Theory of Consumer Behavior

advertisement

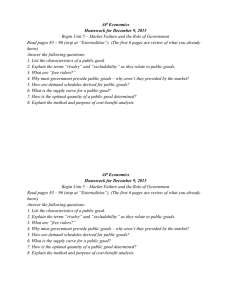

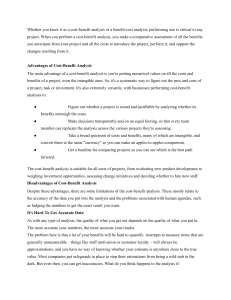

Public Goods Mr. Henry AP Economics • Private Goods include automobiles, clothing, personal computers, household appliances, and sporting goods. • Private good characteristics include: A. Rivalry in consumption (I buy a Pepsi, it is not available to you!) B. Excludability (only people who pay get the benefits ie I buy the Pepsi, I enjoy it!) Review • Have rational behavior (want • A competitive market not only to get “the most for their makes private goods available money”) aka maximize their to consumers but also total utility allocates society’s resources efficiently to the particular • Each consumer has clear-cut product preferences of the goods and services that are • There is neither available in the market; pay underproduction nor market price or go without it overproduction of the product Typical Consumers in the Competitive Market… • Public Goods characteristics include: A. Nonrivalry in consumption (everyone can obtain the benefit from a public good) B. Nonexcludability (once in place, you cannot exclude someone from benefiting) What are examples of Public Goods?? Public Goods • Nonrivalry & nonexcludability create a free-rider problem. • What do you think the “Free-Rider” problem is for Public Goods? • What are examples of the “Free-Rider” problem? Quantity of the Public good • Since we do not know how much demand there truly is for a public good, government has to try to estimate the demand for a public good in order to compare Marginal Benefit to the government’s Marginal Cost • What are ways in which government can measure the demand for public goods? Demand for Public Goods • Demand for a public good is unusual; maybe a gov’t survey asking hypothetical questions about how much each citizen was willing to pay for various types & amounts of public goods rather than go without them. • The supply curve for any good, private or public, is its MC curve. MC rises as more of a good is produced (because of law of diminishing returns / fixed resources) Cost-Benefit Analysis • When comparing MB to MC, government uses cost-benefit analysis for deciding whether to provide a public good and how much of it to provide. • Remember your example of costbenefit analysis? • What would a government example be of cost-benefit analysis?? Example: • In this example, the marginal-cost-marginal-benefit rule tells society which plan provides the maximum excess of total benefits over total costs, or in other words, the plan that provides society with the maximum net benefit. Here, Plan C, a new 4-lane highway, is the best plan. • What problems do you see in society with cost-benefit analysis for Public Goods? HW: Externalities 340-347