Student Investment Management (SIM) Winter 2010

advertisement

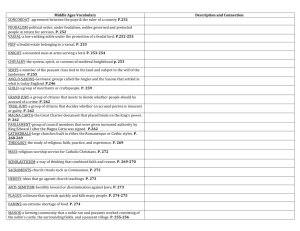

Student Investment Management SIM Analyst: Charles Hathaway IV (SIM) Winter 2010 Phone: 614-859-9550 E-mail: Hathaway.70@osu.edu SIM Portfolio Managers: Chris Henneforth, CFA Royce West, CFA Investment Thesis: Noble Corporation is a Buy with a price target of $60. Since 2005, offshore drilling contractors have experienced significant growth in both revenues and margins, primarily because of the price of oil and the subsequent increase in demand for deepwater oil exploration. Contractors began building new oil rigs and retrofitting old rigs financed by debt to meet this new demand. As Noble is transitioning from a growth phase to maturation, we can expect to see significant amounts of free cash flow to begin coming in. From 2007 to 2010, Noble financed their capital expenditure with retained earnings, decreasing their free cash flow to a very low level. However, in 2010, we will begin seeing a trend of decreasing capital expenditure. This is an opportunity to invest in an undervalued company with great long-term growth prospects that will also act as a fixed income security. Noble Corporation NYSE: NE Market Cap: $11.27 Billion Data as of: March 09, 2010 Recommendation: Buy Target Price: $60 Current Price: $43.80 Upside: 38% Including .78% ($.16) Annual Dividend Noble’s 1 Year Performance Catalysts: Higher Oil Prices Contract Announcements Stock Repurchase Acquisition/Mergers Higher Industry Utilization Rates Noble vs. S&P 500 Year to Date Performance Potential Risks: Overcapacity Lower Bid Rates Lower Oil Prices Environmental Regulation Double-Dip Recession Financial Data Revenues ($Mlns) Operating Margins Net Income ($Mlns) EPS Diluted ($) Dividend/Share ($S) Cash/Share ($) Share Price Data 52 Week Range Performance (%) Noble Corporation (NE) S&P Energy Sector (.SPNY) S&P 500 Index (.INX) FY 2009 3,641 55% 1,675 6.42 .16 2.81 YTD 7.62% 0.49% 2.27% FY2010E 3,500 50% 1,443 5.67 .25 3.00 22.03 - 45.06 1 Year 94.15% 38.96% 68.57% FY2011E 3,600 50% 1,523 6.04 .35 3.20 5 Year 50.54% 21.35% -6.68% Sector Industry SubIndustry Energy Energy Equipment & Services Oil & Gas Drilling Noble Corporation Page | 2 Company Overview…..................................................................................................................................................4 Types of Rigs...................................................................................................................................................4 Utilization Rates….…….…………........................................................................................................................5 Daily Rates…….………………...............................................................................................................................5 Industry Analysis........................................................................................................................................................6 Industry Trends…..……................................................................................................................................6-7 Industry News….…….......................................................................................................................................8 Noble vs. Peers in Offshore Oil & Drilling Performance................................................................................9 Sector Analysis…………………………………………………..………….……………………………………………………………………………….…….9 Macroeconomic Analysis.........................................................................................................................................10 Global GDP Growth………………………………………………………………………………………………………………………………..10 Inventory Levels…………………………………………………………………………………………………………………………………….10 Oil Futures…………………………………………………………………………………………………………………………………………..…10 Oil Prices...…..….………………………………………………………………………………………………………………………………………………….11 Regression Analysis……………………………………………………………………………………………………………………………....11 Discounted Free Cash Flow Valuation……………........................................................................................................12 DCF Sensitivity Analysis........................................................................................................................... 13 Discounted Free Cash Flow Analysis…………………..…………………………………………………………………………………13 Valuation Analysis……………...………………………………………………………………………………………………………………………………14 Advantages...............................................................................................................................................................15 Financial Ratios........................................................................................................................................................16 Risks……………………………….….....................................................................................................................................16 Conclusion ...............................................................................................................................................................17 Noble Corporation Income Statement.....................................................................................................................18 Noble Corporation Balance Sheet............................................................................................................................19 Noble Corporation Cash Flow Statement................................................................................................................20 Noble Corporation Page | 2 Noble Corporation Page | 3 List of Figures Figure 1: Noble Corporation 2009 Revenue by Region ………….………………………….…………………………………………………………..4 Figure 2: Noble Corporation Revenue by Rig Type ………………………………………..……………………………………………….………………4 Figure 3: 2008-2009 Average Utilization Rates ………………………………..…………………………………………………………………………………5 Figure 4: Top Oil Driller Revenue Growth …………………………………………………………..…………………………………………………..………….6 Figure 5: Net Profit Margins………………………………………………………..………………………………………………………………………..……………6 Figure 6: Current Utilization Rates by Rig Type……………………………………………………………………………………………………………….…..7 Figure 7: Current Utilization Rates by Region ……………………………………….…………………………………………………………………………….7 Figure 8: Noble vs. Peers- 1 Year Performance …………………………………………………………………………………………………………………..8 Figure 9: Noble vs. Peers- 2 Year Performance ………………………………………………………………………………………….……………….………8 Figure 10: Noble vs. Peers- 5 Year Performance …………….…………………………………………………………………………………………….…….8 Figure 11: Energy Sector vs. S&P 500 – 1 Year Performance……………………………………………………………………………………………….9 Figure 12: Global GDP Forecast………………………………………………………………..