Document 11015485

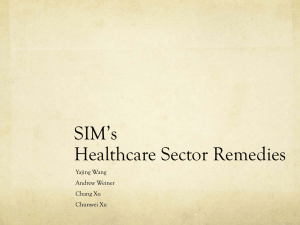

advertisement

HEALTHCARE SECTOR PORTFOLIO COMPARISON S&P500 22.5% SIM Portfolio Allocation - % 20.0% 17.5% 1.8% 15.0% Overweight 12.5% 10.0% 7.5% 5.0% 2.5% 0.0% Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up HEALTHCARE SECTOR RECOMMENDATION Recommendation – Hold Healthcare Sector at current weight. Current Weights: S&P -11.7%, SIM-13.5%, 1.8% Overweight Positives Risks • Big Problems Remain • Cancer • Alzheimer's • Life Expectancy and Age Demographics are Growing • Legislation • Patents / Generics • Medicaid / Medicare • Don’t Expect Large Sector Growth Industries to Overweight Industries to Underweight • Generics • Hospitals • Medical Practitioners Overview Amgen Gilead Sciences •Diagnostic Substances •Medical Laboratories & Research Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up SIM HOLDINGS & RECOMMENDATION SUMMARY AMGN Market Value JNJ 414,373 441,597 PFE TEVA WLP GILD 306,020 370,148 0 0 % of SIM 3.6% 3.9% 2.7% 3.27% 0% 0% Current Price 67.63 64.46 21.28 44.59 66.11 45.26 Target Price 77.20 74.00 28.01 62.95 94 54.5 Upside 14.1% 14.8% 31.6% 41.1% 25.5% 20.4% Recommendation SELL SELL BUY BUY BUY BUY BP Change -360 -390 +60 +23 +347 +320 0% 0% 3.3% 3.5% 3.47% 3.2% Ending Allocation Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up AMEGEN - OVERVIEW • Amgen discovers, develops, manufactures, and delivers innovative human therapeutics. • Helping millions of people around the world in the fight against cancer, kidney disease, rheumatoid arthritis, bone disease, and other serious illnesses. Used to treat anemia (a lower than normal number of red blood cells) in people with chronic kidney failure (condition in which the kidneys slowly and permanently stop working over a period of time). Overview Amgen Used to decrease the chance of infection in people who have certain types of cancer and are receiving chemotherapy medications that may decrease the number of neutrophils, in people who are undergoing bone marrow transplants, and in people who have severe chronic neutropenia. Gilead Sciences Pfizer Used to treat anemia (a lower than normal number of red blood cells) in people with chronic kidney failure (condition in which the kidneys slowly and permanently stop working over a period of time). Teva Johnson & Johnson Used alone or with other medications to relieve the symptoms of certain autoimmune disorders (conditions in which the immune system attacks healthy parts of the body and causes pain, swelling, and damage). WellPoint Inc. Wrap Up AMGEN – CATALYST AND RISKS Catalysts Risks • Strong presence in Europe. • Sales and cash flow support R&D. • 45 products in development with 4 (AMG-785, XGEVA, AMG145, Ganitumab) that can produce significant sales. • Holds an enormous amount of cash. Overview Amgen Gilead Sciences Pfizer • Trying to replace revenue with new products. • There survivability depends on there ability to get drugs approved. • All 4 of their large revenue producing drugs patents end shortly: Enbrel (2012), Neupogen (2013), Epogen (2013), Arnesp(2014). • Various Healthcare regulation. Teva Johnson & Johnson