The Industrials Sector The Ohio State University SIM Program

advertisement

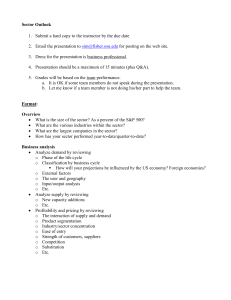

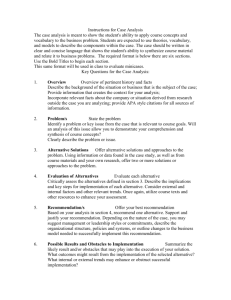

The Industrials Sector The Ohio State University SIM Program Analysts Company Name Contact information Danaher Nicole Heffle heffle.1@osu.edu Joy Global Dun Hou hou_49@fisher.osu.edu Waste Connections Meng Jea Joo joo.50@osu.edu Caterpillar Jingyuan Huang huang.1039@osu.edu Agenda Overview – Industrials Sector – Class Recommendation Review – Current SIM Holdings – Industrials Stock Recommendation Stock – Valuation & Analysis Conclusion & Recommendation Overview of the Sector Sector Overview Market Cap = $1.428 Trillion Industries Aerospace & Defense Electrical Equipment Air Freight & Logistics Industrial Conglomerates Airlines Machinery Building Products Marine Commercial Services & Supplies Professional Services Construction & Engineering Road & Rail Major Companies GE, United Technologies Corp, 3M, Caterpillar, Beoing Recent Sector Performance Last Year Last Quarter Earnings Per Share Up 8.0% Earnings Per Share Up 5.78% Revenues (% Change) 5.0% Revenues (% Change) 5.65% Current SIM Portfolio Recommendation: + 60 BPS, 10.85% Class Vote: +100 BPS SIM Industrials Holdings Team Recommendation Current SIM Portfolio & Recommendation Security Unit Cost Market Price Quantity Unrealized Gain/Loss % of Assets Recom. Danaher Corp. $51.34 $62.15 6,200 $67,022 3.55 +45 BPS Joy Global - $60.97 Waste Connections $ 33.39 $35.98 10,000 $25,900 3.23 +50 BPS Caterpillar $110.28 $86.97 4,200 $(97,902) 3.70 +50 BPS Currently Not Owned by SIM BUY Stock Analysis Danaher Company Overview Founded in 1969 and is headquartered in Washington, DC Designs, manufactures, and markets professional, medical, industrial, and commercial products and services primarily throughout North America, Europe, Asia, and Australia Operates in 5 Segments 1. Test & Measurement 2. Environmental 3. Dental 4. Life Sciences and Diagnostics 5. Industrial Technologies Maintains growth through external acquisitions Key Statistics Industry: Electronic Equipment Market Cap: $42.55 Billion Current Stock Price (as of March 26): $61.84 52 Week Range: $49.18 – $62.90 Recommendation: BUY 45 basis points Facts about DHR Stock Revenue growth has outpaced the industry average of 2.1% Large financial position with reasonable debt levels Debt-to-equity ratio at 0.28, below industry average Growth in EPS 12.7% improvement in most recent quarter Increase in Net Income Exceeded S&P and Industrial Conglomerates average Currently increased by 10.4% in most recent quarter Expanding profit margins Gross profit margin at 56.30% Net profit martin is 12.67% above industry average Positives vs. Negatives of the Stock Positives Negatives Favorable secular growth 1. Aging population (medical technologies) 2. Water Scarcity (water quality) 3. Environmental Concerns 4. Energy Efficiency As Danaher grows, maintaining their growth will become difficult unless they can identify larger acquisition opportunities Declining Cyclicality Achieve growth both organically and through acquisitions = going well! Growth-oriented products/segments will require more R&D DHR vs. S&P 500 12 months Valuation-Multiples Experts Opinion Analysts Opinion Mean Target $66.59 Median Target $68.50 High Target $77.00 Low Target $56.00 # of Brokers 22 Danaher Recommendation Target Price $67.89 Recommendation BUY 45 BPS 4% of SIM Security Unit Cost Market Price