OFFICIAL USE ONLY CODE2010-0038 June 9, 2010

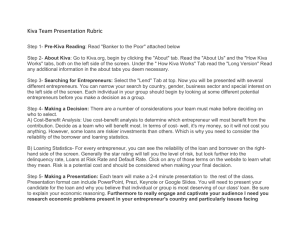

advertisement