GAO DEFENSE CONTRACT MANAGEMENT

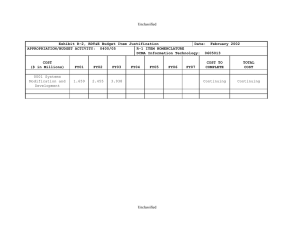

advertisement