Comcast Corporation BUY Ticker: CMCSA,

advertisement

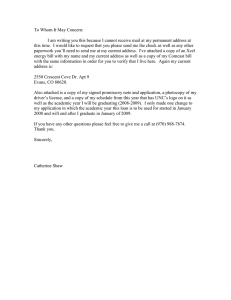

Comcast Corporation Rating: BUY Analysts Pinjalim Bora bora.7@osu.edu (309) 550 - 2734 Ticker: CMCSA, 12/1/2009 Current $14.86 Target $19.90 Open $14.89 52 Wk Hi $18.10 High $15.10 52 Wk Lo $11.10 Low $14.70 Mkt. Cap $42.62B Yield 1.81% 2.95B Shares Recommendation Summary: Buy Comcast Comcast. The share price of Comcast is currently undervalued with maximum upside potential of 68% and minimum upside potential of 25% 25%. The recommendation is based on a detailed analysis of its strategic and financial position of Comcast and its valuation using multiples and discounted cash flow approach. Fundamental Drivers: Change of sales mix towards high mar margin gin voice and internet services. Supported by strong 3rd quarter numbers. Increase ncrease in operating efficiencies driven by the “All Digital” initiative, up selling potential potential. St Strong growth implication in the commercial space. space Partial n neutralization of the “Video over internet” threat. threat Risks: Fierce competition from regional telecom and satellite television companies. Limited Wireless Capability. Regulatory threat threat. Table of Contents Company Overview ........................................................................................................................ 3 Competitive Advantage – An analysis .................................................................................... 4 Latest Events............................................................................................................................ 4 Macroeconomic Overview .............................................................................................................. 5 Industry Overview .......................................................................................................................... 6 Investment Thesis ........................................................................................................................... 8 Fundamental Drivers ................................................................................................................... 8 Financial Analysis ....................................................................................................................... 9 Profitability Analysis ............................................................................................................... 9 Efficiency Analysis................................................................................................................ 10 Liquidity Analysis ................................................................................................................. 11 Solvency Analysis ................................................................................................................. 12 Cash Flow Analysis ............................................................................................................... 12 Projections ............................................................................................................................. 12 Valuation Analysis .................................................................................................................... 14 Sector Valuation (Consumer Discretionary) ......................................................................... 14 Industry Valuation (Cable & Satellite) .................................................................................. 14 Company Valuation ............................................................................................................... 14 Discounted Cash Flow .............................................................................................................. 15 Sensitivity Analysis ............................................................................................................... 16 Potential Risks/Concerns .............................................................................................................. 16 Recommendation .......................................................................................................................... 16 Summary ....................................................................................................................................... 17 Endnotes ........................................................................................................................................ 21 2|Page Company Overview Comcast Corporation (Comcast), incorporated in 1969, is the largest cable television and internet service provider in US in terms of customers served. It caters to both, residential and commercial sectors on a monthly subscription basis. At the end of 3Q 2009, Comcast served approximately 47 million customers.i It has two main business segments: Cable and Programming. Cable Segment The cable segment is the company’s largest operating segment. It primarily comprises of video, high speed internet and phone services. In 2008, Comcast served approximately 24.2 million video customers, 14.9 million high-speed Internet customers, and 6.5 million phone customers. ii Video - Comcast’s “video service offerings range from limited analog service to fulldigital service, as well as advance services, including high definition Television (HDTV) and digital video recorder (DVR)”iii. The number of channels depends on the level of service selected and can range from 20-40 in case of analog service and more than 250 for digital service. It also provides a range of premium channels which broadcasts films, concerts and sporting events without any commercial interruption. Digital service customers also gets the option of subscribing to the “On-Demand” service which gives them the access to a selection of more than 10,000 standard and high definition programs for a full month and are charged on a pay per view basis for the same. In recent years, the digital video segment has witnessed significant growth while the standard video segment is losing business due to fierce competition from regional telecom companies. Average monthly video revenues per customer also increased to $64 in 2008, compared to $61 and $57 in 2007 and 2006 respectively. High-speed Internet - Comcast offers high-speed internet services with downstream speeds ranging from 24mbps to 50 mbps, depending on the service selected. The ability to almost double the speed is because of the incorporation of a new technology called DOCSIS 3.0, also referred to as Wideband. At the end of 3Q 2009, Comcast successfully deployed this technology in 65% of its footprint.iv Revenues increased in 2008 due to additional new customers and cable systems. However, there was little change in the average revenue per unit (ARPU), which had consistently remained around $42 over the last few years. Phone – Comcast provides Voice over Internet Protocol (VOIP) digital phone services that include local as well as domestic long distance calling. Other features offered include caller id, voicemail and call waiting. The phone segment is currently the growth segment for Comcast as more and more customers are opting for the service offered as a part of the bundled product offering. Programming segments This segment mainly consists of the programming networks owned by Comcast. Revenue is generated from the sale of advertising as well as from monthly per subscriber license fees collected from other multichannel video providers who distribute these programming networks. 