAN EQUIVALENCE

Julio J. Rotemberg

Working Paper #1931-87

September 1987

MASSACHUSETTS

INSTITUTE OF TECHNOLOGY

50 MEMORIAL DRIVE

CAMBRIDGE, MASSACHUSETTS 02139

NOV 12 1987

M»BA»> «d

WORAL HAZARD, BORRQUIING, LENDING AND

RICARDIAN EQUIVALENCE

Julio J. Rotemberg

Working Paper #1931-87

September 1987

MORAL HAZARD. BORROWING. LENDING AND

RICARDIAN EQUIV ALENCE

Julio

.1.

Rotomberg''

September 1987

Abstract

In this paper

I

random payoffs

study privately optimal contracts when individuals face

if

they expend unobservable effort. Full ins\iranre

eliminates the incentive to

work so

it

is

generally

tioI

optimal.

Optimal

contracts which tradeoff insurance and the need to preserve incentives are

studied.

In a simple model

I

show that these optimal contracts can be

implemented using only assets, loans and the

instil

ution of iiankcruptcy

Ricardian equivalence even with with taxes that are a function of income

holds locally but not globally

fails

in

this model.

current tax cuts can easUy lead

to

Where Ricardian equivalence

reductions

in

current

consumption.

'•'

Sloan School of Management, MIT.

discussion and the

NSF

I

wish to tliank Olivier Blanchard for

for financial support.

The existence

taken to mean that Ricardian equivalence must

has lost some of

Yotzu7,uka( 1987)

fail.

This a priori argument

force since the papers of Hayaslii (1986) and

its

.

been

of imperfections in financial mari^ots lias often

They show

that the

wedge between lending and borrowing

rates caused by adverse selection in credit markets does not necessarily

imply a failure of Ricardian equivalence.

markets that has been adduced

to

A different

failure in financial

imply absence of Ricardian equivalence by

Barsky, Mankiw and Zeldes (1986) following on work by Chan (1983),

impossibility,

due

to

moral hazard, of selling human capital.

models income insurance

suceeds

in

is

the

is

In their

not privately provided because an individual

who

Then, government

purchasing insurance would stop working.

instituted linear income taxes provide some otherwise vinavailable insurance

which generally affects current consumption.

One weakness

of these

papers

is

that they do not consider optimal

insurance contracts between individvials, they simply postulate that certain

contracts are available and exclude others^^.

In this

paper

is

it

shown

that in a relatively simple model the existence of optimal contracts,

in the

presence of moral hazard, restores Ricardian equivalence

While moral hazard prevents full insurance,

is

locally.

still

Small government insurance schemes are then simply offset by

possible.

changes

some insurance

even

in

this privately

programs have the effect

optimal contracts.

As

provided insurance.

of

Larger

reducing effort even

a result tax cuts

social

insurance

in the equilibria

accompanied by increases

with

in futiire

taxes that are very progressive (i.e. provide a great deal of insurance)

can, by reducing future effort,

and hence

An

reduce the individual's permanent income

his current consumption.

objection to this line of analysis

is

that such privately supplied

optimal insurance schemes are simply not observed.

The simple example

3

developed

in

paper casts some doubt on

this

this criticism

optimal contract can be implemented using only the

which we observe regularly.

three institutions:

it

In particular,

must be possible

of institutions

implementation requires only

borrow,

to

menu

because the

to lend

and

to

go

In implementing the optimal contract via these institutions the

bankrupt.

paper follows the lead of Gale and Hellwig (1985) who show that debt

contracts with bankcruptcy can be optimal contracts

model of asymmetric information.

In their

observabUity of income which leads

model

it

in

is

a rather different

the costly

to these contracts.

Implementation via these borrowing, lending and bankcruptcy has some

appealing features.

First,

people will be observed borrowing and lending

simultaneously even though interest rates on loans exceed interest rates on

assets.

It

rates that

is

betweeen lending and borrowing

of course the difference

is

viewed as suggesting liquidity constraints as well as the

failure of Ricardian equivalence (Pissarides (1978),

Buiter (1985)).