WellPoint Inc. Wrap Up AMEGEN – FINANCIAL OVERVIEW Current Price 67.73 1yr Target Estimate 70.95 52wk Range 47.66 - 70.00 Volume 3,231,006 Market Cap 53.91B Enterprise Value 54.70B Trailing P/E 16.76 Forward P/E 10.08 Return on Assets 7.16% Return on Equity 17.14% 52-Week Change 31.95% Shares Outstanding 796.00M Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up AMGEN – FINANCIAL TRENDS 19000 17000 15000 13000 11000 9000 7000 5000 3000 1000 7 Net Sales Cost of Sales R&D EPSBasic 5 4 EPSDiluted 3 2 ROE Trend Cash & Equiv 6 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up AMGEN – RATIO ANALYSIS Current Price: $67.73 Absolute Valuation P/Forward E High 42.6 Low 10.0 Median 16.5 Current 11.2 Your Target Multiple 15 P/S 16.4 3.2 6.5 3.4 5 19.4 97.00 P/B 12 2 3.7 2.4 2.8 34.8 93.96 31.62 7.13 12.49 10.01 13 6.7 87.10 41.6 7.8 14.1 12.7 15 4.0 60.00 P/EBITDA P/CF Targets 5.2 Target Price 78.45 Amgen’s current multiples are lower than its historical values. The target prices are higher than the current price. Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Amgen- DCF Terminal Discount Rate = 10.6% Terminal FCF Growth = 3.6% Year 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Revenue % Growth 15,453 16,009 3.6% 16,586 3.6% 17,183 3.6% 17,801 3.6% 18,442 3.6% 19,106 3.6% 19,794 3.6% 20,506 3.6% 21,245 3.6% 22,010 3.6% Operating Income Operating Margin 4,312 27.9% 4,771 29.8% 5,357 32.3% 5,155 30.0% 5,340 30.0% 5,533 30.0% 5,732 30.0% 5,938 30.0% 6,152 30.0% 6,373 30.0% 6,603 30.0% Interest and Other Interest % of Sales 142 0.9% 265 1.5% 174 1.2% 198 2.1% 303 1.7% 166 0.9% 248 1.3% 297 1.5% 226 1.1% 297 1.4% 330 1.5% 487 14.3% 653 14.5% 752 14.5% 719 14.5% 730 14.5% 778 14.5% 795 14.5% 818 14.5% 859 14.5% 881 14.5% 910 14.5% Net Income % Growth 3,683 3,852 4.6% 4,432 15.0% 4,238 -4.4% 4,307 1.6% 4,588 6.5% 4,688 2.2% 4,823 2.9% 5,067 5.1% 5,195 2.5% 5,363 3.2% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 1,060 6.9% (581) -3.8% 600 3.9% 1,041 6.5% (496) -3.1% 544 3.4% 979 5.9% (580) -3.5% 498 3.0% 894 5.2% 34 0.2% 378 2.2% 819 4.6% 285 1.6% 445 2.5% 701 3.8% 369 2.0% 479 2.6% 592 3.1% 439 2.3% 439 2.3% 495 2.5% 396 2.0% 435 2.2% 349 1.7% 472 2.3% 287 1.4% 212 1.0% 552 2.6% 191 0.9% 0 0.0% 550 2.5% 0 0.0% Free Cash Flow % Growth 3,562 3,852 8.1% 4,332 12.5% 4,788 10.5% 4,966 3.7% 5,179 4.3% 5,281 2.0% 5,279 0.0% 5,600 6.1% 5,769 3.0% 5,913 2.5% Taxes Tax Rate NPV of Cash Flows 29,494 48% NPV of TV 31,956 52% Projected EV 61,450 100% Free Cash Flow Yield Terminal Value Free Cash Yield 6.60% Current P/E Projected P/E 14.6 16.7 14.0 16.0 12.2 13.9 Current EV/EBITDA Projected EV/EBITDA 9.9 11.3 9.1 10.4 8.4 9.5 Shares Outstanding Current Price Implied EV/share Upside/(Downside) to DCF $ $ 796 67.63 77.20 14.1% Amgen Gilead Sciences Pfizer Teva 87,518 6.76% Terminal P/E 16.3 Terminal EV/EBITDA 13.1 Johnson & Johnson GILEAD SCIENCES - OVERVIEW • Gilead Sciences, Inc., a biopharmaceutical company, is engaged in the discovery, development, and commercialization of therapeutics for the treatment of human immunodeficiency virus (HIV)/AIDS, liver disease, respiratory and cardiovascular/metabolic diseases. •Its products include Truvada, Viread, Atripla, Complera and Emtriva for the treatment of HIV infection in adults. • Gilead’s strategy of creating fixed-dose combinations of existing HIV/AIDS drugs has been an enormous success. Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up GILEAD SCIENCES – CATALYST AND RISKS Catalysts Risks • Deep HIV Pipeline. • Great operating leverage and generates huge amounts of cash each year. Overview Amgen Gilead Sciences Pfizer • All of Gilead’s key products have generic companies seeking to launch competitive products. • All of the companies top ten product lines have their patents end within 10 years. Teva Johnson & Johnson WellPoint Inc. Wrap Up GILEAD SCIENCES – FINANCIAL OVERVIEW Current Price 45.26 1yr Target Estimate 57.70 52wk Range 34.45 - 56.50 Volume 6,876,617 Market Cap 34.09B Enterprise Value 32.04B Trailing P/E 12.75 Forward P/E 10.36 Return on Assets 16.72% Return on Equity 42.94% 52-Week Change 16.11% Shares Outstanding 753.11M Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up GILEAD SCIENCES – ROE Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up GILEAD SCIENCES – PRODUCT LINES Atripla Truvada Viread Hepsera Emtriva Complera AmBisome Letairis Ranexa Other products Total sales 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 205,729 903,381 1,572,455 2,382,113 2,926,579 3,224,518 3,444,108 3,643,866 3,516,331 3,614,788 3,849,749 3,945,993 3,610,583 3,664,742 3,829,656 3,117,340 1,194,292 1,589,229 2,106,687 2,489,682 2,649,908 2,875,141 3,101,990 3,499,044 3,890,937 4,497,923 4,916,230 5,157,126 4,749,713 4,004,008 3,875,880 3,972,777 689,356 613,169 621,187 667,510 732,240 737,867 728,644 745,402 809,507 849,982 871,232 911,309 882,147 868,915 908,885 984,322 230,531 302,722 341,023 271,595 200,592 144,679 102,722 84,232 60,647 40,027 28,419 22,167 18,842 15,545 12,358 9,528 36,393 31,493 31,080 27,974 27,679 28,764 28,908 29,631 29,927 29,949 25,457 22,275 21,562 21,885 22,651 18,121 0 0 0 0 0 38,747 163,443 254,153 350,223 428,673 503,691 551,793 582,142 596,696 605,646 514,194 223,031 262,571 289,651 298,597 305,856 330,156 354,125 376,258 396,952 410,846 375,924 349,609 304,160 243,328 172,763 125,253 0 21,020 112,855 183,949 240,279 293,426 344,189 398,054 447,811 403,030 340,560 269,043 193,711 169,497 156,785 140,322 0 0 0 131,062 239,832 320,004 397,829 460,686 524,721 560,402 612,520 643,758 661,784 556,560 443,578 382,364 8,865 9,524 9,858 16,829 66,956 109,057 130,127 189,985 251,901 339,261 768,425 1,370,487 2,062,583 2,732,922 3,356,028 4,144,695 2,588,197 3,733,109 5,084,796 6,469,311 7,389,921 8,102,359 8,796,083 9,681,312 10,278,958 11,174,882 12,292,208 13,243,559 13,087,226 12,874,097 13,384,229 13,408,915 = US Patent Expiring = EUR Patent Expiring Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up GILEAD SCIENCES – RATIO ANALYSIS Current Price: $45.19 Absolute Valuation P/Forward E High 94.4 Low 8.9 Median 25.7 Current 12.2 Your Target Multiple 15 P/S 32.9 3.8 12.5 4.2 11 4.1 45.06 P/B 23.6 4.2 11.4 6 10 7.8 78.00 P/EBITDA 131.1 7.2 21.0 8.3 15 6.1 91.80 P/CF 135.4 8.3 30.4 12.2 16 4.9 78.40 Targets 4.4 Target Price 66.30 Gilead Science’s current multiples are lower than its historical values. The target prices are higher than the current price. Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Terminal Discount Rate = 11.0% Gilead Sciences - DCF Terminal FCF Growth = 2.8% Year 2011 2012E 8,102,359 8,796,083 Revenue % Growth Operating Income Operating Margin Interest and Other Tax Rate Net Income 2018E 2019E 2020E 9,681,312 10,278,958 11,174,882 12,292,208 13,243,559 13,087,226 12,874,097 13,384,229 13,408,915 7.7% -1.2% -1.6% 4.0% 0.2% 3,506,815 3,191,219 3,631,460 3,854,609 4,402,903 5,101,266 5,774,192 5,509,722 5,149,639 5,515,641 5,425,247 43.3% 40.1% 38.6% 37.5% 39.4% 41.5% 43.6% 42.1% 40.0% 41.2% 40.5% 138,837 148,654 102,622 119,236 156,448 159,799 225,141 248,657 231,734 240,916 214,543 1.7% 1.7% 1.1% 1.2% 1.4% 1.3% 1.7% 1.9% 1.8% 1.8% 1.6% 861,945 976,580 1,078,910 1,109,030 836,552 894,406 1,059,869 973,297 949,156 996,923 1,036,930 12.0% 17.7% 18.7% 19.8% 19.7% 18.1% 19.1% 18.5% 19.3% 18.9% 19.9% 2,506,033 2,065,985 2,449,928 2,626,343 3,409,903 4,047,062 4,489,182 4,287,768 3,968,749 4,277,802 4,173,774 -17.6% 18.6% 7.2% 29.8% 18.7% 10.9% -4.5% -7.4% 7.8% -2.4% 250,000 263,882 261,395 246,695 245,847 245,844 211,897 143,959 102,993 53,537 - 3.1% 3.0% 2.7% 2.4% 2.2% 2.0% 1.6% 1.1% 0.8% 0.4% 0.0% 113,557 615,726 484,066 462,553 122,924 110,630 225,141 327,181 411,971 468,448 509,539 1.4% 7.0% 5.0% 4.5% 1.1% 0.9% 1.7% 2.5% 3.2% 3.5% 3.8% 29,000 26,388 58,088 41,116 33,525 61,461 79,461 52,349 64,370 26,768 - 0.3% 0.6% 0.4% 0.3% 0.5% 0.6% 0.4% 0.5% 0.2% 0.0% 2,840,590 2,919,205 3,137,301 3,294,476 3,745,150 4,342,075 4,846,759 4,706,559 4,419,343 4,773,018 4,683,313 2.8% 7.5% 5.0% 13.7% 15.9% 11.6% -2.9% -6.1% 8.0% -1.9% % Growth NPV of Cash Flows 22,920,147 53% Terminal Value NPV of terminal value 20,677,721 47% Free Cash Yield Projected Equity Value 43,597,868 100% Free Cash Flow Yield 8.34% Current P/E 13.6 Projected P/E 17.4 Current EV/EBITDA 10.9 13.4 Projected EV/EBITDA Shares Outstanding 16.5 21.1 11.9 14.6 58,712,754 7.98% Terminal P/E 14.1 Terminal EV/EBITDA 12.1 13.9 17.8 10.5 13.0 753,110 Current Price $ 45.20 Implied equity value/share $ 57.89 Upside/(Downside) to DCF 2021E 10.0% Capex % of sales Free Cash Flow 2017E 8.7% % of Sales Subtract Cap Ex 2016E 6.2% % of Sales Plus/(minus) Changes WC 2015E 10.1% % Growth Add Depreciation/Amort 2014E 8.6% Interest % of Sales Taxes 2013E 28.1% Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. GILEAD SCIENCES – SENSITIVITY ANALYSIS Terminal Growth Rate Discount Rate Overview 10.50% 10.75% 11.00% 11.25% 2.25% 59.55 57.74 56.03 54.41 2.50% 60.51 58.62 56.84 55.17 2.75% 61.53 59.56 57.71 55.97 3.00% 62.62 60.56 58.63 56.82 3.25% 63.78 61.63 59.61 57.72 Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up PFIZER OVERVIEW What does the company do? A research-based, global biopharm co, which applies science and its global resources to improve health and well-being at every stage of life. It is diversified global health care portfolio includes human and animal biologic and small molecule medicines and vaccines, as well as nutritional prods and many consumer health care products. Segments: Biopharm Biopharm includes the Primary Care, Specialty Care, Established Products Emerging Markets and Oncology customer-focused units. Diversified. Diversified includes Animal Health products that prevent and treat diseases in livestock and companion animals, and Consumer Healthcare products. Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up PFIZER OVERVIEW (CONTINUE) Market Cap 162.81B Shares Outstanding 769M Average Daily Volume 39M Profit Margin 14.85% Revenue 67.42B Div. Yield 4.20% Beta 0.77 P/E 16.59 EPS 1.28 52wk Range 16.63-22.17 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up PFIZER: RISKS & CATALYSTS Risks • Increased regulation pressure • Government might increase controls on buying and price of healthcare products. •Expiration of patents •Patent protection on “Viagra” & “Detrol” will end on March 2012 •Drug approvals •Many products pipelines are pending to FDA to get approval. It is time consuming and expensive •High competition Catalysts • Baby boomers star to enter in “old age” stages •They also dependant on use of prescription to treat health problems •Revenue diversification •Revenue distribution across many business segments and countries •Potential Pipelines •14 drugs in late stage pending to approval Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up PFIZER: FINANCIAL ANALYSIS 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 - EPS-diluted 3.00 2.50 Net Sales 2.00 Cost of Sales 1.00 Cash & Equiv 2006 2007 2008 2009 2010 0.50 2005 2006 2007 2008 2009 2010 ROE 2005 1.50 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up PFIZER: RATIO VALUATION Absolute Valuation High Low Median Current Target Multiple P/Forward E 26.6 5.9 11.9 9.8 11.9 2.2 26.30 P/S 8.8 1.7 3.6 2.4 3.6 8.1 29.30 P/B 14.3 1.3 2.6 1.9 2.6 11.4 29.72 P/EBITDA 33.2 5.4 9.9 5.6 9.9 3.9 38.41 P/CF 28.9 3.9 8.9 6.4 8.9 3.4 30.17 Johnson & Johnson WellPoint Inc. Wrap Up Target Target Price Target Price: $30 Overview Amgen Gilead Sciences Pfizer Teva Terminal Discount Rate Terminal Growth Rate 11.0% 2.5% Year 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Revenue 67,339 63,557 63,146 64,409 65,697 67,011 68,352 69,719 71,113 72,535 73,986 % Growth Operating Income Operating Margin Interest and Other Interest % of Sales Taxes Tax Rate Net Income -5.6% 18,186 23,361 23,644 % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 2.0% 2.0% 2.0% 23,831 24,308 24,794 25,290 2.0% 2.0% 2.0% 2.0% 25,796 26,312 26,838 27,375 36.8% 37.4% 37.0% 37.0% 37.0% 37.0% 37.0% 37.0% 37.0% 37.0% - - - - - - - - - - - 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 546 6,074 5,937 5,958 6,077 6,199 6,323 6,449 6,578 6,710 6,844 3.0% 26.0% 25.1% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 25.0% 17,611 17,270 17,683 17,814 18,171 18,536 18,908 19,287 19,674 20,069 20,471 -1.9% 2.4% 0.7% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% 9,000 1,525 1,452 1,417 1,380 1,340 1,367 1,325 1,351 1,306 1,258 13.4% 2.4% 2.3% 2.2% 2.1% 2.0% 2.0% 1.9% 1.9% 1.8% 1.7% (1,527) 1,152 125 644 657 670 684 697 711 725 740 -2.3% 1.8% 