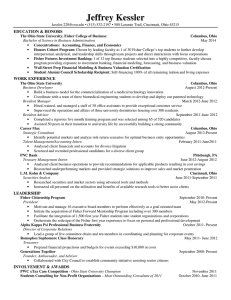

Document 11015564

advertisement

NOVEMBER 16TH 2 0 10 S T U D E N T I N V E ST M E N T M A N A G E M E N T P R O G R A M T H E O H I O S T A T E U N I V E R S I T Y THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS ENERGY SECTOR PRESENTATION David Clark-­‐Joseph Felice Green Jiri Woschitz THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS OVERVIEW BUSINESS ANALYSIS FINANCIAL ANALYSIS VALUATION ANALYSIS RECOMMENDATION Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS OVERVIEW Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Energy Sector • 3rd Largest Sector in S&P • 1.27 Trillion in Market Capitalization • SIM holds 3 S&P 500 Energy Companies SIM Energy Holdings Symbol SIM Weight Chevron CVX 3.78% Murphy Oil MUR 3.70% NaEonal-­‐Oilwell Varco NOV 4.06% Overview Business Financials Industry Oil & Gas Integrated Oil & Gas Integrated Oil & Gas Equipment Services ValuaEon Conclusion 2 of the Largest in the S&P 500 THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Largest S&P Members Exxon Mobil S&P Weight Market Cap (B) 3.24% 358 Apple Inc. 2.60% 283 MicrosoX Corp 2.07% 225 Procter & Gamble 1.68% 183 IBM 1.64% 179 Johnson & Johnson 1.61% 175 GE 1.60% 174 Chevron Corp 1.58% 172 AT&T Inc 1.55% 168 JP Morgan Chase & Co 1.43% 156 Total S&P Weight in Top 10 Holdings 19.04% 2070 Overview Business Financials ValuaEon Conclusion SIM: Energy Overweight 60 bps S&P Sector Breakdown SIM Sector Breakdown THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 3.4% 2.1% 4.0% 3.1% 3.7% 10.6% 13.0% 11.7% 19.1% 4.2% 19.8% 12.3% 10.7% 15.6% 11.2% Overview 12.2% 11.0% Business 10.7% 11.6% 10.2% Financials ValuaEon Conclusion Energy Vs. S&P 500 THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Trailed S&P by 801 bps Over past 12 Mo. Outperformed S&P by 222 bps Over past 3 Mo. Overview Business Financials ValuaEon Conclusion S&P 500 Performance by Sector 25.00% 20.00% THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 15.00% MTD QTD 10.00% YTD 5.00% 0.00% -­‐5.00% Energy Materials Industrials Cons Disc Cons Staples Health Care Financials Sector Energy Materials Industrials Cons Disc Cons Staples Health Care Financials Info Tech Telecom Svc UEliEes Overview Business Info Tech Telecom Svc UEliEes Quarter Returns 11.99% 8.72% 3.17% 7.70% 2.91% 1.20% 4.04% 6.54% 0.31% -­‐0.63% Financials ValuaEon Conclusion S&P Energy Sector THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Industry Makeup of Energy Sector 1% 2% 2% 3% Year to Date Performance: Energy Sector Oil & Gas Refining & MarkeEng Oil & Gas Drilling 16% 25.00% 20.00% Coal & Consumable Fuels 15.00% Oil & Gas Storage & TransportaEon 59% 16% 10.00% Oil & Gas Equipment & Services Oil & Gas ExploraEon & ProducEon Integrated Oil & Gas 5.00% 0.00% -­‐5.00% YTD: Equipment & Services Refining & MarkeEng Storage & TransportaEon Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Largest Companies in Energy Sector Top 10 S&P Energy Components Symbol Market Cap (Billions) Industry Exxon Mobil XOM 358 Oil & Gas Integrated Chevron CVX 171 Oil & Gas Integrated Schlumberger SLB 101 Oil & Gas Equipment Services ConocoPhillips COP 94 Oil & Gas Integrated Occidental Petroleum OXY 71 Oil & Gas Integrated Suncor Energy SU 54 Oil & Gas Integrated Apache APA 40 Halliburton HAL 33 Devon Energy DVN 31 National-Oilwell Varco NOV 24 Overview