United Technologies Corp. (UTX) Sector:! Industrials Industry:!

advertisement

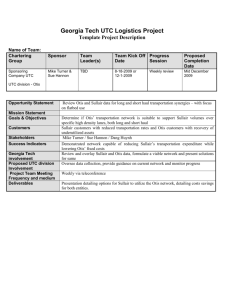

August 5, 2011 United Technologies Corp. (UTX) Sector:! Industry:! Industrials Aerospace & Defense Business Summary UTC provides high technology products and services to the building systems and aerospace industries worldwide. The companyʼs operations are classified into six principal business segments: Otis, Carrier, UTC Fire & Security, Pratt & Whitney, Hamilton Sundstrand, and Sikorsky. Otis, Carrier and UTC Fire & Security are collectively referred to as the “commercial businesses,” while Pratt & Whitney, Hamilton Sundstrand and Sikorsky are collectively referred to as the “aerospace businesses.” Investment Thesis The companyʼs intrinsic value is estimated to be fairly valued at current levels using conservative assumptions. However, it is fear and uncertainty that are again driving market prices, rather than fundamentals. Leading economic indicators are pointing to a rolling over of the global economy. Also it appears increasingly likely that the United States, among other developed economies, is heading into a second recession. Given the companyʼs high correlation to global economic activity, caution and a lack of clarity necessitates a SELL recommendation at this time. Valuation I believe consensus estimates are too bullish in light of weakening economic data and do not price in the possibility of a recession. United Technologies typically trades in a historical range of 8.9x to 17.4x forward earnings. Using a target multiple of 11.3x a conservative forward earnings estimate of $5.76 (FY12) we arrive at a price target of $65.00. Current Risks Multiple contraction resulting from extreme market pressure Further deterioration of leading economic indicators The impact of government austerity in the US and Europe Unfavorable FX translation resulting from a declining Euro The possibility of a downturn in Chinese new construction Extremely bearish technical signals • • • • • • Student Investment Management ! Logan Smyth smyth.31@osu.edu 703.869.0041 Rating Current Price Price Target Projected Return Beta 52-Week Range Market Cap Dividend Yield Sell $74.14 $65.00 (12.3%) 1.03 $64.57 - $91.83 67.37B 2.60% Consensus Earnings Estimates 4.74 5.47 6.21 6.92 7.28 2010A 2011E 2012E 2013E 2014E Consensus Revenue Estimates (billions) 54.3 58.2 61.3 65 68.7 2010A 2011E 2012E 2013E 2014E 1 Year Chart 100 90 80 70 60 50 August 5, 2011 Table Of Contents Company Profile....................................................................................................................! 3 Revenue Breakdown.............................................................................................................! 4 Recent Events.......................................................................................................................! 5 Macroeconomic Climate........................................................................................................! 6 Risks......................................................................................................................................! 9 Financial Analysis..................................................................................................................! 11 Competitor Analysis...............................................................................................................! 12 Sum of the Parts Analysis......................................................................................................! 13 Valuation Analysis..................................................................................................................! 14 Technical Analysis..................................................................................................................! 16 Summary................................................................................................................................! 17 Works Cited............................................................................................................................! 17 Appendix A.............................................................................................................................! 18 Appendix B.............................................................................................................................! 19 August 5, 2011 Company Profile UTC provides high technology products and services to the building systems and aerospace industries worldwide. The companyʼs operations are classified into six principal business segments: Otis, Carrier, UTC Fire & Security, Pratt & Whitney, Hamilton Sundstrand, and Sikorsky. Otis, Carrier and UTC Fire & Security are collectively referred to as the “commercial businesses,” while Pratt & Whitney, Hamilton Sundstrand and Sikorsky are collectively referred to as the “industrial