Second, individuals wUl be genuinely credit constrained, they would

to

borrow more

from doing

individual

so,

is

Not only are they prevented

at the existing lending rate.

no additional borrowing

solvent.

This

is

a

more

is

like

possible even though the

strict version of credit constraint

than the one shown to hold by Gale and Hellwig (1985) since

in their

model,

as in that of Keeton (1979 ch.2) more would be lent, albeit at higher

interest rates.

The paper proceeds

as follows.

optimal contract are presented.

using assets and

in this

liabilities.

In Section

Section

III

is

II

the model and the

devoted

to

implementation

Section IV discusses Ricardian equivalence

model while Section V concludes.

II

I

Their

The model

consider people who

utility in the initial

U(Co)

^

where U

pEU(Ci)

is

a

-

live for

period

is

two periods labeled zero and one.

given by:

k6

(1)

concave function, Cj

is

consumption

expectations conditional on information available

6

is

and

in

the

an indicator variable which takes a value of one

is

in

period

initial

if

effort

E takes

i,

period and

is

expended

zero otherwise.

Effort

is

expended

for the disutility of k,

at the

beginning of period one.

who expend

individuals

income Yg with probability

With probability

tt.

and they earn the same Income

In compensation

effort earn a high level of

(1-tt)

they are unsuccesfull

they would earn without expending effort.

Yj-,

These realizations can be thought

of as uncorrelated across individuals.

As

unobservable while income and consvimption

in

Holmstrom (1979), effort

are observable.

A contract

is

Individuals also have an endowment

specifies transfers

institutions in the initial period,

which depend on the realized

Wq

the first period.

in

between individuals and financial

as well as transfers in period one

level of income.

Equivalently

,

and with some

gain in convenience, one can view them as specifying three levels of

consumption Cq, Cg and

Cj,

which correspond

two possible levels of income respectively.

to the initial

Effort will be

period and to the

expended

if

contract stipulates that:

TTfU(Cg)

-

U(Cb)]

^ k

(2)

the

while

not

will

It

the inequality

If

reversed.

is

Financial intermediaries (which can be thought of as foreigners) are

Such risk neutrality emerges

risk neutral and have a dicount factor R.

naturally

(1985).

If

Thus

the intermediaries are willing to sign any contract whose

Therefore,

gross rate of return equals R.

will

be high

(Wo

-

Judd

the Income uncertainty disappears In the aggregate as In

Is

contracts wLLl be offered which satisfy:

z,

Co)R

the probability that income

if

=

z(Cg

Yg)

-

(l-z)(Cb

+

-

Yb)

(3)

Optimal contracts maximize (1) subject to (3) and the constraint that

effort will be

otherwise

z

effort to be

expended

(I.e.

equals zero.

expended

any contract).

in

I

z

now

equals

-

if

and only

any optimal contract (or even

U(x + Yb)]

-

is

k

assumed

all

that optimal contracts Involve effort

Suppose an individual

Then, by expending effort

values of x.

It

is

is:

(4)

changes by the amount on the LHS

that this change be positive for

throughout

>

reaches period one with assets equal to x.

utility

satisfied;

the absence of

in

to hold

This condition can be interpreted as follows:

expected

is

(2)

if

briefly give a sufficient condition for

This condition which

Vx>0: TT[U(x + Yg)

it)

of (4)

To see

.

I

am requiring

that this implies

sufficient to note that

contracts without effort have z equal to zero in (3) so that optimal

contracts are simply risk free lending contracts.

satisfied,

utility

Hence,

his

if

(4)

is

can be Increased by offering the same size loan and

6

allowing the individual to keep any extra income that

lie

earns by expending

effort.

Given

expending effort

(4)

Expending

costlessly monitored.

is

Suppose effort could be

optimal.

effort would

still

bo optimal but, since

individuals are risk averse and financial intermediaries are risk neutral,

consumption would not depend on whether the effort was succcsfull.

other words

Such

full

have the

Cg would equal C^ and

insurance

is

the individuals would be fuUy insured.

obviously impossible with unobservable effort; we

The optimal contract

will

achieve as much insurance as

possible given the need to induce effort.

