Beef Market & Cattle Supply Prospects 21 January 2009 Joe Burke, Bord Bia

advertisement

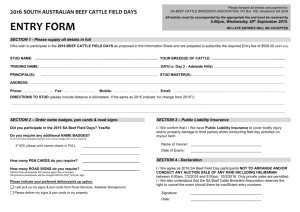

Beef Market & Cattle Supply Prospects 21st January 2009 Joe Burke, Bord Bia Cattle Supplies ‘08 Export plant throughput: change 2008 vs. 2007 (‘000 head) +5,000 + 2,000 0 -14,000 -20,000 -28,000 -40,000 -60,000 -80,000 -77,000 -100,000 -120,000 -112,000 Total Steers Young Bulls Heifers Cows Others Agenda • Cattle Supply ’08 & Availability ‘09 • Distribution of Exports • Review of UK & Continental Markets • Imports into EU Cattle Supplies ‘08 • What were the drivers? • Supply of stores lower: – 2006 Live exp.s increased by 65,000 – 2006 calf births fell by 19,000 • Lighter carcase weights • Disposal patterns: – Disposals from June to November level with ’07 • Producer decisions: – Some carry over into 2009 (BSE testing change) – Young bulls increased from 8% to 9% of prime cattle kill Cattle Supplies ‘08 (‘000 head) 2006 2007 2008 Lower 2009(f) Upper 2009(f) Total 1,692 1,692 1,580 1,592 1,624 - Steers 811 779 702 710 724 - Y Bulls 79 105 107 106 112 Total Males 890 884 809 816 836 - Heifers 418 425 411 414 425 - Cows 358 357 329 341 349 - Other 25 25 30 28 30 Cattle Supplies First half of ‘09 vs. ‘08 (‘000 head) 30,000 30,000 25,000 20,000 15,000 13,000 10,000 10,000 10,000 6,000 5,000 5,000 6,000 3,000 0 0 0 -2,000 -1,000 -5,000 Total Steers Young Bulls Heifers Cows Others Cattle Supplies ‘09 Key Factors: • Live exports fell by 42,000 in ’07 to 208,000 • Lower calf registrations in ‘07: -30,000 • Some carry-over of finished cattle into 2009 • Less replacement heifers likely to be retained in 2009 and higher cull cow disposals • Drop in feed prices will benefit intensive finishers / young bull producers • DAFF destruction of dioxin – restricted herds Export Beef Distribution +5% -10% -6% -10% -8% (‘000 tonnes) 2006 2007 2008(e) TOTAL 522 523 483 UK 267 278 261 Continental EU 217 239 217 France Italy Holland Scandinavia 55 47 41 35 56 48 47 42 50 44 42 44 Other EU 39 45 37 International 38 6 5 of which: Prices - Deadweight R3 Male Cattle prices (c/kg dw) 3.80 3.60 3.40 3.20 3.00 2.80 2.60 2.40 2.20 2.00 Italy France GB ROI Jan Mar May 2007 Jul Sep Nov Jan Mar May 2008 Jul Sep Nov €uro : Sterling Exchange Rate R3 steers (c/kg dw excl VAT) 400 350 GB R3 steer 300 250 Ireland R3 steer 08 vNo Se p- 08 8 l- 0 Ju 8 -0 ay M -0 8 ar M Ja n- 08 07 vNo Se p- 07 7 l- 0 Ju 7 -0 ay M -0 7 ar M Ja n- 07 200 Irish R3 Price rose by 15% in 2008, while GB price only rose by 8% in €uro terms €uro : Sterling Exchange Rate Euro vs GBP 1 0.95 0.9 0.85 0.8 0.75 0.7 Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09 GB Deadweight price in £ stg. GB R3 steer (p/kg dw excl VAT) 300 250 200 Ju l-0 8 Se p08 N ov -0 8 M ar -0 8 M ay -0 8 Ju l-0 7 Se p07 N ov -0 7 Ja n08 7 M ay -0 M ar -0 7 Ja n- 07 150 GB producer price 2008 rose by 26% in Sterling terms United Kingdom 2008 Review • 4.5% Decline in GB prime cattle throughput (N.I: 6%) • UK cow beef production rose by 14% • Beef exports from UK ↑ 25% (56,000t pw for Jan – Sept) (Markets: ROI 37%, NL 32%) • Weakening of £ stg. vs. €uro made imports more expensive, and thereby domestic product more competitive. 