Market Overview Finland Food & Drinks Industry Day Thursday 27

advertisement

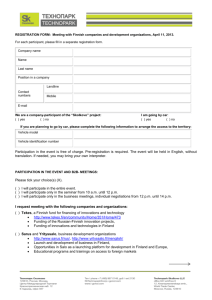

Market Overview Finland Food & Drinks Industry Day Thursday 27th November 2008 Contents • Finnish economy • Finnish foreign trade • Market size and structure • Retail legislation • Retail sector – Definitions – Major players • Catering and foodservice • Alcoholic beverages • Restaurant chains • Import, wholesale and service – Major players • Trends • Reasons for targeting Finland • Barriers & Challenges • Bord Bia Services Finnish economy Economy • The Finnish economy grew by 4.7% in 2007. It was slightly slower growth than in 2006, however better than in the beginning of the decade. • Forecast growth for 2008 is 2.9%, decreasing further to 2.5% in 2009. • The 2007 inflation rate was 4.4%. • Household consumption grew by 5.4%, which did not mean more consumption, but rather, higher prices. • Unemployment rate was at 6.8% in June 2008. • Finland’s population totals 5.2 million, making it the third largest of the Scandinavian countries. • Population densities are highest in the south of the country, with 18.9% of the population concentrated in the three largest cities, Helsinki, Espoo and Tampere. Finnish foreign trade Foreign trade • Finnish exports were worth €65.5 billion in 2007 • Germany is Finland’s most important trading partner, accounting for 10.9% of exports, followed by Sweden and Russia. • Finnish imports were worth €59.5 billion • Germany and Russia lead the import trade, with 14.1% of imports coming from each country. They are followed by Sweden. • In 2007, exports grew by 7%, which is a notable decrease from the previous year’s 14% increase. The majority of the growth was exports to the new EU countries. Finland trading with Ireland • • Imports to Finland from Ireland in 2007 were worth €616 M Exports to Ireland from Finland in 2007 were worth €230 M • Main product groups imported to Finland were – Manufactured products €399 M – Machinery, transport equipment €194 M – Crude materials, inedible, except fuels €148 M – Food and live animals €16 M – Beverages and tobacco €10 M • Main product groups exported from Finland were – Manufactured products (€223 M) – Machinery, transport equipment €111 M – Basic manufactures €48 M – Food and live animals €5 M – Beverages and tobacco €0,5 M Finnish food import and export by SITC 2007 SITC Import 1000 e % Export 1000 e % 2 332 133,9 +11 1 133 630,4 +19 5 498,5 +18 6 122,8 +14 0 Food and live animals 00 Live animals 01 Meat and meat preparations 188 597,5 +14 129 639,9 +11 02 Dairy products and birds' eggs 221 166,6 +9 376 095,5 +15 03 Fish and fish preparations 211 830,5 +14 34 257,7 +64 04 Cereals and cereal preparations 218 231,4 +7 233 517,4 +64 05 Vegetables and fruit 642 338,7 +13 46 194,5 +1 06 Sugars, sugar preparations and honey 133 070,9 +11 77 738,4 -8 07 Coffee, tea, cocoa, spices 281 674,8 +9 87 900,7 +9 08 Feeding stuff for animals 165 094,1 +7 25 772,5 +5 09 Miscellaneous edible products and preparations 264 630,9 +13 116 391,0 +12 486 217,2 +10 126 628,2 +13 1 Beverages and tobacco 11 Beverages 358 512,3 +11 123 188,6 +14 12 Tobacco and tobacco manufactures 127 704,9 +9 3 439,7 -14 4 Animal, vegetable oil, fat 69 690,3 +43 32 718,5 -55 41 Animal oils and fats 7 523,7 +12 3 576,1 +23 42 Fixed vegetable fats and oils 53 411,7 +122 27 683,0 +2 43 Processed animal or veg. oils, etc 8 754,8 -51 1 459,5 -97 Finnish food and live animals import and export by country 2007 Import M€ Export M€ Germany 344 Russia 267 Sweden 315 Sweden 193 Netherlands 236 Germany 77 Denmark 196 USA 44 Spain 125 Great Britain 36 Brazil 117 Norway 31 Norway 11 France 31 France 97 Belgium 30 Belgium 82 Netherlands 29 Italia 70 Denmark 28 Ireland at place 19 (€16 M) Ireland at place 26 (€5 M) Market size and structure Market Size and Structure - Retail • Finland’s grocery retail market is worth €21,404 billion. • Market dominated by domestic players S Group 39.9%, Kesko 33.5% and Tradeka Ltd 11.9%. • The three leading players hold a combined market share of 85.3%. • The rise of the discount format with the market entry of Lidl in 2002 has focussed