Consumer Staples: Company Presentation Charles Buseck, Jonathan Davia, Candler Eve, Sunny Zong

advertisement

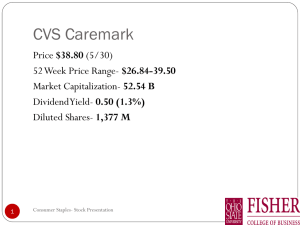

Consumer Staples: Company Presentation Charles Buseck, Jonathan Davia, Candler Eve, Sunny Zong Agenda Recap of Outlook & Sector Recommendation Stock Recommendations Summary Q&A Consumer Staples Recap SIM Consumer Staples Weight: 11.72% S&P500 Consumer Staples Weight : 11.47% Recommendation: • We are currently overweight in Consumer Staples by 25 basis points. We recommend NO CHANGES! • Class voted reduce the weight of Consumer Staples by 125 basis points. Sector Holdings SIM – 11.72% PepsiCo………………2.62% Wal-Mart Stores Inc…3.03% Philip Morris Int’l……..3.57% Procter & Gamble……2.93% 08/4/2010 Sell Recommendations SIM – 11.72% SELL! PepsiCo………………2.62% Wal-Mart Stores Inc…3.03% Philip Morris Int’l……..3.57% SELL! Procter & Gamble……2.93% Total ………………….619 BP Reduction in Weight…125 BP Total for Purchase …..494 BP Buy Recommendations SIM – 10.47% BUY! CVS………...…………4.94% Wal-Mart Stores Inc…3.03% Procter & Gamble……2.93% 08/4/2010 CVS CAREMARK • Company Overview – Retail Pharmacy – Minute Clinic – PBM Services • Market Capitalization – 40.25 B • CVS and Walgreens made-up. CVS - Stock History CVS - Valuation of Multiples Absolute Valuation P/Forward E P/S P/EBITDA P/CF Current Price Target Upside High *Your Your #Your Target E, S, B, Target Target Low Median Current Multiple etc/Share Price 29.8 10 17.6 11 17.6 3.01 1.3 0.4 0.6 0.4 0.6 72.18 15.66 5.04 8.83 5.39 8.83 6.7 25.2 7.7 13.3 8.3 13.3 3.01 30.86 45 46% 53 43 59 40 CVS Terminal Discount Rate = Terminal FCF Growth = 9.5% 4.0% Year 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E Revenue % Growth 98,729 103,665 5.0% 108,849 5.0% 113,747 4.5% 118,866 4.5% 124,214 4.5% 129,804 4.5% 134,996 4.0% 140,396 4.0% 146,012 4.0% 151,852 4.0% EBT EBT Margin 19,950 20.2% 20,733 20.0% 21,770 20.0% 22,749 20.0% 23,773 20.0% 24,843 20.0% 25,961 20.0% 26,999 20.0% 28,079 20.0% 29,202 20.0% 30,370 20.0% Interest Interest % of Sales 14,000 14.2% 14,513 14.0% 15,239 14.0% 15,925 14.0% 16,641 14.0% 17,390 14.0% 18,173 14.0% 18,899 14.0% 19,655 14.0% 20,442 14.0% 21,259 14.0% Taxes Tax Rate 2,205 37.1% 2,301 37.0% 2,416 37.0% 2,525 37.0% 2,639 37.0% 2,758 37.0% 2,882 37.0% 2,997 37.0% 3,117 37.0% 3,241 37.0% 3,371 37.0% Net Income % Growth 3,745 3,919 4.6% 4,114 5.0% 4,300 4.5% 4,493 4.5% 4,695 4.5% 4,907 4.5% 5,103 4.0% 5,307 4.0% 5,519 4.0% 5,740 4.0% Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 1,389 1.4% 1,451 1.4% 1,524 1.4% 1,592 1.4% 1,664 1.4% 1,739 1.4% 1,817 1.4% 1,890 1.4% 1,966 1.4% 2,044 1.4% 2,126 1.4% (72) -0.1% 2,548 2.6% (76) -0.1% 1,555 1.5% (79) -0.1% 1,633 1.5% (83) -0.1% 1,706 1.5% (87) -0.1% 1,783 1.5% (91) -0.1% 1,863 1.5% (95) -0.1% 1,947 1.5% (98) -0.1% 2,025 1.5% (102) -0.1% 2,106 1.5% (106) -0.1% 2,190 1.5% (111) -0.1% 2,278 1.5% 2,514 3,739 48.7% 3,926 5.0% 4,103 4.5% 4,288 4.5% 4,481 4.5% 4,682 4.5% 4,869 4.0% 5,064 4.0% 5,267 4.0% 5,477 4.0% Free Cash Flow % Growth NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 27,926 41,793 69,720 5.62% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 11.9 18.6 2.5 3.6 Shares Outstanding 1,450.0 40% 60% 100% 11.4 17.8 2.4 3.5 Current Price $ Implied equity value/share $ Upside/(Downside) to DCF 10.9 16.9 2.2 