businesses.” The Commercial Businesses Otis is the worldʼs largest elevator and escalator manufacturing, installation and service company. Otis designs, manufactures, sells and installs a wide range of passenger and freight elevators for low-, mediumand high-speed applications, as well as a broad line of escalators and moving walkways. In addition to new equipment, Otis provides modernization products to upgrade elevators and escalators as well as maintenance and repair services for both its products and those of other manufacturers. Otis serves customers in the commercial and residential property industries around the world. Otis sells directly to the end customer and, to a limited extent, through sales representatives and distributors. Carrier is the worldʼs largest provider of HVAC and refrigeration solutions, including controls for residential, commercial, industrial and transportation applications. Carrier also provides installation, retrofit and aftermarket services for the products it sells and those of other manufacturers in the HVAC and refrigeration industries. UTC Fire & Security is a global provider of security and fire safety products and services. UTC Fire & Security provides electronic security products such as intruder alarms, access control systems, and video surveillance systems and designs and manufactures a wide range of fire safety products including specialty hazard detection and fixed suppression products, portable fire extinguishers, fire detection and life safety systems, and other firefighting equipment. The Industrial Businesses Pratt & Whitney is among the worldʼs leading suppliers of aircraft engines for the commercial, military, business jet and general aviation markets. Pratt & Whitney Global Services provides maintenance, repair and overhaul services, including the sale of spare parts, as well as fleet management services for large commercial engines. Pratt & Whitney produces families of engines for wide- and narrow-body aircraft in the commercial and military markets. Pratt & Whitney Power Systems sells aero-derivative engines for industrial applications. Pratt & Whitney Canada (P&WC) is a world leader in the production of engines powering business, regional, light jet, utility and military aircraft and helicopters and provides related maintenance, repair and overhaul services, including the sale of spare parts, as well as fleet management services. Pratt & Whitney Rocketdyne (PWR) is a leader in the design, development and manufacture of sophisticated space propulsion systems for military and commercial applications, including the U.S. space shuttle program. Page 3 August 5, 2011 Hamilton Sundstrand is among the worldʼs leading suppliers of technologically advanced aerospace and industrial products and aftermarket services for diversified industries worldwide. Hamilton Sundstrandʼs aerospace products, such as power generation, management and distribution systems, flight control systems, engine control systems, environmental control systems, fire protection and detection systems, auxiliary power units and propeller systems, serve commercial, military, regional, business and general aviation, as well as military ground vehicle, space and undersea applications. Aftermarket services include spare parts, overhaul and repair, engineering and technical support and fleet maintenance programs. Hamilton Sundstrand sells aerospace products to airframe manufacturers, the U.S. and foreign governments, aircraft operators and independent distributors. Sikorsky is the worldʼs largest helicopter company. Sikorsky manufactures military and commercial helicopters and also provides aftermarket helicopter and aircraft parts and services. Revenue Breakdown FY2010 Net Sales By Business Segment (Billions) $5.6 $6.5 $12.9 FY2010 Net Sales By Geography 15.0% 39.0% 20.0% $6.7 $11.6 $11.4 Pratt & Whitney Otis Carrier Sikorsky Fire & Security Hamilton Sundstrand 26.0% US Europe Asia Pacific Other Page 4 August 5, 2011 Recent Events GTF platform Two significant events occurred in the most recent quarter that will impact the companyʼs Pratt & Whitney business unit, relating to the new Geared Turbo Fan engine platform in development. The new GTF engine platform is the result of considerable R&D investment at Pratt & Whitney. The company is investing heavily upfront in the platform to ensure the program continues to meet checkpoints and stays on schedule. A significant setback for Pratt & Whitney is Boeingʼs decision to re-engine the 737, rather than to design an entirely new replacement for the 737 series. The key distinction here is that by deciding to re-engine, General Electricʼs current contract with Boeing stipulates that Boeing must continue to use GE engines on the 737 series aircraft. This means that despite the technical superiority of the GTF platform, it is unable to compete with General Electric for the 737 series. A possible catalyst