Document 11045638

advertisement

'>^'^*='«'**;;

ri'L.iiy

^^.

HD28

,M414

96>

Heavy

Traffic

Policies:

A

Analysis

of

Dynamic Cyclic

Treatment of theSingle

Scheduling Problem

Unified

Machine

David M. Markowitz and Lawrence M. Wein

#3925-96-MSA

September,

1996

'1.

r

n,;y

4-,(4;p

HEAVY TRAFFIC ANALYSIS OF DYNAMIC

CYCLIC POLICIES: A UNIFIED TREATMENT OF

THE SINGLE MACHINE SCHEDULING PROBLEM

David M. Markowitz

Logistics

Management

Institute

McLean. \'A 22102

Lawrence M.

We in

Sloan School of Management.

ALLT.

Cambridge. ALA 02139

ABSTRACT

This paper examines how setups, due-dates and the mix of standardized and customized

products

affect the

environment.

We

scheduling of a single machine operating in a dynamic and stochastic

restrict ourseh'es to the class of

machine busy/idle policy and

d}'namic cyclic policies, where the

lot-sizing decisions are controlled in a

but different products must be produced

in

a fixed sequence.

dynamic

.As in earlier

fashion,

work, we

conjecture that an a\-eraging principle holds for this queueing system in the heavy

limit,

and optimize over the

class of

dynamic

cyclic policies.

The

traffic

results allow for a

detailed discussion of the interactions between the due-date, setup and product

facets of the problem.

September 1996

mix

This paper focuses on what we consider to be the three most important structural

machine scheduling problems. The

features of single

characteristic

first

the presence or

is

absence of setup costs and/or setup times when the machine switches from one type of

product to another. Setup penalties force the scheduler to exploit the economies of

which leads to dynamic

lot-sizing policies.

The second

factor

is

scale,

the presence or absence

of advanced information regarding future demands, which gives rise to problems with

and without due-dates,

nature of the object

function

function:

If

This aspect of the problem essentially dictates the

advanced information

based on due-date considerations

is

such information

measures

i\'e

respectix^ely.

a\'ailable

is

(e.g.. earliness

then the objecti\'e function

(e.g.. inA'entory costs,

is

is

pro\ided then the objecti\'e

and tardiness

and

if

no

expressed in terms of system

waiting time, throughput).

The

whether products are customized or standardized. This feature

the make-to-stock/make-to-order distinction:

costs)

third characteristic

is

is

intimatel\- related to

Customized products must be made-to-

order whereas standardized products can (but do not need to) be made-to-stock.

The aim

of this paper

is

to pro\'ide a unified (with respect to these three features)

treatment of single machine scheduling

in a

dynamic and stochastic environment. More

we consider a manufacturing system consisting

specificall}'.

multiple types of goods, which we refer to as products.

customized, which requires the request

standardized,

machine

is

in

for

is

machine that produces

Each product can be either

an order before production can begin, or

which case they can be pre-stocked

in a finished

goods inventory. The

limited in capacity and can only produce one unit at a time.

machine switches from producing one product

penalty

of one

to another, a setup cost

Whenever

the

and/or setup time

incurred. Orders arrive to the system, each requesting a unit of the product at

a specified due-date.

must be held and an

a completed unit

is

A

completed unit assigned

earliness cost

is

to

an order before the order's due-date

incurred. Similarly, a tardiness fee

delivered to an order after

its

is

levied

whenever

due-date. In addition, unassigned items

held in finished goods in\'entory also incur a holding cost equal to the earliness fee of that

(standardized) product. Interarrival times. ser\"ice times, due-date lead times (an order

due-date minus

by product.

its

time of

arri\'al)

and setup times are random

x'ariables that

s

can vary

Customized

Xo Setups

No Due-Dates

Standardized

Figure

In this setting, the

it

is

up

current!}' set

The

1:

\

subproblems under consideration.

eight

machine

at an}' point in

idle,

how much

time can

idle,

produce the product that

a setup for a different product. In other words, the

for. or initiate

scheduler makes three t}'pes of decisions

should be bus\' or

Due-Dates

/

to

in a

make

dynamic

fashion:

of each product

(i.e..

Whether the machine

lot-sizing)

and which

product to produce next. In this paper, we restrict ourselves to dynamic cyclic policies.

which allows

full

discretion o\'er the

fixed c\'clic sequence.

We

first

two decisions, but produces each product

in a

wish to optimize the queueing system with respect to long run

expected average costs due to earliness. tardiness, holding and setups.

The

b}'

our

\'enn diagram in Figure

anal}'sis.

Although

the body of the paper. §5

\"enn diagram.

X'enn diagram,

onl\'

is

1

delineates the eight subproblems that are incorporated

the general scheduling problem

is

considered throughout

de\'oted to a discussion of each of the eight regions in the

Since the existing literature has only examined specific regions of the

we delay our

literature re\'iew to this discussion.

This paper expands upon the methods of Markowitz. Reiman and Wcin (1995) (abbrex'iated hereafter

b}'

MRW'j. which analyzes the stochastic economic

lot

scheduling

problem (depicted

Reimans

is

MRW

4 in Figure 1).

fast

one where time

is

sped up by a factor of 0(n) and a slow one where time

increased by a factor of 0(s/n) (where n goes to

is

to analysis. .As in

and then

fluid limit

in

the heavy traffic limit).

to a fluid limit.

averaging principle couples these two processes and makes this

problem amenable

paper

infinit\- in

and the slow scaling leads

fast scaling leads 1o a diffusion limit

traffic

applies Coffman. Puhalskii and

(1995a. 1995b) heavy traffic averaging principle, which considers two sets of

A

scalings:

subproblem

as

MRW.

in the diffusion limit.

to determine

how due-dates

MRW

The primary

affect the

our previous applications of the heavy

1994. 1995.

we optimize the

difficult

control problem,

hea\'y

scheduling

the

first in

analytical contribution of this

system beha\'ior under the

traffic

The

The

fluid limit. .\s

averaging principle (Reiman and W'ein

and Reiman. Rubio and Wein 1995). we conjecture that

this principle

holds for the system under study, without prox'iding a rigorous proof of convergence:

see

Reiman and Wein

(1996) for a heuristic justification of this conjecture.

closed form solution has eluded us.

for soh'ing the control

we

resort to de\'eloping a

Because a

computational procedure

problem. Howe\'er. to gain further insight, we analyze the special

case where each product has a different deterministic (as opposed to random) due-date

Finally, a simulation study

lead time: in this case, the results simplify considerably.

performed to assess both the

the heavy

traffic

in §2.

our proposed policies and the accuracy of

approximation.

The scheduling problem

duced

effect i\-eness of

is

formulated

in §1

and heavy

traffic

preliminaries are intro-

W'e perform a hea\'y traffic analysis of the scheduling problem

work through the deterministic due-date lead time case

in §4.

Section 5

discussion of the subproblems outlined in the \'enn diagram in Figure

results of a

§7.

computational stud\- on due-date

Readers interested only

§2. §3

and

in

effects.

1

is

in §3

and

devoted to a

and §6 contains

Concluding remarks are offered

the qualitati\-e insights derived from this work

in

may omit

§4.

1.

A

is

single

PROBLEM FORMULATION

machine produces

assume that products

1.2

.V

different products.

