NOVEMBER 30TH 2 0 10

advertisement

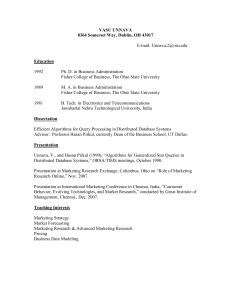

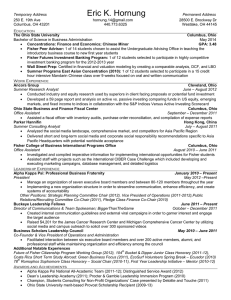

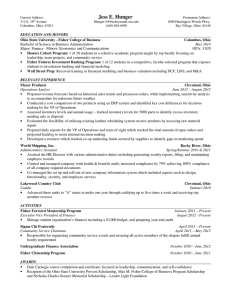

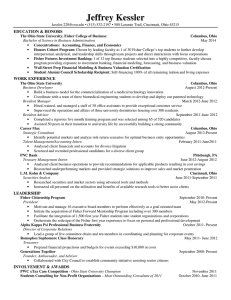

NOVEMBER 30TH 2 0 10 THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS S T U D E N T I N V E ST M E N T M A N A G E M E N T P R O G R A M T HE OHIO STATE UNIVERSITY ENERGY COMPANY PRESENTATION David Clark-Joseph Felice Green Jiri Woschitz THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS SECTOR OVERVIEW NATIONAL OILWELL VARCO CHEVRON MURPHY OIL NEW ADDITION SUMMARY OF RECOMMENDATIONS THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS SECTOR OVERVIEW SIM: Energy overweight 60 bps THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS S&P Sector Breakdown 3.1% 3.4% SIM Sector Breakdown 3.7% 4.0% 10.6% 19.1% 2.1% 4.2% 13.0% 11.7% 19.8% 12.3% 10.7% 15.6% 11.2% 11.0% 12.2% 10.7% 11.6% 10.2% THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Energy Sector • 1.27 Trillion in Market Capitalization • 3rd Largest Sector in S&P • SIM holds 3 S&P Companies SIM Energy Holdings Symbol SIM Weight Chevron CVX 463 bps Murphy Oil NOV 369 bps National-Oilwell Varco NOV 383 bps Industry Oil & Gas Integrated Oil & Gas Integrated Oil & Gas Equipment Services S&P Energy Sector Year to Date Performance: Energy Sector THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Industry Makeup of Energy Sector 1% 2% 2% 3% 16% Oil & Gas Refining & Marketing 25.00% Oil & Gas Drilling 20.00% Coal & Consumable Fuels 15.00% Oil & Gas Storage & Transportation 59% 16% 10.00% Oil & Gas Equipment & Services Oil & Gas Exploration & Production Integrated Oil & Gas 5.00% 0.00% -5.00% THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Recommendation From Sector Presentation • Reduce SIM weight of the energy sector by 110bps (1.1%). Stock SIM Weight Upside Recommendation Final SIM Weight NOV 463 bps 13.78% Hold 463 bps CVX 369 bps 14.80% Reduce 110 bps 259 bps MUR 383 bps (1.60%) Reduce 383 bps 0 RIG 0 40.00% Increase 383 bps 383 bps Sector 1215 bps 1105 bps THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS NATIONAL OILWELL VARCO THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS National Oilwell Varco • National Oilwell Varco specializes in providing equipment for on-shore and offshore oilrigs and drilling. It also provides maintenance services, customer solutions, and supplies as it relates to drilling for oil. NOV operates in 825 countries across 6 continents. • Business Segments: – Rig Technology – Petroleum Services & Supplies – Distribution Services • NOV Information: – Market Cap: $25.8 Billion – 52-Week Range: $32.18 - $63.88 – Current Stock Price: $61.52 • Competitors: – – – – – – Baker Hughes Cameron International FMC Technologies Halliburton National Oilwell Varco Schlumberger • Current SIM weight: 463 bps NOV 52-Week Stock Price Range 65 60 55 50 45 40 35 30 NOV vs. Competitors THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS • 11 Acquisitions from 2005-2009 and stake in one firm. – 2010 Acquisitions: • Ambar Lone Star Fluid Svcs LLC • Advanced Production and Loading PLC (to be completed EOY) Q3 Gross Margin 35.6% Operating Margin 19.8% Net Profit Margin 13.4% ROA 7.3% ROE 10.9% 2009 31.7% 17.5% 11.6% 6.8% 11.0% 2008 32.0% 20.4% 14.5% 11.6% 20.2% 2007 30.5% 20.3% 13.7% 12.7% 22.9% 2006 26.8% 15.3% 9.7% 8.7% 14.8% 2005 23.0% 10.3% 6.2% 6.2% 10.5% Q3 BHI CAM FTI HAL NOV Gross Margin 29.0% 31.3% 27.3% 25.0% 35.6% Operating Margin 10.2% 13.4% 11.6% 17.5% 19.8% Net Profit Margin 6.3% 9.7% 8.4% 10.4% 13.4% ROA 2.5% 6.4% 10.2% 8.1% 7.3% ROE 5.4% 14.0% 32.8% 12.6% 10.9% SLB 31.5% 15.5% 25.3% 8.1% 16.1% THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS NOV vs. S&P 500 1 Year: Lagging S&P 500 by -19.8% 