BUSFIN4221 Spring 2016 Course Syllabus

advertisement

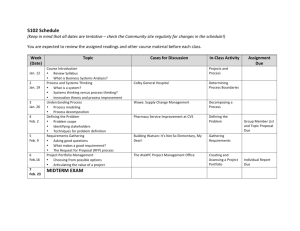

BUSFIN4221 Spring 2016 Course Syllabus Professors: Prof. Xiaoji Lin (lin.1376@osu.edu ) Office: 846 Fisher Hall Phone: 614-292-4318 Office hours: TBD (will begin Feb. 29th) Prof. Susan Clark (clark.238@osu.edu) Office: 638 Fisher Hall Phone: 614-292-6436 Office hours: Tuesday, 2-4 p.m. or by appt. Course Description: Skills for valuation and theories and applications of CAPM, APT, and efficient markets; investment options, forwards and futures, interest rate parity, and relevant market regulation. Prereq: 3220 (620), BusMgt 2320 (330), and 2321 (331). Not open to students with credit for 722, 4220 or 4222. Course Outcomes: At the end of this course the learner should: • Explain the different investment vehicles available in financial markets • Explain how security markets work • Explain the risk/return relationship in the context of efficient portfolios, CAPM • Identify characteristics of efficient markets and describe anomalies that contradict EMH • Determine the value of specific types of investments including stocks, bonds, options and futures • Provide interpretations of various stock market “anomalies” • Analyze choices to be made in actively managed bond portfolios Course Structure: The first seven weeks will be taught by Susan Clark and the second seven weeks will be taught by Xiaoji Lin. Grades from both parts of the course will be combined to give you the grade for the semester. Course Materials: Textbooks (Required): Bodie, Kane, & Marcus; Essentials of Investments (9th ed.), McGraw-Hill Irwin. ISBN: 978-0-07803469-5 Grading: Midterm 1: Final: Homework: Cases: Paper/Project: 40% (100 points) 40% (100 points) 5% 5% (25 points each) 10% (100 points) Grading Scale: 92.5-100 A 89.5-92.49 A86.5-89.49 B+ 82.5-86.49 B 79.5-82.49 B76.5-79.49 C+ 72.5-76.49 C 69.5-72.49 C66.5-69.49 D+ 59.5-66.49 D <59.5 E Homework: In the first seven weeks, the homework will be two cases. You can get copies of the cases from HBS. Click on the link to access the materials. Details on the cases are given below. In the second seven weeks, homework will be posted to Carmen and is more problem based. Cases: To prepare the two cases, you may work in groups of 4-5 students. Please email Susan your group members by Monday of the second week of classes (January 18th). If you do not make your own group, you will be assigned to one. The cases require knowledge of Excel modeling. You must purchase the cases through the following link: https://cb.hbsp.harvard.edu/cbmp/access/38557114 Additional information to help you work the cases will be provided in Carmen under the Content tab labeled Cases. Trading Paper/Project: At the beginning of the semester, you will also be given a Trading project. You will be using the ThinkorSwim platform to invest $1,000,000 over a 10 week period. Please read the Trading & Portfolio Management Project in Carmen. It is up to you to learn how to use the trading website. Attendance: Regular class attendance is expected, but we do not take attendance after the first week. If you miss a class, you are responsible for the material. After obtaining the notes and reading the material, feel free to ask us questions. Students With Disabilities: If you would like to request academic accommodations based on the impact of a disability qualified under the Americans with Disabilities Act and Section 504 of the Rehabilitation Act of 1973, contact your instructor privately as soon as possible to discuss your specific needs. Discussions are confidential. In addition to contacting the instructor, please contact the Student Life Disability Services at 614-2923307 or ods@osu.edu to register for services and/or to coordinate any accommodations you might need in your courses at The Ohio State University. Go to http://ods.osu.edu for more information. Academic