3|Page Other Businesses Comcast’s operations also comprises of other businesses including a portfolio of ecommerce websites focused on entertainment, information and communication. It also owns two professional sports teams and two large multipurpose arenas. It is also involved in managing other facilities for sporting events, concerts and other events. Competitive Advantage – An analysis Infrastructure: The robustness and the flexibility of the cable infrastructure play a very important role in the growth and success of Comcast. The ability to acquire regional players and increase subscriber base is critical for Comcast to ward off fierce competition. It has made significant investments in infrastructure to provide bundled services to retain and attract new customers. However, this investment in infrastructure is the cost of doing business in this industry and hence not a source of competitive advantage. Technology: The current stress on the “All-Digital” initiative increases Comcast’s operating efficiency and reduces costs through automation. Comcast also has a first mover advantage in introducing DOCSIS 3.0 / Wideband which in turn enables it to provide high speed internet over the cable lines. This has enhanced its Internet and VOIP offerings. While these technological developments have given Comcast a competitive edge, they are easily imitable and hence not a source of sustained competitive advantage. Sales & marketing: Comcast sells its services through various channels such as direct marketing, telemarketing and retail sales. It operates in the form of clusters, servicing specific geographic regions as well as specific real estate properties. Comcast’s ability to enter long term contracts with realtors helps Comcast reduce its marketing expenses as well as lock in subscriber base. While this discourages new entrants, incumbent players have no significant advantage over the others. One could argue that this exclusivity is a source of temporary sustained competitive advantage, but recall that Comcast has no control over the supply of content and hence the effect of this advantage is neutralized by the ever increasing expenses related to acquiring content. After analyzing the various part of Comcast’s value chain, I believe that Comcast don’t have a sustained competitive advantage and nor has any other player in this industry. Its competitive edge lies in the economies of scale created by its robust network and wide geographic reach, as well as its ability to exploit the network effects created by locking in customers by offering them discount bundled products and superior customer service. There is a fierce competition not only among other cable TV companies like Time Warner Cable but also from regional bell operating companies (RBOC) like AT&T and Verizon. The mantra seems simple –keep costs low, be the first to differentiate, spread fast and lock in customers. Latest Events The latest buzz surrounding Comcast refers to the talks of a deal with NBC Universal, where Comcast is supposed to own a 51% stake. NBC Universal is one of the world’s leading media and entertainment companies. In the last few years, Comcast’s cost of acquiring content is increasing at a rapid pace, which is a source of concern for the company as programming expense is one of the big ticket items in their cost structure. The increase in the programming expenses can be attributed to the strengthening of position of its suppliers i.e. the content 4|Page providers. There has been a wave of consolidation in the content area with many big players like Walt Disney acquiring small players like Marvel. Such mergers reduce the number of suppliers for Comcast hence putting the company in a precarious position and wide open to opportunistic behavior. There is also a lot of uncertainty about the future of content distribution as online portals like Hulu.com is gaining recognition and the concept of “TV Anywhere” is becoming popular. Keeping all these dynamics in mind, this deal seems to be a classic case of backward vertical integration. The deal would bestow Comcast with lots of power over the cable industry as well as the programming industry. Moreover, it will also secure a lot of future advertising revenue for Comcast irrespective of the future direction of content distribution. On a negative note, the deal raises questions about the appropriation of value created from this merger by Comcast shareholders as well as on Comcast’s capability of managing a content provider like NBC Universal. There are also speculations of regulatory actions that might pose problems for the deal to go through. It will be interesting to note how the events unfold in the next few weeks. Macroeconomic Overview Comcast is a part of the Consumer Discretionary sector which, as the name suggest, is highly cyclical in nature. Its growth and profitability has a high correlation with many macroeconomic factors like consumer confidence, consumer spending, personal savings rate, unemployment rate and inflation. Consumer Confidence is defined as “the degree of optimism on the state of the economy that consumers are expressing through their activities of savings and spending”.vThe Conference Board Consumer Confidence Index edged up in November after a slight decline in October. Currently, the index stands at 49.5, up from 48.7 in October. The current situation index was unchanged, although the expectations index increased to 68.5 from 67.0 in October.vi The gain indicates a slight improvement in the perception of business and labor market conditions by consumers. Consumer spending is a particularly