0.2% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1,513 1,505 1,452 1,417 1,380 1,340 1,367 1,325 1,351 1,306 1,258 2.2% 2.4% 2.3% 2.2% 2.1% 2.0% 2.0% 1.9% 1.9% 1.8% 1.7% 23,570 18,442 17,808 % Growth Overview 2.0% 27.0% % Growth Add Depreciation/Amort -0.6% -21.8% Amgen -3.4% 18,458 18,828 19,206 19,591 3.6% Gilead Sciences 2.0% 2.0% Pfizer 2.0% PFIZER: DCF Current Price $ 21.28 Implied equity value/share $ 26.02 Upside/(Downside) to DCF 22.3% 19,984 20,385 20,794 21,211 2.0% Teva 2.0% 2.0% 2.0% Johnson & Johnson WellPoint Inc. Wrap Up PFIZER DCF SENSITIVITY ANALYSIS Terminal Growth Rate Discount Rate Overview 10.25% 10.50% 10.75% 11.00% 1.50% $26.81 $26.06 $25.35 $24.68 1.75% $27.19 $26.41 $25.67 $24.98 2.00% $27.59 $26.78 $26.02 $25.30 2.25% $28.02 $27.18 $26.38 $25.63 2.50% $28.48 $27.60 $26.77 $25.99 Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up PFIZER OVERALL VALUATION VALUATION PRICE WEIGHT MULTIPLES $30 50% DCF $26.02 50% WEIGHTED AVG. $28.01 CURRENT PRICE $21.28 IMPLIED EQUITY VALUE $28.01 UPSIDE Overview Amgen Gilead Sciences 31.63% Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up TEVA OVERVIEW What does the company do? Teva Pharmaceutical Industries Limited, a pharmaceutical company, develops, produces, and markets generic drugs; and proprietary branded pharmaceuticals in various therapeutic categories and active pharmaceutical ingredients worldwide. It holds 14.4% of generic pharmaceutical market Segments: Generic drugs Brand-named drugs Special respiratory Active pharmaceutical ingredients Women’s health Biosimilars Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up TEVA OVERVIEW (CONTINUE) Market Cap 39.37B Profit Margin 15.07% Revenue 18.31B Div. Yield 1.80% Beta 0.37 Trailing P/E 14.43 Forward P/E 7.44 EPS 3.09 52wk Range 44.44-45.35 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up TEVA: RISKS & CATALYSTS Risks • Governmental interference and regulation • Increasing corporate taxes • Limitations of the growth of generic drugs •Generics can only grow as brand-named drugs lose patent protection •High competition •Particularly in India and China Catalysts • Baby boomers star to enter in “old age” stages •They also dependant on use of prescription to treat health problems • Development on non-infringing products • Production will reduce cost • Multiple sclerosis drug • Copaxone is expected to peak in sales in 2012 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up TEVA: FINANCIAL ANALYSIS 18,000 EPS diluted 16,000 14,000 4.00 12,000 Net sales Cost of Sales Cash & Equiv 10,000 8,000 6,000 4,000 2,000 3.00 2.00 1.00 2005 2006 2007 2008 2009 2007 2008 2009 2010 2010 ROE 2005 2006 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up TEVA: RATIO VALUATION Absolute Valuation High Low Median Current Your Target Multiple Your Target Share Your Target Price P/Forward E 29.2 6.5 17.1 8 13 5.99 77.87 P/S 6.7 2 3.9 2.3 3.2 25.54 81.72 P/B 8.5 1.4 3.1 1.7 2 26.61 53.22 P/EBITDA 29.04 6.89 16.26 8.27 10 5.47 54.70 P/CF 31.8 6.5 15.6 9 11 5.03 55.29 Target Price: $64 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Termina l Discoun t Rate = Termina l FCF