Quantity Unrealized Gain/Loss % of Assets Danaher Corp. $51.34 $62.15 6,200 $67,022 3.55 Joy Global Joy Global Company Overview Over 90 years experience as a global leader in the development, manufacture, distribution and service of underground mining machinery for the extraction of coal and other bedded materials. The world’s second-largest maker of mining equipment 2 lines of business: Underground Mining Machinery & Surface Mining Equipment. Key Driver of Sales: Emerging Markets Major Competitors: Caterpillar Inc, Deere & Company and Komatsu Ltd. Joy Global Financial Analysis 2012 Summary Net sales for 2012 rose to $5.66 billion, a 28.5% increase from 2011 Underground mining machinery sales rose 20.6% Surface mining equipment sales rose 39.7% Operating income rose 27.4% to $1.2 billion Original equipment sales rose 51.8% After-market sales rose 12.7% Joy Global Financial Analysis 2013 First Quarter Earnings Highlights Earnings per share came in at $1.33 versus estimates of $1.14 Revenues were $1.15 billion versus estimates of $1.08 billion Management backed full year estimates for earnings per share of between $5.75 and $6.35 on revenues of $4.9 to $5.2 billion The quarterly dividend was maintained at $0.175 per share Joy Global Stock Dynamic Chart Joy Global DCF Valuation Year 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E Revenue 5,118 5,338 5,780 6,243 6,711 7,181 7,648 8,106 8,512 8,852 % Growth 4.3% Operating Income 954 Operating Margin 18.6% Interest and Other Interest % of Sales Taxes Tax Rate Net Income 19.6% % of Sales 1,459 1,532 18.0% 18.0% 1,593 18.0% 1,641 18.0% (47) (50) (53) (55) (58) (59) -0.7% -0.7% -0.7% -0.7% -0.7% -0.7% 276 303 346 372 390 395 398 422 443 461 475 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 30.0% 645 707 807 867 909 922 929 985 117 4,439 4,777 9,216 11.33% 10.3 14.3 7.2 9.6 107 62.13 86.13 38.6% 14.2% 127 7.5% 125 4.8% 134 1.5% 144 0.7% 153 1,034 6.0% 162 5.0% 170 1,075 4.0% 177 1,107 3.0% 182 2.2% 2.2% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% (124) (248) (125) (126) (126) (124) (122) (106) (89) (68) -2.3% -4.3% -2.0% -1.9% -1.8% -1.6% -1.5% -1.3% -1.0% -0.8% 214 231 218 201 180 153 162 170 177 182 4.0% 534 -29.2% $ $ 18.0% (44) 753 Shares Outstanding 1,377 3.0% -0.7% % Growth Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 19.0% 9,118 (41) 4.0% NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 1,364 4.0% -0.7% 4.5% Free Cash Flow 20.0% 5.0% (38) 205 Capex % of sales 1,342 6.0% -0.7% 230 Subtract Cap Ex 20.5% 6.5% (35) 2.2% Plus/(minus) Changes WC 1,280 7.0% -0.7% 113 % of Sales 20.6% 7.5% (33) 9.6% Add Depreciation/Amort 1,190 8.0% -0.7% % Growth Current Price Implied equity value/share Upside/(Downside) to DCF 1,044 8.3% TERMINAL 2023E 4.0% 530 -0.6% 48% 52% 100% 3.5% 695 31.2% 3.0% 757 8.9% 2.5% 795 5.0% 2.0% 831 4.5% 2.0% 889 2.0% 950 7.0% 6.9% 2.0% 1,005 5.8% Terminal Value Free Cash Yield 9.4 13.0 6.6 8.8 8.2 11.4 5.8 7.8 2.0% 1,054 4.8% 13,564 7.77% Terminal P/E 12.2 Terminal EV/EBITDA 8.0 Joy Global Multiples Valuation Absolute Valuation A. P/Forward E P/S P/B P/EBITDA P/CF High Low B. 36.7 4.1 12.5 27.88 42.3 C. 5.0 0.4 1.5 2.99 4.2 Median Current D. 16.6 1.8 5.6 11.74 15.3 #Your Target Multiple E. 10.1 1.2 2.7 5.16 7.5 Final Target Price: $86.10 Current Price: $60.97 Upside Potential: 41.2% F. 14.5 1.8 4.5 11.74 5.02 *Your Target E, S, B, etc/Share Your Target Price (F x G) G. H. 6.02 47.83 20.16 7.62 15.3 87.29 86.10 