(2)

and optimal risk

usvial tradeoff of incentive compatibility

sharing.

In

It

thus

will

is

make the constraint

hold with equality.

Using

and

(2)

(3)

in

(1)

and differentiating, the optimal contract

satifics:

U'(Co){l

-

TT[U'(Cb)/U'(Cg)

-

1]1

=

pRU'(Cb)

(5)

where primes denote derivatives.

Equation (2),

(3)

and

can be

(5)

solved for the three levels of consumption although that will not be done

here.

Ill

Implementi n g the Optimum with Debts, Assets and Ba nkcruptcy

Before implementing the equilibrium with debt and assets

convenient

to interpret the optimal contract in

insurance terms.

This can be done as follows.

it

is

more traditional asset-

The

individual can be

7

thought of as carrying ovpr an amount of risk free assets A equal

Cq)

Consumption

.

in

period one

Cg

=

AR

.

Yg

>

Xg

Cb

=

AR

*

Yb

^

Xb

where the X's can be though

is

to

(Wq"

then:

of as transfers.

By

(3)

these transfers

represent simply an actuarially fair insurance policy since:

irXb

(i-^)Xg

*

=

0-

(6)

Moreover, since as much insurance

relatively low,

Xb

is

Is

provided as possible and Yb

is

positive.

In the debt-assets implementation the individual carries over instead

an amount of assets equal

A'

=

A

the

maximum

D

=

Xb

which

is

A'such that:

Xb/R

+

so that

to

Cb

is

(7)

simply A'B. + Yb-

Debt obligations D, which are defined as

the person owes to the financial intermediary are equal to:

-

Xg

positive

(8)

by the argument given above.

assets and liabilities supports

tlie

optimal contract as long as bankcruptcy

prevents consumption from falling below Cb-

such that individuals

In

This combinations of

Bankruptcy

is

an institution

debt can ask for protection from their creditors,

8

debts are forgiven as long as the individuals's consumption level

This threshold

a certain threshold.

economy consisted

payoffs,

is

here required

to

equal

the legislated threshold

If

.

below

C]-,.

the

If

of ex-ante identical individuals with uncorrelated

such a threshold would be have a certain appeal

avithorities

is

mechanism for forgiving debt

is

to distressed

different,

to legislative

some other

borrowers would have

be

to

implemented.

With bankcruptcy,

when

are fully paid

that they are paid

probability

be

it

is

Yg.

must exceed R.

Yj, while

is

So the gross return on debts

the event

in

when they are

actually paid must

This can be seen by noting that since A equals (Wq-Cq)

R/tt.

difference between A' and

they

Since debts are only paid with

the gross return on debts

tt,

when income

the debts are forgiven

A must equal the amount

exchange for

the

the financial

intermediary gave the indlvidvial

in

payable only in the good state.

Moreover, using (6),

tiie

,

claim of

(7)

D which

and

(8)

it

is

is

readily established that D/(A'-A) equals R/tt.

If

and

is

A

is

positive,

liabilities of

the implementation implies an overlap between assets

(A'-A).

The only reason assets exceed A

period zero

because the financial intermediary has also provided a loan.

overlaps are commonplace as

of the

and

minimum

liabilities

positive.

is

evident from table

of financial assets

for individuals

Maintenance Experiment^.

and

liabilities

who participated

A negative A would be

his other loans.

Even when A

an overlap of assets and

1

which

to the

lists

maximum

Such

the ratio

of assets

the Denver Income

in

Of course, at the optimal contract A need not be

a risk free "senior" loan

intermediary could be sure to collect on even

to

in

is

if

which the

the individual defaults on

negative, A' can be positive thus leading

liabilities

although,

if

A'

is

negative as well

9

only

liabllltips will

be observed.

Before one can say that assets and

it

is

necessary

show

to

individuals would,

in

that

if

liabilities

only assets and

implement the contract

liabilities

the presence of the appropriate

and

select the appropriate levels of assets

liabilities.

were offered,

bankcrupcy threshold,

1

deal first with

the choice of assets then with that of liabilities.

