Health Care Sector Stock Presentation

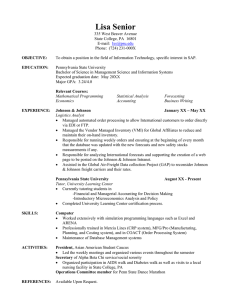

advertisement

Health Care Sector Stock Presentation BRENT SOLLER JAMIE SHRAGER HARISH NAIR Agenda Recommendation Sector Review Johnson & Johnson (JNJ) Review Gilead Sciences (GILD) Review Medtronic (MDT) Review Conclusion Recommendation Recommendation Increase Heath Care weight by 1.00%. As of 10/29/10 Increase GILD by 50 bps Increase MDT by 50 bps Maintain JNJ weight Sector Review Sector Performance Year-to-date health care sector performance is the worst in the S&P 500. Sectors S&P 500 Consumer Discretionary Industrials Information Technology Materials Consumer Staples Telecommunications Services Energy Financials Utilities Health Care QTD 7.42% 9.11% 6.42% 12.04% 11.18% 4.24% 2.43% 10.94% 8.41% 1.99% 2.99% YTD 9.93% 22.32% 18.61% 16.48% 12.51% 9.55% 8.60% 8.18% 8.07% 2.88% 0.58% Health Care Sectors Strengths and Threats Strengths Demographics (Aging) Increasing Spending (Obesity) Historically undervalued on a relative and absolute basis Threats Austerity spending cuts abroad Economic improvement Unknowns Health Care Legislation Impact Recent elections Industries within the Health Care Sector Health Care Pharmaceuticals & Biotechnology Pharmaceutical Biotechnology Equipment & Services Medical Equipment Medical Supplies Managed Care Heath Care Distribution Health Care Industry Valuations Absolute Ratios divided by Median 2 1.8 1.6 1.4 Every current ratio is below its historical 10year median. (A value of 1 indicates that the current valuation ratio equals its historical median valuation) 1.2 1 0.8 0.6 0.4 0.2 0 Price/Trailing Earnings Price/Forward Earnings Price/Book Price/Sales Price/Cash Flow Pharmacuticals Biotech Medical Equipment Supplies Managed Care Distribution Johnson & Johnson Review Johnson & Johnson Overview Diversified healthcare company with 250 operating companies operating in 59 countries, with over 115,000 employees Three major lines of business: Pharmaceuticals (36%) Medical Devices & Diagnostics (38%) Consumer Products (26%) Well-known products include: Tylenol Band-Aids Neutrogena Johnson & Johnson’s Baby Ticker JNJ Current Price $63.62 52 Week Range $56.86-$66.20 Market Cap $174.72 billion Shares Outstanding 2.75 billion Revenue (ttm) $61.897 billion Gross Profit (ttm) $16.58 billion Johnson & Johnson (JNJ) YTD Returns 10-year: 4.76% 5-year: 3.16% 3-year: 1.08% 1-year: 4.62% YTD: 1.21% 10-year YTD Performance Johnson & Johnson Catalysts Health Care Catalysts Demographics, increased spending et cetera Diversification JNJ has broad product mix across all health care industries Research & Development JNJ spends more than $7 billion annually on R&D which creates a robust pipeline 25% of 2009 sales were from products introduces in the last five years Johnson & Johnson Risks Regulatory JNJ must attain FDA approval for pharmaceutical and medical devices Competitive Faces generic drug competition and competition from other pharmaceutical companies Reimbursement Some sales depend on governmental reimbursement in U.S. and overseas Johnson & Johnson DCF Model Year 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E