the price perception of the domestic players. Lidl’s market share is 4.1% • The growing Baltic state economies, are providing an attractive destination for the Finnish operators to expand internationally. Household spending in Finland % of all spending of income on food according to household type Elderly people Single parent Others Families with children All households Families, no children Single people Source: Statistics Finland 2008 Household spending on food 1985 - 2006 Spending in food % 1985 2006 100 100 Bread and cereals 16 17 Meat 22 18 3 4 18 17 Fats and oils 6 2 Fruit and berries 7 7 Vegetables, incl. potato 7 10 Sugar, jams, honey, sweets 7 8 Other food products 4 8 Non alcoholic drinks 9 8 Food and non alcoholic beverages Fish Milk, cheese, eggs Source: Statistics Finland 2008 Retail legislation news and trends • Local authorities control the urban planning system in Finland. The current trend in new developments favours the building of large shopping centres outside of city centres. • The government is making plans to reduce VAT on food to 12% in 2009. The current rate is highest in the EU, 22%. • Opening hours legislation was relaxed in 1997, however only food stores under 400 sqm are permitted to open on Sundays. Opening hours legislation continues to be a current political ‘talking point’. • Alcohol sales are tightly controlled. The state owned Alko chain monopolises the sale of alcohol beverages over 4.7% ABV. However tax reductions of on average 33% were implemented in March 2004 to reduce the influx of cheaper foreign alcohol particularly from Estonia. Retail sector Definitions The Grocery Retail Market • is defined as all food, drink and non-food products (i.e. health & beauty, pet care, clothing, DIY, electronics, etc) sold through all retail outlets selling predominantly food in a given market – This includes the total turnover of hypermarkets and Cash & Carry stores – This is a consistent definition applied to all markets. Store definitions • Hypermarket is a retail store selling a variety of goods in different categories, operating mainly in self-service, with the sales area exceeding 2,500 sq m. Food accounts for less than half of the total area but the focus of sales is on groceries. A hypermarket can be located in or near city centres, in a shopping centre or in other areas with good traffic access. • Supermarket is a mainly self-service-oriented grocery store focusing on food, with at least 400 sqm sales area and food accounting for over half of the sales area. In the practical statistics of the sector, the supermarket stores are divided into the large ones with over 1,000 sq m and small with 400–1,000 sq m convenience stores. Store definitions • Large self-service shops are grocery stores of 200–399 sqm while the small stores in this category have 100–199 sqm. The Sunday opening of a self-service store is permitted also in the areas covered by a town plan during the times defined in the Act. The term “corner shop” or “neighbourhood store” often refers to self-service stores. This group also includes the discount stores Retail sector Major players Major players in 2007 Group Chain Store type Market share % S Group Prisma Hypermarket 11,7 47 S-Market Supermarket 22,7 414 Alepa + Sale Convenience 5,3 297 1,3 111 Others Kesko Food K-Citymarket Hypermarket 10,0 54 K-Supermarket Supermarket 11,3 152 K-Market Convenience 10,0 428 K-Extra Discount 1.7 222 0,9 162 Others Tradeka Number of outlets Euromarket Hypermarket 2,4 26 Siva Discount 5,5 538 Valintatalo Discount 4.0 183 Lidl Discount 4,7 107 Stockmann Department store 1,5 7 Source: Finnish Grocery Trade Association 2008 Sales M € per group Total sales / group 6000 5000 4000 3000 2000 1000 0 S Group Kesko Food Source: Finnish Grocery Trade Association 2008 Tradeka Lidl Stockmann Turnover M € 2007 3500 2961 3000 2500 2000 1526 1305 1500 1000 1474 1305 717 692 500 170 222 117 613 535 300 202 up -S K n km an dl Li oc ity Source: Finnish Grocery Trade Association 2008 St e r k et m ar ke K -M t ar ke t K -E xt ra O E u the rs ro m ar ke t Si Va va l in ta ta lo m ar er th -C Sa s le O K A le p a + ar M S- Pr is m ke t