……………………………………………………………………….10 Figure 13: U.S. Crude Oil Stock Levels…………..……………………………………………………………………………………………………………..……10 Figure 14: West Texas Intermediate – Oil Futures……………..………………….………………………………………………………………………….10 Figure 15: West Texas Intermediate Historical Spot Prices………………..….…………………………...………………………………………….…11 Figure 16: Noble Corporation vs. WTI Crude Spot Price…………….…….………………………………………………………………………………..11 List of Tables Table 1: Noble Corporation Rig Fleet……………………………………………………………………………………………..……………………………………4 Table 2: Average Day Rates by Rig...……..…………………………………….……………….……………………………………………………..……………..5 Table 3: Current Rig Day Rates by Rig Type….……………………………..……………………………………………………………………………..……….7 Table 4: Energy Sector Industry Relative Strength….…………………………………………………..……………………………………………..……….9 Table 5: Noble Corporation vs. Oil Regression Results………………..…………………………………………………………………………………....11 Table 6: Noble Corporation Discounted Free Cash Flow……………..………..……………………………………………………………………..……12 Table 7: Noble Corporation Implied Equity Upside Matrix…………………………………………………………………………………………………13 Table 8: Valuation Analysis – Relative to Industry………………………………………………………………………………………………….………...14 Table 9: Valuation Analysis – Relative to Sector….…………………………………………………………………………………………………………….14 Table 10: Valuation Analysis – Absolute…….……………………………………………………………………………………………………..……………...14 Table 11: Noble Corporation Financial Ratios……………………………………………………………………………………………………..…………….16 Noble Corporation Page | 3 Noble Corporation Page | 4 Company Overview: Noble Corporation (NE) is an oil and drilling company that was spun-off off from the parent company Noble Energy (NBL) in 1985, as oil was nearing an all-time time low. The company has operations in waters off the coasts of five continents, with a fleet of 62 offshore drilling units: 2 submersibles, 4 dynamically pos positioned itioned drillships, 13 semisubmersibles, and 43 jack-up up rigs. Half of its rigs are capable of operating in water depths greater than 5,000 feet. The group, which derives most of its revenues from its offshore drilling contracts, has positioned itself to ri ride de the global trend toward deepwater exploration through acquisitions and equipment upgrading. Noble currently has over $8 Billion in backlog revenue and is looking to sign a number of renewal and new contracts in anticipation of the world economic recover recovery. Contracts would be beginning in late 2010, early 2011. Contracts are expected to be making headlines in the 1st and 2nd Quarters of 2010. Figure 1: Noble Corporation 2009 Revenue by Region $900,000 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $- Figure 2: Noble Corporation Revenue by Rig Type 2009 2008 $2,500,000 $2,000,000 $1,500,000 $1,000,000 $500,000 $- Source: Noble 2009 Annual Report 1 Source: Noble 2009 Annual Report Types of Rigs : • • • Submersibles: Mobile drilling platforms that are towed to the drill site and submerged to drilling position by flooding the lower hull until it rests on the sea floor, capable of drilling up to 25,000 feet in shallow water. Semisubmersibles: Floating platforms that operate like submersibles, however they are only partially submerged. Capable of operating in up to 12,000 feet of water, semisubmersibles are the most expensive to construct and operate. Drillships: Capable of drilling in water depths up to 10,000 feet, these ships are self-propelled propelled and are designed for ultra ultradeepwater harsh environments. They use a computer computercontrolled dynamic positioning system to stay positioned over the well. Noble Corporation 1: Noble Corporation 2009 Annual Report Table 1: Noble Corporation Rig Fleet Number of Rigs Region Type of Rig U.S. Gulf of Mexico Semisubmersible 6 U.S. Gulf of Mexico Submersible 2 Mexico Semisubmersible Mexico Jackups 1 Brazil Brazil Semisubmersible Drillships 3 3 Europe - North Sea Semisubmersible 1 Europe - North Sea Jackups 9 Middle East Jackups 14 West Africa Jackups 5 West Africa Southeast Asia Semisubmersible Drillships 1 1 Southeast Asia Semisubmersible 1 Southeast Asia Jackups 3 12 Source: Noble 2009 Annual Report Page | 4 Noble Corporation Page | 5 Types of Rigs: Figure 3: 2008-2009 2009 Average Utilization Rates • 100% 50% 2009 0% 2008 Independent Leg Cantilevered Jackups: Jackups Jackups are mobile, self-elevating elevating drilling platforms equipped with legs that can be lowered to the ocean floor until a foundation is established for support. The rig is towed to the drill site byy tug boat where water depths are shallow, ranging from 8 to 400 feet. Jackups can drill down to a maximum depth of 30,000 feet. Cantilevered Jackups are also capable of drilling on top of pre-existing existing platforms or structures. Of the 62 rigs that Noble has, ha only 5 are currently not active or under contract, while 2 are coldstacked1. Source: Noble Corporation 2009 Annual Report 2 Utilization Noble has been very successful in keeping its utilization rates above the industry mean. Company utilization in 2009 was 84% while the industry averaged 76%. In specific regions, utilization has been phenomenal. All 6 of the Brazilian rigs received at leastt one month of performance bonus for their ability to maintain uptime above the stated contract utilization. However, the Noble – Jim Day a new semisubmersible under construction, has had some delays and will be pushed back a month. In addition to logistic logistical al delays, regional market forces are a typical cause of underutilization. Weather, unanticipated repairs and early contract termination all lead to less than optimal performance. In 2010, Noble has about half (32 rigs) of their fleet contracts ending. The These se come from primarily three regions, Mexico, Europe - North Sea and the Middle East. Of the 13 rigs under contract with Pemex, 10 rigs must be renewed this year. Noble expects these all to be renewed, but at a lower daily rate. Pemex and Noble have been eextending xtending the lengths of some existing contracts to avoid a work stoppage. This is good for both Noble and Pemex in an uncertain environment. Daily Rates Rates vary based on the rig type. However, in 2009 Noble saw a competitive environment where spot day rates were down nearly 50% from their 2008 highs. Since the 2009 lows, bidding for rigs has gone up slightly with the recovery in oil prices. Noble expects to be able to renew contracts at better than previously expected ted rates. From 2008 to 2009, Noble saw a utilization decrease of 6% from 90% in 2008 to 84% in 2009. This decrease was offset by an increase in average daily rates, particularly semisubmersibles of depths greater than 6,000 