V' are customized and

3

Without

.V"

-I-

1

loss of generality,

V'

-I-

A"'

=

we

A' arc

standardized. Each product

and

jj'l'^

has

;

coefficient of \ariatioii

demand

process.

c,j.

For each product

mean

tributed with

its

and

A,"^

own

Orders

i.

mean

generally distributed service time with

goods arrive from an exogenous renewal

for

the interarri\'al times of orders are generally dis-

coefficient of variation c,^.

The

and service time

arrival

processes for each product are assumed to be independent, although they need not be

Reiman 1984

(see

utilization of product

Orders

is

compound renewal

for the incorporation of correlated

arri\'e to

i

is

=

p,

X,l jJ,

and the system

utilization, or traffic intensity,

The due-date

the system with a specified due-date.

the time interval between an order's arrival and

variable with density f,(s). cumulati\-e distribution function F,{s)

independent of the

a

We

abo\-e the quantity denotes the diffusion scaling.)

time distribution has bounded support, and denote

6,.

further

assume that

a,

>

completed unit

)

of

tardy.

is

If

if

an order

6,

is

present.

Once

and

is

scalings.

minimum and maximum by

its

the unit

a,

demand, we

a customized order

is

onl>-

is

work

serviced, the

either held until the order's due-date or delivered immediately

if

the

held, the order incurs an earliness fee (holding cost) h, per

if

the order

is

past due.

it

incurs a tardiness fee (backorder

per unit time late. In anticipation of our subsequent analysis, we also express

these cost parameters in terms of units of work:

The

/,.

0.

unit time until the due-date:

cost

random

assume that the due-date lead

customized goods are immediatel}- queued. The machine can

for

on a customized product

is

a

and mean

respectively: because due-date information typically reflects future

Orders

order

is

denotes a lack of scaling, a "bar" denotes the fluid scaling, and no symbol

"tilde"

and

i

and service processes. (For quantities that undergo

arrix'al

is

lead time, which

due-date, for product

its

The

processes).

flow of physical product

and orders

is

h,

—

hifj,

and

more complex

b,

for

=

b,iJ,.

standardized products,

and we need to keep track of both orders and completed items. Completed items can be

pre-stocked

in

the finished goods inventory, where each unit accrues holding costs at a rate

of h, per unit time. Orders for standardized products are

filled b}'

queued upon

arri\al.

and can be

an item either from the finished goods in\-entory or directly from the output of

the machine.

Once an item

is

assigned to an order, the s\'stem incurs either an earliness

fee h, for

each unit of time until the order's due-date or a tardiness fee of

=

tardy. Again, these costs have workload equivalents h,

we have made the natural assumption

the finished goods inventory

item

is

and

h,fj,

6,

=

per unit time

Notice that

b,jj,.

that the holding cost for an unallocated item in

identical to the earliness cost incurred

is

b,

allocated to a standardized order before

its

due-date

(in

when

a completed

the latter case, one can

Hence, no

envision the item sitting on the shipping dock until the order's due-date).

benefit can be gained by assigning a completed item to a standardized order before

due-date: Delaying the allocation of completed items to orders results in

and a lower cost

Therefore, without loss of generality,

policy.

that incur no earliness fees for standardized products,

the system

when completed items

The scheduler can observe

notational burden,

will

be used

a

in this section for

set

in

up

those quantities that

Let the slack of an order be

traffic anal}'sis.

is

its

identical to its due-date lead

number

which we denote

(or being set up),

is

unit rate throughout the order's sojourn in the

at

system. The system state includes the

in\entor_\-.

exit

the system, but the slack, which can be positi\-e or negative,

dynamic quantity that decreases

product's queue, the

policies

To ease the

the system state at each point in time.

we only introduce notation

arri\'es to

it

we only consider

and so standardized orders

due-date minus the current time. Hence, an orders slack

time when

flexibility

are assigned to them.

our subsequent hea\y

in

more

its

arri\'al

time and the slack of each order

in

each

of items of each standardized product in finished goods

b\- I,(t) for

;

=

V. the product that

.V" 4-1

and the residual service and setup times

(if

currently

is

they are currently

progress).

The machine

cycle.

follows a

At any point

in

dynamic

c\xlic polic>'.

.\11

time the scheduler can deploy the machine

Produce the product currenth-

set

up

for

(this

The

policy

is

dynamic

in that

the

in

lot

set

up

sizes

in a fixed

one of three ways:

might not be possible

customized product and there are no orders present),

cycle, or idle.

products are serviced

for the next

if

set

up

product

and the busy/idle

for a

in

the

polic}-

can

be molded to address the changing needs of the system.

A

in

the

penalty

c}'cle.

is

incurred ever>- time the machine switches production to the next product

This penalty can be a cost, a period of downtime or both. The hea\y

traffic

performance of the system depends on these penalties

total switchover

and the a\erage

onl\-

through the average setup

time per cycle.

cost

only one form of setup

per cycle.

A',

penalty

present and setups \-ary by product, then the best cycle order can be found by

is

If

5.

sohing a traveling salesman problem, where the distance between two

to the setup penalty

the situation

between two products.

more complex.

is

We

also

the appro.x'imation scheme used here

is

If

cities

corresponds

both forms of penalties are present then

assume that the policy

preemptive-resume, but

is

too coarse to differentiate between a system with

a preemptive-resume polic\' \'ersus one without preemption.

We

wish to minimize the long run expected average cost of the system, and additional

notation

is

required to describe our objecti\-e function. Let T^, be the time that the n'

unit of product

i

we assume

it

this will

t.

The

at

is

minimize

define the

queue

that

assigned to an order.

is

t.

a completed unit

is

assigned to an order,

assigned to the order with the earliest due-date within

slack L,{t) to be the smallest slack

among

J(0 be the cumulati\-e number

Finall\-. let

long run ax'erage cost

its

product, as

and Teneketzis 1995 and Righter 1996). For

cost (sec Pandelis

minimum

time

When

all

t

>

0.

orders in product Ts

of cycle completions

by time

is

^^^

1

E

limsup-|X:

T y,^j

T->oo

T->c

+

Z

=.V'=

where x+(0

+

[l^h.l(t)dt+

'^°

x'{t)

product of cost and queue length

inventory, whereas

+

b,L:{Tr.,)]

(1)

Yl

b,L;{Tn,)]

+ I<J{T)

{n\T„,<T}

1

= max{j(O-0} and

[h.Lt{T^.)

{n|r„,<r}

we have chosen

is

=

ma.x{-x(t).0}. Notice that the multiplicative

integrated o\er time for the items in finished goods

to

sum

the product of cost and time

over orders. This "reversal of the order of integration"

is

(e.g. /i,I, (Tn.,))

a necessary step in analyzing

the effects of due-dates.

2.

HEAVY TRAFFIC PRELIMINARIES

This section prox'ides an over\'iew of the hea\-y

scribed in §1.

The approach outlined here

traffic anal\-sis of

relies heavily

upon

results in

the problem de-

Coffman. Puhal-

and Reiman and

skii

MRW.

and we

Workload Processes. We

heavy

traffic

analysis.

begin by defining the key stochastic processes for our

Recall that the system has queues of orders for

and a finished goods in\entory of items

products

;

=

A'^. let \Vi{t)

1

for all

be the total amount of time required

queue

I

=

+

A'"^

standardized orders of product

;

minus the

total

workload process

The

workload process.

product

for

total

t.

for the

machine

For standardized

machine time already invested

units in product Ts finished goods inventory at time

as the

time

products

be the total amount of time needed to process

A', let \\',(t)

1

at

all

For customized

standardized products.

to process all of the orders that are in product Ts

products

papers for more details.

refer readers to these

=

;

V.

