Consumer Staples

advertisement

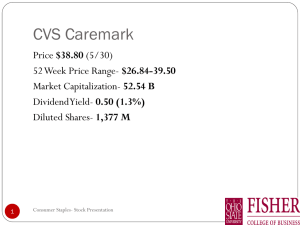

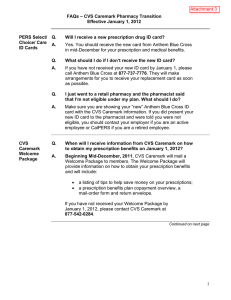

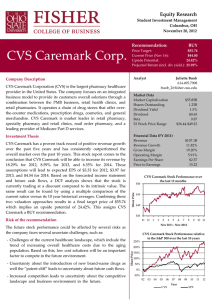

Daiyuan Deng-CVS Botao Duan-Philip Morris Adam Gough-Wal-Mart SECTOR OVERVIEW Cut 145 Basis Points Money better spent elsewhere Economic worries and uncertainty going forward, remain slightly overweight RECOMMENDATION PM CVS WMT DIV ER UPSIDE 3.7% 1.60% 2.5% 14.3% 10.60% 12.2% 18.0% 12.2% 14.0% CVS -sell 100 basis points WMT - sell 35 basis points PM - sell 10 basis points WAL-MART COMPANY OVERVIEW Largest retailer in the world Every Day Low Price (EDLP) strategy Narrow margins Economies of scale Aggressive cost cutting Competitive Advantage Scale Supply chain and supplier relationship SEGMENT OVERVIEW Three segments Wal-Mart Operates 4,637 stores of different varieties Wal-Mart International 6,155 stores in 26 different countries (majority in Latin and South America Sam’s Club 600 units internationally SEGMENT CONTRIBUTION OPPORTUNITIES AND RISKS Opportunities Continued growth in international markets Operating efficiency and margin improvements Risks Payroll tax increases domestically Increased competition from dollar stores and Target Uncertain global economy (Europe) MULTIPLE VALUATION MULTIPLE VALUATION COMPANY OVERVIEW CVS Caremark Corporation (“CVS Caremark”), is the largest integrated pharmacy health care provider in the United States. 200,000 colleagues in 45 states, the District of Columbia and Puerto Rico. 7,400 retail stores, 19 onsite pharmacies, 31 specialty pharmacy stores, 12 specialty mail order pharmacies, five mail order pharmacies, and its CVS.com and Caremark.com websites. MinuteClinic division operates more than 640 retail medical clinics globally. SEGMENT OVERVIEW Retail Pharmacy Segment Pharmacy Services Segment Corporate Segment SEGMENT ANALYSIS in millions Pharmacy Service Segement Retail Pharmacy Segement $ 73,444 3,808 2,679 $ 63,654 19,109 5,654 $ (694) $ (13,965) (411) (411) $ 123,133 22,506 7,228 $ 58,874 3,279 2,220 $ 59,599 17,468 4,912 $ (616) $ (11,373) (186) (186) $ 107,100 20,561 6,330 $ 47,145 3,315 2,361 $ 57,345 17,039 4,537 $ (626) $ (8,712) (135) (135) $ 95,778 20,219 6,137 Corporate Segment Intersegment Consolidated Eliminations Totals 2012 Net revenue Gross profit Operating profit 2011 Net revenue Gross profit Operating profit 2010 Net revenue Gross profit Operating profit OPPORTUNITIES AND RISKS Risk Opportunities Economy situation Health care reform Uncertainty surrounding Aging baby boomers health care reform Competition Litigation and legal risk Competitors’ mistakes CVS Caremark (CVS) Analyst: Daiyuan Deng Date: 2/10/2013 Year 2012 Revenue 123,133 % Grow th 14.97% Operating Income 7,228 Operating Margin Interest and Other Interest % of Sales Taxes Plus/(minus) Changes WC % of Sales Current Price Implied equity value/share Upside/(Downside) to DCF Debt Cash Cash/share Total Assets Debt/Assets Working Capital % of Growth 14,780 280,820 14.0% 16,849 321,539 14.5% 18,006 368,162 14.5% 20,617 421,545 14.5% 23,607 482,669 14.5% 27,029 (905) (786) (914) (1,042) (1,188) (1,355) (1,545) (1,768) (2,025) (2,318) (2,655) -0.7% -0.6% -0.6% -0.6% -0.6% -0.6% -0.6% -0.6% -0.6% -0.6% -0.6% 3,180 38.6% 4,402 13.6% 2,144 4,153 38.6% 5,862 33.2% 2,494 3,988 38.6% 6,342 8.2% 2,843 4,546 38.6% 7,230 14.0% 3,457 5,183 38.6% 8,242 14.0% 3,941 5,908 38.6% 9,396 14.0% 4,493 6,269 38.6% 9,969 6.1% 5,466 7,178 38.6% 11,415 14.5% 6,259 8,218 38.6% 13,070 14.5% 7,166 9,410 38.6% 14,965 14.5% 8,205 1.4% 1.5% 1.5% 1.5% 1.6% 1.6% 1.6% 1.7% 1.7% 1.7% 1.7% (439) (1,987) (2,312) (3,184) (3,630) (4,138) (4,718) (5,595) (6,406) (7,335) (8,398) 28,428 53,873 82,301 4.58% 18.4 21.2 8.0 9.3 1,280 $ $ 14.0% 5.6% -1.4% 2,287 1.6% 2,569 -21.2% Shares Outstanding 12,965 246,333 TERMINAL 2022E 5.6% 3,259 Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 14.0% 2021E 5.6% % Grow th NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 