feet. Overall, daily rates under contract increased on average 13% from $174,506 in 2008 to $197,143 in 2009. In 2010, rates are expected to decrease by about 10%, based on current spot prices. The biggest decreases coming in the Jackups market which is quite saturated currently. Noble Corporation Table 2: Average Day Rates by Rig Change % Day Rate 2008 Day Rate 2008 Revenue (Thousands) 2009 Day Rate 2009 Revenue (Thousands) Jackups $148,532 $2,061,476 $147,701 147,701 $1,878,609 -1% Semisubmersible > 6000' $327,558 $807,758 417,177 $417,177 $1,075,482 27% Type of Rig Semisubmersible < 6000' $220,475 $242,082 253,557 $253,557 $277,645 15% Drillships $201,819 $147,732 $254,084 254,084 $252,305 26% Submersibles $ 54,106 $39,443 $61,711 61,711 $25,795 14% Total $174,506 $3,298,490 $197,143 197,143 $3,509,837 13% Source: Noble Corporation 2009 Annual Report Page | 5 1: Coldstacked is a term used for idle, uncontracted aand nd unmanned rigs that are not being actively marketed in present market conditions th 2: Utilization figures and forecast come from both the 2009 Annual Report and the 4 Quarter conference call. Noble Corporation Industry Analysis: The oil drilling industry is focused on the discovery and development of oil and gas resources. Offshore drilling is any development that requires underwater recovery. This can refer to lake or deep ocean exploration. During the oil bust of the 1980s and early 90s, many major oil companies spun spun-off their drilling ng units to reduce costs and gain efficiencies. The strategy worked well until the 2000s, when demand for offshore drilling increased. The concentrated market for contract drilling maintained its superiority in technology and human capital resulting in everr higher operating margins at the expense of exploration and major oil companies. In February 2010, the drilling industry has grown to over 576 offshore rigs available worldwide. A growing trend has been to move the contractor’s headquarters to a more taxx advantageous location. Transocean, Noble Corporation, Ensco International, and Nabors Industries, have all moved “offshore” since 2007. Industry Trends: The off-shore shore oil drilling industry has experienced boom and bust periods since its inception. The cost of recovering oil in deep waters becomes increasingly expensive with depth, and therefore expansion in this industry is spurred by spikes in oil prices as a result of increases in real demand for oil. The period of 2005 to 2008 was one such period. The consumption of oil in growing economies like China and India, as well as in OECD countries, had oil rising from $45 to a record $140 a barrel in 2008. As with ith most periods of rapid expansion, there was a sharp pullback, which was seen in the Great Recession of 2008 20082009. Oil demand lessened and prices fell to 2003 levels of $36 a barrel. A big concern for investors in early 2009 was whether or not there would d be any demand for the newly built and renovated rigs that were coming online from 2008 construction. Renewal contracts on deep-water water rigs were left on the table and bid rates plummeted, reducing both the huge revenue growth and tremendous operating margins ns from which the oil drillers had benefited in the past few years. 2009 utilization rates were down across the industry. However, several companies benefiting from long-term term contracts were buffered from the carnage. These companies were medium medium-sized contract act drillers, such as Noble Corporation and Diamond Offshore, rather than the larger such as Transocean. Page | 6 Figure 4: Top Oil Driller Revenue Growth 2006 2007 2008 2009 100% 80% 60% 40% 20% 0% -20% -40% Nearly all of Noble’s deepwater rigs are in long term contracts through 2012 and make up a majority of its backlog revenue. Additionally, most of the rigs coming up for contract renewals this year are lower margin shallow water jack jack-ups. Noble Corporation 1: Mergent Online: an online equity research database available to Ohio State students Source: Mergent Online Figure 5:: Net Profit Margins 60% 50% 40% 30% 2006 20% 2007 2008 10% 2009 0% Source: Mergent Online Page | 6 Noble Corporation ion Page | 7 Industry Trends1: Utilization across the industry varies by company, but also by region and rig type. In 2009, utilization rates have fallen precipitously from the 2008 highs, as companies are beginning to be able to get out of the long long--term contracts that usually range from 3-55 years. This allows exploration and production companies to renegotiate long long-term contract daily rates lower (2010 rates) than the previous contracts (2005 (2005-2007), but also allows the off-shore shore drillers to move the rigs to better regions, thereby reducing the supply supply-side for rigs in a specific locale keeping daily rates artificially high. In the long-term, this strategy will not be successful unless the industry is in collusion. In March 2010, worldwide utilization averaged 78.1%, which is up from a low of 76.2%, but still not near the 81.5% rate that the industry saw in March 2009. The decrease is caused by contracts expiring, and not being renewed. These rigs were then released to the open market. Figure 6: Current Utilization Rates by Rig Type Figure 7: Current Regional Utilization Rates 100% 80% 60% 40% 20% 0% 100% 80% 60% 40% 20% 0% Source: Rigzone1 Day Rates2: Rig leasing costs are calculated on a daily rate for a specific amount of time. There are penalties incurred by the rig contractor for delays and downtime related to weather, maintenance, equipment failures, or any unforeseen event. Rigs are also capable of earning a performance bonus for having more uptime than stated in the contract. Generally, the more sophisticated the rig, the more expensiv expensive it is to lease. Sophistication includes the technology on board the rig, as well as the depth to which the rig can get. Rigs range from the shallow water Drill Barges (up to 150 feet) and Jackups (up to 300 feet) to the deepwater Drillships and Semisubmersibles rsibles (4,000 feet). Day rates reached an all all-time high in early 2008 as oil peaked. In 2009, as rates fell, drillers depended on a backlog of revenue from contracts to continue operations and their future looked bleak. Share prices tumbled with this fear. r. However, in 2009 oil prices began recovering and doubled to the current $70 $70-$80 range that it has been trading in since January 1st. As per expectation, daily rates have begun ticking back up and companies are locking in rigs for the anticipated recover recovery. This is perfect timing for drilling contractors, as much of their backlog was evaporating and would be forced to renew contracts at lower rates for 2011 and