Integrity: Academic integrity is essential to maintaining an environment that fosters excellence in teaching, research, and other educational and scholarly activities. Thus, The Ohio State University and the Committee on Academic Misconduct (COAM) expect that all students have read and understand the University’s Code of Student Conduct, and that all students will complete all academic and scholarly assignments with fairness and honesty. Students must recognize that failure to follow the rules and guidelines established in the University’s Code of Student Conduct and this syllabus may constitute “Academic Misconduct.” The Ohio State University’s Code of Student Conduct (Section 3335-23-04) defines academic misconduct as: “Any activity that tends to compromise the academic integrity of the University, or subvert the educational process.” Examples of academic misconduct include (but are not limited to) plagiarism, collusion (unauthorized collaboration), copying the work of another student, and possession of unauthorized materials during an examination. Ignorance of the University’s Code of Student Conduct is never considered an “excuse” for academic misconduct, so I recommend that you review the Code of Student Conduct and, specifically, the sections dealing with academic misconduct. (You can find the full Code at http://studentlife.osu.edu/pdfs/csc_12-31-07.pdf ) If I suspect that a student has committed academic misconduct in this course, I am obligated by University Rules to report my suspicions to the Committee on Academic Misconduct. If COAM determines that you have violated the University’s Code of Student Conduct (i.e., committed academic misconduct), the sanctions for the misconduct could include a failing grade in this course and suspension or dismissal from the University. If you have any questions about the above policy or what constitutes academic misconduct in this course, please contact me. Other sources of information on academic misconduct (integrity) to which you can refer include: • • • The Committee on Academic Misconduct web pages (COAM Home) Ten Suggestions for Preserving Academic Integrity (Ten Suggestions) Eight Cardinal Rules of Academic Integrity (www.northwestern.edu/uacc/8cards.htm) Disenrollment: Fisher College of Business strongly enforces University attendance policies. As per University rule 3335-8-33, any student may be disenrolled from a course for failure to attend by the first Friday of the term, or by the 3rd instructional day of the term, or by the second class meeting, whichever occurs first. Tentative Class Schedule Day Topic Jan. 11 Jan. 13 Jan. 18 Jan. 20 Jan. 25 Jan. 27 Course Overview Asset Classes NO CLASS Securities Markets Mutual Funds/ETF’s Mutual Funds/ETF’s Readings/Class Work Ch. 1 Ch. 2 MLK Day Ch. 3 Ch. 4 Ch. 4 Feb. 1 Risk/Return Ch. 5 Feb. 3 Risk/Return Ch. 5 Feb. 8 Feb. 10 Efficient Diversification Efficient Diversification Ch. 6 Ch. 6 Feb. 15 CAPM Ch. 7 Feb. 17 Feb. 22 Feb. 24 Feb. 29 Mar. 2 Mar. 7 Mar. 9 Mar. 14-18 Mar. 21 Mar. 23 Mar. 28 Mar. 30 Apr. 4 CAPM Review Midterm Exam in class Testing the CAPM Value and Size Value at Risk Efficient Markets Ch. 7 Spring Break Spring Break Efficient Markets Behavioral Finance Behavioral Finance Limits to Arbitrage Bond Prices and Yields Ch. 8 Ch. 9 Ch. 9 Ch. 9 Ch. 10 Apr. 6 Bond Prices and Yields Ch. 10 End Trading Project, Friday 4/8 Apr. 11 Managing Bond Portfolios Ch. 11 HW 3 Apr. 13 Managing Bond Portfolios Ch. 11 Trading Project Paper Due at beginning of class Apr. 18 Apr. 20 Apr. 25 Performance Evaluation Review Final Exam in class Assignments Suggested Chapter Problems #14,17,19 #14,17,18,19,20 #14,15,17,19,21 #13,15-17,21, 24 Begin Trading Project Case #1 due Sunday 2/7/15 11:59 pm. #12-14,18,19 #8-12 Case #2 due Sunday 2/14/15 11:59 pm. #9-11,13-19,24 Ch. 1-7 Ch. 7 Ch. 7 Ch. 5 Ch. 8 Ch. 18 HW 1 Spring Break HW 2 Spring Break