for the GTF platform, though, is American Airlineʼs decision to begin incorporating Airbus manufactured aircraft into their fleet. This decision is significant because it signals that major domestic airlines are willing to begin diversifying their traditionally Boeing aircraft dominated fleet. Of particular significance is that Airbus has yet to select an engine for the new A320 NEO. If the GTF engine is selected for the A320 NEO, it is expected to outperform the 737 on a variety of metrics, making it more desirable to other airlines looking to diversify away from Boeing. Otis Incident In Beijing On July 5th there was an tragic accident in a Beijing Metro station involving an Otis escalator. An Otis 513 MPE model escalator suddenly reversed direction, killing one 13 year old boy and injuring 30 others. Following the accident, Beijing authorities halted all Otis escalators in operation and suspended additional purchases. United Technologiesʼ CFO, Greg Hayes, said the accident was caused by a substandard part furnished by a sub-tier supplier as well as poor maintenance. There are 200 513 MPE model escalators currently in service and all are expected to be inspected and returned to working order. On its most recent conference call, company management has said this was a terrible accident and is working to make sure it never happens again. The impact from this incident on Otisʼ business in China appears to be manageable at this time. The suspension of additional purchases is limited to escalators in Beijing which management estimates to be less than 10% of total China revenue. The company is actively working with the local authorities to restore confidence in Otis products, although some damage to the companyʼs reputation is to be expected. Page 5 August 5, 2011 Macroeconomic Environment Overview One of the most important factors in evaluating a multinational industrial company, such as United Technologies, is the strength of the global economy. Industrials as a whole are very highly correlated to the level of global economic activity, so a proper understanding of the macroeconomic environment is key to any investment decision. The main tenet of my investment thesis is that the global economy is in the early stages of rolling over into another recession. A host of leading economic indicators, both domestic and international, are showing a contraction in global manufacturing, slowing GDP growth, persistently high unemployment, and a possible financial crisis in Europeʼs banking sector. The combination of these factors bodes negatively for United Technologies and broader equity markets in general. Domestic Economy The health of the domestic economy has been deteriorating for the past three months. Further, the traditional gauges of economic health have been consistently below expectations, and in some cases revised even lower than initial reports. The graphs in Exhibit 1 help to illustrate the current state of the domestic economy. US GDP growth has been declining for the past three quarters and the estimate for Q1 was recently revised lower from 1.8% to only 0.4%. The initial estimate for the Q2 was only 1.3%, though another downward revision is possible given the recent trend. Another major gauge of economic health, the unemployment rate has risen from 8.8% in March to 9.2% in June. The unemployment rate has since pulled back slightly to 9.1% for July. The number of unemployed has remained stubbornly high and reported figured do not include under-employed workers. Exhibit 1 US GDP Growth US Unemployment Rate Non-Residential Construction ISM Manufacturing PMI With regard to United Technologies construction-facing businesses, non-residential construction has continued to decline. Further, the ISM manufacturing index has dropped from 61.2 in March to 50.9 in July. This means the pace of expansion in the manufacturing sector is slowing and is very close to contraction. Page 6 August 5, 2011 Eurozone Economy The European economy should be the focus of most economists and investors right now. The sovereign debt crisis that the European Union has been battling for over a year now continues to worsen and is showing signs that it is beginning to affect the European banking sector. The least fiscally solvent members of the EU, known affectionately as the PIIGS have been the subject of many emergency weekend meetings over the past several months. Despite the actions of European leaders, the bond yields for countries like Greece, Italy and Spain have skyrocketed as nervous investors dumped their bonds. With unsustainable debt loads and prohibitively high interest rates, some countries have been unable to access the credit markets and are turning to the European Central Bank as a lender of last resort. The European Financial Stability Facility (EFSF) was set up to facilitate these emergency loans but is not comprehensive enough to solve the problem entirely. For