1

workload at time

t

t.

and

We

let

=

the

W, = {ir,(0-' ^ 0}

refer to

it'

in

all

J2',=i ^^i

represents the total

be the total

amount

of work

currently being requested (in the form of orders) minus the total work stored in in\-entory

(this

work

will

This one-dimensional process

eventually be assigned to orders).

is

the

natural definition of workload for systems with customized and standardized products:

readers should note that, in contrast to

"make-to-order" point of view,

goods inventory

Heavy

traffic

in that

MRW.

work

in

the total workload

orders

is

positi\'e

is

defined from the

and work

in finished

negative.

is

Traffic

Averaging Principle.

Coffman. Puhalskii and Reiman"s hea\y

HTAP)

averaging principle (abbreviated by

has augmented the understanding

of hea\'ily loaded multiclass queueing systems that incur setup costs or setup times.

Although rigorously proved

for a two-class

queue

(in

the absence and presence of setup

times in 1995a and 1995b. respectively) that employs an exhaustive service discipline,

numerical results

in

Reiman and Wein

(1994. 1996).

support the conjecture that the HT.AP holds for a

these applications,

we conjecture

that the

MRW and

Reiman. Rubio and Wein

much wider

class of systems.

HT.AP holds without providing

.As in

a rigorous proof

of convergence.

The HT.AP

is

based on two

sets of limits,

synchronized by a scaling parameter

p)

approaches a constant

c.

n.

The

taken as the total utilization goes to one and

first

limit of the

HT.AP

states that as \/n{l

—

the normalized total workload process \\'(nt)/\/n weakh'

con\'erges to a diffusion process. 11(0. with parameters defined by the system data

and

policy.

It is

the diffusion limit and

calleil

The second

is tli(>

theorem.

result of a functional central limit

same

limit, called the 6iiid limit, states that for the

scaling parameter

and

ii

for

a given total workload, the individual workloads \\',(\/nt)/ \/n. converge almost surely

to

l'V'i(0'

process;

fluid

3,

this result

related to the functional strong law of large

is

numbers.

The time

two limits

scale decomposition inherent in these

approaches one, the amount of work

in

the system

is

intuitive: .As utilization

is

and the

large

workload cannot

total

change quickly; yet, as the machine switches between products, work can

among

The

the individual queues and inventories.

shift rapidly

shifting of individual workloads occurs

an order of magnitude. 0{\/ri). more quickly than the total workload, and so the

exam-

limit evolves for a period while the total workload remains relatively constant. For

workload might change on the order of weeks, while individual workloads

ple, the total

change

daily.

Dynamic

Cyclic Policies and the Fluid Limit. Under a dynamic

a service cycle corresponds to the setting

the machine

will

fluid

is

following a

dynamic

be completed before there

there are

many

.V products. If

many

that

dynamic

cyclic [)olicy can

be expressed

workloads;

level, not the individual

i.e.,

by an idling threshold

cycle center

.r'^{w)

process by

W

u'o

.r';(tr)

traffic

feasible total

of the cycle center

in

the fluid

liiuit.

is

is

workload by w).

the average

The

The

workload

total

fluid

process

amount

of

cycle length t{w)

is

work

the

in

product

amount

in ser\ice.

the process

U',

decreases at rate

8

i

is

i^^

over the

of lime required

and queues to remain balanced,

the machine must allocate p,T{ir) units of time per cycle producing product

is

The

dictated by the latter two functions.

to complete a cycle in the fluid limit. For the inventories

;

level.

can be completely characterized

and the cycle length t{w) (throughout, we denote the

and an arbitrary

course of a cycle

heavy

lot

and two workload-dependent functions, the .V— dimensional

unaffected by the idling threshold, and

product

the

each product and the busy/idle policy depend only on the total workload

policies in

cycles

Because

a significant change in total workload W{t).

workload

.VIRW show that dynamic cyclic

element

HT.\P implies

cyclic policy, then the

cycles for a given total workload, a

as a function of only the total

sizes for

is

up and processing of each of the

cyclic policy.

(1

—

p,):

/.

While

while the machine

is

set

up

for

other products.

=

iV'^+

the fluid limit:

The

inventory for

in

/

relatively infrec[uently.

increases at rate

II',

1,

.

.

N). Setu]) times are unsealed

,

.

large

amount

of

work

in

of .r';{w)

+ p,{ — p,)t(w)/2. The

must

ecjual the total

cycle

must be nonnegative

if

workload, J2,=\

for a

•''''iiw)

remain 0(1)) and vanish

level fluctuates

minimum

—

of x'i{w)

by p,[\

/y,(l

—

—

p,)t[w)

p,)t{w)/2 to a

cycle center and cycle length are parameters

1

that can be set by the scheduler, subject to

(i.e.,

the system causes setups to be performed

Thus. i)roduct Ts workload

over the course of a cycle, and ranges from a

maximum

(p(M-haps by depleting the finished goods

p,

some

=

restrictions:

of the cycle centers

minimum amount

the

u';

The sum

customized product,

.r"-{w)

—

^,(

I

work over the

of

— p,)t{w)/2 >

0;

and

there are setup penalties then the cycle length t{w) must be greater than zero.

Cost per Cycle.

CJiven the

dynamics described above, we can

a fluid cycle. c{ic). in terms of the parameters

composed

and

of individual product (earliness, tardiness

The

and t{w).

cost per cycle

and holding) costs and

is

.setup costs,

given by

is

N

A-

where

total

r'-'{w)

e.xpress the cost of

w)

c,(.r'\ r.

workload

and Wein 1991

is

«-.

product

and

A'

=

/"s

;^-

average cost rate for a cycle given a policy

l\ /

n

is

.r'

and r and

the normalized setup cost per cycle (see

for a justification of this scaling).

In

MRW,

we calculated

Reiman

c,(.r''. r, u')

by

integrating the cost over one production cycle and then dividing by the cycle length. In

the next section,

we perform the same type

of calculation for our due-date

"interchange the order of integration" as discussed before. That

over time in the cycle, we integrate over the orders

Dynamic

Reiman show

When

filled

is,

instead of integrating

during the cycle.

Cyclic Policies and the Diffusion Limit.

Coffman. Puhalskii and

that the drift of the diffusion process for total workload level

there are no setup times, the diffusion limit

is

problem but

w

is

.</T{ic)

a reflected Brownian motion

— c.

(RBM).

regardless of the policy in use: this result coincides with classic results (Iglehart and Whitt

1!)70).

Since the cycle length T(tr)

is

dictated by the

dynamic

cyclic policy, the drift of

the diflfusion process depends on both the policy and setup times

when setup times

are

The variance

present.

of the diffusion process

a^

is

=

J2',=i

^(^ai

+

f"si)' '^"^^

^^^''^ '^

"^"ly

dependent on system parameters.

Although the idhng threshoki

u'o

does not affect the fluid process, this control pa-

rameter does impact the one-dimensional diffusion process

barrier.

There are

system.