Revenue 62,696 65,160 69,185 73,405 77,736 82,012 86,358 90,676 94,938 99,020 102,981 3.9% 6.2% 6.1% 5.9% 5.5% 5.3% 5.0% 4.7% 4.3% 4.0% 16,468 17,323 18,473 18,718 19,823 20,913 22,021 23,122 24,209 25,250 26,260 26.3% 26.6% 26.7% 25.5% 25.5% 25.5% 25.5% 25.5% 25.5% 25.5% 25.5% (31) (33) (35) (37) (39) (41) (43) (45) (47) (50) (51) -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% 3,696 3,888 4,146 4,201 4,449 4,694 4,942 5,190 5,433 5,667 5,894 22.4% 22.4% 22.4% 22.4% 22.4% 22.4% 22.4% 22.4% 22.4% 22.4% 22.4% 12,804 13,468 14,362 14,554 15,413 16,260 17,122 17,978 18,823 19,633 20,418 5.2% 6.6% 1.3% 5.9% 5.5% 5.3% 5.0% 4.7% 4.3% 4.0% 2,932 3,113 3,230 % Growth Operating Income Operating Margin Interest and Other Interest % of Sales Taxes Tax Rate Net Income % Growth Add Depreciation/Amort 2,821 % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 4.4% 4.4% 4.4% 4.4% (1,727) (1,814) (1,899) (1,980) (2,060) 1.4% -0.5% -0.8% -1.0% -1.5% -2.0% -2.0% -2.0% -2.0% -2.0% -2.0% 2,194 2,085 2,006 2,129 2,332 2,952 3,368 3,899 4,177 4,357 4,531 3.5% 3.2% 2.9% 2.9% 3.0% 3.6% 3.9% 4.3% 4.4% 4.4% 4.4% 14,327 13,986 14,931 14,921 15,335 15,276 15,827 16,255 16,924 17,652 18,358 -2.4% 6.8% -0.1% 2.8% -0.4% 3.6% 2.7% 4.1% 4.3% 4.0% Terminal Value 347,137 Free Cash Yield 5.29% Terminal P/E 17.0 59% 100% 8.18% Current P/E Projected P/E 13.7 18.6 13.0 17.7 12.2 16.6 Current EV/EBITDA Projected EV/EBITDA 9.0 12.3 8.6 11.7 8.1 11.0 Upside/(Downside) to DCF 4,531 4.4% (1,640) 41% Terminal EV/EBITDA 2,755 $ 4,357 4.4% (1,166) 98,148 $ 4,177 4.4% (734) 140,075 238,223 Shares Outstanding 3,990 4.4% (539) NPV of terminal value Projected Equity Value Implied equity value/share 3,800 4.5% (330) NPV of Cash Flows Current Price 3,609 4.5% 896 % Growth Free Cash Flow Yield 3,420 4.5% 63.57 86.47 Terminal Discount Rate = 9.5% 36.0% Terminal FCF Growth = 4.0% 11.2 Johnson & Johnson Valuations High Low Median Current Target Multiple Target Metric/ Share Target Price P/Forward E 29.3 11.1 17.1 13.3 16.0 4.71 $75.36 P/S 6.1 2.2 3.8 2.8 3.5 22.9 $80.14 P/B 8.8 3.0 5.7 3.3 5.2 19.3 $100.37 P/EBITDA 20.39 6.94 12.39 8.79 12.2 6.02 $73.37 P/CF 27.0 9.0 16.2 11.0 15.0 5.23 $78.49 JNJ Price Target Upside Potential $82 30% Johnson & Johnson Analyst Estimates Earnings Estimate Year End 2009 Year End 2010 Year End 2011 High $4.63/share Low Revenue Estimate $4.80/share $5.15/share $4.66/share $4.84/share Year End 2009 Year End 2010 Year End 2011 High $61.9 billion Low Recommendation Strong Buy 5 Buy 11 Hold 9 Underperform 0 Sell 0 $62.4 billion $66.8 billion $61.6 billion $62.7 billion Gilead Sciences Review Gilead Sciences Overview Biopharmaceutical company that develops and commercializes innovative medicines in areas of unmet need Primary area of focus includes HIV/AIDS, liver disease and cardiovascular/metabolic and respiratory conditions. Founded in 1987 in Foster City, California Approximately 4,000 employees Global company; operations located in 19 countries Ticker GILD Industry Biotechnology Current Price $37.70 52 Week Range $31.73-$49.50 Market Cap $30.92 billion Shares Outstanding 811.87 million Revenue (ttm) $7.98 billion