Business Financials Oil & Gas Exploration Production Oil & Gas Equipment Services Oil & Gas Exploration Production Oil & Gas Equipment/ Services ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Porter’s 5 Forces: Acracdve Threat of New Entrants (low) n Capital Intensive, Knowledge Intensive n Interest from BRIC and Sovereign Wealth Power of Suppliers (high) n Few, Powerful n Countries increasingly interested in their own energy resources Power of Buyers (low) n Lack of product differenEaEon, but price is inelasEc in short run Subsdtutes (medium) n Petroleum AlternaEves -­‐ Imperfect subsEtutes Compeddve Rivalry (medium) n Mature industry growth rates n Tacit Collusion Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS BUSINESS ANALYSIS Overview Business Financials ValuaEon Conclusion Key Drivers for the S&P 500 Energy Sector THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS • Energy demand -­‐ World populaEon -­‐ Demand for Cars, heaEng etc. • Energy supply (producEon) -­‐ Capacity -­‐ Oil reserves, gas reserves etc. • Prices of Oil, Natural Gas etc. • OPEC Decisions Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS S&P 500 E vs. LIBOR (3Mth.) 700 8 600 7 6 500 5 400 4 300 3 200 US INTERB 3 MTH OR [U$] 2 100 1 0 0 Overview S&P500 ENERGY PI [U$] Business Financials ValuaEon Conclusion S&P 500 E vs. US CPI Energy THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 700 250 600 200 500 150 400 S&P500 ENERGY PI [U$] 300 100 US CPI ENERGY Y [U$] 200 50 100 0 Overview 0 Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS S&P 500 E vs. OPEC Oil Price and Brent Crude Oil Price 700 160 600 140 120 500 100 400 80 300 OPEC Oil Price [U$] 60 200 Crude Oil-­‐Brent [U$] 40 100 20 0 Overview S&P500 ENERGY PI [U$] 0 Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS S&P 500 E vs. Natural Gas 1600 14 1400 12 1200 10 1000 8 800 6 600 4 400 200 2 0 0 Overview Business Financials S&P500 ENERGY PI [U $] Natural Gas US BL [US Cents/MM Btu] Natural Gas US DS [U$] ValuaEon Conclusion S&P 500 E vs. Crude Oil Producdon 700 76.0000 74.0000 THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 600 72.0000 500 70.0000 68.0000 400 66.0000 300 64.0000 62.0000 200 S&P500 ENERGY PI [U$] CrudeOilProd WW M-­‐1 [mBarrels/day] 60.0000 100 58.0000 0 56.0000 Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS S&P 500 E vs. World Populadon 700 6400 600 6200 6000 500 5800 400 5600 300 5400 200 WD POPULATION [Millions] 5200 100 5000 0 4800 Overview S&P500 ENERGY PI [U$] Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Model to explain S&P 500 Energy Index ln(#$)↓' =)↓0 +)↓1 *↓' +)↓2 ln(+,↓' ) +)↓3 ln(-. ,↓' ) +)↓4 ln(/,$#↓' ) +)↓5 /+,↓'−1 +)↓6 01,↓' +2 Where EI: S&P 500 Energy Index L: LIBOR (3 Mth.) OP: Opec Oil Price NGP: Natural Gas Prices CPIE: US ConsumpEon Price Index Energy COP: Crude Oil ProducEon WDP: World PopulaEon Overview Business ValuaEon Conclusion Financials THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Model to explain S&P 500 Energy Index Overview Business Financials ValuaEon Conclusion Forecast explaining variables THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS L: LIBOR (3 Mth.) hlp://www.forecasts.org OP: Opec Oil Price -­‐ hlp://www.forecasts.org, -­‐ Annual Energy Outlook 2010 of the US Department of Energy, -­‐ World Oil Outlook_2009_OPEC NGP: Natural Gas Prices Annual Energy Outlook 2010 of