beyond. Noble Corporation Source: Rigzone2 Table 3: Current Rig Day Rates by Rig Type Rig Type Number of Rigs Average Day Rate Drillship < 4000' 9 $ 231,228 Drillship 4000'+ 34 $ 412,717 Semisub < 1500' 11 $ 294,243 Semisub 1500'+ 61 $ 314,966 Semisub 4000'+ 73 $ 410,417 Jackup IC <250' 32 $ 84,916 Jackup IC 250'+ 40 $ 99,926 Jackup IC 300' 95 $ 124,982 Jackup IC 300'+ 108 $ 159,111 Jackup IS 250' 8 $ 137,000 Jackup IS 300' 2 $ 60,300 Jackup IS 300'+ 3 $ 190,000 Jackup MC < 200' 2 $ 28,000 Jackup MC 200'+ 12 $ 47,109 Jackup MS 200'+ 9 $ 55,156 Drillbarge < 150' 19 $ 30,000 Drillbarge 150'+ 7 $ 77,000 Inland Barge 29 $ 49,585 Platform Rig 150 $ 38,150 Submersible 1 $ 35,500 21 $ 117,325 Tender Source: Rigzone Page | 7 1: Rigzone, http://www.rigzone.com/data/utilization_ri www.rigzone.com/data/utilization_rigtype.asp 2: Rigzone, http://www.rigzone.com/data/utilization_region.asp www.rigzone.com/data/utilization_region.asp Noble Corporation Page | 8 1 Industry News : Since August of 2009, the oil drilling industry has seen some big mergers announced, continuing the trend of consolidating the number of competitors. Baker Hughes, one of the largest inland oil drilling and oilfield services companies, has announced they will buy BJ Services for $6 billion and expect to close the deal in the 1st Quarter of 2010. A more recent announcement was the Schlumberger Ltd. acquisition of Smith International Inc. for $11 billion. This deal was approved on February 21, 2010. These 2 deals look to signal that there is value within the energy services area. Noble’s CEO David Williams mentioned in the 4th Quarter Conference Call that he was hoping for the financial turmoil to last a bit longer so that Noble would be able to pick up some assets cheaply from its distressed competitors. With a record amount of cash on hand, Noble could possibly acquire a company or two in the near future. On March 3rd, the industry has begun announcing large contract deals, such as the Diamond Offshore, $1.4 Billion, 11-year, 3 drilling unit deal with Petrobas in Brazil. Noble has said they expect to announce similar deals in the first half of 2010. Noble Corporation vs. Peers in Offshore Oil & Gas Drilling 1, 2, 5 year Figure 8: 1 Year Performance Figure 9: 2 Year Performance Figure 10: 5 Year Performance Source: Yahoo Finance Noble Transocean Diamond Offshore Rowan Companies Noble has been one of the best performing offshore drilling contractors in the past 2 years. This can be attributed to its excellent management in their smaller rig fleets. Larger competitors like Transocean that outperformed during the oil boom of the 2000s have had a harder time finding contracts for its huge fleet. Nimbler, medium-sized contractors, such as Noble and Diamond Offshore stand to benefit from higher margins and better utilization. In this respect, the smaller the contractor, the more defensive it is. This is important for an industry that is known for its boom and bust image. Noble Corporation 1: http://www.marketwatch.com/story/schlumberger-smith-intl-okay-merger-plan-2010-02-21-145500?dist=beforebell 2: http://www.finance.yahoo.com Page | 8 Noble Corporation Page | 9 Sector Analysis: Table 4: Energy Sector Industry Relative Strength The Energy Sector is the 5th Largest sector in the S&P 500 with 1.15 Trillion in Market Capitalization. Year to date, it is the 6th best performing sector with a .42% return year to date. In 3 and 5 year performance, Energy ranks as the 3rd and best performing industries respectively. Within the energy sector, there are 7 industries spanning the entire oil product life cycle. Relative Strength Industry Coal & Consumable Fuels Oil & Gas Equipment/Services Oil & Gas Drilling Oil & Gas Exploration/Production Oil & Gas Storage Oil & Gas Integrated Oil & Gas Refining/Marketing Baseline Symbol COCOF Since Jan 1 6% 1 Year 65% 10 Year 713% OGEQP OGDRL 4% -3% 26% 20% 88% 84% OGEXP OGSTO OGINT -1% 8% -4% 10% 42% -45% 454% -24% 119% OGREF 11% -53% 127% Source: Thomson Baseline Oil & Gas Integrated dominates the energy sector, and overall sector performance is dictated by its performance. Relative strength by industry is a more accurate gauge of how the sector is doing, and more particularly, how different segments of the sector are performing. Over the past 10 years, energy has been outperforming the S&P solely because of the appreciation of oil. However, in the past couple of years, we have seen some trends emerge. Specialty services have been outperforming traditional integrated oil companies. Integrated oil is lagging because it is not achieving the efficiencies that contractors have been gaining as a result of their specialization. Integrated has also been lagging because of its exposure to refining, which has been abysmal since 2008. Refiners spent significant money building up capacity, and just as it was coming online, demand dropped, and utilization dropped immensely. It shrunk their already small margins further since it is a significant portion of integrated oil’s revenue and profit. Integrated oil’s performance will drag the sector down as long as real demand for oil does not pick up, even if the price of oil increases from speculation. Figure 11: Energy Sector vs. S&P 500 1 Year Source: Google Finance The oil & drilling industry performance is only tied to the performance of the energy sector insofar as the price of oil. There are other key factors that affect the demand for offshore drilling. They include weather, environmental regulation, and the availability of and access to hydrocarbon bearing fields for the oil & gas company. The offshore contract drilling industry is highly competitive and cyclical in nature, capitalized by high capital and maintenance costs. Drilling contracts are traditionally awarded on a competitive bid basis. Price competition, rig availability, location, suitability, experience of workforce, and condition of equipment must be factored into the probability of success of the drilling contractor. Noble Corporation 1: www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa=500-usduf--p-us-l-2: www.google.com/finance Page | 9 Noble Corporation Page | 10 Macroeconomic Analysis: Figure 12: Global GDP Forecast Oil prices depend on several factors: demand, supply, cost of production, and weather. There are readily available means to quantify those factors. Global GDP Growth: Global GDP is highly correlated with oil demand growth. As the world’s economy expands, energy needs increase. In 2008, the global economy contracted at one of the fastest rates since the Great Depression. In 2009, the IMF expected it to rebound and grow at a positive pace of 1% to 2%. In 2010 and 2011, they predict an even stronger recovery of 4-5%, resulting in a large increase in demand for energy. The energy industry has the capacity to meet this additional demand and should expect utilization rates to go up across all industries in energy. 