Kevin Neilon Zhenjiao Tian

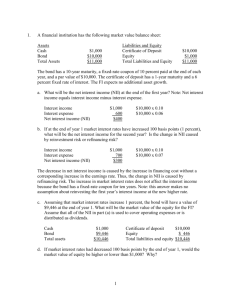

advertisement

Kevin Neilon Zhenjiao Tian Overview Wireless Telecom Services Integrated Telecom Services • Cell phone • Satellite • Paging • Non-wireless • Voice • Data Overview SIM Weight S&P 500 Weight 96.47% 97.27% 2.73% Rest of S&P 500 Telecom Sector 3.53% Rest of S&P 500 Telecom Sector Decided to cut 200 basis points to 1.53% Valuation Analysis Telecom Sector Absolute Basis High Low Median Current P/Trailing E 24.8 9.7 16.3 16.6 P/Forward E 21.7 10.5 15.6 17.5 P/B P/S P/CF 2.7 2.0 7.0 1.0 0.9 3.5 1.9 1.4 5.2 1.7 1.2 5.0 Relative to SP500 High Low Median Current P/Trailing E 1.4 0.7 0.9 1.2 P/Forward E P/B P/S P/CF 1.4 1.0 1.4 0.6 0.8 0.4 0.8 0.4 1.0 0.8 1.0 0.5 1.3 0.8 0.9 0.5 Overview Negatives Sector is not capturing upside of market recovery ROE & Profit margin expected to continue underperforming Industry is not attractive based on 5 forces Positives High dividend yield Wireless Services Industry slightly undervalued Overview Current Holdings AT&T • • • • Current Price: $30.99 Target Price: $31.50 (1.6% upside) Current SIM Weight: 1.97% Recommendation: SELL NII Holdings, Inc. • • • • Current Price: $17.50 Target Price: $22.35 (28% upside) Current SIM Weight: 1.56% Recommendation: HOLD Overview Another option to consider: MetroPCS • Market Cap:$4.3B • Current Price: $10.28 • Target Price: $13.35 (29.8% upside) AT&T Defensive Stock Mature Company Competitors: Verizon, Sprint Revenue by Line of Business Wireless 45% Other 1% Wireline 51% Advertising 3% AT&T Private Communications Construction AT&T Correlation with Market AT&T Slow, unexciting growth prospects AT&T ROE AT&T DCF Model AT&T Valuations Method Revised Target Price: $31.50 Current Price: $30.34 Recommendation: SELL AT&T Valuations Method Revised Target Price: $31.50 Current Price: $30.99 (1.6% upside) With Dividends: 7.4% 1 Year Return Recommendation: SELL NII Holdings, Inc. Founded in 1995 and is based in Reston, Virginia. Provides wireless communication services under the Nextel brand name Primary market is Mexico, Brazil, Argentina, Peru, and Chile. Services include mobile telephone service; mobile broadband services; Nextel Direct Connect service, which allows subscribers to talk to each other on a push-to-talk basis for private one-to-one calls or on group calls; and International Direct Connect service that allows subscribers to communicate across national borders. Provides data services. Market Capital: 3.0 billion Competitors: America Movil, Telefonica Moviles, Telemar’s 0i, Telecom Italia Mobile, Entel, Iusacell, Vivo, Portugal Telecom S.A, Telecom Americas, Italia Mobile NII Holdings, Inc. 5 Year Performance: NII Holdings, Inc. BUSINESS ANALYSIS Business cycle: growth company Business strategy: product expansion, regional expansion and new technology Driving force for sale and catalyst: Push-to-Talk, 3G network and regional expansion Porter’s Five Forces: high barrier to enter, high substitution threat, high buyer power, medium supplier power, high Rivalry Business risk: Country risk, foreign exchange rate, credit default risk and product and technology obsolete risk. FINANCIAL ANALYSIS NII Holdings, Inc. FINANCIAL ANALYSIS More than 84% of the total revenue come from Brazil and Mexico. Future revenue is estimated to continue to increase and driving forces are below: Launch of high performance push-to talk on new W-CDMA network in Peru. Launch of 3G services across most of its markets. Creation of additional distribution presence and enhancement of brand. NII Holdings, Inc. FINANCIAL ANALYSIS Current earnings in Argentina, Peru and Chile is negative. Consolidated earnings in the third quarter and fourth quarter are negative and main reasons are below. Increased cost relating to deployment of new W-CDMA base networks High cost from launch of its new brand depreciation of local currencies relative to dollars Higher cost associated with customer retention driven by competition NII Holdings, Inc. FINANCIAL ANALYSIS NII Holdings, Inc. Valuations Method NII Holdings, Inc. NII Holdings, Inc. DCF Model Terminal Discount Rate = Terminal Cash Flow Growth Rate = 12.0% 4.5% NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 2,170 1,564 3,734 13.06% 58% 42% 100% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA EBIDTA/share 15.0 18.7 3.8 4.2 9.4 10.3 12.8 3.2 3.6 11.2 Shares Outstanding 171 Current Price Implied equity value/share Upside/(Downside) to DCF $ $ 17.50 21.81 24.7% Terminal Discount Rate 10.5% 11.0% Terminal 6.0% FCF growth 5.5% rate 31.3 28.5 26.2 24.3 22.6 29.5 27.0 25.0 23.3 21.9 5.0% 27.9 25.8 24.0 22.5 21.2 4.5% 26.7 24.8 23.2 21.8 20.6 4.0% 25.6 23.9 22.5 21.2 20.1 24.7 23.2 21.8 20.7 19.6 3.5% 11.5% 12.0% 12.5% NII Holdings, Inc. SUMMARY OF VALUATION Weighted average: $22.88 + 0.5 * $ 21.81 =$ 22.35 Current Price $ 17.50 Implied equity value/share $ 22.35 Upside/(Downside) 28% Other analysts’ opinions as of 03/02/2012 (provided by Thomson/First call): Mean Recommendation (this week): 2.3 Mean Recommendation (last week): 2.2 Change: 0.1 NII Holdings, Inc. Recommendations Negatives: Net loss in consecutive two quarters of 2011 attributed to high costs More intense competitive environment Depreciating local currency values. High LT debt to total capital: 50% Positives The famous Nextel brand name High market shares and fast revenue growth Sunk cost in 2011 related to the deployment of 3G networks High upside about 28%. Recommendation: Hold MetroPCS Wireless telecom provider Low-cost, no-contract services Added 1m+ customers each of past 6 years Client base expected to pass 10m in 2012 Focus on high density metropolitan areas Competition: Boost Mobile, TracFone, and new services from AT&T and Verizon MetroPCS 5 Year Performance MetroPCS 2 Year Performance MetroPCS Went public in 2007 near S&P 500 peak Stock took a hit when economy turned sour Has outperformed market in last 2 years during market recovery MetroPCS ROE Absolute: MetroPCS ROE Relative to Sector: MetroPCS EPS MetroPCS EPS Growth Relative to S&P 500 MetroPCS EBITDA Margin Relative to S&P 500 MetroPCS Positives: Strong, steady growth projected We expect ROE to outpace sector $2.2B (23%) of Assets made up of Cash and Short Term Assets (Sector Average is 4%) Considered a top candidate for M&A deal Risks: Increasing competition could squeeze margins New rebate program to attract new customers Government regulation and spectrum limits MetroPCS Valuation Multiples MetroPCS DCF Model MetroPCS Price Sensitivity Analysis In line with expert 1 year target estimate of $13.13 MetroPCS Technical Analysis Recommendations AT&T NII Holdings Total Current SIM Weight 1.97% 1.56% 3.53% Recommended SIM Weight 0.00% 1.56% 1.56% Consider adding MetroPCS in future Questions? Appendix T DCF Appendix NIHD DCF Year 2011E Revenue 6,719 2012E 7,727 % Growth 2013E 8,423 15.0% Operating Income 831 Operating Margin 970 12.4% Interest and Other 288 Interest % of Sales 12.6% 8.8% Taxes 343 Tax Rate 199 % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex 12.0% 12.0% 12.0% 12.0% 1,179 8.0% 201 36.0% 337 5.5% 1,769 12.0% 8.0% 36.0% 317 14,738 1,118 190 2021E 6.0% 1,676 1,054 8.0% 36.0% 296 13,970 1,581 178 2020E 6.5% 12.0% 8.0% 36.0% 275 13,179 990 167 2019E 7.0% 1,485 925 8.0% 36.0% 255 12,374 1,388 155 2018E 7.5% 12.0% 8.0% 36.0% 270 11,565 861 143 2017E 8.0% 1,291 797 8.0% 36.0% 433 10,758 1,195 152 2016E 8.5% 12.6% 7.0% 36.0% 9,961 734 243 292 % Growth Add Depreciation/Amort 15.1% 6.6% 2015E 9.0% 1,157 592 164 36.0% Net Income 9,181 9.0% 1,268 514 2014E 8.0% 212 36.0% 358 36.0% 377 46.6% 48.2% -37.5% -5.7% 8.0% 7.5% 7.0% 6.5% 6.0% 5.5% 786 943 1,036 1,102 1,195 1,291 1,388 1,485 1,581 1,676 1,769 11.7% 12.2% 12.3% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% 206 138 95 46 (40) (43) (46) (49) (53) (56) (59) 3.1% 1.8% 1.1% 0.5% -0.4% -0.4% -0.4% -0.4% -0.4% -0.4% -0.4% 800 896 943 1,102 1,195 1,291 1,388 1,485 1,581 1,676 1,769 Capex % of sales 11.9% 11.6% 11.2% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% 12.0% Free Cash Flow 391 476 621 316 215 232 250 267 285 302 318 21.7% 30.3% -49.0% -32.0% 8.0% 7.5% 7.0% 6.5% 6.0% 5.5% Terminal Value 4,393 Free Cash Yield 7.25% Terminal P/E 11.6 % Growth NPV of Cash Flows 2,060 60% NPV of terminal value 1,394 40% Projected Equity Value 3,453 100% Free Cash Flow Yield 12.51% Current P/E 15.7 Projected P/E 17.3 Current EV/EBITDA 3.9 Projected EV/EBITDA EBIDTA/share 4.1 9.2 Shares Outstanding 175 Current Price Implied equity value/share Upside/(Downside) to DCF Debt Cash $ $ Terminal EV/EBITDA 17.88 19.73 10.4% 4,870 1,770 17.88 22.14 23.8% 2.1 Appendix PCS DCF