In this case,

restrictions on u\) only

of the cost on our policy,

we can

m sup

T->co

given

functions

.(''^(ir)

minimize

(2)

is

Our

in (2).

and

there are no standardized goods in the

Suppressing the notation illustrating the dependence

T'

1

is

"(((').

c{W{t))clt,

/

7;

J/

(3)

Jo

controls arc the idling threshold

.As in .\I1{\V.

with respect to

the optimization

is

ii-u

and the

;V

carried out as follows.

to find the cycle center in terms of r(u')

,r'

— dimensional

and

We

This

lcq.

a constrained nonlinear optimization problem. Then (3) becomes a diffusion control

problem with

a drift control (via the cycle length t{u-))

idling threshold

The

in several steps:

In

^(.].i

is

and

to optimize the cost in

§3.2.

we

('^).

policies

on

a fixed total

3.1.

is

performed

c,{x'^ .t.

w)

in (2) for

To ease readability

in

these two

we suppress the notation depicting the dependence

of the fluid processes

workload w. Then we perform the cost minimization

atul translate the solution into a

problem

This optimization

calculate the cost function

customized and standardized products, respectively.

and

(via the

OPTIMAL DYNAMIC CYCLIC POLICIES

goal of this section

subsections,

and a singular control

icq).

3.

is

reflecting

its

e.xpress the objective function in equation (1) as

11

c{ir)

by acting as

wq must be nonnegative.

The Optimization Problem.

where

if

11'

dynamic

cyclic policy for the original

in §3.3

queueing control

in §3.4.

Customized Products.

to determine

how due-dates

affect

The

i)rimary challenge in calculating c,(.r'\T.

this cost

by normalizing the due-date lead times.

typically 0(i/77) in heavy traffic mocU'ls.

function in the fluid limit.

We

ir)

begin

Because queue lengths and waiting times are

it

is

10

appropriate

for

due-date lead times to also

be 0{\/n). Therefore, we assume that the due-date lead time density f,(\/ns) converges

to the nontrivial density /,{<). witli cumulative distribution function F,{s)

and mean

=

/,

converges to a point mass at ^

appear

is

=

and

Hence, due-dates do not

zero elsewhere.

is

the diffusion process and are isolated

in

F,{^/us)

under a diffusion time scaling the density f,{ns)

In contrast,

l,/\/n-

—

in

the fluid limit. This state of affairs

consistent with the heavy traffic snapshot principle (see Reiman), which states that a

customer's sojourn

=

Let Li{t)

in

the system

is

L,[\/nt)l s/n denote the

define the process D,(s.t) to be the

time

t

that

has slack

is

due

at

time

.•<

=

Let D,{.sJ)

.s.

instantaneous under the diffusion scaling.

-|- f:

in

minimum

amount

slack process in the fluid system,

of product

other words. D,{s.

D,(s/ns.

^t)/

^

t) is

lenote

work present

/

in

and

the system at

the work present at time

t

that

Notice that D,{sJ)

its fluid limit.

provides a more detailed description of the orders than 11,(0-

Equation

(1)

shows that the key to calculating the

the behavior of the

minimum

function

is

c,(.r'^. r. »•)

slack

derixed

tion (11), respectively):

We

in

to

it.

function

is

to determine

throughout the course of the cycle. The cost

/!,(/)

three steps (in Proposition

2,

Proposition 3 and equa-

calculate the process D,{s.t) in terms of the original problem

parameters and the mininumi slack

process D,(.s.t) (in these

cost

first

at the start of the cycle, derive L,(t) in

two steps, we replace D,{s.t)

as explained after Proposition 1).

l>y

terms of the

a process closely related

and express the cost function

c,(.r'^.T. ic) in

terms

of L,(n.

Without

and service

loss of generality,

is

we assume

received from time

(1

—

p,)T to r. Hence, the

the system at the start of a cycle, which

The

initial

work

,r'

the system at time zero.

is

we denote by

nuist be stored in the

greater than or equal to

zero

that a cycle for protluct

Z.,(0).

The

system

/

amount

,rf, is

of product

equal to

.r^"

—

work

—

in

p, )/'-.

as orders with due-date lead times

between D,(s.t) and the workload

given by the following proposition, where f]'{s)

11

/

"^,(1

by definition the smallest slack among product

relation

time zero

starts at

is

defined as

1

—

/

orders in

n',(/) at

F,{.-<).

time

Proposition

1

time

.1/

t

=

0,

=

A(.s.O)

(4)

ifs<LdO)

and

r

1=

P.F[(s)ds.

(5)

JL.iO)

Proof: Because the |)roduct

under the

at rate pi

.s

workload arrival process

/'

any

fluid scaling, at

dt instant of

The work

units of time arrive in the fluid limit.

bounded by wie maximum amount

At time zero, the

work

maximum amount

work plus work that arrived

+

of

which

r)dr.

/

is

of

in

deterministic and flows in

is

time f,(^)p,dl units of work due

the system at time

could have arrived with a due-date of

th;.l

work present with slack

units in the past with a due-date of

equal to p,F^'{s). Thus, D,(.s,0)

<

.s

.s

^-f-^-

+ 7\

Xotationallw this

p,F[{s). This inequality

/o^/3,/,(-s

is

strict

is

being used and the machine processes work at rate one. which

orders due after time L,(0) were worked on. Since an earliest due-date policy

if

is

strictly greater

follows that D,(s.t) at the next instant either vanishes or

it

service and only affected by arrivals.

producing product

is

than

untouched by

time zero, the machine has just switched out of

.\t

implying that the work due after time L,{0) has not been touched

/,

and that there has been no opportunity

for orders to arri\'e

with due-date lead times

below L,(0~), the smallest slack the instant before the switchover. Thus, equation

.r^

=

/£^m) D,{s,0)ds.

Because the interaction of D,[s,

t)

and

holds.

By

is

the recently arrived

is

.s

is

PiF'^ls),

with slack

t

in

construction,

we have

Combining

this

with equation

(4)

(4)

yields equation (5). |

L,(t)

is

complex, we streamline our calculations

by creating a simplified variant of D,(s.t) that evolves through the course of one cycle.

Let Di''(s.t) be the

amount

work

from

for

Di^{sJ)

D;^(.s. /)

product

i

= D,[sJ)

is

useful for

directly from

it.

for

.s

of

work

=

t

>

time

at

nnf;7 r;

L,(f) but

two reasons:

The evolution

of

Its

is

/

with slack

D'^(sJ)

is

/);^(.'<./) is

12

is

if

the machine performs no

only defined for

not necessarily

behavior

.s

for

.s

<

easy to describe, and

t

G

L,(t).

I^,{t)

[O.r).

The

Thus.

process

can be derived

described by the following proposition.

Proposition 2 Fort G

vv

^"(.^.0

[O.r).

=

(6)

p,{Fns)-F[{s +

[

if,<L,{0)-t

t))

Proof: By construction, Di'{i>J) evolves according to

+

D;'(../

That

+

/

s

is,

+

amount

the

df

with slack

is

5

of i)rodurt

,//)

=

work

/'

D;^(5

+

+

f/^/)

amount

dt phis the

D-'isJ)

the solution to eciuation

+ Ml)

D,(s

in for

/

equal to the amount of work that was previously

+

of

in (8).

=

(7)

+

dt that

in

-

p,(F:{s)

F^{s

+

t))

t

+

=

0.