example, because of the EFSFʼs limited reach, the ECB recently signaled that it will begin actively buying Spanish and Italian bonds in the secondary market in an attempt to push down interest rates. Given the ECBʼs rapidly shrinking cash position, they will not be able to employ this strategy for long without devaluing the Euro currency. Exhibit 2 Eurozone GDP Growth Eurozone Unemployment Rate 3 Month Euribor-OIS Spread (1 yr) With the exorbitant debt levels and inability to repay debts, many have called the solvency of the PIIGS into question. A better question would be which banks own that sovereign debt and which wrote the CDS insuring it. If one or more country in the Eurozone defaults it would have tremendous ripple effects throughout the global banking sector. All of this uncertainty is creating a climate of distrust among banks similar to the US financial crisis in 2008. In 2008, the early warning sign of the impending crisis was the increase in Libor-OIS spreads, the rate at which banks lend to each other over the fed funds rate. Similarly, the 3-month Euribor-OIS spreads are widening rapidly. Euribor is essentially Libor denominated in Euros so itʼs more relevant for a European financial crisis. This is very concerning and could be signaling the beginning of a 2008-esque banking crisis in Europe. 3 Month Euribor-OIS Spread (3 yrs) Page 7 August 5, 2011 Chinese Economy Currently the Chinese economy is driving growth for United Technologies. By managementʼs own admission, business in the US and Europe is “flattish”. Essentially, the tremendous growth in China is offsetting weakness in the US and Europe. For this reason, it is of the utmost concern that demand is China is maintained, especially in light of deteriorating economic conditions in the US and Europe. However, the economic data points to a slowdown in China as well. Exhibit 3 Chinese GDP Growth Chinese Premier Wen Jaibao has stated that the countryʼs target growth rate for GDP is 7.5%. As seen at the top of Exhibit 3, Chinaʼs GDP growth rate is still north of 9%. However, the rate of growth has been slowing since February of 2010. In fact, the political leadership in China is intentionally trying to slow down the economy to prevent it from overheating. This can be seen most directly in the consistent increase in interest rates since 3Q10. In addition to raising interest rates, the country has been raising reserve requirements for banks operating in China. With regard to the level of economic activity, the China manufacturing PMI index has been inching ever closer to the 50 level and recently hit its lowest level since February 2009. This indicates that the manufacturing sector in China is growing slower and is close to contraction. While a recession in China has almost zero probability, economic expansion is slowing and that presents a risk to United Technologies. Since the massive growth in China is driving the company's growth, any reduction in growth will impact the companyʼs revenues. On the companyʼs most recent conference call Greg Hayes, SVP and CFO, said that the growth rate in China is near 30% for Otis and over 20% for the overall business. However, he does not think this level of growth is sustainable. He thinks a more accurate estimate is high single digits over the next few years. China Manufacturing PMI China 1 Year Best Lending Rate Exhibit 4 Another concern is a possible bubble in the Chinese housing market. In June, economists for the World Bank warned that a real estate bubble was among the biggest economic risks in China. Exhibit 4 shows the Y/Y change in real estate price in nine major Chinese cities. Since property construction is 13% of GDP, a real estate bubble is a serious concern. Page 8 August 5, 2011 Risks Reversal of Favorable FX Translation One of the biggest risks to earnings growth in the short-term is a reversal in the Euro/US Dollar currency pair. As seen in Exhibit 4, in the most recent quarter, 4% of the 9% total earnings growth was attributable to favorable foreign exchange translation. Because United Technologies is a net exporter, it benefits from a weaker than expected US Dollar. The impact of this favorable translation is even more apparent in business segments that derive a greater share of their revenue overseas, such as Otis, Carrier, and Fire & Security. Both fundamental and technical factors are pointing to a reversal in the EUR/USD currency pair. Such a reversal would create a period of unfavorable FX translation for the company, impeding or reversing earnings growth. Exhibit 4 Total Growth* Organic Growth FX Translation Otis 12% 3% 8% Carrier 10% 11% 5% UTC Fire & Security 8% 4% 8% Pratt & Whitney 5% 5% 0% Hamilton Sundstrand 11% 8% 3% Sikorsky 6% 5% 0% 9% 6% 4% Total UTC *Includes impact of Net Acquisitions & Other Exhibit 5 A number of fundamental factors are driving this reversal in trend. Most notably, the US Federal Reserveʼs