a 0 Market share % by store type 2007 11,3 10 Prisma 1,3 S-Market 5,3 Alepa + Sale 10 Others 1,7 0,9 2,4 5,5 22,7 4 4,7 11,7 Source: Finnish Grocery Trade Association 2008 1,5 K-Citymarket K-Supermarket K-Market K-Extra Others Euromarket Siva Valintatalo Lidl Stockmann Number of outlets 2007 223 453 151 Prisma S-Market 26 Alepa + Sale Others 158 K-Citymarket 56 544 K-Supermarket K-Market K-Extra 112 Others Euromarket Siva 309 Valintatalo 184 417 Source: Finnish Grocery Trade Association 2008 517 121 Lidl Stockmann S Group • S Group has been trading as a co-operative society since 1904, within a vertically integrated business, including farming, food retail, hotels, and department stores. Social responsibility and ethical trading underpin S Group’s commercial ethics. • Current Strategy: – Continued drive to recruit member owners to the co-operative, membership stands at 1.7 million, approximately 70% of Finnish households. – S Group’s own bank will continue to be a bank for “normal people” offering the basic banking services, excluding loans and mortgages. – Store development strategy focuses on non-food trade, in 2008 improvements will be done on logistics and purchase systems. S Group • Future Priorities – New logistics centre to be opened in 2012 in Sipoo, 30 km from Helsinki. – Increasing awareness of origin of food, safety and reliability. • Private labels (X-tra and Rainbow are international brands) • Loyal customer programme for co-owners S-etukortti can be combined with debit and Visa credit card. Kesko • Kesko is a public company, dating from 1940, being a multi merchandise and service retailer. Food retailing is operated under the Kesko food division. • Current Strategy – Regaining the number one position of the market share by focusing on customer service, especially on food retail. – Focus on quality private labels increases – This year’s growth is expected to be higher than in 2007. – Efficient development of entrepreneur driven chain stores. • Future Priorities – Private label development is ongoing – More focus on international trade, new openings in the Baltic region and Russia are planned. – Development of e-commerce Kesko • Private labels (Euroshopper: International private label brand) • Loyal customer programme Plussa, can be combined with debit card, and Master Card or Visa credit card Tradeka • Tradeka Ltd is a centrally organised retailing company, third largest in Finland, which owns all of its centrally managed retail stores. Its business is divided into the following three nationwide store brands: Siwa, Valintatalo and Euromarket. • Since 2005, Tradeka Ltd has been owned by Cooperative Tradeka Corporation, Wihuri Oy, members of its corporate management and IK Investment Partners, an international private equity company. • Current Strategy – Brand development of the three chains, Siwa, Valintatalo and Euromarket. – Increasing focus on Fair Trade products, fastest growing brand in food retail. – Development of low-cost brand varieties is essential in the current economic situation. Tradeka • Future Priorities – Increasing gas prices positively influence neighbourhood stores. – Further openings of Siwa and Valintatalo stores. – Local planning of store product ranges according to the local demand. • Private labels (Eldorado: international brand, also used by Axfood) • Loyal customer programme Lidl • Lidl opened the first store in Finland in 2002 • Since then they have expanded and opened 121 stores in total • Finnish Lidl is part of the international chain, all their purchase decisions are made at the head quarters. • Lidl plans to open new stores in Finland in the future • Despite it’s huge success in Finland, Lidl still made nearly €4 M loss in 2007 due to the aggressive expansion policy of the chain. Stockmann • Stockmann is a Finnish fast expanding listed company engaged in the retail trade. The company was established in 1862 and it has now about 40,000 shareholders. • Stockmann's four divisions are the Department Store Division, the fashion store chains Lindex and Seppälä and Hobby Hall, which is specialized in distance retail. • Current Strategy – Stockmann’s Herkku (deli) has 7 stores in the 6 largest cities in Finland and at the Helsinki-Vantaa airport. – Herkku specialises in delicatessen and gourmet food • – There is a Alko wine store adjoined to each Herkku store Future visions – Stockmann department stores emphasise the Baltic and Russian market developments. – Currently there are no plans to open new stores in Finland. Private label • According to research about private label in food retail conducted in June 2008, Prisma supermarket (S-Group) was the most inexpensive choice. • X-tra (S-group) was most often the cheapest choice of all Private Labels. • In all stores private label was priced lower than general brands. The biggest difference between these two groups was in Prisma, where on average the difference was 37 %. Citymarket’s private label prices are approximately 36% lower. Source: State Provincial Office of Oulu 2008 Catering and Foodservice Catering/Foodservice Sodexho Oy • Sodexho Oy manages public sector kitchens, school canteens, staff restaurants, and hotel restaurants nationwide. • Sodexho Oy also provides building management services • Sodexho Oy has launched a campaign “feeling good” which provides information and tips on better quality of life in their restaurants. The campaign gives guidelines for the food served on Sodexho’s premises. • Sodexho Oy is a member of the international Sodexho Alliance. • Turnover €172 M, 2,600 employees Catering/Foodservice Fazer Amica • Fazer Amica operates in staff and student dining in the Nordic and Baltic countries. The company also operates in the sectors of congress, conference and catering restaurants, conference centres, cafeterias and restaurants in department stores and restaurant services at large-scale public events, as well as the organisation of festivities. • Fazer Amica is part of the Fazer Group, operating in four divisions offering meals, bakery products and confectionery: Fazer Amica, Fazer Bakeries, Candyking and Fazer Russia. • Fazer’s most important associated company is Cloetta Fazer AB, which is the leading confectionery company in the Nordic countries. • Additionally, they operate in the growing business of catering services at day care centres, hospitals and service homes. • Turnover €460 M, 7,300 employees, 900 restaurants Catering/Foodservice Finncatering Oy • Finncatering Oy is part of Finnair Group. It is a food supply and service company. • Their customers are, in addition to Finnair, restaurants and cafeterias, industrial kitchens, retail chains and other airlines. • Their main brands are: – Go! Take-away products and – Aitoja Makuja “home-made” meals for retail chains. • Turnover €20 M, 260 employees Catering/Foodservice Eurest Oy • Eurest Oy runs staff canteens around Finland and is a member of the Compass Group. • Eurest also offers conference, fast food and vending machine service, kiosk service, reception service at the customer companies, event catering • Turnover €10 M, 200 employees • Eurest Oy is part of Compass Group. Other Compass Group members in Finland: – Avecra Oy – catering for the National Railways - www.avecra.fi – Selecta Oy – snack and drink vending machines - www.selecta.fi – SPP Finland Oy – Helsinki Airport catering - www.gatewayrestaurants.fi Catering/Foodservice S Group HoReCa • ABC Service stations www.abcasemat.fi • • • • • • Amarillo restaurant www.amarillo.fi Fransmanni restaurant www.fransmanni.fi Memphis restaurant www.mphis.fi Rosso restaurant www.rosso.fi Sevilla restaurant www.ravintolasevilla.fi Torero restaurant www.s-ravintolat.com/torero • • • Holiday Club Hotels www.holidayclubhotels.fi Radisson SAS www.radissonsas.com Sokos Hotels www.sokoshotels.fi Buyer contact: Inex Partners Oy Catering/Foodservice Restel HoReCa (Tradeka) • Helmisimpukka service stations www.helmisimpukka.fi • • Huviretki restaurants www.huviretki.fi Martina restaurants www.martina.fi • • • • • Cumulus hotels www.cumulus.fi Holiday Inn hotels www.holidayinn.fi Ramada hotels www.ramada.fi Rantasipi hotels www.rantasipi.fi Restel Spa hotels www.restel.fi Buyer contact: Tradeka Alcoholic beverages Alcoholic beverages Oy Alko Ab • Alko Inc. is an independent, entirely