important number for the well being of the US economy as it accounts for about 70 percent of the US gross domestic product. The personal consumption expenditure jumped 0.7 percent in October after a 0.6 percent dip in September. The boost was led by durables which increased 2 percent after an 8.8 percent drop last month. Although, the October numbers paint a rosy picture of the times ahead it is difficult to conclude if the gain was organic or spill-over effects of government incentives like the Cash-for-clunkers. Currently, all eyes are set on the expectation of top line growth in December as a result of the holiday sales to bolster the organic growth story. Personal Savings Rate is the fraction of the personal income that is not consumed. It can also be defined as the percent of disposable income less personal outlays. The 3rd quarter saw a slight drop in the personal savings rate although it is still at a historical high. It has been argued that this represents a fundamental shift in the behavior of American consumer although this statement is open for debate. Unemployment rate rose from 9.8 percent to 10.2 percent in October. The largest job losses were in construction, manufacturing and retail.vii Although the unemployment numbers shows a growing disconnect between economic recovery and continued job losses, it clearly explains the increase in productivity as less number of workers continue to do the job of others. 5|Page Inflation measured in terms of Core CPI numbers increased by 0.1 percent in October while the overall CPI increased by around 0.3 percent. The latter is mainly driven by increase in energy prices which, along with food prices, is excluded in the calculation of the former. The index has decreased 0.2 percent over the last twelve months. What does it all mean? The various economic indicators point to a growing positive consumer confidence which is good news not only for the consumer discretionary sector or Comcast but for the economy as a whole. Regarding the unemployment condition, we have probably reached the bottom as indicated by continuous decline in initial jobless claims as well as an increase in temporary hiring. The firing has almost come to an end and it is just a matter of time for the hiring to start in full swing. I also don’t see any danger of inflation in the near future as the Fed will probably not increase the Feds fund rate over the target of 0-0.25 percent unless the unemployment conditions improve or the falling dollar pose a credible threat. In short, the future economic conditions would be conducive to cyclical companies like Comcast which can ride the high tides along with the economy. Industry Overview The “cable and satellite” industry is primarily comprised of operators engaged as thirdparty distribution systems for broadcast programming. These operators are involved in the delivery of visual, aural, or textual programming received from cable networks, local television stations, or radio networks to consumers via cable or direct-to-home satellite systems on a subscription or fee basis. The operators however, have very limited, or no proprietary programming material of their own.viii In addition to distributing broadcast programming, some companies in the industry have also diversified into the distribution of high speed internet bandwidth and telephony services. Product Segments - The various product segments of the cable industry can be broadly classified as video (comprising of basic programming packages and premium programming packages), high speed data, and voice. Since 2007, the video segment has been under pressure as it is losing subscribers every quarter. These losses are largely attributed to emerging competition from regional telecom companies including AT&T and Verizon, in addition to satellite TV companies. However, despite a declining video subscriber base, the cable industry’s Multiple System Operators (MSOs) have managed continuous growth in the video top-line due to increasing adoption of their digital service offerings. The second largest contributor to their revenues is from the high speed internet segment, while the voice segment is the smallest contributor, though it is growing rapidly. Compared to video and Internet, voice is a relatively new offering for cable providers. Growth in the number of subscribers for voice services remains high for the cable operators, driven mainly by adoption by their current video and data subscribers that have previously used a traditional telecom provider for voice services. Market Segments - The two primary market segments which companies in the cable industry cater to are households / education, and businesses / commercial. Industry data indicates that 96% of total industry revenue is derived from the residential market, while only 4% comes from the commercial and the government sectorix Cost Structure - Given the primary role for operating in the industry is distributing broadcast programming, the majority of costs are related to the acquisition of program content 6|Page and production materials, and depreciating the programming rights and cable infrastructure. Most of the program agreements are structured such that there is a base cost and an additional flat fee or a percentage share of the subscription revenue. The programming expenses have a direct relation with the number of subscribers. Therefore, as the number of subscriber increases so does the programming costs to the distributors. Historically, cable operators have not been successful in passing along increasing programming costs to consumers. Additional cost also arises from marketing and advertisement expenses as competition between the various players in the industry is high. Figure 6 (at the bottom of the page) lists downs the different parts of the cost structure. Item Cost % Depreciation 29.5%* Program costs 26.4%* Wages 15.9%* Utilities 0.8%* Rent 0.7%* Purchases 0.6%* Other 23.6%* Profit 2.5%* x Capital Intensity - The industry has high capital costs associated with cable, fiber optic network supply, and maintenance. The recent upgrade from the analog to digital cable format is also a significant investment. Regulations - The industry is heavily regulated by a combination of legislation and controls at all levels of the government namely the Federal, State and Local. The major regulator of the industry is the Federal Communications Commission (FCC). The FCC monitors industry ownership and control to restrain potential market dominance, in addition to imposing restrictions on content and program diversity. The