3.3 30.86 48.08 55.8% CVS – DCF Sensitivity Analysis Discount Rate Terminal Rate Target Price 11% 3.50% 36.34 10.50% 3.50% 38.97 10% 3.50% 42.01 9.50% 3.50% 45.55 9% 3.50% 49.74 11% 4% 37.75 10.50% 4% 40.66 10% 4% 44.06 9.50% 4% 48.08 9% 4% 52.91 Upside % 18% 26% 36% 48% 61% 22% 32% 43% 56% 71% CVS Summary $ CVS Summary Recommendation: BUY 494 BP’S Current Price: 30.86 Target Price: 45.00 Implied Upside: 46% PepsiCo (PEP) • Company overview: PepsiCo, Inc. manufactures, markets, and sells various foods, snacks, and carbonated and noncarbonated beverages worldwide. • Market capitalization of $99.41 billion. • 18 brands that generate $1 billion or more each in annual retail sales PepsiCo (PEP) Valuation Multiples Relative to S&P 500 Recommendation: Sell Current SIM Weight: 262 BP’s Holding at a loss of 5.86% Current Price: 66.42 Target Price: 75 Implied Upside: 13% Median Current P/Trailing E 1.1 0.99 P/Forward E 1.0 0.99 P/B 1.1 1.1 P/S 1.3 1.1 P/CF 1.1 1.0 PepsiCo (PEP) – Chart PepsiCo (PEP) - Valuation of Multiples Absolute Valuation P/Forward E P/S P/B P/EBITDA P/CF High 31.6 3.6 10.6 16.37 24.9 Current Price Target Upside #Your *Your Target Target E, S, B, Low Median Current Multiple etc/Share Your Target Price 13.1 1.8 4.6 8.55 10.4 73.01 75.53 79.58 70.08 76.32 20 3.1 7.1 12.81 17.7 66.42 75 13% 15.1 2.2 5 10.67 13.4 17.55 2.65 6.05 11.74 15.55 4.16 28.50 13.15 5.97 4.91 PepsiCo Terminal Discount Rate = Year Revenue % Growth EBT EBT Margin Interest Interest % of Sales Taxes Tax Rate Net Income 2010E 57,499 2011E 62,098 33.00% 9,085 15.8% 140 0.2% 2,100 22.8% 7,125 % Growth Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales Free Cash Flow 9,315 15.0% 186 2012E 66,445 7.0% 10,365 15.6% 199 0.3% 2,185 23.0% 7,316 0.3% 2,430 23.0% 8,135 2013E 70,432 6.0% 10,987 15.6% 211 0.3% 2,576 23.0% 8,623 2014E 73,954 5.0% 11,537 15.6% 222 0.3% 2,704 23.0% 9,054 2015E 77,651 5.0% 12,114 15.6% 233 0.3% 2,840 23.0% 9,507 2016E 81,534 5.0% 12,719 15.6% 245 0.3% 2,982 23.0% 9,982 2017E 84,795 4.0% 13,228 15.6% 254 0.3% 3,101 23.0% 10,381 2018E 88,187 4.0% 13,757 15.6% 265 0.3% 3,225 23.0% 10,797 4.0% 2019E 91,715 2020E 95,383 4.0% 14,307 4.0% 14,880 15.6% 15.6% 275 286 0.3% 3,354 0.3% 3,488 23.0% 11,229 23.0% 11,678 2.7% 11.2% 6.0% 5.0% 5.0% 5.0% 4.0% 4.0% 4.0% 4.0% 1,653 2,236 2,259 2,183 2,145 2,097 2,120 2,205 2,293 2,385 2,480 2.9% 3.6% 3.4% 3.1% 2.9% 2.7% 2.6% 2.6% 2.6% 2.6% 2.6% (72) (78) (83) (88) (93) (97) (102) (106) (110) (115) (119) -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1% 2,128 3,105 3,322 3,522 3,698 3,883 4,077 4,240 4,409 4,586 4,769 3.7% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% 6,578 6,369 6,989 7,197 7,409 7,624 7,923 8,240 8,570 8,913 9,269 -3.2% 9.7% 3.0% 2.9% 2.9% 3.9% 4.0% 4.0% 4.0% 4.0% % Growth NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 47,908 70,724 118,633 6.34% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 14.7 18.3 10.1 12.5 Shares Outstanding 8.0% Terminal FCF Growth = 9.5% 1,577.0 40% 60% 100% 14.3 17.8 9.4 11.6 Current Price $ Implied equity value/share $ Upside/(Downside) to DCF 12.9 16.0 8.6 10.6 66.42 75.23 13.3% PepsiCo (PEP) – DCF Sensitivity Analysis Discount Rate Terminal Rate 11% 3.50% 10.50% 3.50% 10% 3.50% 9.50% 3.50% 9% 3.50% 11% 4% 10.50% 4% 10% 4% 9.50% 4% 9% 4% Target Price 56.94 61.04 65.77 