Three Essays in Public Economics

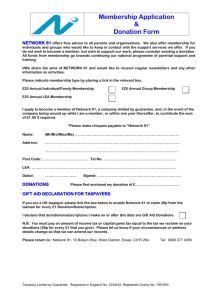

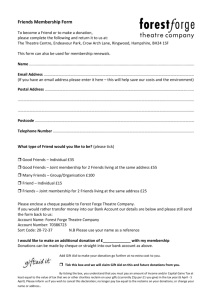

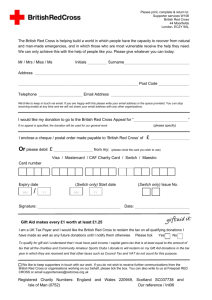

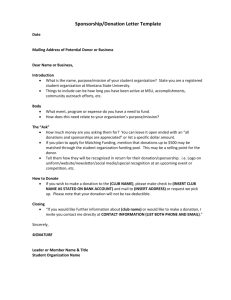

advertisement