3 Month: Ahead of S&P 500 by 46.7% THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS DCF Model Terminal Growth Rate Terminal Growth Rate THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS DCF Sensitivity Analysis 10.0% $73.21 $76.95 $81.32 $86.48 $92.94 Terminal Discount Rate 10.5% 11.0% 11.5% $68.37 $64.13 $60.38 $71.53 $66.82 $62.69 $75.17 $69.89 $65.31 $79.42 $73.43 $68.30 $84.67 $77.78 $71.94 12.0% $57.05 $59.05 $61.30 $63.85 $66.93 10.0% Terminal Discount Rate 10.5% 11.0% 11.5% 12.0% 3.0% 19.0% 11.1% 4.2% -1.8% -7.3% 3.5% 25.1% 16.3% 8.6% 1.9% -4.0% 4.0% 32.2% 22.2% 13.6% 6.2% -0.4% 4.5% 40.6% 29.1% 19.4% 11.0% 3.8% 5.0% 51.1% 37.6% 26.4% 16.9% 8.8% 3.0% 3.5% 4.0% 4.5% 5.0% NOV Valuation Analysis THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS NOV Relative to the Industry Trailing P/E Forward P/E P/B P/S P/CF High 1.8 1.2 1.1 1.1 6.4 Low 0.43 0.43 0.4 0.5 0.6 Median 0.85 0.8 0.5 0.8 1.4 Current 0.61 0.88 0.6 0.9 0.8 Status Undervalued In line In line In line Undervalued NOV Relative to the Sector Trailing Forward P/B P/S P/CF high 7.5 2.5 1.5 2.6 11.4 low 0.6 0.5 0.5 0.8 0.6 median 1.5 1.3 0.9 1.4 2.5 current 1.1 1.3 0.9 2.1 1.5 Status Undervalued In line In line Overvalued Undervalued NOV Absolute Valuation and Target Prices Forward P/E P/S P/B P/EBITDA P/CF High 35.5 3.1 5.1 42.07 107.3 Low Median Current 5.1 16.6 16.6 0.8 1.4 2.1 0.8 2.3 1.7 2.77 11.44 8.63 3.9 17.6 11.8 Target Multiple 16.6 1.4 2.3 11.44 17.6 Target/Share 4.00 29.01 36.19 7.13 5.21 Avaerage: Target Price $66.40 $40.61 $83.24 $81.57 $91.70 $72.70 NOV Advantages & Risks THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS • Advantages – – – – Rising oil prices Contract Agreements GDP growth in developing countries Increased activity in the oil and gas industries • Risks – – – – Lower oil Prices Slow US growth US government regulations Foreign currency exposure THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS NOV Recommendation • Current Price: $61.52 • Target Price: $70.00 – Target Price = • Total Upside: 13.78% • Recommendation: HOLD at 463 bps THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS CHEVRON THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Chevron • Chevron is a major integrated oil and gas producer, currently the 3rd largest energy company in the world, and 8th largest company in the S&P • Business Segments: – Upstream (86%of Net Income) – Downstream (13% of Net Income) – Chemicals (1% of Net Income) • CVX Information: – Market Cap: $165.12 Billion – 52-Week Range: $66.83 - $86.19 – Current Stock Price: $82.05 • Competitors: – – – – Exxon Mobil Conoco Philips Royal Dutch Shell BP • Current SIM Weight: 369 bps 12 Month Stock Performance THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Chevron - Strong Performance relative to peers THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Chevron vs. S&P 500 and Peers THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Chevron vs. S&P 500 and Peers Price Target: $94.17 (+14.8%) Valuation Ranges THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 52-week Trading Range $66.83 $86.19 Multiples Analysis $76.76 $117.97 Sum of Parts Assets and Segment Comparables Discounted Cash Flow Analysis $92.53 $72.95 11/26/10 Trading Range $60.00 $93.45 $81.70 $70.00 $80.00 $82.60 $90.00 $100.00 Illustrative WMT Price per Share $110.00 $120.00 THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS CVX Recommendation • • • • Current Price: $82.05 Target Price: $94.17 Total Upside: 14.8% Recommendation: – Reduce by 110bps: from 369 bps to 259 bps THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS MURPHY OIL THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Murphy Oil Corporation • Murphy Oil Corporation conducts the business from the