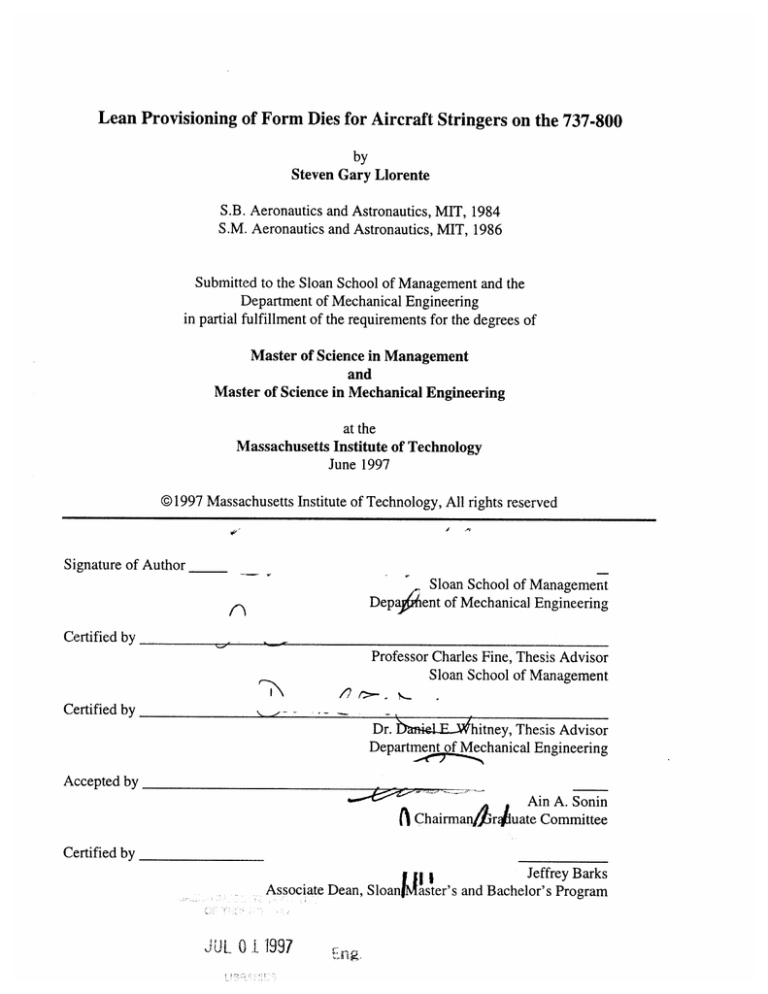

Lean Provisioning of Form Dies for Aircraft... Steven Gary Llorente

advertisement