quantitative easing program that has been systemically devaluing the dollar has now ended. Similarly, the European Central Bank has signaled that it will begin actively buying Italian and Spanish debt in secondary markets in an attempt to drive interest rates lower. This marks the ECBʼs first foray into quantitative easing and should have a similarly destructive impact on the European common currency. Given that the ECB does not have sufficient capital on its balance sheet to buy sizable enough quantities of bonds, it will likely be forced to print more Euros, devaluing the currency. In addition to the impact of quantitive easing, the weak economic fundamentals of the EU member countries are also weighing on the common currency. Several large member countries have unsustainable debt levels of 100%+ their respective GDPs and in some cases, such as Spain and Greece, unemployment is north of 20%. From a technical perspective, if the EUR/USD breaks the major support trendline illustrated in Exhibit 5, selling would accelerate to the downside. United Technologiesʼ management said on their most recent conference call that they are assuming a exchange rate of $1.40/Euro for the second half of the year (illustrated as a dashed red line in Exhibit 5). Given the shift in ECB policy, this exchange rate seems unreasonable and places the company at risk of negative foreign exchange impact in the coming quarters. Page 9 August 5, 2011 Impact of Government Austerity “ The government austerity there is hitting the F&S business significantly because as you know, U.K. is a pretty big portion of total F&S and government jobs were higher margin and with them going away there has been some kind of a negative pressure on the margins. ” Akhil Johri, VP of Financial Planning and Investor Relations United Technologies Q2 Conference Call The above quote represents what will likely be a growing concern for United Technologies shareholders. When George Osborne took over as the U.K.ʼs Chancellor of the Exchequer in May 2010, he began an ambitious campaign to reduce Britain's budget deficit by imposing draconian spending cuts and hiking taxes. About a year later, these spending cuts are already impacting the companyʼs top line. Exhibit 6 Country Debt (% of GDP) Japan 225% While the impact of government austerity programs appears limited right now, that is sure to change over the coming months and years. While the U.K. was quick to implement spending cuts, other debt-burdened nations have been slow to respond. Italy 118% US 93% France 84% As seen in Exhibit 6, most major developed economies have large debt burdens which have been further exacerbated by stimulative government spending over the past two years. The current situation is unsustainable and governments will need to begin imposing deep spending cuts to bring budget deficits in line. Given the nature of government spending, budget cuts will undoubtably impact United Technologiesʼ core businesses of aerospace, defense, and construction. Complicating matters, it is difficult to forecast the timing and size of these cuts. The nature of political process ensures that cuts are subject to change at any time. Further, each government contract is different and many give the government the ability to cancel contracts at any time. Canada 82% UK 77% Germany 75% Another concern regarding government austerity, illustrated in Exhibit 7, is the percentage of total revenues that are derived from business with the United States government. While the budget cuts agreed upon by lawmakers at the end of the July are fairly minimal, it is reasonable to assume that greater cuts will follow the November election next year. Meaningful cuts to NASA, the Department of Defense, or non-defense discretionary could have considerable impact on revenues. Exhibit 7 Sales to US Government FY2010 18% 82% Page 10 August 5, 2011 Financial Analysis The first table in Exhibit 8 shows managements ability to create value for shareholders. The company is posting high single digit returns on its assets. Further, its ROE and ROC are well in excess of its WACC of 9.4% indicating considerable value creation for shareholders. Positive ROCE shows that management is creating considerable returns on the capital it is investing in its operations. Steady gross profit margins highlight managementʼs ability to manage consistently manage fluctuating input costs. The gradual rise in the companyʼs EBITDA, operating, and net profit margins over the past five years shows the effectiveness of managementʼs ongoing cost cutting programs. With uncertainty once again creeping into the global economy as well as credit markets, solvency ratios are key. While the current ratio implies the company would be able to sufficiently meet its obligations, it is assuming all inventory could be liquidated, which is debatable. The most realistic gauge of the companyʼs solvency is the quick