State-owned company. Alko is administered and supervised by the Ministry of Social Affairs and Health. The company was formed on 5th April, 1932. • Alko has a sole right in Finland on the retail sale of alcoholic beverages containing over 4.7 per cent of alcohol by volume. • Alko maintains a wide and constantly renewing selection of alcoholic beverages. • Alko buys products from domestic producers and importers of alcoholic beverages and has an import service available for suppliers abroad. Alko has no own production or own products. • Information on Alko’s listing policies can be found at www.alko.fi Alcoholic beverages • Other distributors for HoReCa sector: – – – – – – Altia Oy - www.altia.fi - I, W, P Beverage Partners Finland - www.bpf-finland.fi - I, W Heinon Tukku - www.heinontukku.fi - I, W Maxxium Finland - www.liquidinspiration.fi - I, W Norex Spirits - www.norex.fi - I, W V&S Finland - www.vsfinland.fi - I, W, P I=Import, W= Wholesale, P=Production, C=Consumer sale Restaurant chains Major players Restaurant chain Hesburger • Hesburger is a franchising hamburger chain. • Currently they have 232 units, both chain owned and with a franchising license, both in Finland and in the Baltic states. • The products include several types of burgers and combination meals. The chain controls the product range and new products are taken in through a centralised product development process. • From the central warehouse in Kaarina, all the materials are transported to restaurant outlets in various parts of Finland by means of centralized logistics. • Hesburger fast food restaurants are located in city centres and commercial centres. • Hesburger’s turnover in 2007 was €83 M, 4,000 employees Restaurant chain McDonalds • McDonald’s Finland operates under the international chain. • They have 82 fast food restaurants in Finland, of which 68 are entrepreneur driven. • McDonald’s Finnish suppliers are: Baco Oy, Ingman, Salico Oy, Paulig, Primula, Fazer, Moilas Oy. • McDonald’s turnover in 2007 was €139 M, 3,200 employees Fast Food Chains • Cafe Picnic www.picnic.fi -> baguettes, salads, coffees, bakery • Subway www.subway.fi -> baguettes, salads • Kotipizza www.kotipizza.fi -> pizzas, salads • Coffee House www.coffeehouse.fi -> coffee shop • Robert’s Coffee www.robertscoffee.com -> coffee shop • Golden Rax Pizza buffet www.rax.fi -> pizzas, salads Import, Wholesale and Service Import/wholesale/service Heinon Tukku • Heinon Tukku Ltd, a family business for more than a century, is now developing under a fourth generation of entrepreneurs. The company’s focus is on the wholesale of daily consumer goods, mainly in southern Finland. The line of business also includes importing foodstuffs and spirits, and the wholesale of office supplies. • Heinon Tukku offers a full range of services for HoReCa customers (hotel, restaurant and catering) and food retailers through cash & carry and wholesale delivery units. • Heinon Toimistopalvelu provides a comprehensive office supplies service to companies. • Heinon’s own imports are growing all the time, today covering over 2,000 items of fresh foods, industrially made food products and alcoholic beverages. • Heinon Tukku Oy is a shareholder of Tuko Logistics Ltd Import/wholesale/service Kesko Food/ Kespro • Kespro, part of Kesko Food, is the leading wholesaler in the Finnish HoReCa business. Its customers include hotels, restaurants, catering companies, service station stores, kiosks, bakeries, manufacturing industry and distributors. • Kespro's net sales totalled €688 M in 2006. The company has 550 employees and is expanding its operations in the Nordic countries, the Baltic countries and Russia. • Kesko Food and Neste Oil Corporation’s subsidiary, Neste Markkinointi, each own half of Pikoil Oy, which operates in the retail market for fuel and daily consumer goods. Pikoil runs K-pikkolo neighbourhood and service station shops. • In the Baltic countries, Kesko Food and ICA Baltic AB, part of the Swedish ICA Group, have equal ownership in Rimi Baltic AB, which operates in the field of daily consumer goods. Import/wholesale/service Wihuri Oy Aarnio • Wihuri Oy Aarnio is one