By: Shane Connor Josh Drushel Jessica Kirwin

advertisement

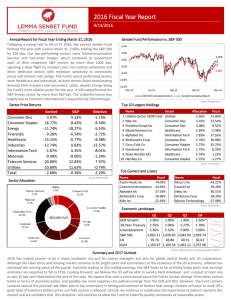

By: Shane Connor Josh Drushel Jessica Kirwin 1. Size and Composition 2. Business Analysis 3. Economic Analysis 4. Financial Analysis 5. Valuation Analysis 6. Recommendation 7. Q&A Materials; 3.2% Consumer Utilities; 4.1% Discretionary ;9.0% Telecom; 3.5% Consumer Staples; 12.0% Information Technology; 18.3% Energy; 12.4% Industrials; 9.9% Financials; 13.6% Health Care; 14.0% Personal Products 2.0% Tobacco 13.5% Food Products 16.1% Beverages 21.5% Food & Staples Retailing 24.4% Household Products 22.6% Wal-mart Stores, Inc. – $189.2 B The Proctor & Gamble Co. - $161.8 B The Coca-Cola Co. – $117.1 B PepsiCo, Inc. – $86.8 B Philip Morris International Inc. – $85.9 B CVS Caremark Corp. – $48.1 B Kraft Foods Inc. – $40.5 B Colgate-Palmolive Co. – $36.7 B Altria Group, Inc. – $35.6 B Walgreen Co. – $30.0 B Market Cap as of 7/20/09 Stable demand Multinational companies Defensive (non-cyclical) Consistent growth and returns Generally lags the market during periods of growth Shift toward international expansion International Domestic Colgate-Palmolive Revenue in millions Region 2008 2007 2006 Avg. Growth Rate North America 2851.7 2720.8 2590.8 4.87% Latin America 4088.0 3488.9 3019.5 16.35% Europe 3582.7 3383.3 2952.3 10.24% Asia 2660.0 2337.6 2006.0 15.16% Inelastic demand - Consumer staples generally remain steady during rough economic times but lag during expansion. Relatively steady demand in the United States Large growth internationally Competition is very high within sector -Due to many established competitors - Can compete on price and cost cutting - Product differentiation Buyer Power – (High) - Many substitutes readily available Low switching costs Supplier Power – (Low) - Due to the many substitutes available Cost of entry is very high - Dominated by very large multinational firms - High capital requirements to enter - Brand loyalty can be hard to break - Most of the businesses have been established for decades and in some cases even centuries Foreign exchange rates Balance of trade GDP Unemployment Rate Inflation Source: Charles Schwab Consumer Discretionary Consumer Staples Energy Financials Health Care Industrials Information Technology Materials Telecommunication Services Utilities Cash S&P 500 Weight 8.97% SIM Weight 7.50% +/-1.46% 12.32% 12.36% 0.04% 12.05% 10.68% -1.37% 13.70% 9.33% -4.37% 14.06% 13.58% -0.49% 9.79% 11.57% 1.78% 18.43% 20.19% 1.76% 3.20% 4.12% 0.92% 3.39% 3.28% -0.11% 4.10% 3.87% -0.23% 0.00% 3.53% 3.53% 100.00% 100.00% 0.00% As of 7/14/2009 Increase weight of Consumer Staples by 25 basis points Economic outlook is uncertain Defensive position Stable, Long term returns International growth increasing If dollar devalues, more favorable position