D,(.s

due

time

at

.s

readers can verify that

+

/,0)

(8)

follows by using equation (1) to substitute

|

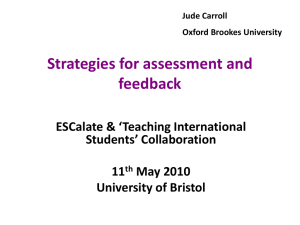

tures regarding the evolution of D]^(s,t) in Figure

2.

of o,

= aj \JTi

D\ {s,t) as a function of

Although

and

6,

=

6,/x/n.

Figures 2b-2d display, for a fixed value of

and

is

perhaps more instructive to describe the dynamics of D'^ {s.t) as

t.

this figure represents

progresses through the cycle, the existing orders age and

metaphor

is

as waves,

and new orders

/

increases.

new orders

arrive.

t.

/.,(0).

snapshots of D^" {s.t) at a fixed time

a,

a, -f

minimum and

under three cases depending on the relative value of

s

fea-

For the sake of concreteness,

Figure 2a contains a uniform due-date lead time distribution, with fluid

maximum

t

that has just

an attempt to enhance the reader's intuition, we point out some noteworthy

In

t

is

the system at time

work with a due-date lead time of

The proposition

(7).

equation

p,/(.s).

the system at time

in

arrived. Using the fact that D'^is.t) equals D,{s.t) at

is

tlie differential

t,

it

As time

.A

useful

to imagine the area under the curves in Figures 2b-2d as water, the curves

work

travel to the left

grow

in

height as

as raindrops

(i.e.,

slack

new orders

time zero has slack

Z-,(0)

—

are

/

at

is

accumulating on the waves. Then the waves of

decreasing)

added

to

time

if

/

in

Figures 2b-2d as time progresses, and

them. Notice that work with slack

no work

13

is

/-i(O) at

performed dining the cycle.

By

equation

is

(6), for slacks

Z)f (s,<)

—

exceeding this

.s

—

is

invariant over time

/.

(.s,/)

Proposition

and

/,(0)

its

at

at

1,

maximum

time

a,

all

values of

>

,s

{sj)

is

of

L,(0)

— /,

—

are

t

propor-

=

=

t

value oi

p,

.^

(see Figures

t

[L,{0)

2b and

—

t.a], D'^'isJ)

is

2c); here, all of the

has arrived.

/

0,

has the e<:|uilil)rium value

Z)f'(.s,0)

depending on

greater than the initial

then no new orders

Also, for

6,.

p,F[{.->)

for

However, the evolution over the cycle of D^{s,t) has two

otherwise.

is

-|-

.s

time

different qualitative structures

lead time o,

arriving for

.s

Figures

The amount

eciuiUbrium:

in these eciuilibrium regions, D'^

/

drops to zero at the point 5

work that could be due

>

is

in

Figures 2b-2d to the right of the barrier Zi(0)

For a fixed time

constant and takes on

i:

in

that has slack

/

complementary cunudative distribution function of the due-date lead time,

tional to the

By

Z);^(.s,/) is in

aging ecjuals the amount of work that

and so the shape of the wa\es

and so /)f

the cjuantity

/,

the work at time

which corres[)oiKl to the regions

p,F^'{s). For these slack values,

2b-2d to the right of Z,(0)

work that

critical value,

minimum

have a slack

will

the earliest possible arriving due-date

if

less

slack Z,(0), or less than

If

it.

L,(0)

than those that had a slack of L,(0)

<

at

time zero. Therefore, orders arrive with just the correct due-date lead time distribution

to maintain the equilibrium behavior of /)-^(.s,0), as displayed throughout Figure 2b.

However,

the

minimum

a small

—

a,

then new orders can arrive with a due-date lead time smaller than

slack of the orders present at time zero. In this case, as time

amount

p,F^{L,{0)

of orders with slacks less than Z,(0)

which

/).

leadtime Z,(0)

barrier

>

if Z/,(0)

—

/

is

the (juantity of work

in

—

/

accumulates but never exceeds

the system at time

with due-date

t

(see Figure 2d). Thus, the critical slack value of Z,(0)

between the

ec|uilil)rium

work

progresses,

i

—

t

marks the

level p,F^{s) (to the right of the barrier)

accumulation of new orders with small due-date lead times (to the

left

and the

of the barrier).

Finally, referring to the portion of the curve to the left of the barrier in Figures 2b-2d,

in

the region

.s

<

Z,(0)

—

D^(^.t) must equal zero

/.

all

for

.'^

arriving at time zero with the

.\ldous. Kelly

mance

of the

<

—

t:

minimum

and Lehoczky

of a single-class (il

a,

work

in

1,(0)

is

due

after

this critical value of s

due-date lead time of

time

.s

+

/,

and hence

corresponds to an order

a,.

(1!)95) use heav\- traffic theor\' to

analyze the perfor-

/G/[ fpieue with randcMU due-date lead times that operates

14

Due-date Lead Time DensitA'

/

(a)

bi

^(0) <

a,

N

D^^^t.)

(b)

1,(0)

-f

h

(I,

a,

<

<

L,(0)

a,

+t

(c)

A'(^-0

"^5

a,-/

L,(0)-t

a,

a

+t <

L,(0)

W

wv

Df(..^)

«,

Figure

2:

-

/

a,

Z,,(0)

The function D]

15

-

(.s./)

/

as a function of

s.

They

uiuler the first-come first-served discipline.

cal to

deriv(> a figure that

essentially identi-

is

Figure 2b. Because there are no setups and only one product, the non-equilibrium

region to the

of the due-date lead time barrier L,{0)

left

—

/

does not appear

in their

problem.

Our next

When

step

the machine

sponds either

/

(i.e.

is

minimum

terms of

slack process L,{t) in

[s.t).

D',

servicing other products, the order with the earliest due-date corre-

to the earliest

<

Z,(0)

is

to calculate the

due-date request just as the server switched out of product

or the request w^ith the due-date lead time of «, that just arrived after

a,)

the machine switched out

l,{t)

(i.e.,

L,{0)

>

«,).

Thus, we have

= m\n[a,-t,L.{0)-t]

for

f

-

e [0.t{1

(9)

p,)).

Recall that D['{s.t) was constructed under the assumption that the machine does not

work on [product

consumes the

left

/

throughout the cycle.

most part of the curves

in

When

product

t

—

t([

—

/>,

)

L,{t) has

Proposition 3

(5),

Ecpiations

ov^er

/.,(/)

/--^

(!))

(.5),

and (10)

(9)

and

1"^'

t

(^"(l

—

the server

/^,),r).

work corresponding to D; {sj)

D^'{sJ)cl..

be used to express the

r(

initial

minimum

minimum

for 5

1

(|ualitative behavior of the

— p, no

)

Since orders age and get closer to their due-date, the

16

minimum

one

cycle.

and the primitive

this expression here).

minimum

and only orders

services occur

(10)

slack process L,(t)

slack

problem (although we do not write out

we can summarize the

zero until time

/e(r(l-p,).r).

for

iiniqucly det(rnunt L,[t) outr tht course of

(10) can

probabilistic processes of the

From time

t

fhf ^inallrst qunntittj that satisfies

the course of one cycle solely in terms of the

In addition,

For

been completed. Thus we have the following proposition.

t-T(l-p,)=

Equations

being served, the machine

Since the machine works according

units of work.

to the earliest due-date rule within each product,

below

is

Figures 2b-2d (in the context of our metaphor,

the machine swallows the water at a constant rate).

would ha\e completed

/

slack process.

arri\'e to

the (pieue.

slack in product

/.

f.,{f).

is

monotonically decreasing at unit rate

—

r(l

until r,

)

/>,

Z,(/)

greater than Dt{s.t)

behavior

orders are being

more comple.x.

is

<

L,{0)

If

o,

product

/,

L,(t) increases linearly until the

machine

is

consuming the

of the cycle.