Gross Profit (ttm) $5.42 billion Gilead Sciences (GILD) YTD Returns 10-year: 23.60% 5-year: 6.86% 3-year: -4.33% 1-year: -18.73% YTD: -12.87% 10-year YTD Performance Gilead Sciences Catalysts Product Advancement: GILD has submitted an application for a fixed-dose combination of Truvada & Tibotec Pharmaceuticals TMC278 for HIV treatment. This will be only the 2nd product to contain a complete treatment regimen in a single once-daily tablet. GILD’s Quad single tablet had a high success rate for Phase II clinical trial results $5 Billion Share Repurchase Program Health Care Reform Plan May increase number of consumers Gilead Sciences Risks Patent expirations Health Care Reform Plan 10k states there is difficulty in determining demand and consumer inventory; a change in benefits may add more difficulty The unknown affecting share price Potential tax increases and/or price pressures Gilead Sciences DCF Model Year 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 8,050,733 8,533,777 8,960,466 9,408,489 9,878,914 10,323,465 10,788,021 11,273,482 11,780,788 12,310,924 12,864,915 6.0% 5.0% 5.0% 5.0% 4.5% 4.5% 4.5% 4.5% 4.5% 4.5% 4,302,841 4,629,880 4,763,194 4,986,499 5,235,824 5,368,202 5,609,771 5,749,476 6,008,202 6,155,462 6,432,458 53.4% 54.3% 53.2% 53.0% 53.0% 52.0% 52.0% 51.0% 51.0% 50.0% 50.0% (18,930) (8,534) (8,960) (9,408) (9,879) (10,323) (10,788) (11,273) (11,781) (12,311) (12,865) 0.2% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% 1,156,656 1,247,763 1,283,643 1,343,815 1,411,005 1,446,627 1,511,725 1,549,315 1,619,034 1,658,651 1,733,290 27% 27% 27% 27% 27% 27% 27% 27% 27% 27% 27% 3,138,737 3,386,557 3,485,120 3,633,276 3,814,940 3,911,251 4,087,257 4,188,888 4,377,387 4,484,500 4,686,303 7.9% 2.9% 4.3% 5.0% 2.5% 4.5% 2.5% 4.5% 2.4% 4.5% Capex % of sales 179,030 2.2% (483,691) -6.0% 281,776 3.5% 213,344 2.5% (300,936) -3.5% 298,682 3.5% 224,012 2.5% (130,140) -1.5% 313,616 3.5% Free Cash Flow 2,552,300 3,000,283 17.6% 3,265,376 8.8% NPV of Cash Flows 21,946,912 43% NPV of terminal value Projected Equity Value 28,834,370 50,781,283 57% 100% Revenue % Growth Operating Income Operating Margin Interest and Other Interest % of Sales Taxes Tax Rate Net Income % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex % Growth 7.9% Current P/E Projected P/E 10.3 16.2 9.6 15.0 9.3 14.6 Current EV/EBITDA Projected EV/EBITDA 6.6 10.7 6.1 9.9 5.9 9.6 Current Price Implied equity value/share Upside/(Downside) to DCF 847,228 $ $ 37.70 59.94 59% 246,973 258,087 269,701 281,837 306,300 320,084 334,488 2.5% 2.5% 2.5% 2.5% 2.5% 2.6% 2.6% 2.6% -148,184 -1.5% 326,004 -154,852 -1.5% 320,027 -161,820 -1.5% 323,641 -169,102 -1.5% 326,931 -176,712 -1.5% 329,862 -184,664 -1.5% 332,395 -192,974 -1.5% 334,488 3.4% 3.3% 3.1% 3.0% 2.9% 2.8% 2.7% 2.6% 3,407,473 4.4% 3,587,725 5.3% 3,694,458 3.0% 3,871,497 4.8% 3,974,691 2.7% 4,177,114 5.1% 4,287,525 2.6% 4,493,329 4.8% Terminal Value Free Cash Flow Yield Shares Outstanding 235,212 -141,127 -1.5% 319,889 Terminal Discount Rate = 10.5% Terminal Growth Rate = 4.5% 78,258,812 Free Cash Yield 5.74% Terminal P/E 16.7 Terminal EV/EBITDA 11.2 Gilead Sciences Sensitivity