To

whether the optimal

find out

whether, starting

level of assets

would be chosen,

at the optimal allocation individuals

would want

I

ask

to

either increase period zero consumption and reduce assets or viceversa.

Because

bankcrupcy these two decisions are somewhat different and must

of

be treated separately.

Suppose that an individual decided

in

period zero and hold one less unit of A.

Intermediary

fall

by R.

is

consumption by one unit

to increase

not collecting anything on

the bad state,

In

its

loan so consumption would

Similarly in the good state the individual

his obligation so constimption

would

by R.

fall

the

is

fully

paying of

Tht:s the change in utility

Is^:

U'(Co)

-

pR[^U(Cg) + (l-Tr)U(Cb)]

<

U'(Co){l + Tr[U'(Cb)/U'(Cg)-in

pRTr[U'(Cg)-U'(Cb)l

where the

first inequality is

due

-

pRfTTU(Cg)Ml-TT)U(Cb)]

<

(9)

to the fact that

lower In the good state than in the bad, the equality

equation that characterizes optimal contracts (5)

inequality

strictly

is

due

to the

same reason as the

bad for the individual.

The reason

=

,

first.

is

marginal utility

is

is

obtained using the

and the second

So this change

is

that for a given Increase

10

in

consumption

in

expected

It

period zero, optimal contracts provide for a smaller

in

utility in

period one than do pure asset contracts.

worth noting that inequalities such as

is

fall

(9)

have iioon defined as

representing liquidity constraints by both Runkle (1987) and Zeldes (1985).

Zeldes (1985) finds evidence that for relatively poor individuals this

inequality holds strictly while Runkle (1987) using the same

PSID data but

different methods disputes this conclusion.

Now consider reducing consumption

of assets.

period zero and raising the level

in

Since bankcruptcy aUows the individual to consume only

extra assets do not secure increased consumption

so only in the good state.

change

in utility

-U'(Co)

the bad state,

consumption rises by R.

In that state

the

they do

So the

is'':

pTTRU'(Cg)

^

in

Cj^,

=

=

{-pU'(Cb)

*

TTpU'(Cg)[l-TT(l-U'(Cb)/U'(Cg))]}/0

p(l-iT)(-U'(Cb)

*

TT[U'(Cg)-U'(Cb)]l/<^

<

(10)

^ =

1

+

TT[U'(Cb)/U'(Cg)

where the

first equality is

also unatractive.

state

-

1]

obtained using (5)

assets required by the optimal contract

In the strongest possible sense;

worse

This change

This occurs because extra assets are useless

where they must be turned over

strictly

.

to creditors.

is

is

in

thus

the bad

Hence, the level of

the individually rational choice

any deviation makes the individual

off.

Now consider

are only relevant

the choice of liabilities.

if

high income

is

Changes

in

period one debts

realized since none of the debts are

11

paid

Suppose the individual reduces

the bad state.

in

his

consumption

in

period zero and correspondingly carries fewer debts forward so consumption

in the

good state of period one

corresponding change

-U'(Co)

Thus

^

this

Is

in utility

pRU'(Cg)

=

increased by

Using

R/tt.

(5),

the

is:

p(l-TT)[U'(Cg)-U'(Ch)]/<^

makes the individual

strictly

worse

<

off.

This means that

the individual would like to increase his indebtness by one dollar and

consume the proceeds

consumption

have

to

will

This means that the inequality

take place.

be written

would impose a

is

more

zero and

to

the consumption during

wLU be reversed so that

all

the debts would

strict than

It

is

He

this.

worth noting that the

what has been derived, for instance

(1985) in that additional credit wouldn't be extended

any interest rate.

in

z falls

(2)

in

The intermediary would never accept

off.

by Gale and Hellwig

more dollar

Thus

strict credit constraint.

credit constraint

at

Such an increase, however, lowers

period zero.

good state without any change

in the

the bad state.

no effort

tt/R in

The reason

is

that

if

the individual owes even one

the good state, he stops working and the equilibrium

is

destroyed.