40000 30000 25000 20000 15000 10000 5000 Dec 09, 2009 Apr 09, 2009 Aug 09, 2009 Dec 09, 2008 Apr 09, 2008 Aug 09, 2008 Dec 09, 2007 Apr 09, 2007 Aug 09, 2007 Dec 09, 2006 Apr 09, 2006 Aug 09, 2006 Dec 09, 2005 Apr 09, 2005 Aug 09, 2005 Dec 09, 2004 Apr 09, 2004 0 Source: U.S. Energy Information Administration Oil Futures: Oil is traded on a number of commodity exchanges worldwide 100 and they are all traded in the futures market. Futures contracts 95 allow intermediaries purchase and sell rights to oil in 1,000 90 barrel increments with or without taking physical possession. 85 The price is dependent on two factors: the spot price, and the 80 cost of holding the oil. The futures market has been in contango 75 for awhile. Contango occurs when there is an upward sloping 70 yield curve. Since the beginning of the year, the curve has been narrowing, which indicates strong fundamentals (demand increasing) and shows where traders believe oil is going. Traders are valuing oil today more than in the future, and the cost to carry oil is becoming cheaper narrowing the contango. Noble Corporation Inventory 35000 Aug 09, 2004 Inventory levels are a good indication of how well supply is meeting demand. If inventory is decreasing, it means that demand is currently greater than production. In the reverse case, increasing inventories show that demand is lagging production. Although inventories are not a good indication of future oil prices (.0072 correlation), it can show an increase in demand. As oil reached its peak in 2008, there was a sharp increase in inventory levels, which accompanied the sharp drop in price. Looking forward towards 2010, inventories have been dropping, showing that demand is starting to pick up once again and that if this trend continues, there will be a need to increase production of oil, which is another positive for the energy industry. Figure 13: U.S. Crude Oil Stock Levels Figure 14: Oil Futures Oil Futures Price Apr-10 Nov-10 Jun-11 Jan-12 Aug-12 Mar-13 Oct-13 May-14 Dec-14 Jul-15 Feb-16 Sep-16 Apr-17 Nov-17 Jun-18 Inventory Levels: Source: IMF World Economic Outlook Source: Yahoo Finance Oil Futures Chain Page | 10 Noble Corporation Page | 11 Oil Prices: Figure 15: West Texas Intermediate Crude Historical Spot Price From the 1980s through early 2000, the price of oil 160 was stable at around $20 a barrel. During this WTI Crude time, traditional oil exploration companies such as 140 Spot Price Noble Energy and Sonat Energy, spun off their 120 drilling units as they were not profitable to keep 100 them around for internal use. Today, those companies are both successful and independent 80 under the names Noble Corporation and Transocean. From 1999 onwards, oil has been 60 anything but stable and oil drillers have ridden oil’s 40 climb from $20 to a height of $140 a barrel in the summer of 2008. The resulting crash in oil was 20 spurred by The Great Recession of 2008. In 2009, prices bottomed out in the $30 range and began 0 rebounding. Oil is currently trading at nearly $80 Jan 02, Jan 1986 02, Jan 1988 02, Jan 1990 02, Jan 1992 02, Jan 1994 02, Jan 1996 02, Jan 1998 02, Jan 2000 02, Jan 2002 02, Jan 2004 02, Jan 2006 02, Jan 2008 02, 2010 and is expected to remain in the $70-$80 range for the next year. If the economy is better than expected, oil will respond appropriately to the upside. This bodes well for Noble and the other Figure 16: Noble Corporation vs. West Texas Intermediate Crude offshore drillers because it will make economic 160 West Texas Intermediate 140 sense to conduct offshore exploration, and will Noble Corporation (NE) 120 allow them to renew drilling contracts. The longer 100 that oil trades within this range, the more 80 comfortable exploration companies will be locking 60 40 in rigs for long-term contracts at favorable day 20 rates. 0 As long as the world’s population is increasing, the demand for energy will increase. The key is by how much and how fast. This fact keeps a floor on oil prices, and provides some safety for investors. Table 5: Noble Corporation vs. Oil Regression Results Regression Analysis A simple regression of Oil vs. Noble Corporation, over the past 10 years shows a correlation of .8278. This is nearly a 1 to 1 relationship and confirms the hypothesis that Noble will perform as oil does. As oil is not expected to drop drastically lower anytime in the near future, the limited downside provides security in investing in Noble with a huge upside if oil begins spiking again. Jan 04, 2000 Jan 04, 2001 Jan 04, 2002 Jan 04, 2003 Jan 04, 2004 Jan 04, 2005 Jan 04, 2006 Jan 04, 2007 Jan 04, 2008 Jan 04, 2009 Jan 04, 2010 Summary ANOVA Table Explained Unexplained Multiple R R-Square Adjusted R-Square StErr of Estimate 0.9098 0.8278 0.8277 5.108141564 Degrees of Sum of Mean of Freedom Squares Squares 1 319034.8602 319034.8602 2544 66380.87245 26.09311024 F-Ratio p-Value 12226.7854 < 0.0001 Standard Regression Table Constant West Texas Intermediate Coefficient Confidence Interval 95% t-Value p-Value Error Lower Upper 6.686807406 0.226188153 29.5630 < 0.0001 6.243275755 7.130339057 0.432830435 0.003914368 110.5748 < 0.0001 0.425154763 0.440506107 Noble Corporation 1: WTI Crude Spot Prices, http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RWTC&f=D Page | 11 Noble Corporation Page | 12 Discounted Free Cash Flow: Year Revenue 2009 3,641 2010E 3,500 Growth BP%Plc. 2,003 Operating Margin 5 0.14% 323 Tax Rate Minority Interest 8 301 - Minority Interest % of Sales 0.0% Net Income 1,675 % Growth 0.0% 1,443 0.0% 1,523 -13.8% Add Depreciation/Amort % of Sales 5.6% 0.0% 1,624 6.6% 0.0% 1,681 3.5% 0.0% 1,740 3.5% 0.0% 1,801 3.5% 2,441 51.5% 10 352 365 1,929 3.5% 15.0% - 0.0% 3.5% 0.22% 15.0% - 0.0% 51.5% 0.22% 15.0% - 1,864 2,359 10 340 - 4,741 3.5% Page | 11 0.22% 15.0% 2019E 3.5% 51.5% 10 329 - 4,580 2,279 0.22% 15.0% 2018E 3.5% 51.5% 9 318 - 4,425 2,202 0.22% 15.0% 2017E 3.5% 51.5% 9 307 - 4,276 2,128 0.22% 15.0% 2016E 3.5% 51.5% 9 297 - 4,131 2,056 0.22% 15.0% 2015E 3.5% 51.5% 8 287 - 3,991 1,986 0.22% 15.0% 2014E 3.5% 51.5% 8 269 - 3,856 1,919 0.22% 16.0% 2013E 3.5% 50.0% 0.17% 16.2% 3,726 1,800 50.0% 6 2012E 2.9% 1,750 55.0% Interest % of Sales Taxes 3,600 -3.9% Operating Income Interest and Other 2011E Table 6: Noble Corporation Discounted Free Cash Flow 0.0% 1,996 0.0% 2,066 3.5% 3.5% 408 500 500 522 540 539 558 556 553 573 593 11.2% 14.3% 13.9% 14.0% 14.0% 13.5% 13.5% 13.0% 12.5% 12.5% 12.5% 75 10 10 Plus/(minus) Changes WC % of Sales 19 19 20 21 21 22 23 24 