FCC also monitors technological compliance to insure non-interference with other telecommunications signals. Its social responsibility charter requires operators to report on equal opportunity policies, measures, and outcomes. While basic cable rates are monitored by the FCC, premium cable rates (those above basic cable services) are not. Industry outlook & Comcast I believe that as competition further intensifies and the different players start providing similar offers, the communication services would be increasingly viewed as a “commodity” by consumers and the main drivers of demand would be price, along with speed (for internet consumers) and reliability(for phone customers). This would probably lead to a waning of pricing power and force the industry players to move towards a “low cost” strategy. Keeping in mind Comcast’s constant efforts on reducing cost and its initiative for rapid deployment of technology to enable high speed internet, I believe Comcast is favorably positioned for the future. 7|Page Investment Thesis Fundamental Drivers Change of sales mix towards higher margin voice and internet services A close look at the sequential changes in number of customers of the different segments suggests that there is a continuous shift in the sales mix towards the higher margin voice and internet services. This is mainly fueled by the fully integrated bundled product offerings which provide Comcast the potential to up sell. In 3Q 2009, High speed internet adds outpaced that of the regional telecom companies by almost a 2:1 margin while digital voice adds were the highest for the year. With penetration level at 15%, I believe there is a huge growth potential for the digital voice segment. As the housing market again picks up, I expect a greater uptick in the voice subscriber base for Comcast since, I believe, it is in a better position to lock in customers given its triple play product offering as compared to the telecom companies. With the increase in popularity of online video streaming, I expect a surge in the required bandwidth by consumers. Keeping in mind that, Comcast has successfully deployed DOCSIS 3.0 in 65% of its footprint by the end of 3Q2009, xi I believe it has a superior standing compared to not only its industry competitors but also the telecom companies. The “All digital" initiative – increase in operating efficiencies, up sell potential The “All Digital” project is an initiative to convert mode of delivery of cable television from analog to digital. Analog delivery takes up more space on the network. For every analog channel, Comcast can deliver 10-15 standard definition Digital Channels or 2-3 High Definition channels.xii The “All digital” project is gaining acceptance as the number of customers shifting to digital delivery of cable television is increasing. The increase is also acting as an offset to the overall decrease in basic video subscribers. The digital mode of delivery not only frees up space but also increases the picture quality. The whole digital experience also paves way to potential up selling opportunity towards more profitable services like the Video on Demand service. In addition to all the product benefits, the digital conversion also creates operating efficiencies by allowing automation of many activities which previously required a technician. This complements Comcast’s the cost reduction initiatives. Growth potential in commercial space Comcast is focusing on providing communication services to small and medium sized business through its Business Services division. This division is realizing consistent yearover-year revenue growth of 40-50% over the last 18 monthsxiii I believe there is a huge growth potential in this space as it is a very new initiative in this industry. 8|Page Neutralizing the “Video over internet” threat Comcast is investing a lot on DOCSIS 3.0/Wideband technology in order to put in place a robust architecture which could enable downstream speed of up to 50mbps. This will not only help Comcast to lure more broadband consumers but will also help neutralize the threat to video streaming over internet. Video streaming requires a lot of bandwidth and if the online content distribution model proves to be a hit, consumers will demand higher bandwidth which in turn places Comcast in a better position as compared to DSL services. Comcast also have launched the “TV Everywhere” model which allows Comcast subscribers to watch missed episodes on the internet. Although, this is a great move to build capabilities for online content distribution, it has the potential risk of cannibalizing Comcast’s present efforts to sell services like DVR. Financial Analysisxiv Profitability Analysis Horizontal comparative analysis A cursory glance at the numbers shows somewhat flat returns per dollar of asset, equity and overall invested capital for the last three years. This can be simply explained by the flat growth in net income which is in turn driven by high interest expense charges on debt taken in 2006 as part of the growth initiative to capitalize the popularity of triple play offering. Additionally, the prevailing macroeconomic circumstances slowed things down a bit. The slight growth in the EBITDA margin as compared to the growth in the Gross Profit Margin indicates decreasing SG&A expenses as a result of the efficiencies created by the bundled product offerings; for e.g. decreasing marketing expenses as all of the three products can be advertised together. Moreover, the net profit margin when compared to the EBITDA margin clearly indicates the impact of depreciation and amortization in this industry. Return on Assets Net Profit Margin Total Asset Turnover Financial Leverage Return on Equity Return on Invested Capital Gross Profit Margin EBITDA Margin Net Operating Margin FYE2004 0.9% 5% 0.18 2.50 2.3% 1.5% 63.4% 37.4% 14.7% FYE2005 0.9% 4% 0.20 2.53 2.3% 1.4% 64.4% 38.3% 16.7% FYE2006 2.3% 10% 0.23 2.67 6.1% 3.6% 60.7% 37.8% 18.5% FYE2007 2.3% 8% 0.27 2.73 6.2% 3.5% 60.6% 38.1% 18.1% FYE2008 2.3% 7% 0.30 2.77 6.3% 3.5% 60.7% 38.3% 19.7% (The sudden increase in the profitability numbers from 2005-2006 and beyond is because of the introduction of bundled product offering in 2006 which was an instant hit) 9|Page Competitive analysis (2008) In terms of profitability as well as margins, Comcast takes the cake. As compared to its competitors, it has successfully sailed through the economic crisis and has been able to maintain pretty stable returns and comparatively high margins. Focused marketing efforts and offers like the free analog to