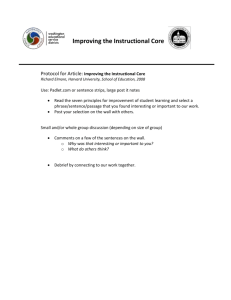

Informal Guidelines for Implementing Public Education Bills

advertisement