Growth = Analyst: Shanshan Xie Date: 02/26/12 Year 2011E Revenue % Growth 18,312 2012E 2013E 21,940 22,599 19.8% 3.0% 2014E 2015E TEVA: DCF 10.7% 3.5% 2016E 2017E 2018E 2019E 2020E 2021E 24,700 27,195 30,486 33,107 36,253 39,914 43,826 48,340 9.3% 10.1% 12.1% 8.6% 9.5% 10.1% 9.8% 10.3% 3,109 17.0% 3,532 16.1% 3,819 16.9% 4,224 17.1% 4,596 16.9% 5,152 16.9% 5,595 6,127 16.9% 16.9% 6,745 16.9% 7,407 16.9% 8,169 16.9% Financial expenses and other Interest % of Sales 153 0.8% 223 1.0% 240 1.1% 445 1.8% 789 2.9% 1,097 3.6% 1,093 1,523 3.3% 4.2% 1,636 4.1% 2,147 4.9% 2,175 4.5% Taxes Tax Rate 127 0.7% 351 1.6% 836 3.7% 208 5.5% 263 6.9% 332 8.2% 419 387 9.3% 8.4% 542 10.6% 515 9.8% 629 10.5% Net Income % Growth 3,666 4,120 12.4% 4,500 9.2% 3,511 -22.0% 3,485 -0.8% 3,662 5.1% 4,024 4,157 9.9% 3.3% 4,507 8.4% 4,684 3.9% 5,305 13.3% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 1,069 5.8% 856 3.9% 972 4.3% 519 2.1% 1,061 3.9% 1,250 4.1% 960 2.9% 1,305 3.6% 1,038 2.6% 1,402 3.2% 1,644 3.4% 597 3.3% 736 4.0% 685 3.1% 851 3.9% 600 2.7% 972 4.3% 371 1.5% 519 2.1% 490 1.8% 1,061 3.9% 366 1.2% 1,250 4.1% 265 0.8% 960 2.9% 109 0.3% 1,305 3.6% (599) -1.5% 1,038 2.6% (351) -0.8% 1,402 3.2% 145 0.3% 1,644 3.4% Free Cash Flow % Growth 4,596 4,810 4.6% 5,100 6.0% 3,882 -23.9% 3,974 2.4% 4,028 1.4% 4,289 6.5% 4,266 -0.5% 3,909 -8.4% 4,333 10.9% 5,450 25.8% Operating Income Operating Margin Overview Amgen Gilead Sciences Pfizer Teva Current Price $ 44.59 Implied equity value/share $ 61.89 Upside/(Downside) to DCF Johnson & Johnson WellPoint Inc. 38.8% Wrap Up TEVA OVERALL VALUATION VALUATION PRICE WEIGHT MULTIPLES $64 50% DCF $61.89 50% WEIGHTED AVG. $62.93 CURRENT PRICE $44.59 IMPLIED EQUITY VALUE $62.95 UPSIDE Overview Amgen Gilead Sciences 41.1% Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Investor Basics Current Price $64.42 1yr Target Estimate $74 52wk Range $57.50 - $68.05 Volume 10,478,532 Market Cap $176.12B Enterprise Value $163.55B Trailing P/E 18.47 Forward P/E 11.87 Return on Assets 10.2% Return on Equity 16.4% 52-Week Change 4.92% Shares Outstanding 2.73B Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Segments $24.1B Overview Amgen Gilead Sciences •Circulatory disease products •Orthopedic joint reconstruction •Surgical products •Diabetes care Pfizer Teva $15.5B Consumer •Anti-infective •Antipsychotic •Contraceptive •Dermatology •Gastrointestinal •Immunology •Neurology •Oncology Medical Devices Pharmaceutical $25.7B Johnson & Johnson •Baby care •Skin Care •Neutrogena, •Aveeno •Wound Care – Bandaid, •Oral Care Listerene WellPoint Inc. Wrap Up Business Drivers Value Drivers Potential Risks •Age Demographics •R&D is 10% of sales ~$6.8B in 2011 •Growing Emerging Markets •Healthcare is growing in other economies. •Consumer Brands are penetrating. Overview Amgen Gilead Sciences Pfizer •Failed / Stalled FDA Approvals •Political Healthcare Reform •Pressure from Generics •Product Recalls •Leadership Transition • Price Pressure from Insurance issuers and government Teva Johnson & Johnson WellPoint Inc. Wrap Up Financials Earnings Statements 2011 Earnings – 14.0B 2013E Earnings – 15.5B 70 Sales to