Analysis Discount Rate 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11.00% 11.50% 12.00% 2.00% 73.86 67.99 62.97 58.62 54.82 51.46 48.49 45.83 43.44 2.50% 78.27 71.59 65.94 61.10 56.91 53.25 50.02 47.15 44.58 Terminal 3.00% Growth 3.50% Rate 84.15 76.36 69.87 64.38 59.67 55.60 52.03 48.89 46.10 92.05 82.70 75.05 68.68 63.3 58.68 54.69 51.19 48.11 4.00% 100.74 89.43 80.39 72.99 66.83 61.61 57.15 53.28 49.89 4.50% 113.27 99.00 87.90 79.03 71.77 65.72 60.61 56.22 52.43 5.00% 129.95 111.28 97.28 86.40 77.69 70.57 64.63 59.61 55.31 5.50% 153.31 127.67 109.35 95.61 84.93 76.38 69.39 63.57 58.64 6.00% 185.22 148.17 123.46 105.82 92.58 82.29 74.05 67.31 61.70 Gilead Sciences Valuations High Low Median Current Target Multiple Target Metric/ Share Target Price P/Forward E 94.4 8.9 26.4 10.1 17.7 3.7 $64.78 P/S 33.7 3.8 13.4 4.2 8.6 9.4 $81.10 P/B 23.6 4.2 12.2 4.9 8.2 8.1 $66.26 P/EBITDA 131.1 7.5 22.4 7.5 11.7 5.3 $62.19 P/CF 135.4 8.3 32.8 10.0 20.6 4.0 $81.38 GILD Price Target Upside Potential $60 59% Gilead Sciences Analyst Estimates Earnings Estimate High Year End 2009 $2.82/share Low Revenue Estimate Year End 2009 Low $7.0 billion High Recommendation Strong Buy 8 Buy 8 Hold 11 Underperform 0 Sell 1 Year End 2010 Year End 2011 $3.81/share $4.26 /share $3.38/share $3.71/share Year End 2010 Year End 2011 $8.1 billion $8.8 billion $7.8 billion $8.1 billion Medtronic Review Medtronic Overview Medtronic is one of the largest medical devices company that develops and commercializes implantable medical products including: Pacemakers, defibrillators, heart valves, stents, insulin pumps, and artificial spinal discs Customers include: Hospitals, clinics, third party healthcare providers, distributors and other institutions Ticker GILD Industry Medical Equipment Current Price $34.70 52 Week Range $30.80-$46.66 Market Cap $36.72 billion Shares Outstanding 1.08 billion Revenue (ttm) $15.81 billion Gross Profit (ttm) $3.10 billion Medtronic (MDT) YTD Returns 10-year: 2.81% 5-year: -7.72% 3-year: -8.52% 1-year: -10.25% YTD: -19.15% 10-year YTD Performance Medtronic Catalysts Market leader with > 50% market share in ICD Leading position in diversified product portfolio across 7 market segments Announced acquisition of Ardian for $800 million Developer of catheter-based therapies to relieve hypertension Historically low ratio valuations Dividends announced for Q2 2011 Medtronic Risks Efforts to reduce costs by insurance companies and government MRI-Safe Pacemakers Waiting for over a year for FDA approval Product risk Recalls/lawsuits are omnipresent Health Reform Law Approximately $150-200 million in a new medical device tax ICD saturation could adversely affect revenues Medtronic Recent Events 8/24 Quarterly earnings meets wall street expectations but 2011 expectations slashed due to weaker global demand for medical implants 8/25 Approved cash dividend $0.225 per share of the company’s common stock payable on October 29, 2010 9/20 Receives FDA Approval of Integrity® Coronary Stent 10/14 Medtronic Settles US Lawsuits on Sprint Fidelis Family of Defibrillation Leads 10/29 FDA Classifies Previous Field Action of Medtronic