ratio. This ratio has been improving, likely because of the persistent macro uncertainty of the past few years. Perhaps most interesting is the companyʼs considerable financial leverage, also seen in its D/A and D/E ratios. Management has leveraged the companyʼs earnings considerably through the use of debt and that is reflected in the companyʼs outsize earnings growth relative to its revenue growth. However, if indeed economic conditions do sour, as in 2009, earnings will outpace revenue to the downside. Exhibit 8 Management Effectiveness WACC: 9.40% FY2010 FY2009 FY2008 FY2007 FY2006 Return on Assets 7.65% 6.80% 8.42% 8.31% 8.02% Return on Equity 21.10% 21.37% 25.27% 21.86% 21.77% Return on Capital 16.16% 15.76% 18.57% 17.48% 17.05% Return on Capital Employed 43.69% 41.40% 50.70% 49.58% 52.71% Profitability Analysis FY2010 FY2009 FY2008 FY2007 FY2006 Gross Profit Margin 27.45% 26.57% 26.98% 27.10% 27.37% EBITDA Margin 15.72% 14.59% 14.97% 15.02% 14.91% Operating Margin 13.23% 12.22% 12.76% 12.87% 12.75% Net Profit Margin 8.05% 7.24% 7.85% 7.71% 7.80% Solvency Analysis FY2010 FY2009 FY2008 FY2007 FY2006 Current Ratio 1.33 1.29 1.24 1.26 1.24 Quick Ratio 0.73 0.72 0.70 0.67 0.67 Cash Ratio 0.23 0.25 0.22 0.17 0.17 Debt/Assets 17.59 17.47 20.19 16.76 16.82 Debt/Equity 45.43 45.56 67.80 41.08 43.74 Financial Leverage 2.76 3.14 3.00 2.63 2.71 Historical Growth Rates FY2010 FY2009 FY2008 FY2007 FY2006 Revenue Growth 2.7% (9.8%) 7.2% 14.5% 13.1% Earnings Growth 15.4% (16.5%) 14.1% 15.1% 22.8% Page 11 August 5, 2011 Competitor Analysis The above table presents essential valuation metrics for several of United Technologiesʼ competitors. Given the diverse nature of United Technologiesʼ business, it makes more sense to identify the relevant competitors for each individual business unit. It is also worth noting that many of the competitors listed above are headquartered outside the United States, so the risks facing United Technologies may not be relevant and may affect the relative valuation. For comparative earnings analysis it makes most sense to use EV/EBITDA, as the metric is capital structure agnostic. By this metric, United Technologies is slightly undervalued relative to the benchmark industrials index. A quick glance shows the market is assigning lower multiples to defense contractors, possibly a result of the impeding government spending cuts discussed earlier. Looking at the other five business segments, though, shows that United Technologiesʼ valuation is fairly consistent with those of its competitors. The two exceptions are General Electric and TransDigm, likely for company-specific reasons. With regard to P/B, since it is not a measure of the companyʼs ability generate earnings, it seems sufficient that the company is in line with the benchmark index. Similarly, its dividend yield is also in-line with the industryʼs benchmark index. Those companies with comparatively high dividend yields, such as defense contractors, are likely the result of lower prices and lack of investor demand. With regard to P/CF, it is clear that the market is assigning higher multiples to HVAC OEMs and aerospace companies. Given the relative size of United Technologiesʼ Carrier and Hamilton Sundstrand business units, the companyʼs premium relative to the benchmark index is justifiable. Page 12 August 5, 2011 Sum of the Parts Analysis For large, diversified companies that operate in many different business segments, it is useful to establish a value for the sum of its parts. This valuation methodology helps to establish whether management is creating positive or negative synergies for shareholders. The competitor analysis on the previous page details the earnings multiples assigned to competitors in each of United Technologies business segments. Using these multiples, an average peer group earnings multiple is established for each business segment. This multiple is then applied to the implied EPS from each of United Technologies business segments to determine an implied market value for each business segment, as if it were a standalone company. By summing these implied market values it is possible to establish a fair value for the sum of United Technologies six business segments. As can be seen above, this valuation methodology determines an intrinsic value of $68.58 for the whole of United Technologies. Given that the current price of the stock is $74.14, this exercise implies that management is creating positive synergies for shareholders of about 7.5%. When looking at the nature of United Technologies business segments and their end markets, these synergies make complete sense. By organizing the company into industrial-facing businesses and aero/defense-facing businesses they are creating considerable synergies. For the industrial businesses, it allows the company the ability to cross-sell other United Technologies products for construction projects. Similarly, the