Consumer Discretionary

advertisement

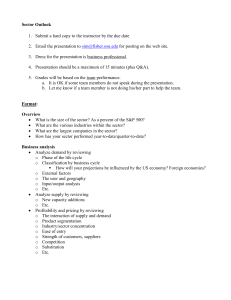

Cole Blackmore Xinxin Li Agenda Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Sector Breakdown S&P 500 SIM 12.46% 14.33% Overweight: 1.87% Sector Industries Sector: SIM: Hotels, Restaurants, Leisure Housewares Durables Internet & Catalog Retail Media Textiles, Apparel, Luxary Goods Apparel & Accessory Automobile Manufactures General Merchandise Retail Apparel Cable & Satellite Largest Companies Comcast Corp Amazon.com Inc Home Depot Inc Walt Disney Co McDonald’s Corp Twenty-First Century Fox, Inc Ford Motor Co Time Warner Inc Starbucks Corp NIKE Inc Sector Performance YTD: Outperformed S&P by ~9% Sector Performance QTD: Outperformed S&P by ~1% Agenda Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Sector Performance Overperforms: Early Stage Underperforms: Late & Recession Business Analysis: Demand Non-essential Goods Sector highly cyclical: very sensitive Often leads economies out of Recessions Porter’s 5 Forces Barriers to Entry: High High Start-up Cost Mature Firms; Incumbent Power Buyer Power: High Easy switching costs (Retail & General Merchandise) High Competition=Price Wars Supplier Power: Variable Depends on Industry High Raw Materials Costs & Multiple Vendors=Low Bargaining Power Substitutes: High Product availability very diverse: ie, AE, ANF, Aero all offer similar clothing. Lack of differentiation Competition: High Retail Apparel: has many established brands Automobile Manufactures: emergence of foreign cars built & sold in US Agenda Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Retail Sales Employment Disposable Income Consumer Spending Real GDP Agenda Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Sector Sales EPS Net Profit Margin (Absolute) Net Profit Margin (Relative S&P 500) Housewares Durables Housewares Durables Apparel Cable & Satellite Auto Auto Parts Agenda Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Sector Performance Absolute Basis P/Trailing E P/Forward E P/B P/S P/CF High 53.7 44.1 4.4 1.3 12.2 Low 13.9 13.0 1.5 0.4 5.7 Median 20.0 17.4 2.5 0.9 9.1 Current 20.9 19.0 4.0 1.3 12.2 Relative to SP500 P/Trailing E P/Forward E P/B P/S P/CF High 3.9 3.0 1.7 0.9 1.2 Low 1.1 1.0 0.7 0.5 0.7 Median 1.2 1.2 1.0 0.6 0.9 Current 1.3 1.2 1.6 0.9 1.1 Industry Performance Automobile Manufacturers Cable & Satellite Industry Performance Hotel, Restaurants, & Leisure Houseware Durables Industry Performance Internet & Retail Catalog Multiline Retail Industry Performance Retail Apparel Relative to SP500 P/Trailing E P/Forward E P/B P/S P/CF High Low 1.6 1.3 3.1 1 1.5 Median 0.7 0.73 1 0.4 0.6 Current 1 1 1.5 0.7 1 1.1 1.2 2.5 0.9 1.3 Agenda Overview Business Analysis Economic Analysis Financial Analysis Valuation Analysis Recommendation Recommendation Sim Portfolio should: Stay Overweight: trailing P/E has consistently performed at or above relative to S&P Underweight: Auto Manufacturers Diversify by adding new Industry to portfolio Pro’s & Cons: Business cycle still in expansion stage, continued outperformance Industries sensitive to global economic changes (ie European markets)