digital upgrade, helped Comcast to maintain growth in broadband and voice segment while offsetting the basic video subscriber losses. CMCSA Return on Assets 2% Net Profit Margin 7% Total Asset Turnover 0.30 Financial Leverage 2.77 Return on Equity 6% Return on Invested Capital 3% Net Gross Margin 61% EBITDA Margin 37% Net Operating Margin 20% TWC -15% -43% 0.36 2.79 -43% -21% 53% 36% 18% CVC -2% -3% 0.77 (1.75) 4% -4% 59% 34% 10% Efficiency Analysis Horizontal comparative analysis The turnover ratios show a steady increase in efficiency as Comcast is increasingly able to make more money for every dollar of fixed or total asset. The slight drop in the cash turnover ratio is as a result of negative cash flow in FYE 2007 which decreased the FYE 2008 beginning balance of cash. The decreasing trend of the accounts receivable turnover days shows that Comcast is able to efficiently manage its credit sales and is able to get the money from their customers sooner. The decreasing trend in the accounts payable turnover days can probably be attributed to the current macroeconomic conditions as credit terms become tighter. Cash Turnover Ratio Total Asset Turnover Fixed Asset Turnover Accounts Receivable Turnover (days) Accounts Payable Turnover (days) SG&A/Sales FYE2004 43 0.18 1.03 18 39 26% FYE2005 22 0.20 1.19 17 37 26% FYE2006 FYE2007 FYE2008 20 32 29 0.23 0.27 0.30 1.17 1.31 1.40 18 18 17 37 37 36 23% 22% 22% Competitive analysis As compared to its competitor, Comcast seems to be better at cash utilization. However, its ability to generate sales by using its assets is comparatively lower. Comcast’s low total asset turnover indicates that may be it has overestimated some of the intangible assets acquired as part of acquisitions. 10 | P a g e Comcast has the lowest A/R turnover days and the highest A/P turnover days. This suggests that Comcast is much more efficient in managing receivables and payables as compared to its competitors. By maintaining low receivable turnover days and high payable turnover days, Comcast is essentially enjoying an interest free loan. CMCSA Cash Turnover Ratio 28.67 Total Asset Turnover 0.303 Fixed Asset Turnover 1.40 Accounts Receivable Turnover (days) 17.43 Accounts Payable Turnover (days) 35.85 SG&A/Sales 22% TWC 3.16 0.359 1.27 18.10 22.78 17% CVC 22.40 0.771 2.08 30.53 18.73 24% Liquidity Analysis Comparison to previous years Although Comcast has a low level of current liability as compared to its total asset base, it is very significant when compared to its current assets. The current asset ratio of 0.42 for FYE 2008 suggests that it has 42 cents for every dollar of liability coming due in the next twelve months. It indicates that in case of an emergency, Comcast may be in a dire position to pay off its current debt. The high current liability is because of its high rate of borrowing. The borrowed funds are mainly for used for acquisition, to pay for share buy backs or for capital expenditures. A look at the actual cash flows, however, speaks a different story. Comcast has enough cash flow from operations to pay for the current liabilities, if need be. Current Liability / Total assets Cash Ratio Quick Ratio Current Ratio Cash flow ops / Current liabilities FYE2004 8.2% 0.23 0.343 0.41 - FYE2005 6.3% 0.17 0.322 0.43 0.56 FYE2006 FYE2007 FYE2008 6.5% 7.0% 7.9% 0.41 0.13 0.14 0.615 0.340 0.322 0.72 0.46 0.42 1.01 1.22 1.29 Competitive analysis A comparison among the competitors reaffirms the fact that Comcast has the lowest liquidity ratios in the Industry but it has enough cash flow from operations to satisfy the current liabilities. CMCSA Current Liability / total assets 8% Cash Ratio 0.14 Quick Ratio 0.32 Current Ratio 0.42 Cash flow ops / Current liabilities 1.29 TWC 6% 1.90 2.19 2.32 1.84 CVC 24% 0.22 0.48 0.81 0.59 11 | P a g e Solvency Analysis Comparison to previous years Even though the increasing trend of the debt-equity ratio seems alarming, a glance at the debt-asset ratio neutralizes the threat. The total debt of the company is not even 30% of its total asset base. Moreover, the interest coverage ratio for FYE 2008 indicates that Comcast’s operating income is more than 1 and half times its interest expense which gives it the status of a safe and solvent entity. Debt to Equity Debt to Assets Interest Coverage Ratio FYE2004 0.56 0.23 0.930 FYE2005 0.57 0.23 0.958 FYE2006 FYE2007 FYE2008 0.70 0.75 0.80 0.26 0.28 0.29 1.741 1.900 1.664 Competitive analysis Comcast has the lowest debt-equity and debt to asset ratio among its peers. This indicates the highly leveraged nature of the cable industry. CMCSA Debt to Equity 0.80 Debt to Assets 0.29 Interest Coverage Ratio 1.66 TWC 1.03 0.37 3.24 CVC (2.10) 1.20 0.93 Cash Flow Analysis Comparison to previous years A glance into the financing section of the cash flow statement shows that Comcast is involved in constant borrowing as well as steady repayment of previous debt. There is also a component of regular share repurchase. Moreover, Comcast started paying dividends from 2008 and it currently pays around 68 cents on the dollar The main ticket item in the investing section is the capital expenditure. Comcast has been investing a lot on the cable network as well as on deployment of technologies like DOCSIS. Comcast is involved in a lot of strategic acquisitions as well although it experienced a downward trend after it bought E! Entertainment television from Disney in 2006. Projections Earnings forecast The table below compares my estimates for EPS, revenue and EBIT to the consensus estimates. As evident from the table, I am slightly aggressive towards my long term outlook of the company and I believe there is a lot of potential for top line as well as bottom line growth, especially with the current low penetration levels of high margin services like voice and internet. 