90.72 89.46 76.81 Joy Global Recommendation Target Price Recommendation $86.10 BUY Rumors: M&A with GE China Coal Miner Demand to Gain as Power Use Rises Goldman Sachs’ 10 stocks with most upside potential Waste Connections Waste Connections Business Analysis Industry: Waste Management Business Segments Business Line $ Mil. % of Total 1,176 62.1 Disposal & Transfer 525 27.7 E&P Treatment, Disposal & Recovery 62 3.2 Recycling 82 4.3 Intermodal and Other 50 2.7 (233) - 1,662 100 Collection Less: Intercompany Elimination Total Waste Connections Business Analysis About 2 million commercial, industrial, and residential customers in 29 states. Waste Connections Business Analysis Economics Rebound in Housing Expanding Commercial Construction Improved Manufacturing Purchasing Managers Index (PMI) Pros Nationwide demand for Waste Management Threats of Substitute - Low Cons Strong Competition among big players Cyclical to economic condition Waste Connections Business Analysis Waste Connections Business Analysis Waste Connections Business Analysis Release of 10-K Waste Connections Business Analysis Waste Connections Financial Analysis Market Cap: $ 4.5 B Current Stock Price: $ 35.98 52 Week Range: 28.70 – 36.56 2012 Sales: $ 1.66 B 1-Year Sales Growth: 10.38% 2012 Net Income: $159.09 M 1-Year Net Income Growth: (3.72%) Dividends Yield: 1.06% ($0.40) Waste Connections Financial Analysis Waste Connections Financial Analysis Waste Connections Financial Analysis Per Share Data Waste Connections Financial Analysis Profitability Waste Connections Financial Analysis Financial (Capital Structure) Waste Connections Financial Analysis Growth Waste Connections Valuation Analyst: MENG JEA JOO Date: 3/30/2013 Year 2012 Revenue 1,661,618 % Grow th 316,147 Operating Margin 19.0% Interest and Other (51,044) Interest % of Sales -3.1% Taxes 105,443 Tax Rate 39.8% Net Income 159,660 % Grow th 193,584 % of Sales 11.7% Plus/(minus) Changes WC (24,372) % of Sales -1.5% Subtract Cap Ex 153,517 Capex % of sales 9.2% Free Cash Flow 168,432 % Grow th 408,260 1,973,595 2,540,541 4,514,136 3.84% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 27.5 28.3 12.9 13.2 Shares Outstanding 121,824 $ $ 35.98 37.05 3.0% 2,238,935 23,212 0.19 5,076,026 44.1% 3.93% 2014E 2,177,384 12.0% 457,251 2015E 2,395,123 10.0% 526,927 2016E 2,526,854 5.5% 581,177 2017E 2,665,831 5.5% 639,800 2018E 2,812,452 5.5% 703,113 2019E 2,967,137 5.5% 741,784 2020E 3,130,330 5.5% 751,279 2021E 3,286,846 5.0% 755,975 2022E 3,418,320 4.0% 752,030 21.0% 21.0% 22.0% 23.0% 24.0% 25.0% 25.0% 24.0% 23.0% 22.0% (48,602) (54,435) (59,878) (63,171) (66,646) (70,311) (74,178) (78,258) (82,171) (85,458) -2.5% -2.5% -2.5% -2.5% -2.5% -2.5% -2.5% -2.5% -2.5% -2.5% 143,036 39.8% 216,622 233,291 12.0% 27,738 1.4% 204,130 10.5% 248,424 47.5% NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield Debt Cash Cash/share Total Assets Debt/Assets Working Capital % of Growth 1,944,093 35.7% Add Depreciation/Amort 10.3% 4.0% Waste Connections Valuation 2013E 17.0% Operating Income Current Price Implied equity value/share Upside/(Downside) to DCF Terminal Discount Rate = Terminal FCF Growth = 160,200 39.8% 242,616 12.0% 261,286 185,745 39.8% 281,304 15.9% 275,439 206,011 39.8% 311,995 10.9% 290,588 227,943 39.8% 345,211 10.6% 306,571 251,665 39.8% 381,136 10.4% 323,432 265,507 39.8% 402,099 5.5% 341,221 267,660 39.8% 405,360 0.8% 359,988 267,972 39.8% 405,832 0.1% 377,987 39.8% 401,477 -1.1% 393,107 