Taylor Captline Matthew Chadwell Hadd Francis

advertisement

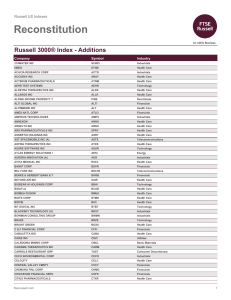

Taylor Captline Matthew Chadwell Hadd Francis 41 companies 11.82% of S&P 500 Telecommunica tion Services, 2.40% Utilities, Cash, 2.50% 3.69% Materials, 3.88% Sector Industries include: Agricultural Products Brewers Industrials, Distiller and Vinters 9.44% Food Distributors Information Technology, Household Products 19.92% Hypermarkets and Supermarkets Packaged Foods and Meats Personal Products Retail – Drugs Retail – Food Soft Drinks Tobacco Consumer Discretionary, 7.93% Consumer Staples, 13.06% Energy, 11.31% Health Care, 17.74% Financials, 8.14% COMPANY NAME WAL-MART STORES MRKT CAP 5/1/09 (millions) % of Sector $ 196,324.0 18.7% 145,076.0 13.9% COCA-COLA 98,304.0 9.4% PEPSICO 77,488.0 7.4% PHILIP MORRIS INTL 74,507.0 7.1% CVS/CAREMARK 46,955.0 4.5% KRAFT FOODS 34,516.0 3.3% ALTRIA GROUP 33,824.0 3.2% WALGREEN COLGATE-PALMOLIVE 31,112.0 30,781.0 3.0% 2.9% PROCTER & GAMBLE Top 10 account for 73.4% of sector market cap. As of 5/1/09 S&P 500 Number of Companies MKTCAP Level as of 5/1/09 Daily MTD QTD YTD 500 $ 7,626,466 877.52 0.54% 0.54% 9.98% -2.85% Energy 39 $ 977,849 366.87 3.05% 3.05% 8.01% -5.04% Materials 28 $ 256,116 154.36 0.31% 0.31% 15.45% 12.19% Industrials 58 $ 800,743 192.92 1.10% 1.10% 19.02% -6.89% Consumer Discretionary 81 $ 717,135 182.29 -0.66% -0.66% 17.75% 7.61% Consumer Staples 41 $ 917,842 226.43 0.46% 0.46% 3.51% -8.20% Health Care 54 $ 1,048,033 280.15 -0.13% -0.13% -1.02% -9.46% Financials 80 $ 908,860 142.95 -1.68% -1.68% 20.12% -15.31% Information Technology 75 $ 1,404,006 271.56 0.58% 0.58% 12.69% 17.15% Telecommunications Services Utilities 9$ 285,789 105.99 1.42% 1.42% 3.68% -5.10% 35 $ 310,094 134.41 2.66% 2.66% 3.09% -9.14% Consumer Staples performing below S&P 500 daily, MTD, QTD and YTD Information gathered from S&P500 website 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% S&P 500 Weight SIM Weight Consumer Staples is currently weighted at 13.06% in the SIM compared to 12.04% in the S&P 500. It is currently overweight by 102 bps. Life cycle International Domestic Business cycle Bernanke testified today that recession should end later this year. Supplier power Low Barriers to entry High Competition High Buyer power High Substitutes High Forward P/E to S&P 500 Trailing P/E to S&P 500 Price Net Profit Margin to S&P 500 ROE to S&P 500 Mean Current AGPRD 16.6 7.3 BRWRS 17.9 12.3 DSTLR 18.5 11.6 FOODD 20.7 13.8 HSHLD 20.4 12.2 HYPMK 16.9 14.9 PKGFD 18.6 13.1 CSMTG 23.8 15.9 RTDRG 22.8 13.5 FOODR 13 9.8 BEVGS 21.2 13.7 TBACO 11.9 11.1 AGPRD – mean reversion Hit hard by recession HYPMK – stable TBACO – stable but not showing signs of large growth Price to Sales Price to Book Price to CF • Mean Reversion Price to Sales Price to Book Price to CF Current values extremely close to mean values Sector P/E P/E P/E TO P/E P/E TO P/E LATEST 5 YR 5 YR 10 YR 10 YR REL TO 4 QTRS AVG AVG AVG AVG SPX CONSUMER DISCRETION 30.3 20.4 1.5 21.8 1.4 2.4 CONSUMER STAPLES 13.0 18.6 0.7 20.6 0.6 1.0 ENERGY 6.8 11.7 0.6 16.5 0.4 0.5 FINANCIALS NM 14.5 NM 15.4 NM NM HEALTH CARE 10.4 17.2 0.6 22.1 0.5 0.8 INDUSTRIALS 9.2 17.6 0.5 20.6 0.4 0.7 INFORMATION TECH 14.2 21.5 0.7 33.5 0.4 1.1 MATERIALS 10.8 15.9 0.7 20.5 0.5 0.8 TELECOMMUNICATION 10.7 15.6 0.7 19.1 0.6 0.8 UTILITIES 10.7 16.0 0.7 14.7 0.7 0.8 Reduce sector weight in SIM portfolio by 124 basis points to bring in line with S&P 500. Economic indicators signal recovery Sector appears fairly valued What Questions Do You Have?