12 | P a g e Year EPS Estimates ($) Consensus Estimates Low High Revenue Estimates ($) Consensus Estimates Low High EBIT Estimates ($) Consensus Estimates Low High 2008 0.86 34,256 6,732 2009E 1.18 1.18 1.09 1.25 35,782 35,552 35,410 35,664 7,365 7,153 7,120 7,177 2010E 1.23 1.2 1.1 1.34 37,551 36,731 35,753 37,499 7,784 7,647 7,427 8,075 2011E 1.40 40,051 (Please refer to the attached income statement for a detailed view) Revenue Forecast To dig a little deep into the model, I divided the revenue from the cable division (which accounts for almost 95% of the total revenue) into its constituent business segments and further divided the business segments into number of customers and average revenue per unit (ARPU). To obtain the forecasted revenue for the years 2009-2011, I forecasted the growth in ARPU and the customer base and rolled them together to get the segment revenue which was further rolled up to get the revenue of the cable division. To reflect the continuous loss of video customers, I modeled in a decline of 4% for 2009 leveling it off to a decline of 2% by 2011 as I believe the increase of digital customers will help offset the overall decrease in subscribers. For internet and voice services, I have used a subscriber growth rate of 5% and 15% respectively for the year 2009. If compared to the growth rates as of 3rd quarter, these numbers can be considered conservative (Figure 7 shows the trending schedule of Comcast for the 3rd quarter). I have also used very conservative ARPU growth. EBIT Forecast For the cable division, I used an EBIT margin of 21% for 2009 and grew it slowly to 23% by 2011. Keeping in mind the favorable changes in sales mix towards the higher margin services, I believe my forecast is conservative, at least in the short term. Even after using such aggressive estimates, as compared to the street, my EPS numbers are almost in line with consensus mainly because I have not factored in any future share buybacks which seems to be a regular activity for Comcast. Moreover, I have also used a conservative tax rate of 40%. In my opinion, the street seems to be underestimating the numbers a bit. This probably can be explained by its short term view which is currently mired by the doubts about the prevailing macroeconomic conditions. 13 | P a g e Valuation Analysisxv Sector Valuation (Consumer Discretionary) In absolute basis, looking at the forward PE, P/S and the P/CF ratios, the consumer discretionary sector seems to be slightly undervalued, although relative to the index, it seems to be fairly valued. The extremely high current trailing P/E ratio can be explained by the low earnings during the last few quarters due to the current macroeconomic conditions. The high P/B ratio indicates an inflated price which can be attributed to the current rally of the stock market. Overall, the sector seems to be attractive especially after looking at the forward P/E ratio which seems to still factor in the uncertainty of economic growth. Absolute Basis P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 53.7 44.1 5.0 1.0 14.3 17.2 15.9 1.5 0.4 5.5 21 19.6 2.4 0.9 9.3 49.7 18.1 3.1 0.7 8.9 Relative to S&P500 P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 3.9 3.0 1.4 0.7 1.0 0.69 .75 0.7 0.4 0.7 1.2 1.2 0.8 0.6 0.8 2.7 1.1 1.4 0.6 0.8 Industry Valuation (Cable & Satellite) The cable and satellite industry looks really cheap relative to the index as all the multiples are sufficiently below the median. However, on an absolute basis, it seems to be undervalued in terms of P/S and P/CF and fairly valued in terms of forward earnings. In other words, the industry is attractive in the universe of S&P , although it might have a few overvalued companies within itself. Absolute Basis P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 189.5 14.2 17.4 12.8 40.5 14.3 15.8 14.3 Relative to S&P500 P/Trailing E P/Forward E 1.6 3.0 8.0 1.4 2.1 5.9 1.6 1.2 5.0 P/B P/S P/CF 1.1 1.0 3.8 High Low Median Current 10.1 1.6 0.87 0.81 2.5 1.0 0.87 0.85 0.8 1.8 0.8 0.7 1.0 0.5 0.8 1.5 0.6 0.7 1.1 0.5 Company Valuation Comcast currently looks really cheap across all the multiples. Assuming reversion to the median, Comcast clearly has a lot of upside potential and hence the resounding “BUY” rating for the stock. 14 | P a g e Relative to Industry P/Trailing E P/Forward E P/B P/S P/CF EV/EBITDA High Low Median Current 1.2 1.1 0.8 1.5 1.1 21.2 1.1 1.0 0.8 1.4 1.0 9.4 0.78 0.95 0.7 1.0 0.9 5.5 0.89 0.98 0.7 1.1 0.9 5.5 Relative to S&P 500 P/Trailing E P/Forward E P/B P/S P/CF EV/EBITDA High Low Median Current 24.8 23.3 1.6 3.0 3.3 21.2 0.77 0.84 0.5 1.1 0.4 5.5 2.8 2.4 0.6 2.2 1.2 9.4 0.77 0.84 0.5 1.1 0.4 5.5 A quick determination of the expected target price based on Comcast’s absolute multiples suggests a range of $18.53 - $24.96 per share. The target multiples assumed for this calculation (as shown in column F) are pretty conservative as compared to the median. Absolute Valuation A. P/Forward E P/S P/B P/EBITDA P/CF High Low Median Current B. 435.4 6.8 8.2 19.24 56 C. 13 1.2 0.9 2.98 4.2 D. 36.8 3.4 1.7 7.87 13.1 E. 12.41 1.18 0.99 3.3 4.6 Target Multiple Target value/share F. 17 2 1.4 4.3 7 G. 1.09 12.48 13.49 4.5 3.22 Target Price (F x G) H. 18.53 24.96 18.89 19.35 22.54 (The insanely high forward P/E ratio was because of a data error in Baseline) Discounted Cash Flow Using a DCF model, the intrinsic value of Comcast was calculated as $19.94 per share. A number of assumptions were used for the model as explained below. I assumed a revenue growth rate of around 7% by 2011and leveled it off to around 3% by 2019 assuming a mature high speed internet and the voice segments as well as possible loss of revenue from new reliable technologies. I believe Comcast would be able to enjoy the positive effects of efficiency on its margin as the Digital initiative completes and their commercial business grows. So, I assumed a EBIT margin of 15% and tapered it down to 7% by 2019 To simplify the model and remain conservative, I assumed a constant rate for interest and a constant tax rate. Moreover, I also used a low value for change in working capital for the same reasons. To remove any affect from depreciation and amortization, I assumed that D&A gets cancelled out with any additional capital expenditure in the long run. I assumed a discount rate of 10.5% as I think Comcast’s business is not that risky. However, there are some risks related to regulations, advent of new technology and consumer spending habits. I believe that Comcast has a pretty stable cable business and the growth potential is mainly in the internet and the voice segments. Assuming that these services will be pretty stable by 2019, I used a terminal growth rate of 3%. 