12.0% 11.5% 11.5% 11.5% 11.5% 11.5% 11.5% 11.5% 11.5% (9,332) (9,413) (5,462) (5,762) (6,079) (6,413) (6,766) (6,459) (5,374) -0.4% 228,625 10.5% 255,655 2.9% 44% 56% 100% -0.4% 275,439 11.5% 276,043 8.0% -0.2% 290,588 11.5% 308,942 11.9% -0.2% 306,571 11.5% 341,990 10.7% -0.2% 323,432 11.5% 377,739 10.5% -0.2% 341,221 11.5% 398,514 5.5% -0.2% 359,988 11.5% 401,579 0.8% -0.2% 377,987 11.5% 402,222 0.2% Terminal Value Free Cash Yield 20.2 20.8 10.3 10.5 265,096 18.1 18.6 9.2 9.4 -0.2% 393,107 11.5% 398,473 -0.9% 6,630,593 6.01% Terminal P/E 16.5 Terminal EV/EBITDA 7.7 Waste Connections Recommendation Target Price Recommendation $38.36 BUY Security Unit Cost Waste Connections $ 33.39 50 BPS Market Quantity Price $35.98 10,000 3.73% of SIM Unrealized Gain/Loss % of Assets $25,900 3.23 Caterpillar Inc Overview The company was founded in 1925 and is headquartered in Peoria, Illinois. Caterpillar Inc. manufactures and sells construction and mining equipment, diesel and natural gas engines, financial products and so on. Major Business Segments • Energy & Power Systems • Construction Industries • Resource Industries • Financial Products Rank 46 in FORTUNE 500 List in 2012 Key Statistics Market Cap: $56.10 Billion Current Stock Price: $85.64 (On 4/2/2013) 52 Weeks Range: $78.25 - $109.77 2012’s revenue rose to $65.88 Billion from $60.14 Billion in 2011 2012’s operating profit rose to 8.57 Billion from $7.15 Billion in 2011 P/E Ratio: 10.1 Key Statistics by Segments Construction Industries Sales in 2012 was $19.33 Billion; Drop by $333 Million compare with 2011 Profit in 2012 was $1.79 Billion; Drop by $267 Million compare with 2011 Energy & Power Systems Sales in 2012 was $21.12 Billion; Increased by $1.01 Billion compare with 2011 Profit in 2012 was $3.43 Billion; Increased by $381 Million compare with 2011 Resource Industries Sales in 2012 was $21.16 Billion; Increased by $5.53 Billion compare with 2011 Profit in 2012 was $1.79 Billion; Increased by $984 Million compare with 2011 Financial Products Sales in 2012 was $3.09 Billion; Almost the same compare with 2011 Profit in 2012 was $763 Million; Increased by $176 Million compare with 2011 5-Year Total Return Caterpillar vs. S&P 500 vs. S&P Machinery Index Valuation - Multiples Absolute Valuation High Low Median A. P/Forward E P/S P/B P/EBITDA P/CF B. 40.1 1.7 7.4 15.48 14.2 C. 7.3 .3 2.4 2.23 2.8 D. 12.9 1.2 4.6 7.44 9.7 Current 11.9 .9 3.5 5.36 7.3 E. Final Target Price: $108.9 Current Price: $86.97 Upside Potential: 25% #Your Target Multiple 10.5 1.8 5.2 12.67 8.56 F. *Your Target E, S, B, etc/Share Your Target Price (F x G) G. H. 9.6 50.44 19.67 8.6 14 100.8 90.8 102.3 108.9 119.84 Caterpillar Inc. Recommendation High growth rate for the Energy & Power Systems segment High demand of mining equipment from China Recovering of the World’s economy Caterpillar Inc. Recommendation Target Price $108.9 Recommendation BUY 50 BPS 4% of SIM Security Unit Cost Market Price Quantity Unrealized Gain/Loss % of Assets Caterpillar $110.28 $86.97 4,200 $(97,902) 3.50 Recommendations SIM Industrials Holdings Team Recommendation Current SIM Portfolio & Recommendation Security Unit Cost Market Price Quantity Unrealized Gain/Loss % of Assets Recom. Danaher Corp. $51.34 $62.15 6,200 $67,022 3.55 +45 BPS Joy Global - $59.52 Waste Connections $ 33.39 $35.98 10,000 $25,900 3.23 +50 BPS Caterpillar $110.28 $86.97 4,200 $(97,902) 3.50 +50 BPS Currently Not Owned by SIM BUY Thank You Q&A