2009 Outlook • Predict Lower UK supplies of prime cattle and cows • Production predicted to fall by 1.5% • However, consumption likely to drop by 1.5% • Therefore, import requirement could fall UK Beef Consumption and Consumer Demand GB Household beef purchases for 12 weeks ended 30 Nov 08 +3.7% 5 +4% 0 -0.5% -2.0% -5 -6.7% -10 -15 -16% -20 Beef Source: TNS Roasting Steak Mince Burgers / grills Stewing France • French female beef production declined by 3.5% in 2008, though expected to rise again in 2009 • Predict a 1.5% fall in domestic consumption • French beef exports related to livestock situation • French Young bull slaughterings up to end Sept ’08: 776,000; an increase of 1.0 % on the same period in 2007 Distribution of French Live Exports Jan – end Nov 2008 (000’ (000’ head) 2007 2008 % change Total 929 843 - 9.3 % Italy 859 718 - 16.5 % Spain 115 91 - 21 % Greece 13 19 +52% Italy • Scarcity of beef on the market, especially of young bull beef: - Less domestic production on account of lower live imports - Consumer demand also lower Italy Beef and Veal Balance 2006 2007 2008 2009 Net production (000 tonnes cwe) - Male beef 1,111 677 1,127 692 1,070 640 1,090 665 Meat imports (000 tonness cwe) 505 473 456 430 Meat exports (000 tonnes cwe) 144 138 150 155 Consumption (000 tonnes cwe) Source: Bord Bia 1,472 1,462 1,376 1,365 Other beef import markets • Netherlands – Production declined in 2008 (-15%) due to less cow beef – Imports only slightly lower: • Despite sharp fall (-66% in Jan-Sep) for Brazil • Germany the main beneficiary; shipments +13% – Little change expected for import levels in 2009 • Sweden – Swedish prime beef production declining (-3% in Jan-Sept) – Imports increasing (+8% in Jan-Sep): With Ireland increasing market share to 43%; shipments +26% – Import demand to ease slightly in 2009? EU beef balance: - Scarcity of supply in 2008 - Small increase in availability likely for 2009 (from slightly increased EU imports / reduced exports) EU-27 Beef and Veal Balance 2006 2007 2008 2009 Net production (000 tonnes cwe) 8,132 8,188 8,040 8,045 Meat imports (000 tonness cwe) - Chilled/frozen 585 485 500 388 335 240 360 260 Meat exports (000 tonnes cwe) 185 111 150 110 Consumption (000 tonnes cwe) - Per capita Source: Bord Bia 8,532 17.3 8,577 17.3 8,225 16.5 8,295 16.6 EU prime beef production falling EU Male Beef Production (% Change 2009/08) • EU Production to fall by up to 1% or 45,000 tonnes in 2009 4.0 3.0 2.0 • All major countries showing some decline, with exception of Italy, Netherlands & Ireland 1.0 0.0 -1.0 -2.0 • Little change expected in overall availability in 2009 -3.0 -4.0 Italy Neth Ire UK Ger Sp Fr Total of these Brazilian imports lower • Chilled shipments 90% lower • Frozen exports to EU down by 77% • Processed shipments 6% lower • Some increase in number of farms approved expected – Currently 733 – Additional states approved Brazilian beef exports to the EU Jan to Nov (tonnes pw) 300 200 100 0 Total • Frozen Processed Chilled Total imports from Sth. America 37% lower 2007 2008 Source: GTIS