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% Subtract Cap Ex 1,466 1,000 800 671 694 718 744 770 797 824 853 Capex % of sales 40.3% 28.6% 22.2% 18.0% 18.0% 18.0% 18.0% 18.0% 18.0% 18.0% 18.0% Free Cash Flow 692 % Growth 953 1,233 1,494 1,546 1,580 1,635 1,671 1,708 1,767 1,829 37.7% 29.4% 21.1% 3.5% 2.2% 3.5% 2.2% 2.2% 3.5% 3.5% Terminal Value 22,274 Free Cash Yield 8.21% Terminal P/E 10.8 NPV of Cash Flows 8,277 54% NPV of terminal value 7,172 46% Projected Equity Value 15,448 100% Free Cash Flow Yield 6.26% Current P/E Projected P/E 6.6 9.2 Current EV/EBITDA Projected EV/EBITDA Shares Outstanding BP Plc. 10.7 4.6 6.4 $ 43.80 Implied equity value/share $ 59.88 Noble Corporation 7.3 10.1 4.9 6.9 Terminal EV/EBITDA 4.8 36.71% 7.3 6.7 Page | 13 258.00 Current Price Upside/(Downside) to DCF 7.7 Analyst: Charles Hathaway Terminal Discount Rate = 12.0% Date: March 9, 2009 Terminal FCF Growth = 3.5% Page | 12 Noble Corporation Page | 13 Discounted Free Cash Flow: Table 7: Implied Equity Upside Matrix Terminal Growth 2.0% 2.5% 3.0% 3.5% 4.0% 12% 26.4% 29.5% 32.9% 36.7% 41.0% Discount Rate 12.5% 13% 20% 14.3% 22.7% 16.6% 25.7% 19.2% 28.9% 22.0% 32.6% 25.2% 13.5% 9% 11% 13.3% 15.7% 18.5% 14% 4.2% 6% 7.9% 10.1% 12.5% 14.5% -.3% 1.3% 3.1% 5.0% 7.0% 15.0% -4.4% -2.9% -1.4% .3% 2.1% Noble Corporation has an implied equity of $59.88 according to the discounted free cash flow model while including a terminal growth of 3.5% and a discount rate of 12%. Noble can attribute this strong valuation to their past performance and funding capital expenditures with retained earnings, rather than distributing it back to shareholders. If demand for oil recovers as expected and stabilizes, the recent speculative build up in new drilling rigs will negate the need for any new construction to be completed in the short term. There will be serious impacts on the market: temporarily reduced day rates due to a surplus of capacity, dropped profit margins for contractors, and a reduction in capital expenditure. This will lead to a huge growth in free cash flow for Noble, which the company has never experienced in its history. Only two options are left for the board; declare a dividend, or repurchase stock. They have indicated they will do both. Revenue: The renewal of contracts will reduce Noble’s revenue in 2010. However, in 2011, 3 new rigs that are currently in construction; the Globe Trotter 3, Noble – Jim Day, and the Noble – Dave Beard will buffer the decrease in day and utilization rates. With energy prices expected to outpace core inflation, there is not a long-term viability risk for Noble as there will be continued demand for deepwater drilling rigs and that justifies the minimal 3.5% terminal revenue growth. Operating Margins: Operating margins will level out around 50%, down from their high in 2009 of 57.5% as companies renew and establish new contracts with Noble at lower daily rates. However, as the industry grows into the new capacity, daily rates will stabilize at a healthy level. Long-term profit margins should remain elevated as barriers to entry in this market are high. Exploration companies will likely demand shorter contracts, which will help drillers like Noble. Interest and Financing Costs: Financing expenses will continue to stay low and may disappear completely as the company will continue financing operations and growth with cash generated in its operations. This will result in a net positive interest item, as short-term investments with cash on hand will generate interest income for the company. Taxes: Tax consideration is an essential piece of the value of Noble. Currently, its tax rate is at 16% and guidance from the company believe that they will be able to reduce their average tax rate further to around 15%. If taxes do go up, this will eat up a significant portion of free cash flow generated and could be a cause for concern. Capital Expenditures & Depreciation Accompanying the decrease in capital expenditures, there will be a decrease in depreciation expense, as there are fewer new assets to depreciate. With the number of rigs staying constant, revenues will grow at a considerably slower pace than seen in the past. This is because of the transition into the maturation phase of the company and industry lifecycle. Once demand begins outpacing current supply capacity, we will see an increase in capital expenditures again. Noble Corporation Page | 13 Noble Corporation Page | 14 Valuation Analysis1: Noble Corporation is underappreciated by the capital markets. It suffered a catastrophic decline along with the rest of the energy sector as oil prices dropped into the basement in 2008. Since the March 2009 market lows, Noble has outpaced the S&P 500. However, it is still undervalued, according to the valuation ratio’s test, in relation to the industry and sector means. It also remains undervalued according to its own past ratios averages. Table 8: Noble Corporation Valuation - Relative to Industry Relative to Industry High Low Median Current Status P/Trailing E P/Forward E P/B P/S 1.3 1.1 1.5 1.7 0.63 0.52 0.8 1.1 0.94 0.89 1.1 1.3 0.67 0.58 1.1 1.6 Undervalued Undervalued Fairly Priced Overvalued P/CF 1.5 0.8 1.3 1 Table 9: Noble Corporation Valuation - Relative to Sector Relative to Sector P/Trailing E P/Forward E P/B P/S P/CF Absolute P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 3.7 0.4 1.1 1.9 0.3 0.8 1.3 0.6 1.0 7.7 2.7 4.5 3.4 0.5 1.5 Table 10: Noble Corporation Absolute Valuation High Low Median Current 50.5 25.7 4.1 23.85 26.8 4 3.3 1.1 2.58 3.1 13.8 9 3.2 9.51 10.4 Undervalued 0.4 0.6 0.8 2.8 0.7 Status Undervalued Undervalued Undervalued Undervalued Undervalued Target Multiple Target/Share Target Price 9 9 2.5 7 7.5 6.42 5.538 25.29 9.58 8.15 57.78 50 63.24 67.06 61.98 6.9 7.8 1.7 4.57 5.3 Source: Thomson Baseline The market has kept the Noble’s share price down because of the uncertainty in regards to revenue and earnings. The market is unsure of whether or not Noble will be able to renew their contracts with primary companies like Pemex and Petrobras. Until that uncertainty is cleared up, Noble won’t revert back to their mean valuations. It is also unlikely they will revert back 100% to mean valuations if the industry is indeed in maturation, as mature companies trade at lower multiples than growth companies. CEO David Williams reported in the 4th Quarter Conference Call that they were working diligently with the oil companies in the bidding process for the rigs. He expects a flurry of announcements in the 1st and 2nd Quarters of 2010 with awards in Mexico and the Persian Gulf and that all of the rigs will be active and under contract with none going to ready stacked status. With this guidance from management, the