Energy Sector Stock Recommendation March 2, 2010 Eric DeWees

advertisement

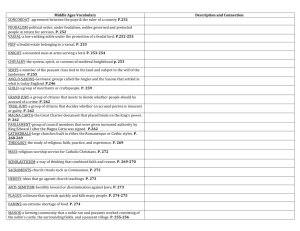

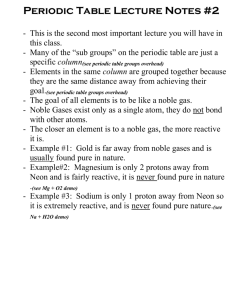

Energy Sector Stock Recommendation March 2, 2010 Eric DeWees Honglei Gong Charles Hathaway Danqing Zhou um er Dis cre Co tio ns na um ry er Sta ple s En erg y Fin an cia ls He alt hC are Inf orm Ind ust ati on ria ls Te ch Te n lec olo om gy mu M a nic ter ati ials on Se rvi ce s Uti litie Div s ide nd Ca Re sh cei va ble s Co ns S & P 500 Sector Weights (as of 2/28/2010) Sector Weights 20.00% 18.00% 16.00% 14.00% 12.00% Weight 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% Sector S&P 500 Weight SIM Weight Sector Performance YTD (2/28/2010) Sector Performance 4.00% 2.00% 0.00% -2.00% -4.00% -6.00% -8.00% YTD -10.00% Mat eria ls Ind ust rial s Con sD is c Con sS t ap le s He a lth Car e Fin anc ials Info Tec h Tel ec o mS vc Ut il itie s -12.00% Ene rgy Price Return Sector Sector Performance YTD Sector Performance (1 month) Sector Recommendation • Reduce the Energy Sector to 50 Basis Points Underweight • Current holdings are BP, ConocoPhillips, Transocean, National Oilwell Varco • We would like to: – Sell 100% of BP Plc. (BP) – Sell 100% of ConocoPhillips (COP) – Buy Noble Energy (NE) Noble Corporation • Noble Corporation (NE) is a oil drilling company that was spun-off the parent company Noble Energy in 1985. • The company, with operations in waters off the coasts of five continents, has a fleet of 63 offshore drilling units: three submersibles, four dynamically positioned drillships, 13 semisubmersibles, and 43 jack-up rigs. Many of its rigs are capable of operating in depths greater than 5,000 feet. • The group, which derives most of its revenues from offshore contracts, has positioned itself to ride the global trend toward deepwater exploration. Through acquisitions and equipment upgrading, Noble has been expanding its geographical reach and increasing its ability to drill in deeper off-shore areas. Noble Corporation Advantages • Low Taxes – Moved from Cayman Islands to Switzerland. Avg Tax Rate (16%) • Geographically Dispersed – World-wide, primarily in Mexico, Brazil, and Nigeria • Long-Term Historical Growth – Has experienced over 6% Earnings and Revenue Growth since 2000 – Baseline has a long-term growth rate of 5% • First energy industry to recover – Oil & Gas Drilling Services is one of the first industry to recover when oil prices increase. – Exploration and Production must first acquire leases on drilling rigs, years and months in advance Noble Corporation Advantages • • • Maintained high margins despite downturn – 44% in 2009, 44% in 2008 – Utilization went down from 88% to 83% Financially Stable – 735 Million Cash on Hand, $2.80 Per Share – Low Debt (750 Million), $2.82 Per Share – Growth Financed Heavily through Retained Earnings (70% of Total Liabilities and Equity) Noble increased its capital expenditures – – – – Building more rigs to sustain growth, don’t build until contracts are made 1.4 Billion in 2009, 1 Billion in 2008. Guidance in 2010 is 1 Billion Oil Majors are increasingly turning to offshore drilling Expecting a slew of contract announcement for 2011 in 1Q and 2Q Noble Corporation Baseline Filter • • • • • • • • • • Energy Sector P/Latest Earnings less than 1.0 Market Capitalization: 1 Billion or greater Earnings: 3 Year Historical Growth Rate 6% or Greater Earnings: 5 Year Growth Rate 6% or better Long-Term Future Growth Rate: 4% or greater ROE: 26% or greater Reinvestment Yield: 10.0% Price-Relative Strength to all stocks 70% or better Earnings Momentum Value: 90% or greater Noble Corporation (NE) the only energy stock to meet this criteria Noble Corporation Risks • Tax Increase – Currently taxes average 16%, there’s some risk that Switzerland, and other countries that Noble does business in will increase taxes • Currency Risk – Earnings are in Swiss Francs, not dollars. If dollar strengthens significantly, earnings will suffer in dollar terms • Huge Capital Investments – 79% of assets are in drilling equipment and facilities – Utilization dropped from 83% from 88% • Oil Prices Decrease Significantly – Sustained Oil Prices sinking to the $30-$40 level would reduce the desirability of offshore oil production – In the short term, we believe oil prices will be fluctuating between $65 and $85 per barrel Noble Corporation Stock Repurchases and Dividends • Stock Repurchase – Yearly stock repurchase – 2009: $204 Million – 2008: $314 Million • Dividend – Current Dividend is 16 cents per share. – Current dividend yield is .38%. – Talk of Possible Increase at Annual Shareholders Meeting April 30, 2010. Mentioned in 4Q Earnings Call • Debt to Total Capital is 10.5%. Energy Industries Relative Strength Noble Corporation EPS Surprise History Noble Corporation Earnings Growth Rates Noble is trading at one of the lowest Price to Books in years Noble Corporation Margins Margins have been increasing since ’05 but are expected to fall back slightly as contracts are renewed in ‘10 and ‘11 Noble Corporation Valuation Analysis Relative to Industry High Low Median Current P/Trailing E 1.3 .63 .95 .65 P/Forward E 1.1 .52 .90 .60 P/B 1.5 .8 1.1 1.1 P/S 1.7 1.1 1.3 1.6 P/CF 1.5 .8 1.1 1.0 Relative to S&P 500 High P/Trailing E 2.9 Low .32 Median .84 Current .39 P/Forward E 1.5 .25 .59 .53 P/B 1.5 .6 1.1 .8 P/S 5.5 2.1 3.6 2.6 P/CF 2.4 .4 1.0 .5 Noble Corporation Valuation Analysis Absolute Valuation P/Forward E High 50.5 4.0 13.9 P/S 25.7 3.3 9.0 7.8 9 5.538 50.00 P/B 4.1 1.1 3.2 1.7 2.5 25.29 63.24 23.85 2.58 9.51 4.57 7 9.45 66.17 26.8 3.1 10.4 5.3 7.5 8.15 61.13 P/EBITDA P/CF Low Median Current Target Target E,S,B Target Price Multiple /Share 6.6 9 6.43 57.87 Current Share Price : $43.24 Implied equity value/share : $62 Upside/(Downside) to Valuation : 43% Noble Corporation Discounted Free Cash Flow Terminal Growth Rate: 5% Implied Value: $60.34 Discount Rate: 12% Upside: 39.5% Noble Corporation Target Price Sensitivity Matrix Target Price for Noble Corporation: $60 Current Price: $43.24 DCF: $60.38 Valuation: $61 Upside Potential: 39% Noble Corporation Performance Year to Date • • Noble Corporation has consistently outperformed the S&P since it was spun off. It has significantly outperformed since 2000. This can be attributed to the increase in oil prices and world demand Noble Corporation Performance 1 Year Noble Corporation Performance 2 Year Noble Corporation Performance 5 Year Noble Corporation Performance 10 Year Noble Corporation Performance 20 Year BP Plc. Report • • • • • • Current Price: $53.05 Target Price: $60 Upside: 14.7% Dividend Yield: 3.36 / 6.28% % of SIM: .97% Recommendation: Sell 100% BP Plc. Valuation BP Plc. Discounted Free Cash Flow Implied Value: $60.63 Terminal Growth Rate: 3% Discount Factor: 12% Upside: 15.9% BP Plc. DCF Sensitivity ConocoPhillips Report • • • • • • Current Price: $48.91 Target Price: $57.00 Upside: 16.5% Dividend Yield: 4.17% % of SIM: 3.18% Recommendation: Sell 100% ConocoPhillips DCF Implied Value: $ 57.36 Terminal Growth Rate: 3% Discount Factor: 12% Upside: 17.3% COP Valuation Absolute Valuation High Low Median Current P/Forward E 18.6 5.3 8.8 8.0 8.8 7.8 68.64 P/S 1.2 .2 .60 .50 .60 131.53 78.92 P/B 3.5 .80 1.5 1.2 1.5 41.46 62.19 P/EBITDA 12.44 2.53 3.97 4.86 3.97 12.73 50.54 P/CF 11.0 2.3 5.5 4.9 5.5 13.00 71.52 Target Multiple Target E,S,B Target Price /Share Proposed Energy Sector Holdings As % of SIM • Noble Corporation (NE): • Transocean (RIG): • National Oilwell Varco (NOV): Proposed SIM Weight: S&P Energy Sector Weight: Current SIM Weight: 11.14% 11.48% 1.68% 4.18% 4.78% 10.64% Energy Team Questions? Transocean Report • • • • • • Current Price: $80.33 Target Price: $110 Upside: 36.9% Dividend Yield: No Dividend % SIM: 4.18% Recommendation: No Action Transocean DCF and Valuation Terminal Discount Rate = 11% Terminal FCF Growth Rate = 3% National Oilwell Varco Report • • • • • • Current Price: $43.66 Target Price: $40.34 Downside: 7.6% Dividend Yield: 40 Cents / .92% % SIM: 4.78% Recommendation: No Action National Oilwell Varco DCF and Valuation Terminal Discount Rate = 11% Terminal FCF Growth Rate = 3%