In conclusion,

the implementation of the optimal contract has three

empirically relevant features.

For individuals, rates of return on assets

are lower than those on liabilities.

types of instruments.

they are allowed

Individuals nonetheless hold both

Moreover, individuals would

like

to

borrow more than

to.

While the implementation of the optimal contract with assets and

liabilities

appears

in

some ways natural one caveat

is

in

order.

The

12

implementation of the optimal contract

The main

take on more values^.

of simultaneous assets

and

will

be more complex when income can

point of this section

liabilities

that the existence

is

the presence of bankcruptcy

in

simplifies the implementation of the optimal contract.

IV Ricardian Equivalence

In this section

I

consider government tax and transfer schemes which

have an expected present discounted value of

to

depend on the

of

A transfer scheme

.

payments from the government

GqR

+

zGg

where

z is

allow these transfers

1

realization of income so that these transfers can in

principle be distortionary

Gg)

7,ero.

+

(l-z)Gb

is

thus a triplet (Gq,

to individuals

Gj^,

which satisfy:

=

(11)

again the probability that high income

is

earned.

Contracts between financial institutions and individuals are entered upon

after the G's

become known.

consumption Cq, Cg and

Cj,.

They

Now

still

specify the three levels of

for the financial intermediary to be

willing to offer a given contract:

(Wo

*

Go

-

Co)R

which, using,

offer the same

maximize

only

if

(1)

(2)

is

menu

=

(11)

z(Cg

-

Gg

reduces

to

-

Yg)

(3).

+

(l-z)(Ch

is

"

(12)

Yfa)

Optimal contracts

subject to (3) and the condition that z

and

Gfa

So intermediaries are willing

of contracts as before.

satisfied

+

is

equal to zero otherwise.

equal to

Thus,

if

still

it

if

in

and

to

13

equilibrium effort takes place, consumption

intervention.

(4)

unaffected by the government

is

With government transfers, the condition corresponding to

which ensures that effort

Vx>0: TTfUCx+Yg+Gg)

-

Is

U(x + Yb + Gb)

The argument given below

try to earn Yg.

Moreover,

expended

(4)

k

-

1

>

(13)

ensures that

if

(13) holds,

individuals

holds there are exists nonzero government

(4)

if

is:

transfers which are such that (13) holds.

These transfers can have

progressive elements so that, for instance,

Gg can be negative

while

G^

is

positive.

Yet, there are also transfer schemes which prevent (13) from holding.

In the extreme case in which the transfers schemes are such that (13) holds

with the inequality reversed for

taking place.

all

x,

the only equilibrium has no effort

Siippose that even though (13)

This can be seen as follows.

holds with the inequality reversed intermdiaries are offering a contract in

This means that

which effort takes place.

equality.

if

income

So,

is

payments from the intermediary

high than

if

it

is

low.

Suppose

deviating intermediary equalized payments

In the

(2)

good state and raising them

than U'(Cb) the individual

is

is

to the individual are

that,

Yet,

larger

maintaining (3) a

both states by lowering them

bad.

Since U'(Cg)

is

better off with this contract even

somehow be kept working hard.

reversed the individual

in the

in

holds at least with

smaller

if

he can

because (13) holds with the inequality

made even better

off

by giving up

effort.

Hence, intermediaries who offer contracts that involve no effort can take

all

the customers from intermediaries whose contracts require working hard.

Government transfer shemes that eliminate

effort have

Gg

lower than

14

Gb, they are progressive^.

So,

one form of intervention that can have this

a cut in taxes at time zero followed

effect

is

in the

event

by

a small increase in taxes

a large tax

if

Yg

eliminates effort, lifetime income

is

lowered so that consumption at time

ta.x

cut lowers consumption unlike what

zero

falls

Yjj

and

unambiguously.

The

is

realized instead.

Barsky, Manklw and Zeldes regard as the normal case

in

If

this sciieme

which the

progressive income tax raises current

corresponding increase

in a

consumption because

reduces future consumption uncertainty'.

it

15

V Conclusions

This paper has two

presence of assets and

One

foci.

liabilities

show that the simultaneoiis

to

is

together with a certain kind of credit

constraint can Implement an optimal contract.