11,373 216,082 2020E 5.6% 1.6% Free Cash Flow 14.0% 2019E 6.0% 2,030 Capex % of sales 10,930 189,545 2018E 6.0% -0.4% Subtract Cap Ex 16.3% 2017E 6.0% 1,753 % of Sales 8,367 166,268 2016E 6.0% 11% Add Depreciation/Amort 16.1% 2015E 6.6% 3,875 % Grow th 142,916 2014E 5.9% 38.6% Net Income 2013E 9.50% 3.5% 5.9% 2,441 Tax Rate Terminal Discount Rate = Terminal FCF Growth = 55.64 64.30 15.6% 9,208 8,419 6.58 65,912 14.0% 12.0% -1.4% 2,660 1.6% 3,730 45.2% 35% 65% 100% -1.7% 3,033 1.6% 3,440 -7.8% -1.7% 3,457 1.6% 4,107 19.4% -1.7% 4,188 1.7% 4,470 8.8% -1.7% 4,774 1.7% 5,096 14.0% -1.7% 5,466 1.7% 5,156 1.2% -1.7% 6,259 1.7% 5,904 14.5% -1.7% 7,166 1.7% 6,760 14.5% Terminal Value Free Cash Yield 16.2 18.7 6.9 7.9 12.1 14.0 5.4 6.2 -1.7% 8,205 1.7% 7,740 14.5% 133,510 5.80% Terminal P/E 8.9 Terminal EV/EBITDA 3.8 MULTIPLE VALUATION Absolute Valuation-CVS P/Forward E P/S P/B P/EBITDA P/CF High Low Target Target Value/ Target Median Current Multiple Share Price 26.4 0.8 3.7 12.63 18.3 10 0.4 1 4.88 7.5 16.4 0.6 1.9 7.69 11.9 15 0.5 1.8 6.94 10.7 16.4 0.55 1.96 6.94 11.9 3.03 96.2 29.63 7.47 4.5 49.7 52.91 58.07 51.84 53.55 TARGET PRICE PHILIP MORRIS INTERNATIONAL BUSINESS OVERVIEW Philip Morris International is the leading international tobacco company, with seven of the world’s top 15 international brands, including Marlboro, the number one cigarette brand worldwide. PMI’s products are sold in more than 180 countries. In 2012, the company held an estimated 16.3% share of the total international cigarette market outside of the United States, or 28.8% excluding the People’s Republic of China and the United States. PMI GLOBAL MARKET SHARE 35% 30% PMI Global Market Share Marlboro Global Market Share 28.8% 28.3% 27.6% 25% 20% 15% 10% 9.1% 9.2% 9.3% 5% 0% 2010 *Excluding the People’s Republic of China and the USA Source: 2012 annual report 2011 2012 BUSINESS SEGMENTS Philip Morris International operates outside the United States. The four major business segments are: European Union Eastern Europe Middle East & Africa (“EEMA”) Asia and Latin America & Canada (“LA&C”). 2012 PMI RESULTS BY REGION Net Revenues: $31.4 billion Asia 36% LA&C 11% EU 27% EEMA 26% Adjusted OCI: $14.2 billion Asia 37% LA&C 8% EU 29% EEMA 26% OPPORTUNITIES & RISKS Opportunities Risks Organic volume growth Challenging regulatory Emerging market environment Unfavorable foreign exchange momentum China Favorable financing Stable dividend yield and continuing share repurchase INCOME STATEMENT PROJECTIONS Segment (millions) Net Sales (including excise tax) European Union Eastern Europe, Middel East & Africa Asia Latin America & Canada Total Net Sales (excluding excise tax) Consensus Sales Growth European Union Eastern Europe, Middel East & Africa Asia Latin America & Canada Total FY 2015E FY 2014E FY 2013E FY 2012 FY 2011 25,788 24,736 27,031 10,120 87,675 36,150 26,863 21,890 24,135 9,921 82,809 33,686 34,600 27,982 19,372 21,549 9,727 78,629 31,539 33,100 27,338 19,272 21,071 9,712 77,393 31,377 29,768 17,452 19,590 9,536 76,346 31,097 -4.00% 13.00% 12.00% 2.00% 5.88% -4.00% 13.00% 12.00% 2.00% 5.32% -6.00% 11.00% 10.00% 2.00% 2.99% -8.16% 10.43% 7.56% 1.85% 1.37% 6.12% 9.57% 28.59% 12.19% 12.75% DCF MULTIPLE VALUATION Target Current Multiple Target E, S, B, Target Price /Share Absolute Valuation High Low Median P/Forwar dE 24.1 9.9 15.8 24.1 20.0 5.7 113.4 P/S 4.7 1.1 1.7 4.7 3.0 47.2 141.7 P/B P/EBITD A P/CF 62.3 5.8 15.9 56.2 40 1.8 72.7 14.1 5.5 9.8 14.1 11.0 9.0 99.6 21.8 8.8 14.1 21.1 18 5.7 102.0 FINAL PRICE TRIANGULATION Valuation Method P/E P/S P/B P/EBITDA P/CF DCF Final Target Price Current Price Upside Target Price 113.40 141.70 72.70 99.60 102.00 109.08 Weight 6% 2% 8% 8% 6% 70% $ 106.00 $ 92.72 14.3% RECOMMENDATION RECOMMENDATION OVERVIEW PM CVS WMT DIV ER UPSIDE 3.7% 1.60% 2.5% 14.3% 10.60% 12.2% 18.0% 12.2% 14.0% CVS -sell 100 basis points WMT - sell 35 basis points PM - sell 10 basis points Q&A