S P R I N G 2 0... Y I J U N G E

advertisement

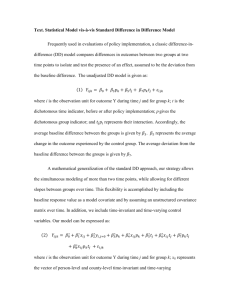

SPRING 2012 YIJUN GE BRET ROSENTHAL YANG SHEN CHENGQIAO SUN GREG VAN WAGNEN YING ZHONG AGENDA Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendations SIZE OF THE SECTOR AND AS A PERCENT OF S&P 500 S&P 500 SIM Information Technology: $2,585,445 S&P: $12,684,881 In Millions Source: http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l-- 16 INDUSTRIES OF THE INFO TECH SECTOR Application Software IT Consulting and Service Communication Equipment Internet Software and Services (GOOG) Computer Hardware (AAPL, HPQ) Office Electronics Computer Storage and Peripherals Semiconductor Equipment Electronic Component (GLW) Semiconductors (INTC) Electronic Equipment Services-Data PROC Electronic MNFRG SVC Systems Software (ORCL) Home Entertainment Software Technology Distribution 5 LARGEST SECTOR COMPANIES Ticker Price Market Cap (Billions) Apple Inc. Microsoft Corporation IBM Google Inc. Oracle Corporation Hewlett-Packard Intel Corning Inc. AAPL $603.00 MSFT $31.98 IBM $206.96 GOOG $614.98 ORCL $29.24 SIM COMPANIES $563.79 $268.66 $238.00 $200.05 $145.47 HPQ INTC GLW $48.92 $141.80 $21.94 $24.74 $28.38 $14.45 Info Tech Sector Performance YTD and QTD Largest Companies in Info Tech Sector Returns YTD QTD Info Tech 19.83% -1.08% S&P 500 11.59% -0.36% Source: http://www.finance.google.com http://www.standardandpoors.com/indices/sp-500/en/us/?indexId=spusa-500-usduf--p-us-l-- PHASE OF THE LIFE CYCLE Mature with continued growth potential BUSINESS CYCLE - CYCLICAL Pulling out of the recession Outperforming the market Source: Baseline BUSINESS CYCLE - CYCLICAL Similar moving trend with Real GDP Closely related to the US economy Source: Baseline BUSINESS ANALYSIS Economic Environment Nature of economy Level of disposable income GDP Global economic conditions Users and Geography All of the modern world Global Businesses and Individuals FIVE FORCES ANALYSIS Threat of new entrants – Medium High barriers to entry: capital investment, R&D costs Lower brand loyalty New idea creates huge growth Power of Suppliers – Low Few significantly dominating suppliers Low switching cost Competition between suppliers to sell to manufacturers FIVE FORCES ANALYSIS Power of buyers (customers) – Medium Product differentiating and brand loyalty Low switching cost for individual buyers Harder for companies to switch off windows or servers Threat of substitutes – High Continuing innovation keeps pushing out new products Windows or Android base makes conversion easy Industry Rivalry – High Companies with comparable size and growth strategy Product innovation Price competition PROFITABILITY AND PRICING High profit margin Products with innovative and differentiating features can charge a premium High R&D costs Long term prospective of input and output High industry concentration Key players within each industry Example: Computer Hardware (Apple, HP, Dell), System Software (Oracle, IBM) CONSUMER PRICE INDEX Correlation with CPI Historical correlation with a recent divergence Source: Baseline DISPOSABLE INCOME Strong historical correlation Technology is a luxury good Source: Baseline CONSUMER SPENDING: COMPUTERS & SOFTWARE Strong correlation Circular reasoning Source: Baseline FINANCIAL ANALYSIS – INFORMATION TECHNOLOGY Revenue per Share Revenue Per Share 2010 2011 2012 250 2007 2008 2009 Mar 36.43 39.93 34.51 39.50 46.45 50.08 200 Jun 37.45 41.62 35.16 42.29 48.78 52.61 150 Sep 38.94 40.99 37.02 44.10 49.29 54.02 Dec 42.20 38.95 42.23 48.10 54.93 60.09 100 50 Yr. Yr. to Yr. 155.03 161.50 148.93 173.99 4% -8% 17% 199.46 213.27 15% 7% 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Historical growth trend Continued growth into the future Source: Baseline FINANCIAL ANALYSIS – INFORMATION TECHNOLOGY 40.00 35.00 Earnings Per Share 2007 2008 2009 Earnings per share 2010 2011 2012 Mar 4.20 4.75 3.33 6.03 7.59 8.66 Jun 4.19 4.91 4.08 6.55 8.15 8.62 Sep 4.78 5.07 4.94 7.21 8.03 9.11 Dec 5.73 4.40 6.86 8.80 9.84 11.17 30.00 25.00 20.00 15.00 10.00 5.00 Yr. Yr.to Yr. 18.91 19.12 1% 19.21 28.59 0% 49% 33.62 36.44 18% 8% 0.00 Earnings per share Rapid growth Continued growth into the future at a normalized pace Source: