SERVICE CORPORATION INTENTIONAL

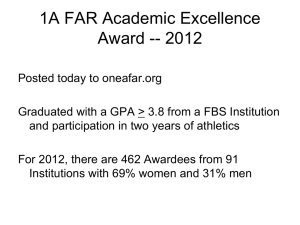

advertisement

BY: SAEED AL DHAHERI CONSUMER DISCRETIONARY SERVICE CORPORATION INTENTIONAL CONSUMER DISCRETIONARY RECAP Definition : • Businesses that sell non-essential goods and services. Such As: • • • • • Retailers Media Consumer services Consumer Durables and Apparel Automobiles and components • Very Cyclical ( attend to perform with economy) 2 investopedia.com PERFORMANCE ² Underperformancined relative to other sectors and the S&P 500 3 RECAP RECOMMENDATION ² The sector is underweighted in SIM portfolio (77) basis point ² Underperform the S&P 500 for the last year ² The Economy need sometime after the recession, it would recover after awhile Final recommendation: ² Hold some for the recovery which is not very far and the same time sell to some in SIM STOCKS IN SIM FOR CONS. DISCR. SCI OVERVIEW ² leading provider of death care products and services in North America. ² Founded in 1962 ² headquartered in Houston, Texas ² owns and operates more than 1,400 funeral homes and 370 Cemeteries in 43 states, eight Canadian provinces, Washington, DC, and Puerto Rico BASIC DATA Market Data Financial Data Market Cap 4.50B Revenue 2.56B Shares 213.53M Revenue Growth 6.10% Dividend Yield 1.60% Gross Margin 21.5% Dividend 0.32 Operating Margin 16.23% Beta 0.86 P/E 35.85 52 Week Price Range $16.81-$21.10 EPS 0.59 STOCK PRICE FOR 1 YEAR BUSINESS DRIVERS ² Drivers ² Aging U.S. Population ² Recovery Economies ² Expanding through acquisition and organic growth ² Risks ² Insider trading Alert ² Uncertainty of Economies COMPETITOR ANALYSIS FY 13 SCI MATW CSV HI Industry Revenue Growth 6.10% 9.40% 7.3% 58% 10.17% EBITDA Margin 23.00% 13.6% 23% 13.36% 20.1% ROE 9% 9.71% 10.6% 16.1% 28.47% Current ratio 0.6 2.2 0.8 1.4 1.3 Debt/Assets 25.6% 30.8% 33.4% 33.2% 38% MULTIPLE VALUATION P/E P/B P/S P/CF P/EBITDA SCI 20.76 42.80 1.51 11.09 6.89 S&P 500 17.27 2.62 1.62 9.33 8.69 Cons. Disc 35.92 4.12 1.30 12.68 9.00 Industry 29.02 4.50 2.40 20.22 7.00 Relative to S&P 500 1.20 16.34 0.93 1.18 0.80 Relative to Cons. Disc 1.03 10.38 1.16 0.87 0.77 Relative to Industry 0.72 9.51 0.63 0.55 0.99 MULTIPLE VALUATION Current Multiple (SCI) MATW CSV HI STEI DTY LN Target Multiple Target Price P/E 23.01 17.58 26.87 21.5 23.93 17.87 21.69 19.87 P/S 1.68 1.19 1.42 1.25 2.13 2.82 2.01 25.20 P/B 3.11 2.05 1.88 3.34 2.48 17.65 5.17 33.07 Average Target Price 26.05 % change from current prices 13.12% RECOMMENDATIONS RECOMMENDATION DCF Target Price Multiple Target Price Weighted Average Price SCI is a BUY Target Price Potential Weight 21.59 6.7% 70% $26.05 13.12% 30% 22.93 8.62 100% STOCK TO SELL • • • • Abercrombie & Fitch Co. 45% decrease Lost its value from SIM 9.05% Sell 131 bps • • • • Tumi 22% decrease Lost its value from SIM 21.5% Sell 131 bps STOCK TO BUY ² Direct TV ² 49% increase ² Buy 200 bps ² Comcast ² 28% increase ² Buy 171bps ² SCI ² 15% Increase ² Buy 115 bps