of Finland's oldest grocery wholesalers. • The company includes three chains; Metro cash-and-carry wholesale outlets, the Tarmo chain of independent grocers, and the Kymppi chain of independent convenience stores. • Wihuri Oy Aarnio is one of the divisions in the Wihuri group, together with the packaging, technical trade, specialty products and services divisions. • The group is also the largest shareholder in Tuko Logistics, a leading Finnish wholesaler of groceries and other household products. • Turnover €1,500 M, 1,800 employees Import/wholesale/service Tuko Logistics • Tuko Logistics Oy provides acquisition and logistics services to its ownercustomers throughout Finland. • The company acquires and delivers daily consumer goods for its customer chain stores: processed and fresh food, fruit, vegetables and non-foodproducts as well as domestic and foreign consumer goods. Its product range covers both retail and HoReCa-products. • Tuko Logistics is owned by its main customer chains; Wihuri, Tradeka, Stockmann and Heinon Tukku. • Turnover €844 M, 800 employees Import/wholesale/service Inex Group • Inex Group is the S Group’s sourcing and logistics company, a subsidiary of SOK. • Inex Partners Oy purchases and distributes a large proportion of S Group stores’ grocery supplies and, in addition, provides logistics services for special products to the S Group. Inex Partners Oy’s turnover in 2006 was €1,863.4 million. Inex has nearly 2,200 employees. • Meira Nova Oy is an Inex subsidiary. The product range includes fruit and vegetables, meat, processed meat, dairy products, processed foods, frozen foods, tobacco, alcohol products and non food product for HoReCa sector. Meira Nova’s turnover in 2006 was €254 M and they employ 260 people. • Inex Partners Oy owns half of Finnfrost Oy, the other half belonging to Tuko Logistics Oy. Finnfrost is a purchase and logistics company that handles frozen foods. Finnfrost has a turnover of €223 M and 160 employees. International partners • AMS Sourcing BV – Since 1987 AMS Sourcing BV has been initiating, managing, and coordinating joint buying activities for its members, European retailers. – Kesko Food is the only Finnish member • Coop Trading – Coop Trading is the inter-nordic procurement company for Coop in Denmark, Norway and Sweden. – S Group and Inex co-operate with Coop. Trends • Sales of daily consumer goods have grown by 9.4% in 2008 and this trend is expected to continue. • Partially this trend is explained by increased prices. Food prices especially have risen. • According to international statistics, food in Finland is approx. 10% more expensive than in European Union countries on average. The government has made plans to reduce the VAT on food to 12% from the current 22% • HoReCa sector continues to grow slowly. According to Finnish Grocery Trade Association, the growth was 3% in 2007. Trends • Opening hours in the retail sector cause debate in Finland. The majority of consumers would like to see shops open on Sundays. The labour union PAM is afraid that it would cause too much stress to the sector’s work force while the government seems unable to make up its mind. • Responsibility, food safety, sustainable development, green values and functional food are the core values in current and future food marketing. Source: Finnish Grocery Trade Association PTY www.pty.fi Reasons for Targeting Finland • Finns have high per capita income and enjoy high levels of disposable income • Ireland’s ‘music and pub tradition’ portrays an ideal image for supplying alcoholic beverages • Unlike its neighbours, Finland is in the Euro system Barriers & Challenges • Transport costs from Ireland to Finland are high and can place suppliers at a competitive disadvantage • Internal distribution is costly and demands co-operation with established players • Domestic preference is strong • Language is often a barrier to doing business – few speak good English Bord Bia Services • Market Information for exporters • Tailored research for companies in key market segments • Mentoring service for Irish companies • Contact Bord Bia HO Dublin Frank.murray@bordbia.ie Mobile +353 87 7680567