Baseline FINANCIAL ANALYSIS – INFORMATION TECHNOLOGY Margins relative to S&P 500 2.0 1.8 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0.0 2003 2004 2005 2006 EBITDA Margin 2007 2008 2009 Net Profit Margin 2010 2011 ROE Outpacing S&P 500 Growing margins over past 10 years Source: Baseline FINANCIAL ANALYSIS – COMPUTER HARDWARE Margins Relative to Sector 1.80 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.20 2003 2004 2005 2006 EBITDA Margin 2007 2008 Net Profit Margin 2009 2010 2011 ROE Consistent with slight growth recently Sustained consistency into the future Source: Baseline FINANCIAL ANALYSIS – SYSTEM SOFTWARE Margins relative to Sector 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 2003 2004 2005 2006 EBITDA Margin 2007 2008 Net Profit Margin 2009 2010 2011 ROE Historic al down trend Projected leveling off compared to the sector Source: Baseline FINANCIAL ANALYSIS – SEMICONDUCTORS Margins relative to Sector 2.00 1.80 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.20 0.00 2003 2004 2005 2006 EBITDA 2007 Net profit margin 2008 2009 2010 2011 ROE Decreasing historically Slight growth recently that will level off in the future Source: Baseline FINANCIAL ANALYSIS – INTERNET SOFTWARE & SERVICE Margins relative to Sector 2.50 2.00 1.50 1.00 0.50 0.00 2003 2004 2005 2006 EBITDA 2007 Net profit margin 2008 2009 2010 2011 ROE Historically consistent Expecting consistent margins into the future Source: Baseline SECTOR VALUATION Absolute Basis High Low Median Current P/Trailing E 59.3 11.1 22.1 14.3 P/Forward E 47.1 11.3 20.1 14 P/B 4.8 2.3 3.9 3.5 P/S 3.3 1.3 2.5 2.4 P/CF 23.1 8.2 14.1 11.3 Relative to SP500 High Low Median Current P/Trailing E 2.4 0.91 1.3 1.1 P/Forward E 2.1 0.89 1.3 1.1 P/B 1.8 1 1.4 1.6 P/S 2.1 1.5 1.8 1.9 P/CF 1.8 1.1 1.4 1.2 Below median and near lows High potential upside Source: Baseline INDUSTRY VALUATION – P / FORWARD E Absolute Basis High Low Median Current Semiconductors (INTC) 422.1 9.1 20.8 13.9 27.4 10 18.1 11.6 184.5 13.7 33 15.2 Electronic Component (GLW) 19.3 7.9 11.3 12.1 System Software (ORCL) 30.9 9.8 18.4 12.1 Computer Hardware (APPL, HPQ) Internet Software & Service (GOOG) Relative to SP500 High Low Median Current Semiconductors (INTC) 34.7 0.73 1.3 1 Computer Hardware (APPL, HPQ) 1.3 0.78 1.1 0.85 Internet Software & Service (GOOG) 8.1 1.1 2.2 1.1 Electronic Component (GLW) 1.4 0.67 0.77 0.88 System Software (ORCL) 1.7 0.78 1.2 0.88 Electronic Components are above median All others below average and near lows Source: Baseline INDUSTRY VALUATION – PRICE / SALES Absolute Basis High Low Median Current 7.3 1.6 3.3 2.5 2 0.9 1.5 2 Internet Software & Service (GOOG) 24.4 2.8 7.3 4.1 Electronic Component (GLW) 5.1 1.7 3.8 2.8 System Software (ORCL) 9.7 2.2 4.9 3.2 Semiconductors (INTC) Computer Hardware (APPL, HPQ) Relative to SP500 High Low Median Current Semiconductors (INTC) 4.7 1.9 2.5 2 Computer Hardware (APPL, HPQ) 1.6 0.8 1 1.6 15.5 3.1 4.8 3.2 4 1.6 2.6 2.2 6.4 2.3 3.3 2.5 Internet Software & Service (GOOG) Electronic Component (GLW) System Software (ORCL) Computer Hardware is at the high All others below average and near lows Source: Baseline TECHNICAL ANALYSIS TA on our stocks in the Information Technology Sector Weekly P&F Point & Figure View $SPT S&P 500 Information Technology Sector Index (EOD) Daily P&F $SPT Weekly View $SPT Daily View $SPT S&P 500 Information Technology Sector Index (EOD) Other Important Information Technology Benchmarks to note: $XIT Information Technology Index AMEX IXN iShares S&P Global Information Technology Sector VITAX Vanguard Information Technology Fund Fund INDIVIDUAL STOCK PERFORMANCES CHARTED WITH S&P INFO TECH SECTOR INFO TECH SECTOR RECOMMENDATION We recommend remaining overweight in the sector relative to the S&P 500 Positives Risks Moore’s Law Apple (Can they keep this up?) Innovative Technology Company Maturity Continued Product Growth Europe Apocalypse / U.S. DEBT Industry Overweight Internet Software and Services because of high profit margins and attractive financial ratios. (GOOG) Underweight Computer Hardware because ratios are at 10 year highs and there has been huge growth. Comfortable with current weighting of the three other industries in Info Tech sector.