CONSUMER DISCRETIONARY Mike Anderson & Bingqian Lu

advertisement

CONSUMER

DISCRETIONARY

Mike Anderson & Bingqian Lu

AGENDA

Recommendations

Industry Recap

Analysis of Stocks

Conclusion

RECOMMENDATIONS

Current Sector Weight: 12.80

Current SIM Weight: 12.61

Recommendation: Slightly Underweight*

Sector Stock Recommendations

Current Proposed

Basis

Basis

Current

Price

Target

Price

Upside

(Downside)

Recommend

2.17

63.24

66.80

5.6%

HOLD

2.58

0.00

92.76

94.20

1.6%

SELL

HOG

3.13

4.25

57.67

63.44

10.0%

BUY

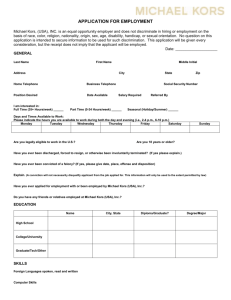

Michael Kors

KORS

1.43

2.50

43.47

58.01

33.4%

BUY

Service

Corporation Intl

SCI

3.30

3.30

29.67

31.30

5.5%

HOLD

12.61

12.22

Company

Ticker

Comcast

CMCSA

2.17

Direct TV

DTV

Harley Davidson

TOTAL:

UNDERWEIGHT

Industry Recap

• Size: 2.398 T

• Status: Cyclical

• Categories: retailers, media

companies, consumer services

companies, consumer durables and

apparel companies, and

automobiles and components

companies

Performance

Securities

Con Dis

SPX

Price Change

121.66%

64.94%

Total Return

154.45%

99.33%

Difference

55.12%

ANALYSIS

KORS

HOG

DTV

Michael Kors

Company Overview

Stock Overview

Competitive Advantage

Investment thesis

Valuation

Risks & Concerns

Recommendation

Company Overview

Michael Kors sells watches, jewels,

handbags, apparels and etc by

distinguishing itself as a global luxury

lifestyle brand.

Founder: Michael Kors

Founded in 1981

North America, Europe, Asia

Two Collections: Michael Kors & Michael

Michael kors

Stock Overview

12 month stock price

• Market Cap:

$8.55B

• Shares Outstanding:

200M

100

• Dividend Yield:

0%

90

• 52 Weeks Low:

$41.52

• 52 Weeks High:

$91.79

60

• Profit Margin:

23.70%

50

• EPS:

$4.28

• Target Price:

$58.01

80

70

40

2014/7/1

2014/11/1

2015/3/1

2015/7/1

Competitive Advantage

Sales strategies:

partnership & shop-in-shops

international expansion & e-commerce

Marketing Strategies:

brand awareness & selection

price advantage

Investment Thesis

Current economic condition-unfavorable

Gucci, Prada, Burberry continuously marked down their

inventories, which forced the operating margin of entrylevel luxury products down.

Financial Analysis

Strong new store growth & above average same

store sales

Financial Analysis

Most efficient profit generator, sales per square

feet and operating margin are the highest among

its competitors

Financial Analysis

Stable on DIO growth, 8% growth from 2011 to

2015

Valuation

Target Price:

Avg: $67.99

Heavily rely on

sale revenue

Avg estimate is

high

Sensitivity Analysis

Discount Rate

Terminal Growth Rate

10.00%

10.25%

10.50%

10.75%

11.00%

11.25%

11.50%

11.75%

12.00%

3.00%

$61.75

$59.37

$57.16

$55.10

$53.17

$51.35

$49.65

$48.05

$46.53

3.25%

$63.29

$60.79

$58.46

$56.29

$54.26

$52.36

$50.58

$48.91

$47.33

3.50%

$64.95

$62.30

$59.84

$57.56

$55.43

$53.44

$51.57

$49.83

$48.18

3.75%

$66.75

$63.93

$61.33

$58.92

$56.67

$54.58

$52.63

$50.80

$49.08

4.00%

$68.69

$65.70

$62.93

$60.38

$58.01

$55.81

$53.75

$51.84

$50.04

4.25%

$70.81

$67.61

$64.67

$61.95

$59.45

$57.12

$54.96

$52.94

$51.06

4.50%

$73.11

$69.68

$66.54

$63.65

$60.99

$58.53

$56.25

$54.12

$52.14

4.75%

$75.64

$71.95

$68.58

$65.50

$62.66

$60.05

$57.63

$55.39

$53.31

5.00%

$78.41

$74.43

$70.80

$67.50

$64.47

$61.69

$59.12

$56.75

$54.55

Risks & Concerns

Foreign exchange risk

-dollar appreciate, all forward contract will expire at the

beginning of 2016 fiscal year

Strategic risk

-consumer preference

Expansion concern in Asia

-licensing issue with Michael Kors Far East Holding Ltd

Recommendation

Shares Outstanding

200,865

Current Price

$43.47

Implied equity value/share

58.01

Upside/(Downside) to DCF

33.4%

Debt

0.00

Cash

$978,922

Cash/share

4.87

Current Weight

143bps

Recommended Weight

250bps

Harley Davidson

Company Overview

Stock Overview

Investment thesis

Financial Analysis

Growth Strategy

Valuation

Risks & Concerns

Recommendation

Company Overview

Harley-Davidson, Inc. (HOG)

Harley-Davidson Motor Company

The Motorcycles & Related Products

segment designs, manufactures, and sells

at wholesale street-legal HarleyDavidson motorcycles, as well as a line of

motorcycle parts, accessories, general

merchandise, and related services.