Surgical Device as Class I Recall 11/01 Medtronic Receives FDA Approval of Talent Captivia® System for Endovascular Treatment of Thoracic Aortic Aneurysms 11/16 Completed acquisition of Osteotech for $123 million, expanding the range of its biologics product offerings Medtronic DCF Model Year 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 15,911.90 16,643.85 17,476.04 18,306.15 19,175.70 20,038.60 20,940.34 21,830.30 22,758.09 23,668.42 24,615.15 4.60% 5.00% 4.75% 4.75% 4.50% 4.50% 4.25% 4.25% 4.00% 4.00% 4,773.57 4,993.15 5,242.81 5,491.85 5,752.71 6,011.58 6,282.10 6,549.09 6,827.43 7,100.52 7,384.55 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 30.00% 159.12 166.44 174.76 183.06 191.76 200.39 209.40 218.30 227.58 236.68 246.15 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% 1.00% Taxes 986.54 1,031.92 1,083.51 1,061.76 1,112.19 1,162.24 1,214.54 1,266.16 1,319.97 1,372.77 1,427.68 Tax Rate 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 3,946.15 4,127.67 4,334.06 4,247.03 4,448.76 4,648.96 4,858.16 5,064.63 5,279.88 5,491.07 5,710.72 4.60% 5.00% (2.01%) 4.75% 4.50% 4.50% 4.25% 4.25% 4.00% 4.00% 95.47 765.62 873.80 915.31 958.78 1,001.93 1,047.02 1,091.52 1,137.90 1,183.42 1,230.76 0.60% 4.60% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 418.02 (182.99) (208.05) (183.06) (191.76) (200.39) (209.40) (218.30) (227.58) (236.68) (246.15) Revenue % Growth Operating Income Operating Margin Interest Income Interest % of Sales Net Income % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 2.63% (1.10%) (1.19%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (95.47) (765.62) (873.80) (915.31) (958.78) (1,001.93) (1,047.02) (1,091.52) (1,137.90) (1,183.42) (1,230.76) (0.60%) (4.60%) (5.00%) (5.00%) (5.00%) (5.00%) (5.00%) (5.00%) (5.00%) (5.00%) (5.00%) 4,364.18 3,944.69 4,126.01 4,063.97 4,257.00 4,448.57 4,648.76 4,846.33 5,052.30 5,254.39 5,464.56 (9.61%) 4.60% (1.50%) 4.75% 4.50% 4.50% 4.25% 4.25% 4.00% 4.00% Terminal Value 94,719.11 Free Cash Yield 5.77% Terminal P/E 16.59 Terminal EV/EBITDA 11.23 % Growth NPV of Cash Flows 27,522.29 42.98% NPV of terminal value Projected Equity Value 36,518.32 64,040.61 57.02% 100.00% Free Cash Flow Yield 11.34% Current P/E Projected P/E 9.75 16.23 9.32 15.51 8.88 14.78 Current EV/EBITDA Projected EV/EBITDA 8.32 13.57 7.04 11.47 6.63 10.80 Shares Outstanding Current Price Implied equity value/share 1,151.72 33.42 55.60 Terminal Discount Rate = Terminal Growth Rate = 10.0% 4.0% Medtronic Sensitivity Analysis Discount Rate 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11.00% 11.50% 12.00% 2.00% 63.60 58.55 54.23 50.49 47.22 44.34 41.78 39.50 37.44 2.50% 67.20 61.47 56.63 52.49 48.90 45.76 42.99 40.54 38.34 Terminal 3.00% Growth 3.50% Rate 71.51 64.92 59.43 54.79 50.81 47.37 44.36 41.70 39.34 76.79 69.06 62.74 57.48 53.02 49.21 45.90 43.01 40.46 4.00% 83.38 74.12 66.71 60.65 55.60 51.33 47.67 44.50 41.72 4.50% 91.86 80.44 71.57 64.47 58.65 53.81 49.71 46.19 43.14 5.00% 103.16 88.58 77.64 69.12 62.31 56.74 52.09 48.15 44.77 5.50% 118.98 99.42 85.44 74.95 66.78 60.25 54.90 50.43 46.65 6.00% 142.72 114.60 95.84 82.44 72.37 64.54 