aero/defense business has the ability to cross sell engines and components to aircraft manufacturers like Airbus. Finally, any process improvements or technical breakthroughs can be shared across the company when relevant. These natural synergies, combined with an effective organizational architecture and skilled management, clearly warrant the implied premium to intrinsic value. Page 13 August 5, 2011 Valuation Analysis Sector Valuation When appraising the current valuation of the industrials sector it is important maintain a frame of reference for some perspective of overall market valuation. For this reason, it makes more sense to evaluate the sectorʼs valuation relative to the S&P 500, rather than in absolute terms. As seen in Exhibit 9, the sector is currently trading at a slight premium to the S&P, but in line with the historical median. This is typical of cyclical sectors in times of economic expansion. If however, economic activity does indeed begin to slow, the sector would begin to trade at a discount to the S&P. In absolute terms, the sector is trading at a discount to historical median multiples. However, the data covers a ten year time period and investors may simply not be willing to assign as high of multiples as they once were. For this reason the relative valuation multiples provide a better understanding of current sector valuation. Industry Valuation As before, when evaluating the industry valuation, it makes more sense to compare valuation relative to the S&P, rather than in absolute terms. As seen in Exhibit 9, earnings multiples for the industry are currently at a discount to the S&P. This implies investors are less bullish on the aerospace & defense industry than the broader market. The current P/B multiple, though implies that investors are still willing to pay a premium for the book value of the firm. This makes sense given the company has considerable tangible assets compared to say a financial services firm. With regard to absolute valuation, the industry is trading at a discount to historical median multiples. Again though, given the recent macroeconomic uncertainty, it is understandable that investors would be willing to pay less of a premium relative to the historical median. Exhibit 9 Sector Valuation (Relative to S&P 500) High Low Median Current P/E (TTM) 1.2 0.66 1.1 1.1 P/FE 1.2 0.82 1.1 1.0 P/B 1.4 0.9 1.1 1.2 P/CF 1.2 0.8 1.1 1.1 Sector Valuation (Absolute) High Low Median Current P/E (TTM) 25.4 7.1 18.3 13.5 P/FE 24.3 9.2 16.7 11.7 P/B 4.5 1.4 3.2 2.3 P/CF 15.8 6.0 11.2 8.7 Industry Valuation (Relative to S&P 500) High Low Median Current P/E (TTM) 1.3 0.63 0.95 0.94 P/FE 1.2 0.53 1.0 0.90 P/B 1.6 0.7 1.1 1.3 P/CF 1.4 0.7 1.1 1.0 Industry Valuation (Absolute) High Low Median Current P/E (TTM) 23.6 7.9 17.3 11.3 P/FE 20.6 8.0 16.5 10.5 P/B 4.0 1.7 3.0 2.5 P/CF 14.9 6.8 11.7 8.3 Page 14 August 5, 2011 Earnings Forecast The data presented in Appendix A details the assumptions used when forecasting earnings for United Technologiesʼ fiscal years 2011 through 2013. As can be seen in the model, my assumptions and forecast for 2012 and 2013 deviate considerably from consensus estimates. Generally, consensus estimates are for revenue growth of around 6% and earnings growth of around 12% for this two year period. The outsize rate of earnings growth is attributable to the companyʼs considerable financial leverage, discussed on page 11. It is my belief that consensus estimates for revenue growth are unrealistically high and do not fully reflect what will be a very challenging macroeconomic climate. If revenue growth is in fact impacted by a weakening global economy, consensus estimates for earnings growth will be off considerably. For this reason, my forecast for revenue growth is slightly more conservative than consensus. Likewise, my forecast for earnings growth is considerably more conservative than consensus to reflect the impact of the companyʼs financial leverage in what is expected to be a challenging economic environment. Another assumption worth noting is the shift in revenue mix from products to services. While the shift is marginal, it seems reasonable given the considerable macro economic headwinds. If global economic activity begins to recede, it is reasonable to assume that spending will begin to shift from new products to servicing and maintaining existing ones. Other assumptions built into the model include maintaining the companyʼs pace of share repurchases, an effective tax rate equal to the five year historical average, and maintaining the companyʼs dividend growth rate. Also, it is worth noting that my forecast for 2011 is in-line with estimates. Since management reaffirmed guidance for the second half on their most recent conference call this seems reasonable. Discount Cash Flow Analysis The DCF model presented in Appendix B builds on the assumptions mentioned above to establish a conservative