customers Cost of products sold SG&A 60 Dollars - Billions 50 40 30 R&D 20 Interest 10 Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson 2013 2012 2011 2010 2009 2008 2007 2006 0 Net earnings WellPoint Inc. Wrap Up Return on Equity Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Valuation - DCF Valuation - DCF Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Valuation - Ratios Price Overview Upside Current Price $64.42 DCF Projection $70.15 8.9% Ratio Analysis $78.36 21.6% Price Target $74.00 14.9% Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Sum of Parts Synergies could exist between the divisions which would not be captured by this valuation. Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Sell Recommendation Q: Johnson and Johnson looks OK; why sell? A: 1. Two divisions are very similar to other SIM holdings. • • • • • 14.9% Upside 3 Divisions Pool Risk Defensive Stock, β≈0.56 Pharmaceutical ↔ Pfizer Consumer ↔ TEVA 2. DCF is very sensitive to growth and discount rates. 3. Could capture another industry and stock within the sector that has a better upside. Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Investor Basics Current Price $66.11 1yr Target Estimate 52wk Range $56.61 - $81.92 Volume 2,875,844 Market Cap $23.11B Enterprise Value $14.46B Trailing P/E 9.12 Forward P/E 7.79 Return on Assets 5.37% Return on Equity 11.24% 52-Week Change -0.54% Shares Outstanding 349.60M Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Business Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Business Drivers Value Drivers Potential Risks •Aggressively Drives Value-based Healthcare •Age Demographics •Growing Need to administer / Deliver Healthcare •Growing Medical Complexity •New Treatments •Growing Providers •Consulting to Governments and Businesses looking to reduce their cost. Overview Amgen Gilead Sciences Pfizer •Political Reform •Nationalized Healthcare Plan. •Medicare / Medicaid. •End of Life Care $$$ are increasing. Teva Johnson & Johnson WellPoint Inc. Wrap Up Financial Projections Earnings Statements 50 Sales to customers Cost of products sold SG&A 40 R&D 30 Taxes 20 Interest 10 Net earnings 70 Dollars - Billions 60 Overview Amgen Gilead Sciences Pfizer Teva 2013 2012 2011 2010 2009 2008 0 Johnson & Johnson WellPoint Inc. Wrap Up Return on Equity Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Valuation - DCF DCF Valuation Sensitivity Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up Valuation - Ratios Price Overview Amgen Upside Current Price $66.11 DCF Projection $82.3 24.9% Ratio Analysis $84.56 27.5% Price Target $83.00 25.5% Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up RECOMMENDATION SUMMARY AMGN Market Value JNJ 414,373 441,597 PFE TEVA WLP GILD 306,020 370,148 0 0 % of SIM 3.6% 3.9% 2.7% 3.27% 0% 0% Current Price 67.63 64.46 21.28 44.59 66.11 45.26 Target Price 77.20 74.00 28.01 62.95 94 54.5 Upside 14.1% 14.8% 31.6% 41.1% 25.5% 20.4% Recommendation SELL SELL BUY BUY BUY BUY BP Change -360 -390 +60 +23 +347 +320 0% 0% 3.3% 3.5% 3.47% 3.2% Ending Allocation Overview Amgen Gilead Sciences Pfizer Teva Johnson & Johnson WellPoint Inc. Wrap Up