The other

show that

to

is

RIcardlan equivalence survives at least locally when markets are incomplete

due

to

moral hazard.

which failures

in

One question which

arises

whether other models

is

the credit market are derived from contracting

difficulties can also explain the simultaneous existence of assets

liabilities

in

and whether Ricardian equivalence would survive

in

and

these

models.

It

is

worth stressing that reasons for credit rationing advanced by

Keeton (1979) and Grossman and Weiss (1981) are not very compatible with

the actual contracts that

we

see.

One reason

advanced by Jaffee and Russell (1976),

(1986)

and Yotzuzuka (1987)

is

for credit constraints

Stiglitz

and Weiss (1981), Hayashi

that different otherwise indistinguishable

borrowers have different propensities

to

go bankrupt.

Yet,

if

insurance

contracts were explicitely allowed in this adverse selection model and

individuals were risk averse while intermediaries were risk neutral, any

equUibriiim would include at least some individuals

insured.

In particular,

who would be completely

pooling equilibria would have

everyone while separating equilibria would have

full

full

insurance for

insurance at least for

the worst risks.

Another reason for credit constraints advanced by Keeton (1979) and

Stiglitz

is

and Weiss (1981)

They note

involved.

be tempted

to

is

more related

to this

paper since moral hazard

that as interest rates increase individuals would

undertake investements with higher risk but with lower

16

This induces credit rationing by making rises

expected return.

demand

rates an unprofitable response to excess

in

when

Yet,

for loans.

interest

the

potential actions of individuals affect the variability of returns the

standard debt contract

is

very unappealing.

Instead,

to

induce people to

refrain from adopting needless risk, optimal contracts would specify that

Individuals be penalized

when outcomes which are unusual under more

conservative strategies are observed.

setup

in

Stiglitz

This

is

particularly easy for the

and Weiss (1987) were the risky and safe project differ

only in the probability of the good outcome and in the size of the good

outcome.

To prevent the risky

project from being undertaken

sufficient to reduce consumption to zero

project

It

Stiglitz

income

is

the good outcome of the risky

observed.

may thus be

costly observability of income which lies behind the

Gale and Hellwig (1985) show that

and Weiss (1987) analysis.

is

if

observable only

at a cost,

the optimal contract

actual debt contracts with bankruptcy provisions.

when

is

it

the borrower

is

a risk neutral firm.

As

is

if

identical to

Their model applies only

a result their

inconsistent with joint holdings of assets and liabilities.

model

Such

holdings might well arise, even when the only imperfection

is

is

joint

the costly

observation of income when borrowers are risk averse individuals.

It

if

may be tempting

to

conclude that, whatever the market imperfection,

optimal private contracts have the structure of assets and liabilities

then changes

liabilities

in

taxes which resemble changes

in

people carry over can't have an effect.

paper shows that this intuition

is

the level of assets and

In

some sense

this

only partially right since Ricardian

equivalence does not hold globally.

Therefore, whether Ricardian

equivalence would carry over into a world in which income

is

imperfectly

17

observable

It

model

is

in

Is

an open question.

worth pointing out that Ricardian equivalence holds

this

part because contracts are signed either after the government

institutes balanced

budget transfer schemes or because they are made

contingent on such transfer schemes.

transfer schemes are instituted after

government policy.

(1983) in which

reason he doesn't explain,

in

is

is

government

many contracts have been signed and

This incompleteness

randomness

of course

In practice,

the contracts we observe rarely have clauses that

Yet,

in

make them contingent on

reminiscent of the work of Chan

is

introduced by the government which, for some

not privately insured.

models with simultaneous borrowing and lending there

natural reason why,

when the government

signed contracts, the private sector

governments action.