estimate of intrinsic value. While several assumptions are pulled through from the income statement model, the key assumptions are the companyʼs terminal discount rate and terminal FCF growth rate. Given that a companyʼs discount rate is simply its cost of capital, the assumption of 10.4% is the companyʼs cost of equity from its WACC breakdown. For the terminal FCF growth rate, 4% is assumed to be slightly in line with the long-run growth rate of global GDP. The forecast intrinsic value is then based on a gradual smoothing to these terminal growth rates with other variables assumed to be their historical average. With these assumptions the intrinsic value of United Technologies is estimated to be $73.63 or 0.7% below the current price of $74.14. Essentially, at current levels the stock price fairly reflects long-term intrinsic value. Page 15 August 5, 2011 Exhibit 10 Technical Analysis S&P 500 Index (3 Years) The the graphs in Exhibit 10 highlight an extremely significant technical breakdown that just recently occurred. As can be seen in the first graph, the S&P 500 Indexʼs 200 day moving average (red) began to converge with the major support trendline (white) dating back to the March 09 lows. The second graph shows a large head-andshoulders pattern formation (yellow) that has been forming over the course of the year. On August 2, the S&P broke decisively through the 200-day MA, the major support trendline, and the neck line of the head-andshoulders formation. This is an extremely significant technical breakdown and signals a reversal of the recent uptrend in the market. S&P 500 Index (1 Year) Similarly, the chat of United Technologies below shows the same convergence of the 200-day moving average over the major support trendline. Though there is no headand-shoulders formation on UTXʼs chart, this would still be considered a rather significant technical breakdown. United Technologies (3 Years) Page 16 August 5, 2011 Summary The companyʼs intrinsic value is estimated to be fairly reflected at current levels using conservative assumptions. Most valuation metrics employed show that the companyʼs intrinsic value is fully reflected in the current market price. The major concerns for investors, though, are uncertainty and the considerable economic headwinds. In light of these risks, fear is driving stock prices, not fundamentals. While this may seem irrational, these conditions show no sign of abating anytime in the near future. Further, a significant technical breakdown will likely exacerbate losses for investors in the short term. As discussed earlier, leading economic indicators around the world are deteriorating and increasing the likelihood of a second recession. Also, it appears as if Europeʼs sovereign debt crisis is transforming into a European financial crisis, similar to the one experienced in the United States in 2008. If this is the case, global economic activity is likely to be impacted in a similar, if not more severe, fashion. If such a financial crisis were to occur in Europe, it would likely be detrimental to the Euro, creating negative foreign exchange translation effects for the company. In addition to external factors, the companyʼs use of considerable financial leverage means that the company would drastically underperform in a weak economic environment. Coupled with the typical underperformance of the industrials sector in weak economic times, United Technologies could be a very risky investment at this time. With the lack of clarity, macroeconomic uncertainty, and considerable leverage in mind, it is only prudent to sell the companyʼs equity at this time until the outlook for growth improves. Works Cited I, Logan Smyth, hereby attest that the views about the companies and their securities discussed in this report are accurately expressed. Information contained in this report may be found in the companyʼs annual, quarterly, and proxy filings with the Securities and Exchange Commission and additional information was obtained from the sources listed below... Morgan Stanley Equity Research Citi Investment Research CNBC The Wall Street Journal The IMF Thompson Reuters Baseline Bloomberg (Charts) Thinkorswim (Charts) Page 17 August 5, 2011 Appendix A: Selected Financial Data Page 18 August 5, 2011 Appendix B: Discounted Cash Flow Model Sensitivity Analysis Discount Rate 9.4% 9.9% 10.4% 10.9% 11.4% 2.5% $75.24 $70.18 $65.76 $61.87 $58.41 3.0% $78.51 $72.89 $68.03 $63.79 $60.05 3.5% $82.32 $76.02 $70.63 $65.97 $61.89 4.0% $86.84 $79.68 $73.86 $68.46 $63.98 4.5% $92.29 $84.02 $77.15 $71.35 $66.38 5.0% $98.97 $89.25 $81.32 $74.72 $69.15 Growth Rate Growth Rate Discount Rate 9.4% 9.9% 10.4% 10.9% 11.4% 2.5% 1.5% (5.3%) (11.3%) (16.6%) (21.2%) 3.0% 5.9% (1.7%) (8.2%) (14.0%) (19.0%) 3.5% 11.0% 2.5% (4.7%) (11.0%) (16.5%) 4.0% 17.1% 7.5% (0.4%) (7.7%) (13.7%) 4.5% 17.1% 13.3% 4.1% (3.8%) (10.5%) 5.0% 33.5% 20.4% 9.7% 0.8% (6.7%) Page 19