Harley-Davidson Financial Services

Manufactures cruiser and touring

motorcycles. The company operates in

two segments, Motorcycles & Related

Products and Financial Services.

The Financial Services segment provides

wholesale and retail financing, and insurance

and insurance-related programs to dealers and

retail customers.

Founded in 1903

Stock Overview

12 month stock price

STOCK DATA

Ticker

Sector

Price (7/14/15)

52-week range

Market Cap. (M)

Shares Out. Diluted (M)

Annual Dividend

Dividend Yield

Est P/E (2015)

Est PEG (2015)

Book Value / Share

HOG

Consumer Disc

$57.67

$53- $71

$11,674.3

208.1

$1.24

2.21

14.09

1.26

$14.11

Investment Thesis

Harley-Davidson currently represents a BUY

opportunity due to the following reasons:

Loyalty

to its customer base and brand despite

competitors discount pricing as a result of exchange

rates

Growing customer base with a solid strategy for

growth

A stock price that appears inexpensive

Financial Analysis

Exchange rate issues

Profit margin improvements

NOPAT growth

Stock repurchase

Future projections

Strategy for growth

“Fatten the tails”

Outreach customers and programs

Middleweight market

Valuation

Multiples:

Industry

COMPANY

Mkt Cap (USD)

Average

29.5B

HARLEY-DAVIDSON INC

11.7B

POLARIS INDUSTRIES

9.8B

HONDA MOTOR CO LTD

58.1B

SUZUKI MOTOR CORP

18.5B

YAMAHA MOTOR CO

7.7B

BMW

71.2B

P/E ('15)

14.20

14.10

19.77

11.36

18.86

10.85

10.27

P/B

3.59

3.97

11.16

1.05

1.52

2.00

1.80

P/S

1.13

1.90

2.11

0.56

0.75

0.61

0.78

P/CF

14.89

10.77

19.99

4.99

8.86

14.87

29.86

P/EBITDA PEG ('15)

6.89

1.77

7.28

1.26

11.15

1.22

4.49

0.94

7.20

1.74

6.77

0.84

4.10

4.57

Firm

Absolute

Valuation

Current

Target

Multiple

TGT/Current

Expected

EPS

Target Price

P/E

14.10

14.5

1.02

4.09

60.43

P/B

P/S

P/EBITDA

3.97

1.90

7.28

4

2

7.5

1.01

1.05

1.03

60.89

63.61

62.26

Multiples

HOG

RATIO

CURRENT

AVERAGE

HIGH

LOW

ABSOLUTE

P/E

14.168

16.383

42.899

2.808

P/B

3.947

4.083

6.914

.902

P/S

1.933

1.948

3.375

.326

P / EBITDA

7.556

8.968

22.931

1.523

P/E

.641

.878

2.397

.015

P/B

.775

1.391

2.628

.464

P/S

1.244

1.922

3.571

.809

P / EBITDA

.716

1.189

3.220

.341

P/E

.774

1.004

2.324

.252

P/B

1.401

1.666

2.431

.590

P/S

1.064

1.337

2.088

.468

P / EBITDA

.754

1.224

3.040

.370

S5COND

SPX

Valuation

Multiples (cont.)

DCF

Target price: $65.08

Combined:

Avg target price $61.80

$63.44 (equal weight)

Analysts (13)

Mean Target: $66

Risks & Concerns

Continued strength of U.S. dollar

Aging core demographic

Potential credit market deterioration

Competition from other motorcycle makers

Economic stalling or contraction

Recommendation

Shares Outstanding

208.1M

Current Price

$57.67

Implied equity value/share

$63.44

Upside/(Downside) to DCF

10.0%

Debt

$5.93B

Cash

$8.21M

Cash/share

$3.95

Current Weight

313bps

Recommended Weight

425bps

DTV

Recommend: Sell

Potential

AT&T merger at $95 valuation

Small upside (projected 1.6% return)

No dividend

Sunday Ticket class action suit

CONCLUSION

•

•

•

•

Underweight sector (12.22 vice 12.80)

Buy additional HOG (313bps to 425 bps)

Buy additional KORS (143 bps to 250 bps)

Sell DTV (258 bps to 0)

QUESTIONS?