the US Department of Energy CPIE: US ConsumpEon Price Index Energy AssumpEons based on the forecasts of the price trends of Oil and Gas COP: Crude Oil ProducEon Annual Energy Outlook 2010 of the US Department of Energy, WDP: World PopulaEon Stable Overview Business Financials ValuaEon Conclusion S&P 500 Energy Index Model Forecast THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 600.0000 500.0000 400.0000 300.0000 S&P 500 Energy Index upper bound 95% 200.0000 lower bound 95% 100.0000 0.0000 Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS FINANCIAL ANALYSIS Overview Business Financials ValuaEon Conclusion REVENUE GROWTH YEAR-­‐OVER-­‐YEAR ENERGY S&P 500 CVX MUR NOV THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 250% 200% 150% 100% 50% 0% -­‐50% -­‐100% 2000 Overview 2001 2002 Business 2003 2004 2005 Financials 2006 2007 ValuaEon 2008 2009 Conclusion 10-­‐YEAR ENERGY REVENUE THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Energy Revenue 700 high 609.6 low 182.9 median 381.4 current 461.0 600 500 400 300 200 100 0 2000 2001 Overview 2002 2003 Business 2004 2005 2006 Financials 2007 2008 ValuaEon 2009 2010 Conclusion EPS GROWTH YEAR-­‐OVER-­‐YEAR ENERGY S&P 500 CVX MUR NOV THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 200% 150% 100% 50% 0% -­‐50% -­‐100% 2001 2002 Overview 2003 2004 Business 2005 2006 Financials 2007 2008 ValuaEon 2009 2010 2011 Conclusion Energy: Net Profit Margin Absolute NPM Energy Absolute high 9.8 low 4.9 median 7.4 current 7.1 12.0% 10.0% 8.0% THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS 6.0% 4.0% 2.0% 0.0% 2000 2001 2002 2003 2004 2005 2006 2007 2008 Energy: Net Profit Margin Reladve to S&P 500 1.60 1.40 1.20 2009 2010 NPM Reladve to S&P 500 high 1.4 low 0.7 median 0.9 current 0.9 1.00 0.80 0.60 0.40 0.20 0.00 2000 2001 Overview 2002 2003 Business 2004 2005 Financials 2006 2007 2008 ValuaEon 2009 2010 Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS VALUATION ANALYSIS Overview Business Financials ValuaEon Conclusion Industry & Sector Valuadon THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS Energy Sector Reladve to S&P 500 Rado Trailing P/E Forward P/E P/S P/B P/CF High 1.1 1.2 1 1.4 0.9 Low 0.5 0.57 0.6 0.7 0.6 Median Current 0.74 .98 0.78 0.84 0.7 0.8 0.9 1.0 0.7 0.9 Oil Equipment Reladve to S&P 500 Rado Trailing P/E Forward P/E P/S P/B P/CF Oil Exploradon Reladve to S&P 500 Rado Trailing P/E Forward P/E P/S P/B P/CF High 1.4 1.9 3.5 1.3 0.9 Low 0.31 0.5 0.9 0.5 .3 Median Current .69 1.2 0.75 1.1 1.9 2.7 0.7 0.9 0.5 .8 High 3.3 1.7 2.8 2.8 1.6 Low .58 .61 1 .9 .8 Median Current 1.5 1.7 1.3 1.2 1.5 2 1.4 1.5 1.2 1.6 Oil Integradon Reladve to S&P 500 Rado Trailing P/E Forward P/E P/S P/B P/CF High 1.4 1.2 .8 1.4 0.9 Low 0.5 0.46 0.5 0.7 0.6 Median Current 0.68 .81 0.73 0.73 0.7 0.7 1.0 1.0 0.7 0.8 Overvalued by >10% Inline with S&P Undervalued by >10% Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS RECOMMENDATION: REDUCE 60 BPS Overview Business Financials ValuaEon Conclusion THE OHIO STATE UNIVERSITY FISHER COLLEGE OF BUSINESS RECOMMENDATION • Current SIM weight: 12.3% vs S&P 500 weight of 11.7% • Reduce holdings by 60 bps to mirror S&P 500 – Do not foresee much movement within the energy sector – Opportunity to allocate addiEonal holdings to another area of the pornolio with larger upside Overview Business Financials ValuaEon Conclusion