If

Z,(0)

the region to the

left

when the

is

barrier

>

flat

a,

step

tii.al

—/?,))'

seen in (9).

<^s

then,

when

end of the

part of the curve

and

of the barrier Z,(0)

—

in

t

to

always

is

cycle; referring to Figure 2b, the

L,(t) does not reach a, before the

is

moving quickly through

volatile,

Figures 2c and 2d, dramatically slowing

tail

determine product

.rj'

i's

(represented by

average inventory cost per cycle

and cycle length

r.

It

is

in

terms

the average of the

ecjual to

Since the machine

earliness or tartliness costs associated with orders as they are filled.

follows an earliest due-date policy, the earliness or tardiness of an order filled at time

/.,(/)

or the due-date lead time associated with a current arrival

a due-date lead time

than

L,(t),

than L,(t).

less

end

reached.

is

of Li{t) for a given cycle center

either

its

the machine begins working on

passed and then speeding up again as the right

is

From time

than they can age), although

filled faster

then the rate of increase

p,F[{s) in Figures 2c and 2d)

Our

G (0,r(l

t

monotonically increasing because the service rate

is

(i.e.,

for

then the machine spends

If

if

t

is

that arrival has

there are arrivals with due-date lead times ^ less

p,f,{-s) fraction

of effort on

Thus the average

fraction of effort on orders with slack Li{t).

them and

1

— p,F,(L,{t))

cost for a product

/

order

is

r,«,r,»0 = i

r

(b,L;(t)

T Jt(\-p,) \

+

h,

['^'^'\>J.{s)sds ]dt.

(l-p,F,(L,[t)))L:{t)+

'

[^

Ju

\)

(11)

Although

HTAP

in

this cost function

is

complex, the average cost per cycle

has dramatically simplified the problem. As noted

a Markov decision process framework

is

The

fluid limit

iD,(.s./).

point of view, the ideas are similar because D,[-J)

is

L^

.

The

is

a point

fluid limit

in tin-

the state of the system

in §1.

progression through this complex state space into

so

computable. The

unwieldy l)ecause the evolution of orders

with due-dates needs to be tracked over time.

domain and

is

has transformed order

From

a functional analysis

a bounded function on a compact

infinite-dimensional space of sc|uare integrable functions

thus approximates the e\-olution of orders

in

the system as a path

L^

in

.

parameterized by

the path in L'

index

tlie

t

in

made computationally

is

"reversing the order of integration."

we

Standardized Goods. The

more complex than

in

of product

/

embedded

work

machine time embedded

.An

abstract.

is

xMoreover, by

1-3.

are able to take advantage of this tractability

cycle.

cost calculations for standardized products are

the customized case because the ciueue of orders and the inventory

of completed items are

amount

relationship

tliis

tractable by Propositions

and translate D,{s.t) into an average cost per

3.2.

Althongh

D,(-J].

important aspect of

in

finished goods inventory at time

in

in /,(0)- a'ld let

U

/(/)

Let W/{t) represent the

the products' workload.

that

is

it

W/{t)

=

^y/{\/nt)/

must be nonnegativc

inventory; backorders are in the form ol unfilled orders

^

as

it

f

be

(i.e.,

the

its fluid

amount

of

counterpart.

represents actual goods

We

assume, as

in

the customized case, that at time zero the server has just switched out of product

/.

in

Because D]

(.^.t)

=

D,{.^.t) for

.s

>

in

D,(s,t).

workload process

L,{t). the

IV',(0 f^^n

'^f'

expressed

as

r

\V,{t)^

r)^'{s.t)ds-\V,'{t)

/G[0,r).

for

(12)

Jl,{i]

Recall that

we do not

assign completed units to standardized orders before their

due-date. This leads to the imj^ortant observation that L,{t)

for this

is

simple:

If

for

some unexplainable reason

event suddenly shifts the total workload le\el

to orders

and instead place them

in finished

\\',(t))

>

Z,(/)

<

for all

(for

/.

instance

The

rational

when

a rare

then we assign no completed units

goods in\entory. The

then decreases to zero and never again goes higher. This

is

minimum

slack

/.,(/)

a transitory effect that will

be washed away after the repetition of several cycles and so can be ignored. Hence, by

equation (6) we can conclude that

D;^'(.s,/)

=

/j,/'7(.s)

for

.s

>

and

/e[0,r).

Because units from in\entory are allocated to |)revent backorders,

only

when 117(0 =

it

follows thai

(13)

/.,(/)

<

0: i.e.,

\\\'{t)L,{t)

=

for

18

all

/.

(14)

So

<

Z,(^)

if

product

then the next unit of product

completed by the machine

/'

order with the earHest due-date, and a tardiness cost

/'

is

assigned to the

is

incurred.

Completed

units that are not assigned to ord<^rs are placed in the finished goods inventory represented

by \V/{t) and accumulate a holding cost. Therefore, the cost per cycle

product

1

r

W]

T.

b~i-{t)dt^-

r hxv![i)dt

Ecpiations (r2)-( 14) lead to the useful relation that li'/(/)

=

PiF[(s)ds, and so \\'/{t)

know the behavior

of 11,(0

(n'',(/)

—

pj,)

cost portion of the cost per cycle in (15)

equivalently, cycle center

(SELSP) holding

Now we

,r^')

by

p,l,

It

is

in (15).

r

.s

in

>

Z,(0)

<

—

(9)

/

Thus, the liolding

economic

lot

scheduling problem

Because

<

/.,(/)

when

tardiness costs

D^{sJ)ds+ rp,F:{,)ds

in

and the

fact that

the

integral,

first

in this integral,

:i6)

Jo

during these times. To determine D^^isJ)

-'*

MRW.

follows by (12)-(14) that

it

by

<

just a translation in terms of workload (or

is

JL,[t)

t

\V,{t)

cost.

U-(/)=

—

if

important to note that we already

of the stochastic

turn to the tardiness costs

are incurred,

.

positive only

is

standardized products from

fui"

(15)

Jo

Jt(\-p,)

Z,(0)

a standeirdized

is

C,(X%

Ji]^

for

Z,(0

is

in

the

first

integral,

nondecreasing

and so D^" (sj)

equation (16) becomes \\\{t)

=

=

for

p,F^'(s)

/

we observe that

€ (t(1 —

/>,).r).

by Proposition

jl^^,)p,ds

+

pJ,.

We

2.

L,(t)

>

Hence.

Because

conclude that

the backorder regions

p,L;(t)

By equations

(15)

and

(17). the

= {\\\{t)-pjY

(17)

.

time average tardiness cost

r

for a

given total workload

(\\){t)-p,tydt

is

(IS)

/'.

.Again, this

is

a translation of the

SELSP

cost per cycle.