exploration of the raw material over the production and refining to the distribution and sales of the final products in the market • Business Segments: – Exploration and Production – Refining and Marketing • MUR Information: – Market Cap: $12.6 Billion – Diluted Shares Outstanding: 192.468M – 52-Week Range: $48.44- $68.91 – Dividend Yield: 1.7% • Current SIM Weight: 383 bps Stock Price MUR 80 70 60 50 40 30 20 10 0 11/24/2009 11/24/2010 THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Statistical Analysis Economic Factors Implied Price: $61.50 -5.8% Price Range: [$48, $80] [-26.5%, 22.5%] THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS DCF Model THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS DCF Sensitivity Analysis Implied Price: $61.49 -5.8% Price Range: [$52.70, $75.30] [-19.3%, 15.2%] THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Multiples: Median vs. Current Murphy Oil too cheap in 13 out of 15 cases. BUT: Oil prices will not go beyond $90/barrel until end of March (assumption) Murphy Oil will not reach is median stock price in the near future THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Multiple Valuation Implied Price: $69.69 +6.7% Price Range: [$27.84, $103.05] [-57.4%, 57.8%] THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS MUR Recommendation • • • • Current Price: $65.74 Target Price: $64.23 Downside: -1.6% Recommendation: SELL 383 BPS Risk to Recommendation Main assumptions: 1) Oil prices remain on today’s level 2) Economy will not strengthen in the near future If this is not true the recommendation fails. If the economy strengthens and oil prices increase, Murphy Oil’s stock price can perform very well. THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS TRANSOCEAN (RIG) THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Transocean (RIG) • Transocean Ltd is an international provider of offshore contract drilling services for oil and gas, with 138 mobile offshore units. Transocean is the largest operator of these services, twice the size of the next largest competitor. It also has a backlog of $28B. • Primary Business – Contract Drilling • RIG Information: – Market Cap: $21.6 Billion – 52-Week Range: • $41.88- $94.88 – Current Stock Price: $67.77 • Competitors: – Noble – Nabors – Rowan • Not a current SIM holding 1 Year Stock Performance THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Transocean: Thesis We think that the impact on market capitalization to date resulting from the Gulf Oil spill is overblown, and impact to Transocean’s balance sheet and future profitability are minimal. - Transocean received a $560M Insurance payout - The contract between Transocean and BP indemnifies Transocean for any liabilities related to discharges from the well or costs to control any cleanup. - Transocean is also best positioned to take advantage of integrated oil companies such as Chevron pushing upstream deepwater exploration. THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Transocean vs. S&P 500 and Peers THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Transocean vs. S&P 500 and Peers THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS RIG DCF Target: $94.90 THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS RIG Recommendation • • • • Current Price: $67.77 Target Price: $94.17 Total Upside: 40.0% Recommendation: – Initiate position of 383 bps. THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS SUMMARY OF RECOMMENDATIONS THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS RECOMMENDATIONS Stock SIM Weight Upside Recommendation Final SIM Weight NOV 463 bps 13.78% Hold 463 bps CVX 369 bps 14.80% Reduce 110 bps 259 bps MUR 383 bps (1.60%) Reduce 383 bps 0 RIG 0 40.00% Increase 383 bps 383 bps Sector 1215 bps 1105 bps