15 | P a g e Sensitivity Analysis Discount rate A small sensitivity analysis was conducted to show the affect of different discount rates and terminal growth rates on the value of the stock. The analysis is pretty consistent with the multiple valuations done earlier and has a very similar range of prices. $ 19.94 10.00% 10.20% 10.40% 10.60% 10.80% 11.00% 3.00% 21.14 20.64 20.17 19.72 19.29 18.88 Terminal 3.50% 21.88 21.33 20.80 20.31 19.84 19.40 Growth Rate 4.00% 4.50% 22.75 23.77 22.13 23.06 21.54 22.40 20.99 21.79 20.48 21.21 19.99 20.67 5.00% 24.99 24.18 23.43 22.73 22.07 21.46 Potential Risks/Concerns Increasing competition from RBOCs and Satellite – The competition from regional telecom companies like AT&T and Verizon as well as from satellite television companies like Dish TV and Direct TV are increasing mainly in the video segment. This may continue to eat on to Comcast’s subscriber base if they are not able to differentiate their products in some aspects or if they are unable to build the perceived differentiation. Limited Wireless Capability – Wireless service is a big threat to Comcast’s services as they have very limited, if any, capability in this sector. Although Comcast is waking up to this call, if they don’t work fast they might be left behind as wireless voice services becomes more reliable and efficient. Regulatory threat – Change in incumbent regulation can also be perceived as a threat in this heavily regulated industry. Any change in regulation may force the firm to offer services that compromise profitability. Recommendation Using the results from the DCF model and the multiples analysis suggests that the intrinsic value of Comcast’s share price lies anywhere between $18.53 – 24.99. A quick calculation based on the share price dated 01/01/2009, shows a maximum upside of 68% and a minimum upside of 25% in the investment. Hence, my final recommendation is a resounding “BUY”. Current Price Implied equity value/share Upside/(Downside) DCF 14.86 19.9 Low 14.86 18.5 High 14.86 25.0 34% 25% 68% 16 | P a g e Summary Comcast is a well managed company with a lot of growth potential especially in the voice and internet segments. The current change in sales mix towards these higher margin businesses looks promising. The commercial segment also looks promising. It warded off the recent financial turmoil with grace and it is ready to enjoy any uptick in the economy. Its continuous efforts of cost reduction as well as rapid deployment of new technology have positioned it as a strong player in the industry. There are a few potential risks associated with it mainly the fierce competition from RBOCs and the satellite television and the effect of any future regulations. However, these risks are not that severe and Comcast is aware of the same and working towards neutralizing them. In term of numbers, its financial statements look good. It is the most profitable in the industry. It has a liquidity issue, however, that can be explained by the nature of the industry it is in. It has been constantly paying debt and starting from 2008 has started paying dividends. In terms of multiples it looks amazingly cheap in both absolute as well as relative terms with respect to the industry and the S&P 500. A DCF analysis on Comcast suggest that it is currently undervalued and indicates an upside potential of 34% (based on the share price dated 01/01/2009) while other numbers suggest a maximum upside of 68% and a minimum upside of 25%. In other words, it would be a rational decision to invest in Comcast as soon as possible. 17 | P a g e Figure 1: Income Statement & Segment Information Income Statement of Comcast Corporation (in millions, except share data) Revenue Operating (excluding depreciation and amortization) Expenses Gross Profit Selling, general and administrative EBITDA Depreciation Amortization Operating income (EBIT) Investment income (loss), net Equity in net income (losses) of affiliates, net Other income (expense) Interest expense Earnings before taxes (EBT) Tax rate Income tax expense Net income from continuiing operations before minority Interest Minority interest Net income from continuing operations Income from discontinued operations, net of tax Gain on discontinued operations, net of tax Net income Weighted average shares outstanding Basic Diluted EPS Basic Diluted FYE 2004 FYE 2005 FYE 2006 FYE 2007 FYE 2008 FYE 2009E FYE 2010E FYE 2011E $ 19,221 $ 21,075 $ 24,966 $ 30,895 $ 34,256 $ 35,782 $ 37,551 $ 40,051 7,036 7,513 9,819 12,169 13,472 12,185 13,562 15,147 18,726 20,784 5,005 5,490 5,705 6,940 7,652 7,180 8,072 9,442 11,786 13,132 3,197 3,413 3,828 5,107 5,457 1,154 1,138 995 1,101 943 2,829 3,521 4,619 5,578 6,732 7,365 7,784 8,721 472 89 990 601 89 716 751 801 (81) (42) (65) (63) (39) (39) (39) (39) 397 (53) 114 522 (285) 224 127 182 (1,874) (1,795) (2,064) (2,289) (2,439) (2,505) (2,629) (2,804) 1,743 1,720 3,594 4,349 4,058 5,761 5,994 6,862 46.0% 50.8% 37.5% 41.4% 37.8% 40% 40% 40% (801) (873) (1,347) (1,800) (1,533) (2,304) (2,398) (2,745) 942 847 2,247 2,549 2,525 3,457 3,597 4,117 $ (14) 928 42 970 $ (19) (12) 38 22 828 2,235 2,587 2,547 100 103 195 928 $ 2,533 $ 2,587 $ 2,547 $ 22 3,479 22 3,619 22 4,139 3,479 $ 3,619 $ 4,139 3,360 3,375 3,295 3,312 3,160 3,180 3,098 3,129 2,939 2,952 2,939 2,952 2,939 2,952 2,939 2,952 0.29 0.29 0.28 0.28 0.80 0.80 0.84 0.83 0.87 0.86 1.18 1.18 1.23 1.23 1.41 1.40 Revenue (Consensus) EBIT (Consensus) EBT (Consensus) EPS (Consensus) 35,500 7,153 5,010 1.18 36730 7647 5620 1.2 -7% 2% 1% -7% 2% 0% Common size Statement Revenue Operating (excluding depreciation and amortization) Ex Gross Profit % Selling, general and administrative EBITDA Depreciation Amortization Operating Margin Interest expense Investment income (loss), net Other income (expense) Income before income taxes Income tax expense Profit Margin - Continuing Operations 100% 37% 63% 26% 37% 17% 6% 15% 10% 2% 2% 9% 4% 5% 100% 36% 64% 26% 38% 16% 5% 17% -9% 0% 0% 8% -4% 4% 100% 39% 61% 23% 38% 15% 4% 19% -8% 4% 0% 14% -5% 9% 100% 39% 61% 22% 38% 17% 4% 18% -7% 2% 2% 14% -6% 8% 100% 39% 61% 22% 38% 16% 3% 20% -7% 0% -1% 12% -4% 7% -7% 2% 0% 18 | P a g e Segments of Comcast Corporation (in millions, except share data) Revenue: Video High Speed Internet Phone Advertising Other Franchise fees Cab le Segment Programming Segment Corporate and other Eliminations Tota l Reve nue EBITDA: Cab le Segment Programming Segment Corporate and other Eliminations Total EBITDA Depreciation and Amortization: Cab le Segment Programming Segment Corporate and other Eliminations Total De pre ciation a nd Amortiza tion EBIT: Cab le Segment Programming Segment Corporate and other Eliminations Total EBIT Capital Expenditure: Cab le Segment Programming Segment Corporate and other Eliminations Total Ca pital Ex penditure FYE 2004 FYE 2005 FYE 2006 FYE 2007 FYE 2008 FYE 2009E FYE 2010E FYE 2011E 12,211 2,938 620 1,206 654 601 18,230 787 332 (128) $ 19,221 12,887 3,737 617 1,249 859 638 19,987 919 315 (146) $ 21,075 15,062 4,953 911 1,468 927 721 24,042 1,054 412 (542) $ 24,966 17,686 6,402 1,766 1,537 1,087 827 29,305 1,314 515 (239) $ 30,895 18,849 7,225 2,649 1,526 1,283 911 32,443 1,426 644 (257) $ 