71.29 77.82 59.13 63.38 68.97 75.23 82.74 Upside % ‐14.3% ‐8.1% ‐1.0% 7.3% 17.2% ‐11.0% ‐21.2% 3.8% 13.3% 24.6% PepsiCo (PEP) Summary Recommendation: SEL 262 BP’S Current Price: 66.42 Target Price: 75 Upside: 13% Sell All the Holdings Philip Morris International (PM) Company Information Risks • • • • • Leading international tobacco company Products in 160 countries Own 7 of the top 15 brands in the world 15.4% share of the international market • • • • Tightening health and marketing regulations (Ex: Indonesia) Litigation (over 2,000 open cases) Intense competition Cigarette related taxes Environmental regulations Philip Morris (PM) - Chart Philip Morris (PM) Valuation of Multiples Absolute Valuation High 12.9 *Your Target E, S, B, etc/Share 4.09 Your Target Price (F x G) 52.76 3.5 1.5 34.12 51.18 13.3 18.9 13.3 2.64 35.11 6.24 8.82 8.60 8.82 5.80 51.16 8.8 12.9 12.6 12.9 3.96 51.08 Low Median Current #Your Target Multiple P/Forward E 16.1 11.0 12.9 13.0 P/S 3.5 1.1 1.5 P/B 19.9 7.2 P/EBITDA 11.79 P/CF 139.8 Current Price Target Upside 52.97 52.76 ‐1% Terminal FCF Growth = PM Terminal Discount Rate = 9.75% Year 2011E 2.0% 2012E 2013E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E Revenue % Growth 66,341 68,331 2.8% 70,381 2.8% 72,141 2.5% 73,944 2.5% 75,608 2.3% 77,120 2.0% 78,663 2.0% 80,236 2.0% 81,841 2.0% 83,477 2.0% Operating Income Operating Margin 11,004 16.6% 11,574 16.9% 11,923 16.9% 12,221 16.9% 12,526 16.9% 12,808 16.9% 13,064 16.9% 13,325 16.9% 13,592 16.9% 13,864 16.9% 14,141 16.9% 315 0.5% 315 0.5% 315 0.4% 323 0.4% 331 0.4% 338 0.4% 345 0.4% 352 0.4% 359 0.4% 366 0.4% 374 0.4% Taxes Tax Rate 2,468 23.1% 2,468 21.9% 2,468 21.3% 2,499 21.0% 2,561 21.0% 2,619 21.0% 2,671 21.0% 2,724 21.0% 2,779 21.0% 2,834 21.0% 2,891 21.0% Net Income % Growth 8,220 8,791 6.9% 9,139 4.0% 10,045 9.9% 10,296 2.5% 10,528 2.3% 10,738 2.0% 10,953 2.0% 11,172 2.0% 11,396 2.0% 11,623 2.0% Interest and Other Interest % of Sales Add Depreciation/Amort % of Sales Plus/(minus) Changes WC % of Sales Subtract Cap Ex Capex % of sales 853 1.3% (412) -0.6% 943 1.4% 888 1.3% (393) -0.6% 854 1.3% 915 1.3% (405) -0.6% 880 1.3% 938 1.3% (577) -0.8% 902 1.3% 961 1.3% (592) -0.8% 924 1.3% 983 1.3% (605) -0.8% 945 1.3% 1,003 1.3% (617) -0.8% 964 1.3% 1,023 1.3% (629) -0.8% 983 1.3% 1,043 1.3% (642) -0.8% 1,003 1.3% 1,064 1.3% (655) -0.8% 1,023 1.3% 1,085 1.3% (668) -0.8% 1,043 1.3% Free Cash Flow % Growth 7,718 8,432 9.3% 8,770 4.0% 9,504 8.4% 9,742 2.5% 9,961 2.3% 10,160 2.0% 10,363 2.0% 10,570 2.0% 10,782 2.0% 10,997 2.0% NPV of Cash Flows NPV of terminal value Projected Equity Value Free Cash Flow Yield 60,366 57,088 117,454 7.67% Current P/E Projected P/E Current EV/EBITDA Projected EV/EBITDA 12.2 14.3 9.8 11.2 51% 49% 100% 11.4 13.4 9.3 10.6 11.0 12.9 9.0 10.3 Current Price $ 52.97 Implied equity value/share $ 61.82 Upside/(Downside) to DCF 16.7% Philip Morris (PM) – DCF Sensitivity Analysis Discount Rate Terminal Rate Target Price Upside 11% 2% $53.15 0.3% 10.5% 2% $56.31 6.3% 10% 2% $59.87 13.0% 9.75% 2% $61.82 16.7% 11% 2.50% $54.63 3.1% 10.50% 2.50% $58.04 9.6% 10% 2.50% $61.91 16.9% 9.75% 2.50% $64.05 20.9% Philip Morris (PM) Summary Recommendation: SELL 337 BP’s Current Price: $52.97 Sell All the Holdings Summary We are going all in on CVS! •Sell Pepsi •Sell Phillip Morris •Buy CVS