Therefore, the cost per cycle for standardized goods with due-dates

same

as the

SELSP

cost

with a cycle center

19

shift

by

/>,/,.

which

is

is

just

exactly the

])ro(luct

/

s

utilization times its

products,

case,

is

it

follows

and the cost

t

is

mean due-date

For a system with only standardized

lead time.

hat the optimal switching curves are shifted by pj, from the

independent of the due-date lead times;

discussed further in §4.5, §5.6 and §5.8. Thus, as

into three regions based on

the cycle.

The

there

is

c,(.r"', r, tr)

is

broken down

only holding, only backordering or mi.xed costs over

cost per cycle can be expressed as

f'dpJ^

c,{x'-\T.ir)

if

important observation

this

.MRW,

in

SELSP

=

-

-1-1)

2

ifoe

[/>,/,

-,r:-±^i^4^]

<^

if /j,[,

-

.r;'

<

TpAi-P.)

(19)

3.3 Optimization. With an expression

in

for

average cost

for

each level of workload

hand, we can optimize over the dynamic cyclic policy as determined by

U'o-

The

generalit\- of the

due-date lead time distribution prevents an

numerical procedure, however,

is

both the

levels.

fluid

and the diffusion

.;"',

r

and

e.xact solution.

.A

Policy optimization must be performed on

possible.

I'nder the fluid scalings. the cycle center

,;•"

cycle length r and total workload level u\

can be optimized with respect to a given

This nonlinear program can be stated as

follows:

min

such that:

Z'XiC,(x'.T.

E;^=

.r?

The

(20)

(21)

i-K

> iMizM

f^.)r

;

highly noidinear aspects of L, and thus c,{x''.t.u')

V"

1,

make

(22)

this

problem complex.

Nonetheless, the problem can be solved numerically using standard descent methods,

and we denote the solution

In the dilfusion

Ci\en

In' .;"'( r, lu).

scheme, the long run average cost of the

that the optimal cycle center x''{t.

ir) is

20

entirt^

problem

is

minimized.

known, the minimization of equation

(3)

reduces to a diffusion control problem with a

(via Wo). Let

V (»')

drift control (via

(see

Mandl

1968),

<

^("'1

y^Cj(a-'' (r, w). r,

w)

unbounded, we assume that standard

is

and express the associated Hamiltou-Jacobi-Bellman

optimality equations, after using equation

min

)

be the potential (relative value) function and g be the gain (optimal

long run average cost). Although the drift of \V

arguments apply

t{w) and a singular control

(2), as

g

-\

~

c\''[u')

+

—

V'"(fr)

(

=

for tr

<

Wq

U=l

(23)

and

V"(('')

MRW,

.\s in

we numerically

=

for u'

(24)

u'o.

solve the diffusion control problem by approximating

the diffusion process by a Marko\' chain.

This Markov chain approximation algorithm

was developed by I\ushner (1977), and we

for details of the algorithm.

>

.MRW

refer readers to I\ushner

contains a

full

description of

its

and Dupuis (1992)

application to solving

the corresponding optimality equations for the SELSP. Because the optimality equations

in

MRW

and

refer readers to

When

and the

we omit a

are very similar to equations (23)-(24),

.Appendix

description of the algorithm,

1.

there are no setu]) times, however, the diffusion process

diffusion control

cycle center

.r"

must

still

problem

is

easy to solve.

be optimized

for

W

becomes a

.-Mthough the cycle length r and

each total workload

level,

they can be done

individually without the need to refer to or update the potential function

the steady state distribution of the total workload process

times are zero, the optimal idling threshold

k'q

=

argmm,^,,

r

3.4.

and

a""'

are the parameters for the

Proposed

Policy.

The

W

is

—

o-

f^BM

e

^^

'

for interpretation,

Since

exponential when setup

'aw,

U'.

solution outlined in §3.3 needs to be unsealed to

be implemented. .-Mthough the translation to an unnormalized

room

V''(a').

given by

c(a')

/

Jw'

where

is

REM

we propose an

intuitive policy.

polic\'

The heavy

has considerable

trafiic analysis

hnds

a

minimum

work experienced by an

every total workload

for

it.

lexel of

we propose

that the

minimum amount

of

level.

product over the course of a cycle

iiulividual

Because work

depleted while the machine

is

is

machine continue production on the current product

work

serving

until this

reached, and then begin setting up for the next product

is

the cycle. In addition, the machine idles

when the

workload

total

in

level has fallen to the

idling threshold.

We define the

0,{l),

which

which

is

I

number

number

.V.

\

identity O,

known

the

is

the

= iW +

policy in terms of

-

I,

=

to hold for a

of orders of product

For ease of exposition,

/;,ir,,

where 0,{t)

in

we

let

= 0,(nli/^

policy

Switch out of product

scheduling policy

.V

< A/',

/

queue

in

for

/

=

=

for

and

/,(/)

in

heavy

terms of

/

l....,N and

=

1, ...

=

[,{nt)/s/^

traffic, is

6',(/)

in practice:

/,(/),

goods inventory

in finished

/

7,(0

wide variety of queueing systems

traffic solution to a

o,{t)-i,{t)

/

of completed units of product

the heavy

is:

two quantities that are naturally observed

and

,

/V"-".

The

,

for

linear

which

is

used to translate

/,(/).

The proposed

when

..-w/>.,^

,-..^^

^.^

.e-,i:;li//;^(Q.(0-/.(0)

E; = ^- (O.(O-MO)

,

v/n

(26)

and

idle the

machine when

X:/'r'(^.(o- A(0) = v^u'o^

c-^")

1=1

where

.rf (tr).

in §3.3.

t'(w) and

((\"

are determined from the optimization procedure outlined

Because a computational i)rocedure

of the heavy traffic parameter

/;,

and we

is

let

»

being employed, we must choose a value

=

(1

—

/>)"'.

.A.s

in

MRW,

exploratory

computations (not shown here) reveal that the performance of the proposed policy

is

very insensitive to our choice of n.

.Although we do not do so here,

point

in

more complicated

time over the cycle, our analysis yields

policies can

tlie lluid

workload

be created.

level of

.At

any

each [jroduct.

This type of information can be used to determine when random events throw the cycle

0>

manner

off course in a

cyclic

not predicted by the

approach can thus provide "red

specif\-

when

warnings

flags" or

to skip jModucts in the cycle or

We

an unusually high number of orders.

when

fluid scaling.

i)olicy

to

The dynamic

unusual surges

for

A more complicated

or slow-downs in machine processing.

would

HTAP's 0(s/n)

in

demand

using this information

jump

to a product that has

leave the specification of such [)olicies for future

investigation.

DETERMINISTIC DUE-DATE LEAD TIMES

4.

In this section

we assume

that due-date lead times for each product are deterministic,

thereby allowing us to write a closed form expression for the cost per cycle

In a(^hlition,

in §1.1.

optimal cycle center

is

found

terms of

in

to

some

The

and

.r"^'

\

method

are able to state a quick

'(»•)

and the

still

jn'oposed solution

is

total

equation (2)

§4.2 for determining the

in

provitle a formulaic solution.

problem must

diffusion control

algorithm.

we

in

With

this,

cycle length r

However, the solution to the

workload w.

be computed by the Markov chain ai)proximation

stated in §4.3. .Subsections 4.4 and 4.5 are devoted

structural properties of the optimal solution and the value of due-date lead times,

respectively.