The reason

is

be able

at least in

to

undo the

some sense, agents

find themselves at corners since there are credit constraints.

is

instituted,

suppose

So,

the government institutes a tax rebate financed by future taxes.

contracts were signed after this program

a

acts after private agents have

will not

that,

is

If

individuals would

simply be able to borrow less and the scheme would have no effect.

contracts are set in stone by the time the scheme

is

individuals would continue to avail themselves of the

allowed to borrow so the allocation would change.

If

instituted,

maximum they are

The general analysis

of

the effect on Ricardian equivalence of letting the government act after

contracts which are not contingent on government actions have been signed

is left

for further reseach.

18

FOOTNOTES

This criticism applies more generally to most of the literature on

1

credit rationing including Jaffee and Russell (197G), Keeton (1979),

In

Stiglitz and Weiss (1981,1987), Hayashi (1986) and Yotzuzul<a (1987).

their models people would like insurance yet only "borrowing" contracts are

considered

am grateful to David Runkle for providing the data on which these

2

I

computations are based.

3

It is worth noting that reduced assets do not reduce the desire to

work. Consumption falls by the same amount in both states so utility falls

This means that

by more in the low state where marginal utility is high.

the difference in utility in the two states actually increases.

Again, the increased assets do not impair effort since the increase in

4

consumption when the good state is realized is actually bigger when more

assets are carried forth.

Such more general optimal contracts are discvissed by Varian (1980) who

5

discusses insurance provided by an optimizing government but whose solution

corresponds to optimal contracts which are privately supplied.

6

Budget balance dictates that the government note that the scheme will

eliminate effort so that Gg becomes immaterial.

The low (or negative)

never

actually

takes

place.

transfer Gg

7

This normal case of course requires that U'" be positive.

19

REFERENCES

Barsky, Robprt, N.Gregory Manklw and Stephen Zeldes "Ricardian

:

Consumers with Keynesian Propensities" American Economic Review

,

1D86,

76,

G76-91

Buiter, Wlllem

Economic Policy

,

H.:"A Guide

to Public

Sector Debts and Deficits"

1985

Chan, Louis K. C. "Uncertainty and the Neutrality of Governenment

:

Financing Policy" Journal of Monetary Economics

,

1983,

11,

351-72

Douglas, and Martin Hellwig: "Incentive Compatible Debt

Gale,

Contracts: The One-Period Problem", Review of Econ omic Studies, 52,

1985,

647-63

Hayashi, Fumlo: "Tests for Liquidity Constraints: A Critical Survey",

NBER Working

Paper

# 1720

.

1986

Holmstrom, Bengt: "Moral Hazard and Observability", BeU. Journal of

Economics

,

Jaffee,

Spring 1979, 74-91

Dwight and Thomas Russell: "Imperfect Information, Uncertainty

and Credit Rationing", Quarterly Journ al

of

Econom ics,

Judd, Kenneth: "The Law of large Numbers with

Random Variables", Journal

of

Economic Theory

,

35,

40,

a

1976,

651-66

Continuum

1985

of IID

20

Keeton, William: Equilibrium Credit Rationin g, Garland Press, NY,

Pissarides,

Cristopher A. "Liquidity Considerations

in

:

Consumption" Quarterly Journal of Economics

,

the

Theory

1979

of

1978

Runkle, David: "Liquidity Constraints and the Permanent Income

Hypothesis: Evidence from Panel Data" Mimeo 1987

Joseph and Andrew Weiss: "Credit rationing

Stiglitz,

Imperfect Information", American Economic Review

:

,

71,

in

1983,

Markets with

305-18

"Macro-Economic Equilibrium and Credit Rationing", mlmeo,

1987

Yotzuzuka, Toshiki: "Ricardlan Equivalence

in

the Presence of Capital

market Imperfections" Mlmeo MIT June 1987

Zeldes,

Stephen: "Consumption and Liquidity Constraints: An Empirical

Investigation" Wharton Working Paper #24-85

,

November 1985

1813

C

^3

Date Due

MIT LIBRARIES

3

TDflD D04

TEA 3bT

![MA1124 Assignment3 [due Monday 2 February, 2015]](http://s2.studylib.net/store/data/010730345_1-77978f6f6a108f3caa941354ea8099bb-300x300.png)