34,256 $ 6,940 269 (310) 281 7,180 $ 7,947 272 (302) 155 8,072 $ 9,704 241 (357) (146) 9,442 11,922 286 (425) 3 $ 11,786 13,170 362 (399) (1) $ 13,132 $ 4,102 162 105 (18) 4,351 $ 4,346 154 71 (20) 4,551 $ 4,657 166 80 (80) 4,823 $ 5,924 223 100 (39) 6,208 $ 6,125 199 107 (31) 6,400 $ 2,838 107 (415) 299 2,829 $ 3,601 118 (373) 175 3,521 $ 5,047 75 (437) (66) 4,619 $ 5,998 63 (525) 42 5,578 $ 7,045 163 (506) 30 6,732 7,514 179 (358) 30 7,365 8,261 244 (751) 30 7,784 9,212 280 (801) 30 8,721 $ 5,993 35 130 6,158 $ 5,545 44 161 5,750 5,607 76 160 - $ 4,244 16 31 104 4,395 5,257 64 150 - $ 3,409 16 38 158 3,621 5,010 54 143 - $ 3,394 17 21 228 3,660 $ 19,000 7,662 3,199 1,602 1,411 947 33,822 1,554 676 (270) 35,782 $ 5,725 208 111 (31) $ $ 6,013 5,206 19,252 8,206 3,742 1,698 1,552 1,023 35,474 1,663 710 (297) 37,551 $ 6,008 248 116 (31) $ $ 6,341 5,471 19,810 8,872 4,536 1,817 1,708 1,115 37,858 1,780 746 (332) 40,051 6,408 280 124 (31) $ $ 6,782 5,843 As % of total Reve nue Depreciation and Amortization: Cab le Segment Programming Segment Corporate and other Total De pre ciation a nd Amortiza tion EBIT: Cab le Segment Programming Segment Corporate and other Total EBIT Capital Expenditure: Cab le Segment Programming Segment Corporate and other Total Ca pital Ex penditure 21% 0.84% 0.55% 23% 21% 0.73% 0.34% 22% 19% 0.66% 0.32% 19% 19% 0.72% 0.32% 20% 18% 0.58% 0.31% 19% 16% 0.58% 0.31% 16% 0.66% 0.31% 16% 0.70% 0.31% 15% 0.56% -2% 15% 17% 0.56% -2% 17% 20% 0.30% -2% 19% 19% 0.20% -2% 18% 21% 0.48% -1% 20% 21% 0.50% -1.00% 22% 0.65% -2.00% 23% 0.70% -2.00% 18% 0.09% 0.11% 19% 16% 0.08% 0.18% 17% 17% 0.06% 0.12% 18% 19% 0.11% 0.42% 20% 16% 0.13% 0.47% 17% 14% 0.15% 0.40% 14% 0.17% 0.40% 14% 0.19% 0.40% 6% 27% 0% 4% 31% 6% 10% 17% -5% 14% 10% 17% 33% 48% 18% 8% 13% 20% 15% 31% 271% 18% 17% 29% 94% 5% 17% 15% 22% 25% 25% -56% 24% 7% 13% 50% -1% 18% 10% 11% 9% 25% 8% 11% 1% 10% 21% 1% 7% 17% 3% 8% 21% 5% 10% 4% 6% 10% 8% 7% 10% 9% 4% 5% 7% 9% 5% 5% 7% 5% 10% 7% 5% 12% 4% 5% 7% As % of Y/Y Grow th Revenue: Video High Speed Internet Phone Advertising Other Franchise fees Cab le Segment Programming Segment Corporate and other Eliminations Tota l Reve nue - Subscribe r Base ( In millions) Homes passed(a) Video 37.80 38.60 45.70 48.70 50.58 20.50 20.30 -1.0% 23.40 15.3% 24.76 5.8% 24.18 -2.3% 23.215 -4.00% 22.402 -3.50% 21.954 -2.00% Available homes(e) Internet customers Y/Y Growth Penetration(c) Phone 37.10 6.60 38.20 8.10 23% 0 45.20 11.00 36% 0 48.10 13.59 24% 0 50.30 14.90 10% 0 15.645 5% 16.427 5% 17.413 6% Available homes(e) Phone customers Y/Y Growth Penetration(c) 8.90 1.10 19.60 1.20 9% 0.06 31.50 2.40 100% 0.08 42.20 4.60 92% 0.11 46.70 6.50 41% 0.14 7.475 15% 8.746 17% 10.495 20% 53 7% 38 3.6% 43 -8.8% 54 1% 38 -2.4% 32 -26.2% 60 11% 39 4.6% 32 1.1% 65 9% 40 2.96% 34 6.2% Video customers(b) Y/Y Growth High-speed Internet Average Revenue Per Unit per month Video Y/Y Growth High speed internet Y/Y Growth Phone Y/Y Growth 0 0.12 50 37 47 68 72 75 5% 5% 5% 41 1% 36 42 2% 36 42 2% 36 5% 0% 1% 19 | P a g e Figure 2: Discounted Cash Flow Comcast Corporation Analyst: Pinjalim Bora 10/20/2009 Year Revenue 2009E 35,782 % Grow th EBT EBT Margin Interest Interest % of Sales Taxes Tax Rate Net Income % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 5,761 16.1% 2,505 7.0% 2,304 40.0% 5,961 Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 6,013 16.8% 16.0% 2,629 7.0% 2,398 40.0% 6,225 6,341 16.9% 10.5% 3.0% 2011E 2014E 40,051 6.7% 6,862 17.1% 2,804 7.0% 2,745 40.0% 6,921 11.2% 6,782 16.9% 79 32 125 0.2% 0.1% 0.3% 5,206 14.6% 6,846 5,471 14.6% 7,127 4.1% 35,146 23,711 58,857 15.72% 12.5 16.9 6.4 7.7 Shares Outstanding 2,952.0 Current Price Implied equity value/share Upside/(Downside) to DCF $ 14.75 $ 19.94 35.2% Debt Cash Cash/share 5,994 4.4% % Grow th NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 37,551 4.9% % Grow th Add Depreciation/Amort 2010E Terminal Discount Rate = Terminal FCF Growth = 5,843 14.6% 7,984 12.0% 60% 40% 100% 2012E 2013E 2015E 2016E 2017E 2018E 42,855 45,854 48,147 50,555 52,577 54,680 56,867 58,573 7.0% 7.0% 5.0% 5.0% 4.0% 4.0% 4.0% 3.0% 6,428 6,420 5,778 5,055 5,258 4,921 3,981 4,100 15.0% 14.0% 12.0% 10.0% 10.0% 9.0% 7.0% 7.0% 2,571 2,751 2,889 3,033 3,155 3,281 3,412 3,514 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 6.0% 3,600 3,668 3,467 3,235 3,365 3,281 2,957 3,046 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 40.0% 5,400 5,503 5,200 4,853 5,047 4,921 4,436 4,569 -22.0% 1.9% -5.5% -6.7% 4.0% -2.5% -9.9% 6,420 6,741 7,078 7,361 7,655 7,961 8,200 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 86 92 96 101 105 109 114 117 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% 6,000 6,420 6,741 7,078 7,361 7,655 7,961 8,200 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 14.0% 5,485 5,594 5,296 4,954 5,153 5,031 4,549 4,686 -31.3% 2.0% -5.3% -6.5% 4.0% -2.4% -9.6% Terminal Value 10.5 14.2 5.5 6.6 3.0% 6,000 Free Cash Yield 12.0 16.3 6.1 7.3 2019E 3.0% 64,352 7.28% Terminal P/E 14.1 Terminal EV/EBITDA 7.8 32,456 1,195 0.40 20 | P a g e Endnotes i Comcast 3Q 2009, Call transcript Comcast 2008 10-K, item 1, pg 3 iii Comcast 2008 10-K, item1, pg 3 iv Comcast 3Q 2009, Call transcript v http://en.wikipedia.org/wiki/Consumer_confidence (Accessed:11/28/2009, 10am EST) vi http://www.conference-board.org/economics/consumerConfidence.cfm (Accessed:11/28/2009, 10am EST) vii http://www.bea.gov/newsreleases/national/pi/pinewsrelease.htm (Accessed:11/28/2009, 10am EST) viii Cable, Internet & Telephone Providers in the US: 51322 (IBIS World industry report, November 10, 2009) ix Cable, Internet & Telephone Providers in the US: 51322 (IBIS World industry report, November 10, 2009) x Cable, Internet & Telephone Providers in the US: 51322 (IBIS World industry report, November 10, 2009) xi Comcast 3Q 2009, Call transcript xii http://blog.comcast.com/2009/05/going-all-digital-tons-more-hd-and-a-faster-internet.html (Accessed:11/28/2009, 9pm EST) xiii Comcast 3Q 2009, Call transcript xiv The two main pure-play competitors Comcast has are Time Warner Cable and Cablevision Systems. There are other companies like Dish TV and Direct group which competes in the video segment and AT&T and Verizon which completes in the internet and voice business. For competitive analysis, however, I have included only the pure play firms in order to maintain an apples-to-apples comparison. ii xvxv The valuation analysis is based on multiples obtained from Baseline using a 10 year time period. Mean reversion has been used as an assumption in the analysis. 21 | P a g e