58.27 53.13 48.85 Medtronic Multiples Valuations High Low Median Current Target Multiple Target Metric/ Share Target Price P/Forward E 29.4 9.7 19.7 10.5 19.5 2.5 $48.75 P/S 24.4 9.0 17.3 9.8 16.0 3.5 $56.00 P/B 6.7 2.3 4.9 2.5 4.5 12.7 $57.15 P/EBITDA 6.7 2.2 4.4 2.3 4.0 14.3 $57.20 P/CF 22.8 6.6 14.0 6.57 12.0 4.5 $54.00 MDT Price Target Upside Potential $55 61% Medtronic Analyst Estimates Earnings Estimate Year End 2009 Year End 2010 Year End 2011 High $2.92/share Low Revenue Estimate $3.23/share $3.46/share $3.19/share $3.35/share Year End 2009 Year End 2010 Year End 2011 High $14.6 billion Low Recommendation Strong Buy 5 Buy 9 Hold 17 Underperform 1 Sell 0 $15.8 billion $16.3 billion $15.6 billion $15.7 billion Conclusion Upside Relative to SIM Opportunities Ticker TXT GLW MDT GILD NIHD AAPL GD HPQ PEG ORCL JNJ CMCSA INTC CCL CVS T BBY LNC FLS AA NOV TJX WMT VZ GS CVX MUR HCBK PG LAZ XEL BUCY FCX Stock Name Textron Inc Corning Inc Medtronic Gilead Sciences Inc. NII Holdings Apple General Dynamics Corp. Hewlett Packard Public Service Enterprise Group Oracle Corp. Johnson & Johnson Co. Comcast Corp. Intel Corp. Carnival Corp CVS Caremark AT&T Inc Best Buy Co. Lincoln National Corp Flowserve Alcoa National Oilwell Inc. TJX Wal-Mart Stores Inc. Verizon Goldman Sachs Group Inc. Chevron Murphy Oil Hudson City Bancorp Procter & Gamble Co. Lazard Xcel Energy Inc Bucyrus International Inc. Freeport-McMoRan Sector Industrials Info Tech Health Care Health Care Telecom Info Tech Industrials Info Tech Utilities Info Tech Health Care Cons Discr Info Tech Cons Discr Cons Staples Telecom Cons Discr Financials Industrials Materials Energy Cons Discr Cons Staples Telecom Financials Energy Energy Financials Cons Staples Financials Utilities Industrials Materials $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Current Price 20.81 17.49 34.12 37.85 38.82 301.21 65.48 41.74 31.40 27.61 63.02 20.23 21.06 41.28 29.64 28.14 42.75 23.58 105.01 13.01 57.51 45.01 54.27 32.13 165.10 82.57 65.41 11.55 63.39 36.42 23.48 89.27 97.05 Date of Current Price 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 11/16/2010 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Target Price 40.00 29.00 55.00 60.00 61.00 445.00 88.00 55.00 41.00 36.00 82.00 26.00 27.00 52.00 37.00 35.00 53.00 29.00 125.00 15.00 66.00 51.00 61.00 36.00 184.00 88.00 68.00 12.00 62.00 35.00 22.00 80.00 86.00 Date of Target Price 11/1/2010 11/1/2010 11/1/2010 11/19/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 11/1/2010 Expected Return 92.2% 65.8% 61.2% 59.0% 57.1% 47.7% 34.4% 31.8% 30.6% 30.4% 30.1% 28.5% 28.2% 26.0% 24.8% 24.4% 24.0% 23.0% 19.0% 15.3% 14.8% 13.3% 12.4% 12.0% 11.4% 6.6% 4.0% 3.9% -2.2% -3.9% -6.3% -10.4% -11.4% Final Recommendation Name Johnson & Johnson Ticker Current Price Upside Price Target Current Recommended Weight Weight JNJ $63.62 $82 31% 4.62% 4.62% Gilead Sciences GILD $37.70 $60 59% 3.17% 3.67% Medtronic MDT $34.70 $55 61% 1.05% 1.55% All three names have “buy” recommendations, but due to the weight of JNJ we propose only increasing investment in GILD and MDT. Health Care Stock Presentation THANK YOU, ANY QUESTIONS?