only question remaining; is at what price will Noble Corporation get the contract, and for how long. Valuation Analysis Results Implied Equity: $60.01 Current Price: $43.80 Upside: 38%* *Including .78% dividend yield Noble Corporation 1: Valuations are based on a 5 year Time period. Industry is Oil & Gas Drilling (OGDRL) 2: Conference Call Transcript: http://seekingalpha.com/article/185220-noble-corporation-q4-2009=earnings-call-transcript?page=-1 Page | 14 Noble Corporation Page | 15 Advantages: Noble’s shareholders should be excited about the performance of their company during the recession. Even though their share price suffered, the company survived and is fundamentally strong going forward without any lag in its performance. There are several particular reasons why Noble is a strong buy: • Undervalued: Relative to other offshore drillers, Noble is undervalued. Although the market for drilling is unique, and needs for specific types of rigs would lead to some variation in the values of an offshore contractor, Noble is diversified. They have deepwater, shallow water, and medium depth drilling units stationed all over the world and is positioned to respond to the needs of its customers. They have 3 new rigs coming online in 2011 which should continue to add to the versatility of the company. They have been performing better than Transocean who is the industry leader over the past 2 years, but yet Noble is still underappreciated. • Contract Renewals: Coming through the recession unscathed has put Noble in a great financial situation to which they can negotiate with their customers. Pemex is the largest customer for Noble, and they have 10 of 13 rigs coming up for renewal in 2010. Pemex sole sourcing their drilling needs, puts Noble in an excellent position for renewal because of the specification and working relationships which they companies enjoy. There is no indication that they will not renew the rigs. Morgan Stanley has released a research report expecting demand for drilling rigs to exceed available supply by the 2nd half of 2010. This will only help contract bid rates going forward and may lead to a revision in estimated revenue for 2010 and 2011. • Stock Buyback Program & Dividend: Since 2006, Noble has instituted a stock repurchase program and has returned over $1 Billion to shareholders. They have indicated that they will continue to repurchase stock as long as they feel the stock is undervalued. Their Annual Shareholder’s meeting is on April 30, 2010 and there are expectations for the program to be extended and increased. In addition to the buyback program, there is talk of increasing the dividend which is a meager .78% currently. As future free cash flow is expected to grow, it is likely that this will in fact happen. In February 2010, Diamond Offshore announced a special 8.8% dividend. Noble Corporation is in the same fiscal position as Diamond and may announce a similar special dividend at its Annual Shareholder’s meeting. • Oil price stabilization: Oil prices have stabilized over the past couple of months in the $70 to $80 range and this has given some confidence to the markets by establishing a price floor for oil. Noble has benefited from this by seeing an increase in bidding for their rigs. Stable oil prices benefit energy companies because it allows the companies to more accurately forecast future needs and are more confident in locking in long-term contracts, which benefited Noble in the past couple years. • Strong Balance Sheet and Fiscal Position: Noble has a backlog of revenue of over $8 Billion at the beginning of the 2010. Meaning that if they are not able to renew any new contracts ever again, they are nearly guaranteed $8 Billion in revenue, excluding any counter party risk. With net profit margins hovering at 40%, they would have a terminal value of nearly 100% of current market value. $3.2 Billion in net income ($8 Billion * .40) along with $8 Billion in assets which can be sold to other companies. This equals $11.1 Billion, which is approximately their market cap at this writing. As a mid-sized company with a positive reputation, they would be a great takeover opportunity. There has been such activity with the Schlumberger-Smith takeover as well as the Baker Hughes – BJ Services deal. Noble Corporation th Noble Corporation 4 Quarter Conference Call Noble Corporation 2010 Annual Report Page | 15 http://www.reuters.com/article/idUSSGE61I0DI20100219?type=marketsNews Noble Corporation Page | 16 Financial Ratios: Table 11: Noble Corporation Financial Ratio’s 2007 2006 Quick Ratio 3.2 1.73 1.65 1.23 1.74 Leverage Ratio 11% 14% 18% 21% 41% Return on Assets 22% 24% 23% 16% 8% Return on Equity 28% 32% Cash Flow per Share $8.28 $7.11 Book Value per Share $26.29 $20.2 Risks: 2009 2008 32% 2005 25% 12% $5.3 $3.64 $1.94 $16.1 $12 $9.97 Noble’s strong balance sheet is typified by their quick ratio. As they have been spending less on capital expenditure, they have bringing in a lot of cash. They have historically strong ROA’s and ROE’s. Along with their repurchasing shares and reinvesting earnings, they have been increasing the book value per share by 25% a year. They have been reducing long-term debt since 2005 and will eliminate it completely in the next couple of years. Noble is a financially strong company with a ridiculously small amount of risk of default. Noble’s earnings and shareholder value face a number of threats ranging from macroeconomic factors such as interest rate risk, systemic risk, higher taxes, and currency disparities to company related risks such as environmental regulation, sovereign risk, and finally to acts of terrorism on its property. • Overcapacity1: Noble’s greatest threat is that they will be renewing contracts at lower day rates that will reduce their revenue and their operating margins. In 2010 they will be renewing half of their rigs (32 of 62). 