4.1

/,,

Cost per Cycle.

which

is

/,

=

Let each product

For a given cycle center

or 1,(0)

=

products

.r*

/,

is

.

'

\

The cumulative

<

if-s

1

—

is

^

cycle length r and total workload level w. the cost per cycle

is

given by (19). with

and D[^(s.t) given

.r'/p,.

distribution function

/,

/,

in

place of

cost per cycle for a customized prodvict,

of Dt{.s.l). L,{t)

slack

.r;

standardized product

To Hnd the

have a deterministic due-date lead time of

f,/\/n under the fluid scaling.

'^

for a

/

.r"^

and

r.

By

we must determine the behavior

Proposition

1.

Therefor(>, Z,(0) has a range of [— dc.

greater than or equal to zero. This

must be no larger than

/,

makes

because no orders can

23

/,.

\\v

/,],

have

=

//'(o)

Z-*'^''*-

since for customized

intuitive sense:

arrive-

.r'

The mininuim

with larger due-date lead

times.

From Propositions

1

ami 2 respectively, we have

D.U.O) =

«(/-''/"/)

if.'

{''„

(.29)

otherwise

1^

and

if

f

=

D'^'i-^.t)

I

if

P,

if

[

We

can solve

Because

—

(I

bounded above by

the

initial

We

r(l

—

-

Pi))/p,

Xote that

/',.

inventory

L- -rl/p,

=

—

p,){t

/

by using Proposition

for L,{t)

^.(0

< /, - .r;V^>, / - -rj/p, -t<s<f,

/ < ^

.^

(1

—

-

(1

P.}T

—

For

3:

+

p,)T

G

/

-

(1

-

p.){t

—

/9,).r),

r(l

- /0)M.

(31)

than or equal to zero. L,(t)

less

is

(7"(1

(30)

.

is

depends on the the decision variable

this function

x']

also

via

.r^.

can now substitute (31

into equation (11) to calculate the average cost per cycle.

)

Since no orders arrive with due-date lead times L,{t)

than

less

/,.

equation (11) can be

rewritten as

c,(.r^r.».)

This structure

cycle

is

is

= -

r

(b.l;(t)

SELSP

similar to that in the

of the cycle

(i.e.. if />,/,

-

,r^"

>

rp,(l

If

—

!,(/)

is

h,l + (f))dl.

case discussed in

broken down into three cases depending on

both during the course of the cycle.

+

if

(32)

MRW'. The

cost per

orders are only tardy, only early or

always greater than zero over the course

pt)/2) then orders are always filled early and so

equation (32) implies

c,(.r^r, w)

=

-h,

which simplifies to

MRW: The

f

[./

c,(.r^\-, lu)

cost per cycle

is

- xUp, -

=

h,p,{f,

(

—

1

-

/>,

+

)r

(

1

This

.i"'Jp,).

ecpial to that in the

-

is

SELSP

p,){t

-

"(1

-

p,))/p,] dt

.

(33)

very similar to the results from

with axes shifted by

p,f,.

The

similarity can be viewed as an application of Little's law. In our notation, the utilization

p,

corresponds to the arrival rate of work and

24

/,

-

-i^l/p, is

the average waiting time, and

their product

is

Similarly,

if

cost

the nuniher

is

tardy then L,{t)

t)rders are alvvays

is c,(.v'-'.T,w)

then £,(/)

queue.

in

=

b,pt[(.r'i/pt)

—

If

/,].

is

less

than

for all

G

/

and the

[0,r],

orders are both early and tardy over the cycle

both positive and negative over the cycle and the average cost per cycle

c,(j-^r,

«•)

=

b,p

is

^-i(-/^-?) + i-(l-^^'

341

^''

'^'

^

I

+lhP,

2t(1-p,)

r

if

2^-l'

Again, this reduces to a Little's law version of the

For ease of reference,

we say

tiiat

e [pj,

-

product

.(;

±

i

r/j,(l

summary, the average

•)

+

SELSP

results.

the parameters are such that

if

condition

is

in

-

p,)/2]

and

Similarly,

I.

condition 3

in

we

5^(1-/3,;

/>,/,

-

customized products

cost per cycle for

x'^)

c,{x'-\t.w]

>\

I

+ h,

I

^

result:

/

Tp,(l

in

condition 2

for

condition

Equations (19) and

that for customized products the cycle center

.rj"

cannot be

4.2.

us to

Optimization. The

make

if

In

for

condition 2

1

35)

(3-"))

condition 3

imply that

less

than

for the de-

and standardized

/j,(

is

I

the restriction

—

p,)r/2. Due-

dates have transformed customized products into (juasi-standardized ones.

and

p,)/2.

,.c\2

f

ones are exactly the same. The only difference between the two types

in ^j5.7

p,)/'2,

is

terministic due-date case the cost structure for customized products

the interpretation of this resvdt

—

>

< -Tp,{[ -

.v";

for

This leads to a remarkable

x'^^

product

call

if /;>,/,

—

We

discuss

§5.9.

explicit derivation of average cost per cycle in §4.1 allows

further progress in optimizing this system. First,

we derive the optimal

cycle

center and cycle length, and then construct an algorithm for use in the dilfusion control

problem.

Cycle Center. By our

analysis

in §4.1.

the only ilifference between the optimization

of the cycle center in (20)-("22)

and

MRW

in

is

the inchision of the equation (22) con-

customized products.

straints representing the non-negativity restrictions on

MRW,

In

the solution to the program without inequalities (22) was found exactly. For later refer-

we

ence,

by

the "unconstrained" version of (20)-(22) and denote

call (20)-(21)

.As discussetl in

.r"'*".

MRW,

the form of the cycle center

three regions depending on whether the objective function

cheapest product at the point

it

used

is

in

of

and

.r^^'

We

broken down into

linear or quadratic in the

because

.r"

r.

solving (20)-(22)

the boundary conditions in equa-

is

exploit the structure of the objective function to determine the structure

to find

which

objective function

minimum

in

is

wish to find a similar expression for

determining the optimal cycle length

The major complication

tion (22).

We

.r*-'".

is

.r*^*"

solution

its

exists

it

is

piecewise quadratic with linear edges.

will

be a global minimum.

.As

convex and so

It is

,V

A.;0

=

c{r^,r.

.r)

+

A

(

^

w

is

(V^

\

,<

a local

if

per Bertsekas (199-5), the Lagrangian

associated with (20)-(22) with fixed cycle length r and total workload level

I(.r'-.

The

are binding with respect to the inequality constraints.

.r^~*"s

- u^ +

E/',(^^^\^

"

-rj)

(36)

•

:1

The Karesh-Kuhn-Tucker necessary

exist

Lagrangian multipliers A' and

where 0*

pj)l'l.

is

We

for j

=

•V''

I

there

=

0.

(37)

^i'

>

0.

(38)

^-

=

the set of non-binding cycle centers;

Vj€0',

i.e..

we

(39)

products j such that

suppress the dependence of 0" on r and

set of

.r"

such that

lv

for

x'j

binding products

categorize the binding products

in

The products with binding

>

Tpj{l

increased readability,

l)y

their condition.

0'' be the set of products with binding cycle centers and in condition

be the

3).

//'

minimum

V,ci(.r'--.A'./r)

additional ease of reference,

let

conditions state that for local

J

—

for

We

and 0"'

condition 2 (no binding product can be in condition

cycle centers are pushed to their limit,

26

in

the sense