10 of those are with Pemex and those renewals are expected to be fine. Concern comes with their rigs in the Middle East and North Sea, where the contracts are with a number of different companies and Noble will be facing market competition for specific assignments In the run up to the world recession, Noble and the entire drilling industry spent billions of dollars investing in new rigs, especially in high margin deepwater rigs. Noble spent $1.4 Billion in 2009, $1.2 Billion in 2008 and $1.3 in 2007 on capital expenditures. These investments will only bear fruit if energy demand and prices bounce back to the levels we saw in 2007 and 2008. It is uncertain in this economic environment if that will happen. In 2009, Noble’s utilization rate was down from 90% to 84%. This did not affect Noble’s margins in 2009 because of the long-term contracts they had. However, half of those contracts are being renewed this year and overcapacity is going to be a factor in the new daily rates. • Environmental Regulation2: Global climate change has been a hot topic since 2006. In December of 2009, the UN Framework Convention on Climate Change was held in Copenhagen, Denmark. This was aimed at creating rules to extend the Kyoto Protocol and make the C02 emission reductions more binding. Although it was unsuccessful in garnering any real progress, it highlights the risk that energy companies are going to face in the future. If it had not been for the current recession, we probably would have seen some real commitments made. Noble is the only drilling contractor that produces a sustainability report. In their most recent report in 2008, they reported 26 unplanned spills, with only 52 gallons of hydrocarbons “reaching the sea”. This is extraordinarily low. Continuing their stellar performance, Noble had no newsworthy environmental accidents in 2009 or so far in 2010. • Reserve Replacement3: Reserve replacement is an important part of an oil exploration company’s sustainability, as well as the drilling contractor that relies on them. Environmental regulation has increasingly focused on where oil companies can go to extract oil. Instances of areas protected have come with increasing frequency, eg. Florida, Argentina. The one saving grace for offshore deepwater exploration is that it is normally far off the coasts of countries where the out of sight, out of mind mentality actually benefits drilling. It is also a question of who exactly owns the rights to the deposits and who’s in charge of the regulation. Noble Corporation 1: http://www.noblecorp.com/Docs/NE_FleetStatus.pdf 2: http://www.noblecorp.com/Docs/SR2008.pd 3: http://www.reuters.com/article/idustre61c2lt20100213, http://www.nytimes.com/2010/02/26/world/americas/26argentina.htm Page | 16 Noble Corporation Page | 17 Conclusion: Noble Corporation is a Buy with a price target of $60. Since 2005, offshore drilling contractors have experienced significant growth in both revenues and margins, primarily because of the price of oil and the subsequent increase in demand for deepwater oil exploration. Contractors began building new oil rigs and retrofitting old rigs financed by debt to meet this new demand. As Noble is transitioning from a growth phase to maturation, we can expect to see significant amounts of free cash flow to begin coming in. From 2007 to 2010, Noble financed their capital expenditure with retained earnings, decreasing their free cash flow to a very low level. However, in 2010, we will begin seeing a trend of decreasing capital expenditure. This is an opportunity to invest in an undervalued company with great long-term growth prospects that will also act as a fixed income security. Discounted Free Cash Flow The discounted free cash flow shows an implied equity of $59.88 with a discount rate of 12% and a terminal growth rate of 3.5%. This shows that the company is undervalued and has an upside of 37%. Any uncertainty of revenues is offset by the decrease in capital expenditures. Noble is aware of the risks of capital expenditure and will not build new rigs speculatively. With that in mind, regardless of revenues going forward, there will be large amounts of free cash flow generated by Noble, which will either be reinvested to fuel future growth, or will be returned to shareholders, through dividends and buybacks. Implied Value: $59.88 Current Price: $43.80 Expected Upside: 37% Discount Rate: 12% Terminal Growth: 3.5% Valuation Analysis: Absolute P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 50.5 25.7 4.1 23.85 26.8 4 3.3 1.1 2.58 3.1 13.8 9 3.2 9.51 10.4 6.9 7.8 1.7 4.57 5.3 Noble is undervalued under the Valuation Analysis test, particularly in Price to Cash Flow and Price to Sales at nearly 50% undervalued. The averages of these ratios indicate that Noble is undervalued with a 38% upside. Noble Corporation Target Multiple Target/Share Target Price 9 9 2.5 7 7.5 6.42 5.538 25.29 9.58 8.15 57.78 50 63.24 67.06 61.98 Implied Equity: $60.01 Current Price: $43.80 Upside: 38%* *Including .78% dividend yield Page | 17 Noble Corporation Page | 18 Noble Corporation Income Statement Year Ended December 31, Operating revenues Contract drilling services 2012E 2011E 2010E 2009 2008 2007 2006 2005 2004 3,559,650 3,448,600 3,348,500 $3,509,755 $3,298,850 $2,714,250 $1,886,987 $1,187,185 $937,414 Reimbursables 90,000 90,000 100,000 99,201 90,849 121,241 92,354 86,332 50,234 Labor contract drilling services 75,000 60,000 50,000 30,298 55,078 156,508 111,201 91,465 51,237 1,350 1,400 1,500 1,530 1,724 3,312 9,697 17,155 27,256 Total Revenues 3,726,000 3,600,000 3,500,000 3,640,784 3,446,501 2,995,311 2,100,239 1,382,137 1,066,231 Operating costs and expenses Contract drilling services Other 1,099,000 1,142,000 1,047,035 1,006,764 1,011,882 880,049 696,264 580,864 521,663 Reimbursables 80,000 74,000 88,436 85,035 79,327 105,952 79,520 76,238 44,610 Labor contract drilling services 25,000 20,000 19,580 18,827 42,573 125,624 91,353 77,041 42,610 17,520 16,779 22,678 27,339 Enginnering, consulting and other Depreciation and amortization 500,000 500,000 500,000 408,313 356,658 292,987 253,325 241,752 209,123 Selling, general and administrative 85,000 80,000 83,472 80,262 74,143 85,831 46,272 40,278 33,714 15,000 30,839 (26,485) (3,514) (10,704) (29,759) - 1,789,000 1,816,000 1,753,523 1,630,040 1,538,098 1,504,449 1,172,809 1,009,092 879,059 1,937,000 1,784,000 1,746,477 2,010,744 1,908,403 1,490,862 927,430 373,045 187,172 500 (-800) (1,200) (1,685) (4,388) (13,111) (16,167) (19,786) (34,389) 8,500 8,800 7,000 6,843 8,443 11,151 10,024 10,833 9,034 Income before income taxes 1,929,000 1,792,000 1,752,277 2,015,902 1,912,458 1,488,902 921,287 364,092 161,817 Income tax provision (289,000) (269,000) (301,000) (337,260) (351,463) (282,891) (189,421) (67,396) (15,731) Net income 1,640,000 1,523,000 $1,451,277 $1,678,642 $1,560,995 $1,206,011 731,866 296,696 146,086 Basic $6.67 $ 6.07 $5.69 $6.44 $5.85 $4.49 $2.69 $1.09 $1.10 Diluted $6.63 $6.04 $5.67 $6.42 $5.81 $4.45 $2.66 $1.08 $1.09 $.40 $..35 $.25 $0.18 $0.91 $0.12 $.08 Basic 246,000 251,000 255,000 258,035 264,782 266,700 271,834 Diluted 247,000 252,000 256,000 258,891 266,805 269,330 274,756 (Gain)/loss on asset disposal/involuntary Operating income Other income (expense) Interest expense, net of amount capitalized Interest income and other, net Net income per share Dividends per share Weighted-Average Shares Outstanding: Noble Corporation Page | 18 Noble Corporation Page | 19 Noble Corporation Page | 19 Noble Corporation Page | 20 Noble Corporation Page | 20